Good morning and welcome to today's report.

The agenda is now complete.

Update 12.30: today's report is now complete. We're expecting a busier week next week, as Mark discusses in The Week Ahead.

In the meantime, I hope you have a good weekend.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Berkeley group (LON:BKG) (£3.4bn) | On track to achieve FY26 PBT of £450m, in line with guidance. Expect a similar result in FY27. | AMBER (Roland) [no section below] I’ve long viewed this brownfield redevelopment specialist as one of the best-run housebuilders on the UK market. However, today’s in-line update suggests to me that the business will generate a return on equity of c.10% in both FY26 and FY27. At this level of profitability, the shares look fairly valued to me, trading in line with last-reported NAV. In addition, I’d echo Graham's previous comment that Berkeley's ongoing practice of making share buybacks at or above book value may be propping up EPS, but isn’t accretive to NAVps. For a property company, I’d prefer to see surplus cash returned as dividends unless the shares are trading at a discount to NAV. I'm staying neutral. | |

Ashmore (LON:ASHM) (£1.22bn) | SP -6% AUM -3% to $47.6bn, net outflows reduced to $5.8bn (FY24: $8.5bn) Adj PBT -33% to £70.1m. | AMBER/GREEN (Roland) Another year of net outflows, with investors withdrawing more than 10% of opening AUM through the year. It’s some consolation to me that Ashmore’s positive investment performance recouped much of this loss. But until investors start to allocate cash back into the group’s emerging market funds, it looks like earnings will remain depressed. The 10% dividend yield is not covered by profits, but it is still supported by a strong balance sheet, with over 70p per share of surplus capital. That should limit the near-term downside risk, in my view, while significant recovery potential exists if Ashmore can manage to start attracting positive flows. While I remain broadly positive on the recovery potential of this business, I don’t think I can be fully positive on the stock with the current combination of outlook and valuation. | |

Tufton Assets (LON:SHIP) (£224m) | Sold Neon (a ship) for $23.5m, a 2.6% premium to NAV. IRR 13.5%. Now has 19 vessels. | ||

Camellia (LON:CAM) (£145m) | Rev +2.5%, Loss before tax £10.4m. NAV -10% to £312.4m. 2025 results exp ahead of 2024. | ||

Peel Hunt (LON:PEEL) (£125m) | SP +10% Strong start to year in M&A and capital markets. FY26 results now to be ahead of expectations. | GREEN (Roland) [no section below] Graham correctly called this broker as GREEN in July and today’s update seems to confirm that activity levels in UK equity markets may be improving. Peel says it has acted on some "substantial" M&A transactions in recent months and now has 58 FTSE 350 clients, up from 52 at the end of March. The firm also reports signs of improving activity in capital markets and execution services. Profits can bounce back quickly in this type of business. With ample net cash on the balance sheet and a valuation of just 1.4x net assets, I see no reason to change our positive view today. | |

Victoria (LON:VCP) (£76m) | Trading remains in line with July guidance. Focus remains on self help initiatives and deleveraging. | ||

Gear4music (HOLDINGS) (LON:G4M) (£56m) | Q1 FY26 revenue +27% vs Q1 FY25. FY26 results to be ahead of exps (rev £155.8m, PBT £3m) | AMBER/GREEN (Roland) The music equipment retailer says it’s gaining market share and benefiting from more supportive market conditions in the UK and Europe. Today’s upgrade is the second in three months and has sent the share price to a post-2022 high, leaving the stock up by 50% since Graham turned GREEN in June. I think there’s scope for further growth (and upgrades), but I’m also aware this remains a low margin retailer with limited visibility of sales ahead of the peak Christmas trading period. Gear4Music has also struggled to consistently generate attractive returns in recent years, leading to an unfortunate debt splurge. While leverage now looks comfortable to me, I think some further growth is already priced into the current forward P/E of 23. To reflect this view, I’m moderating our view by one notch today. | |

