Thank you to everyone who filled in our recent survey inviting feedback on Stockopedia content. We’ve heard your ideas and are excited to let you know about some upgrades that are coming down the tracks. These aim to improve the areas of analysis that are most important to you, and create space for additional content that you’ve told us you would find valuable.

Your number one priority: In-depth stock analysis

In our survey, 40% of you told us that your most important feature of Stockopedia editorial is in-depth stock analysis. The good news is that all of us analysts here at Stockopedia love getting our teeth into a stock and using our data and ratios to really understand the investment case.

And with that in mind, we are making some improvements to the stock analysis we provide on the site.

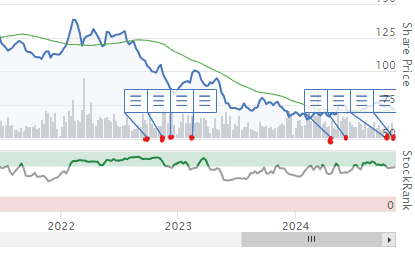

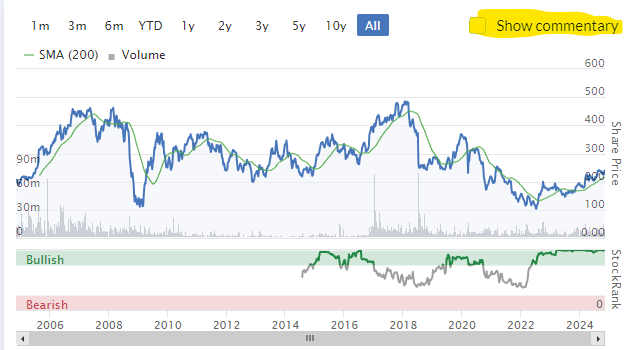

The first is an expansion of the range of companies we analyse in depth, both in response to news events and from ideas generated by our screens and StockRanks. All of this analysis will now be available via the charts on the individual StockReports of each company. You will be able to navigate back through the history of our analysis with ease.

We’ll also be launching Stockopedia’s model portfolios. We have run two portfolios (the NAPS and the SIF) for the best part of ten years, but we want to do more to help you understand the investment case of the stocks within these portfolios. The analysis of these companies will soon live within a dedicated section of the Discuss area, where we’ll also track and update the performance of our portfolios.

Look out for this new section in the coming weeks.

Insights from our data to improve your decision making

Our survey found that 35% of you would like to see more content to improve your investment approach. In order to deliver this, we plan on leaning on our StockRanks and Styles to provide guidance and ideas around portfolio creation, buying and selling rules, and market discipline.

