Good morning and welcome to Friday's report.

It's almost the end of the half year and news flow today is limited to a handful of small companies with very late accounts. We may take a look at some backlog items from this week - please feel free to drop any suggestions in the comments.

Spreadsheet accompanying this report: link.

12.15: today's report is now complete, thanks for all your comments.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

IG group (LON:IGG) (£3.7bn) | Capital has been reduced by the cancellation of £300m worth of shares, a £126m reduction in the premium account and £3,501 reduction in the capital redemption reserve. | GREEN (Roland - I hold) [no section below] These changes are an accounting exercise with no real-world cash effects. Their purpose is to allow IG to return more of its surplus cash to shareholders, if it should choose to do so. Graham explained this issue in more detail here. | |

Aew UK Reit (LON:AEWU) (£167m) | NAV up 7% to £174m and NAV total return up substantially to 15.3%. Cash of £28m at the year end, management comments that it is “an excellent time to deploy capital”.

Rental income -5% to £18.85m | AMBER/GREEN (Roland) [no section below] | |

Seeing Machines (LON:SEE) (£132m) | Six week pilot trial for its AI-powered transport safety monitoring system. This is the first trial to come out of the pipeline of opportunities from the agreement with MEAA signed in February. | ||

Devolver Digital (LON:DEVO) (£98m) | Trading in line with current expectations. Consensus exps are for the company to move back into profitability in FY25. | AMBER/GREEN (Roland) [no section below] I think this could be an interesting contrarian situation. With net cash covering c.30% of the market cap, I estimate that the shares trade on a cash-adjusted forward P/E of c.12. That could be too cheap if the business can deliver a multi-year run of growth, in line with forecasts. | |

DP Poland (LON:DPP) (£87m) | Rev +20% to £54m (18% lfl growth). Average weekly order count +13%. Group losses reduced to £0.5m. Trading in first few months of the new financial year is ahead of the same period in FY24. | (MB) Results to Dec 2024 being published in late June are a red flag. | |

Likewise (LON:LIKE) (£54m) | Rev +10%. Continued investment in logistics network to support “significantly higher sales activity”. Group is “well on course” to achieving current forecasts.

Broker Zeus leaves forecasts unchanged today, but notes they look “increasingly achievable”. | AMBER/GREEN (Roland) [no section below] Revenue growth of 10% is ahead of consensus forecast revenue growth of 6.7% for this year. Likewise says it is continuing to gain market share. Assuming this level of performance can be maintained, I think there could be some scope for an upgrade to forecasts in H2. While minimum wage and NI increases are expected to be a headwind, positive operating leverage from higher volumes may help to offset this. I have tentatively upgraded our view today to reflect strong momentum. | |

Brave Bison (LON:BBSN) (£41m) | 2025 YTD trading in line with exps, “strong progress”. Four acquisitions so far this year. | AMBER/GREEN (Roland) [no section below] Today’s in-line statement provides useful reassurance and does not alter forecasts or our moderately positive view. Mark covered the MiniMBA acquisition and related issues in depth on Wednesday. | |

Hercules (LON:HERC) (£35m) | An electrical transmission line specialist. Consideration up to £15.7m (9x PBT). | ||

EMV Capital (LON:EMVC) (£13m) | Closed £350k of £1m fundraising for Q-Bot and converted £865k of convertible loans. Equity in Q-Bot will be 30% (£1.4m) | ||

Switch Metals (LON:SWT) (£9m) | Non-trading in 2024. Acquired miner Switch CDI and joined AIM in April 2025, raising £2m. | (RH) Results to Dec 2024 being published in late June are a red flag. | |

Jarvis Securities (LON:JIM) (£7m) | Second Interim Results & Change of accounting reference date | Rev +8.4%, PBT +71% to £2.4m for 6mo to 31/12/24. Warns certain conditions of sale to ii not satisfied. | (RH) Results to Dec 2024 being published in late June are a red flag. |

Mindflair (LON:MFAI) (£5m) | NAV +85% to £10.8m for y/e 31/12/24 due to Infinite Reality investment. PBT of £3.2m, NAVps 205p. | (RH) Results to Dec 2024 being published in late June are a red flag. |

Roland's Section

Next 15 (LON:NFG)

Down 28% to 208p yesterday (£210m) - Statement re. Mach49 LLC & Trading Statement - Roland - RED

Shares in this tech and data-driven growth consultancy group fell by 28% yesterday after the company disclosed legal problems at a subsidiary and issued a profit warning.