Tialis Essential IT (LON:TIA) (£21m) | Begun delivery of major UK govt contract announced Jan 25, exp value £15m over 5 years. | ||

Fadel Partners (LON:FADL) (£13m) | Rev -11%, adj EBITDA £(2.4)m. FY outlook unchanged for EBITDA loss of $0.8-1.0m. |

Roland's Section

Gear4music (HOLDINGS) (LON:G4M)

Up 10% to 292p (£61m) - Roland - AGM Statement & Trading Update - AMBER/GREEN

[...] strong trading in the year to date provides the Board with sufficient confidence to once again increase its expectations for the Group's financial performance for the year ending 31 March 2026

Today’s update from this online music equipment retailer is short but sweet, with Gear4Music upgrading its profit guidance for the current year for the second time in three months. (Graham turned GREEN at the last upgrade, with June’s results, flagging a possible opportunity)

My reading of today’s update is that the company has successfully retrenched following the post-pandemic slowdown and is now benefiting from some of the same competitive advantages that fuelled its earlier growth:

Revenue in the first quarter of FY26 (Apr-Jun) was 27% ahead of the same period last year, “with traction continuing in Q2 FY26 to date”

Refreshed growth strategy is delivering results, aided by “a more favourable competitive landscape” in both the UK and Europe

Management believes the group is gaining market share

Outlook & Estimates

With the caveat that it’s still early in the year and ahead of peak Christmas trading, the company now expects FY26 results to be ahead of the upgraded guidance provided in June.

Gear4Music doesn’t provide updated financial guidance but does reference current consensus expectations for revenue of £155.8m and pre-tax profit of £3m.

Fortunately, paid research house Progressive has issued an updated note this morning providing more detail on expectations for this year and next:

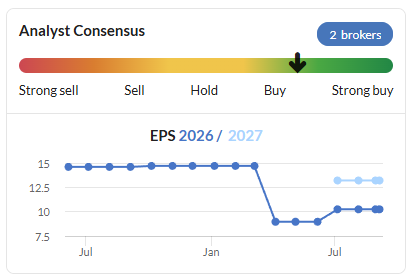

FY25 actual EPS: 3.8p

FY26E EPS: 12.1p (prev. 9.3p)

FY27E EPS: 12.5p (unch)

This is a 30% upgrade for FY26 – a substantial increase.

However, strong recent share price gains mean Gear4Music is still trading on a FY26E P/E of 24 after this morning’s gains.

Progressive’s FY27 forecasts have been left unchanged today, which the research house says reflects a lack of formal guidance from the company. An update is expected with the H1 results in November.

Roland’s view

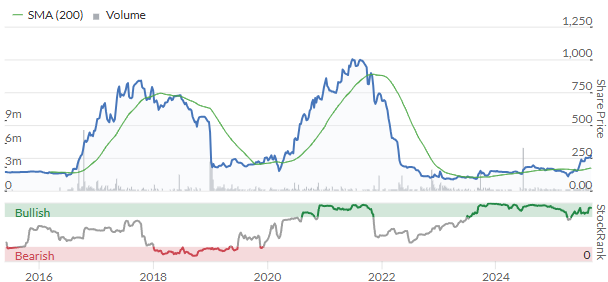

Gear4Music (and its shareholders) have been on a remarkable journey since its listing in 2015:

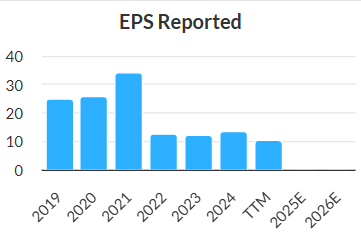

Earnings expectations have also been volatile over the last year, perhaps serving as a reminder of the limited visibility the company has on consumer demand:

Our coverage has reflected this, with Mark and Megan both warning of the elevated debt levels in April, before Graham turned positive in June when full year results showed a reduction in debt and improved trading.