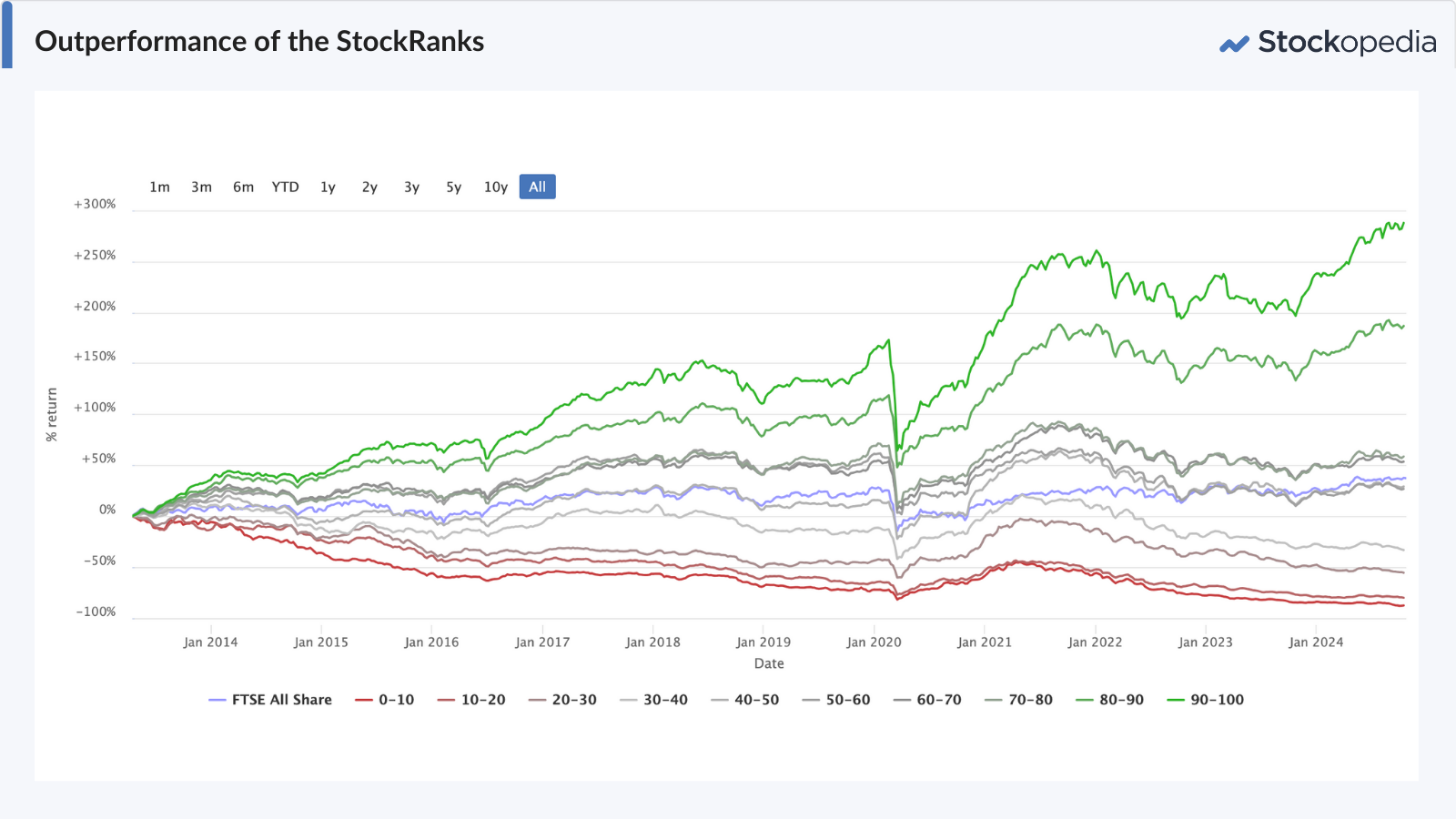

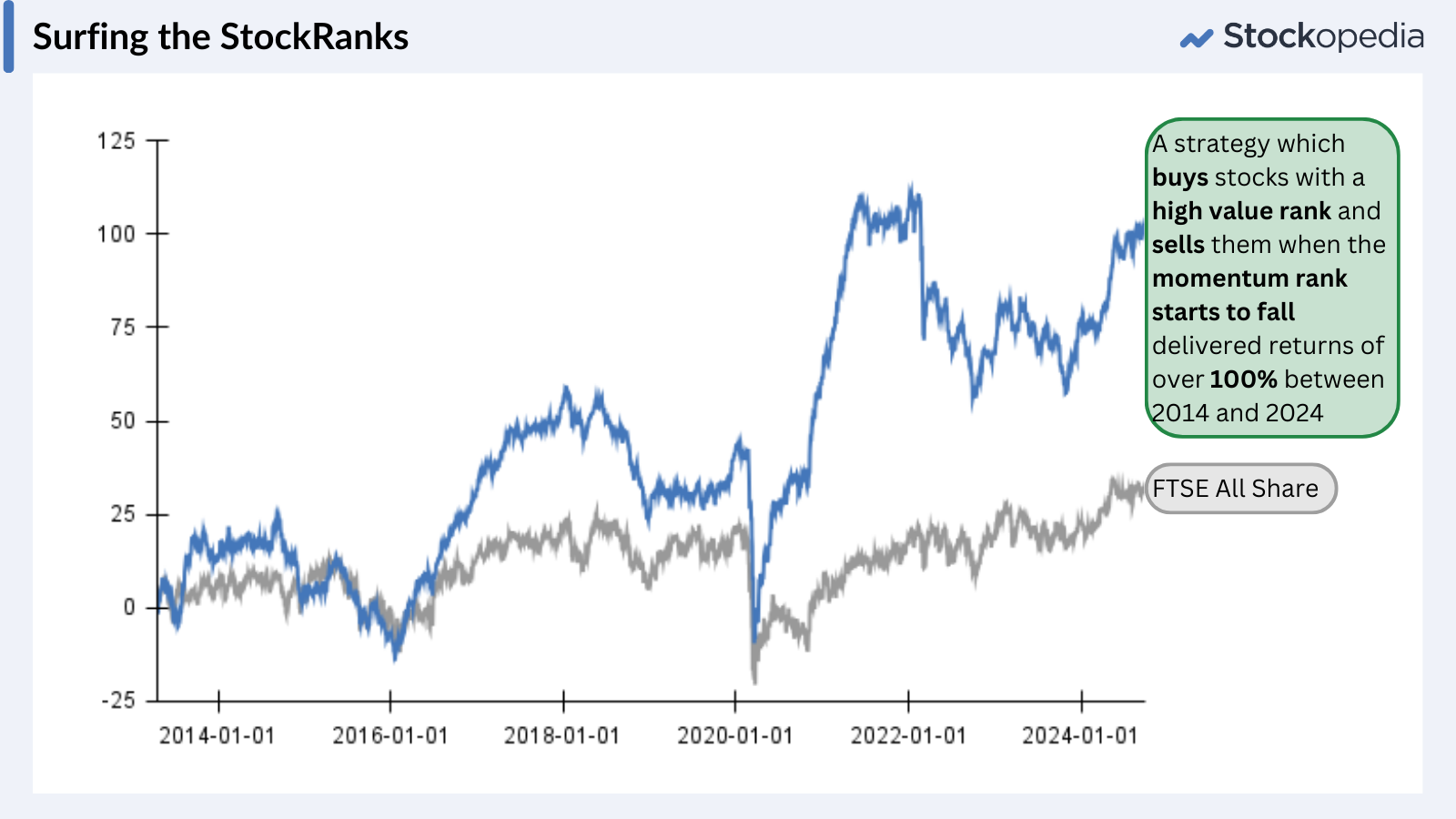

Most of you will have seen the performance chart of our StockRanks, which shows material outperformance in all global markets. Our StockRanks Styles can also help you with your stock-picking decisions. A portfolio built by selecting stocks from any of the four winning styles has also beaten the market comfortably, which we will explain in more detail in an upcoming research project.

On an individual basis our ranks can work wonders as well. We recently tested the performance of portfolios constructed by buying stocks with a high Quality and Value rank and rising Momentum. Rebalanced on a bi-annual basis, the portfolio sold shares as soon as the momentum rank began to fall. Portfolios constructed in this way generated an average performance of over 100% over the last ten years. And following the strategy is so simple.

You can check out the full results and rules here.

We’re going to invest in more data insights like this. Whether you’re a fully systematic, rules based investor or (like 54% of you who attended a recent webinar) identify as a discretionary investor, these insights can guide you to better investment decisions.

And talking of webinars…

We hope some of you have already had a chance to explore our events page and Academy. Both of these pages will soon get a permanent home within the app, making it easier for you to find our content to guide you to better decisions and sign up to our events.

The events page supports our plans to run webinars more regularly, so let us know if there are any topics you’d like us to cover.

Expanded market coverage

And finally, we’ve heard your requests for daily analysis of a broader range of stocks. About a quarter of you have asked for more market coverage, and so we’re responding by increasing our investment in our daily analysis.