Here’s a summary of the timeline:

Wed 25 at 4.20pm: Statement RE: Mach49 LLC - “become aware of potential serious misconduct concerning the Mach49 business”

Thu 26 at 7am: Trading Statement - “the Group now believes that profit for FY26 will be materially below current year expectations”

Thu 26 at 7am: Directorate Change: long-time CEO Tim Dyson will retire after a transitional period to hand over to his replacement, Sam Knights (currently CEO of a Next 15 subsidiary, Shopper Media)

Let’s take a look at what’s happened.

Mach49 legal issues

For some background, Next 15 acquired Mach49 in 2020, when the business was described as a “Silicon Valley-based growth incubator for global businesses”. The price of the deal wasn’t disclosed at the time.

In this week’s statement, the company says it was working on calculating the final earnout payment for the sellers of Mach49 when it became aware of “potential serious misconduct”.

As a result, three senior managers at Mach49 have been fired and the former co-CEO has been appointed as sole CEO.

The potential misconduct appears to be serious:

Next 15, on behalf of Mach49, is in the process of reporting the matters to relevant law enforcement agencies. It is too early to know the outcome, but Next 15 will ensure that full co-operation is provided to those agencies.

Next 15 has paused any further payouts to Mach49's selling shareholder until these issues are resolved.

Profit warning

The Mach49 RNS crept out just before markets closed on Wednesday. There wasn’t much time for traders to react. On Thursday morning we got a conventional 7am Trading Statement with more bad news, triggering yesterday’s share price slump.

Here’s a summary of the main points:

Revenue for FY26 (y/e 31 May 26) is expected to be broadly in line with market expectations, given as £491.7m

However FY26 profit is expected to be materially below current year expectations due to a range of factors:

Mach49: management expects to see a “lower conversion of opportunities within this brand’s pipeline”. This is said to be the most significant impact on expected profit;

Growth investment: additional spending on staff, products and AI;

FX effects: adverse movements in the USD/GBP exchange rate, with over 50% of revenue in USD.

Updated estimate: advisory h2Radnor has provided updated estimates for FY26 - many thanks.

FY26E revenue: £486.1m (prev. £494.1m)

FY26E adj PBT: £63.0m (prev. £82.3m)

FY26E adj EPS: 43.5p (prev. 57.6p)

These forecasts suggest a cut to profit expectations of c.24% for the current year. Some recovery is forecast for FY27, but I’m not sure I would place much weighting on the outlook for next year, given the potential legal issues here.

Roland’s view

When Mark looked at Next 15 in January, he reminded us that Next 15 suffered a mishap in 2024 when it lost a major contract for its growth consultancy division. January’s trading statement was also quite downbeat, warning that profits would be at the lower end of expectations.

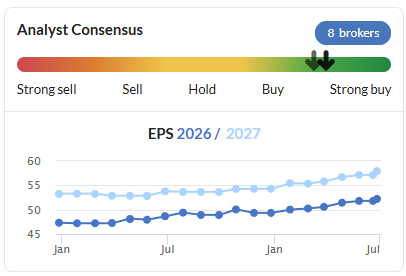

Even before this week’s bad news, there seems to have been a backdrop of disappointing performance – reflected in the consensus trend chart:

The risk here is that bad news and additional costs could continue for some time before positive momentum is restored. Even before this week’s news, the StockRanks were flagging up very low momentum, which can be a risk factor:

A further concern for me is the timing of the departure of the CEO. Tim Dyson has been in this role since 1992 and joined the firm straight from university. The company says succession planning has been in progress for some time, but I would speculate that the timing of the news may suggest that the board has decided to accelerate the process of leadership change.

It’s possible that Next 15 shares are cheap at current levels and may recover. This week’s updated forecasts from h2Radnor suggest the shares may now be trading at just four times FY26 earnings:

However, there are too many factors that are simply unknown at this time for me to consider this as a possible investment. In this case, I’m particularly concerned by the risk of exceptional costs and reputational issues that might affect Next 15’s ability to win new contracts.