The StockRanks have picked up the opportunity this year and Gear4Music’s shares have risen by 50% since June:

Where does that leave us today? I’ve been impressed by Gear4Music’s progress in recent months and I think there’s a reasonable chance of further upgrades.

At the same time, my feeling is that forward visibility on sales is somewhat limited ahead of peak festive trading, due to competitive pressures and the uncertain consumer backdrop across Europe.

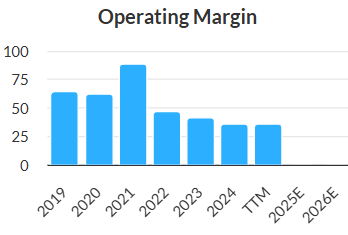

A further concern for me is that this remains a low-margin retailer. From what I can see, operating margins have averaged around 3% since the company’s IPO, ignoring the distortion of the 2021 pandemic boom year.

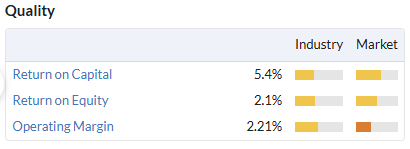

Returns on capital have also been low in recent years – presumably below the cost of capital for this business. This probably explains the company’s previous use of debt to fund growth – profitability was not high enough to allow the business to self-fund major expansion.

However, today’s updated forecasts suggest to me that ROCE could improve to c.8% this year, with potential for further improvement in FY27. Further debt reduction also seems likely – I no longer see leverage as a significant concern.

I’m also impressed by current momentum here and aware that repeated upgrades can often trigger a surprising run of growth, as Ed has discussed recently.

I don’t want to get hung up on the valuation as I think there is scope for further growth beyond current expectations over the next 18 months. However, with the share price up by 50% since Graham turned GREEN in June, I think some of this potential is now priced in.

For these reasons, I’m going to moderate our view by one notch to AMBER/GREEN today.

Ashmore (LON:ASHM)

Down 5.5% to 162p (£1.15bn) - Roland - Final Results - AMBER/GREEN

Emerging market specialist asset manager Ashmore has benefited from the broader share price rally in this sector this year, but has come off the boil recently. Today’s results seem to provide some justification for this, with the Reuters newswire suggesting today’s results have fallen below consensus expectations.

Let’s take a look.

FY25 results summary (y/e 30 June)

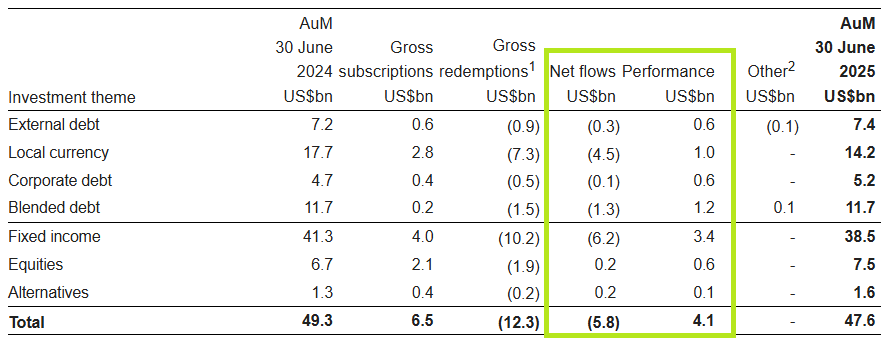

The main headlines from this morning’s results show revenue down by 23% to £144.1m. This drop was mainly driven by a 19% decline in management fees, which fell to £129.7m.

Lower management fees are a reflection of lower assets under management. Ashmore’s year-end AUM fell by 3% to $47.6bn, but average AUM through the year was 7% lower, at $48.9bn.

Employee costs fell by 15% to £71.8bn. This largely reflects the drop in performance fees earned last year and the resultant reduction in bonus payments. However, with salary costs unchanged there was still some negative operational gearing. Operating profit dropped 34% to £49.4m, excluding £9.4m of gains on seed capital.