From tomorrow 5 November our daily Small Cap Value Report will be renamed the Daily Stock Market Report and we’ll use the space to analyse the biggest investment stories of the day, regardless of the size of the stock or the market on which it is listed. Our daily coverage will be published at 7 am as always, allowing you to start the discussion about the top stories in the UK at market open.

We’ll also be able to be guided by you, our community, on the stocks you’d like to read about most. This is thanks to our new content centre, which allows us to plan for the upcoming week’s announcements. Every Friday, we’ll be publishing The Week Ahead, which will allow you to let us know which stocks you would like us to analyse. We’ll also be able to lean on all our expert analysts to ensure we have sector specialists covering the stocks which require an additional level of knowledge.

And, in the coming weeks, we’ll be launching a new section of the Discuss channel called ‘Companies & Markets’ which will house all of our daily analysis of news and market events. We’ll be able to cover a broad range of stocks from different geographies and you’ll be able to drill down into the content you want with our new filtering tool.

Improving access for the whole community

In addition to showcasing our expert analysts, we want our Discussion boards to be available to all our subscribers to share their ideas, ask for guidance and support each other through the ups and downs of the stock market.

To help make this part of our service as useful to you as possible, we’re pleased to announce that we’re adding comment notifications soon. You can choose to receive notifications in-app or via email whenever you receive a response to your comments.

We’re also committed to continually improving our moderation policy to help ensure the community remains as friendly and supportive an environment as it can be. We look forward to chatting in the coming weeks and months.