Until we have some clarity from the new CEO on both the Mach49 situation and trading performance, I am inclined to view Next 15 shares as uninvestable. RED

Babcock International (LON:BAB)

Up 11% to 1,144p on Wed 23/6 (£5.9bn) - Preliminary Results - Roland - AMBER/GREEN

I’m circling back to look at FTSE 100 defence contractor Babcock International, which released its full-year results on Wednesday this week.

It's no secret that defence stocks are enjoying structural headwinds at the moment. Babcock has also been benefiting from a successful turnaround under CEO David Lockwood, previously of Cobham (which was controversially sold to private equity!).

As a result, the Babcock share price has tripled over the last three years:

I don’t think Babcock is ever likely to become a takeover target, due to its national security significance as a key contractor looking after the Royal Navy’s nuclear submarines. But there seems little doubt that the company is in a strong position at the moment.

FY25 results summary (y/e 31 March)

Babcock’s revenue rose by 10% to £4,831.3m last year, supporting a 51% increase in operating profit to £363.9m, giving a margin of 7.5%. This is a reported profit figure – refreshingly, the adjusted operating profit figures were almost identical.

Adjusted earnings for the year rose by 63% to 50.3p while the dividend was lifted 30% to 6.5p. That seems a surprisingly small payout for a business with this level of profitability, giving a total payout of c.£33m – equivalent to a yield of just 0.6%.

The explanation seems to be that Babcock has decided to follow the fashion for prioritising share buybacks over dividends. This week’s results included details of a £200m buyback (39.5p per share) to be carried out over the coming year. That’s equivalent to a yield of 3.4% that shareholders could have enjoyed in cash.

Personally, I’m not a fan of this approach - especially when a company’s shares are trading on a relatively high valuation and the planned buyback is not covered by free cash flow. Both of these are true here, based on last year's results.

Trading: Babcock’s trading performance for the year was supported by strong growth in the Nuclear and Marine divisions, according to the company. The contract backlog remained stable at £10.4bn, reflecting new business wins offset by the ongoing delivery of some long-term contracts.

Some of the highlights flagged by the company include the hull completion of the first Type 31 Frigate for the Royal Navy and the docking of the first Astute Class nuclear submarine in upgraded facilities at Devonport.

Elsewhere, the firm secured a five-year, £1bn support contract with the Army and a 15-year deal to provide military air training solutions for the French Air Force and Navy.

Balance sheet/cash flow: looking over Babcock’s accounts in more detail doesn’t suggest any obvious concerns to me.

Debt levels are now comfortable at 0.3x EBITDA (net debt of £101m exc leases). Free cash flow of £153m (my calculation) represented 61% of net profit for the year. This level of cash conversion looks fine to me against a backdrop of elevated investment to support future growth.

Outlook

Babcock now expects to achieve its previous medium-term operating margin target of 8% in FY26, one year earlier than previously planned. Brokers have tweaked forecasts slightly higher this week, according to the consensus data on Stockopedia:

FY26E EPS +0.8% to 52.2p

FY27E EPS +1.2% to 57.9p

This valuation and growth outlook is reflected in High Flyer styling and a StockRank that’s weighted to quality and momentum:

Average mid-single digit revenue growth;

Underlying operating margin of at least 9%;

Average underlying operating cash conversion of at least 80%.

Roland’s view

Earnings forecasts have trended steadily higher over the last 18 months, supporting the strong momentum we've seen:

I’m relieved to see that I upgraded Babcock to AMBER/GREEN in April when the company issued a positive trading statement, confirming full-year guidance and emphasising an improvement in margins.

Based on valuation and current year forecasts alone, I might be tempted to revert to a neutral view. But I can't ignore the stock's strong momentum and the broader expectation of a structural increase in defence spending, highlighted by CEO Lockwood:

This is a new era for defence. There is increasing recognition of the need to invest in defence capability and energy security, both to safeguard populations and to drive economic growth. Our specialist capabilities are increasingly relevant …

The main risk I can see is that we could now see an awkward pause in growth while the market waits to see how pledges for higher defence spending will translate into concrete commitments and contracted projects.

Even so, I think the direction of travel remains clear and believe that Babcock should be well positioned to benefit. I’m going to leave our view unchanged at AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.