Although these results still show Ashmore generating a creditable 33.7% adjusted operating margin, this is down from 39.8% last year and well below historic levels:

EPS & Dividend: the dividend for the year was held at 16.9p per share, giving a 10% yield. This was not covered by reported earnings of 11.8p per share, but may reflect a) the strong balance sheet and b) founder/CEO Mark Coombs’ 29.5% shareholding. This provides him with dividend income of c.£35m per yearr.

Balance sheet: Ashmore shares are trading at around 14x today’s reported earnings, but as we’ve commented previously this business has a very strong balance sheet with capital and cash that cover the majority of the market cap:

Net asset value: £782.6m (FY24: £882.6m)

Surplus capital over regulatory requirements: £510.9m (FY24: £599.2m)

The group’s surplus capital is equivalent to just under 72p per share, by my calculations, supporting nearly half the current market cap.

It’s probably worth noting that both NAV and surplus capital have reduced since last year. My feeling is that this largely reflects the maintenance of the dividend at 16.9p – a level that’s not been covered by earnings since 2021:

While I’m not generally a fan of uncovered dividends, in this case I think it is a justifiable decision. Ashmore has ample surplus capital and can readily afford to return some of it to shareholders.

This aside, I think some of the other movements in the balance sheet are also worth noting. Ashmore’s cash balance fell from £512m to £349m last year, but this was largely due to £113m of additional capital invested in the company’s seed funds.

These are investments for which Ashmore is building a track record in the hope of being able to offer them to clients in the future.

In this case, management says funds were invested in strategies including “frontier blended debt, impact debt and Mexico equities”. They were also used to help scale up some existing funds:

providing additional scale to existing funds in anticipation of client demand as investor interest in the emerging markets asset classes gathers momentum.

Trading commentary: is the outlook for this business as poor as Ashmore’s profit slump suggests?

My impression is that this company has been suffering from the same malaise as many other parts of the market – its offerings have underperformed the Mag 7 and broader US market.

However, today’s commentary suggest Ashmore’s performance is not too bad when compared to relevant benchmarks and improved dramatically last year:

As at 30 June 2025, 57% of AuM is outperforming over one year, 70% over three years and 81% over five years (30 June 2024: 40%, 59% and 62%, respectively).

The real problem was that clients continued to withdraw funds from all the group’s strategies despite seemingly positive performance:

Today’s results go into considerable detail on market conditions and Ashmore’s efforts in various regions of the world and make interesting reading.

The company is putting increasing effort into some of its regional offices. While local office AUM only represents 16% of the group total, this is seen as an important area for long-term growth and diversification.

Outlook

As always, CEO Mark Coombs is a perma-bull on the opportunities in emerging markets, but in fairness I can see his point. Surely at some point there will be a rotation from the largest US stocks into a broader range of opportunities?

The global macro environment remains complex, notably with the impact of US policies and geopolitical risks including conflicts. However, several themes are evident and point to the need for investors to rebalance allocations away from the US and to other regions, and particularly to emerging markets, in order to position for higher risk-adjusted returns over the medium term.

Coombs also notes that recent changes to emerging market credit ratings have been “net positive” and suggests that the prospect of a weaker dollar may mean that emerging markets become relatively more attractive for foreign investors in US markets.

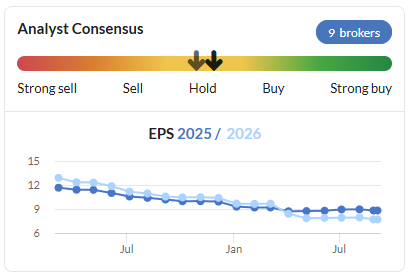

There’s no formal financial guidance in today’s results, but consensus estimates prior to today were cautious, suggesting another weak year may lie ahead:

These figures put the stock on a FY26E P/E of21, with a tempting (but uncovered) 10% dividend yield.

Roland’s view

I’m reassured by the continued strength of Ashmore’s balance sheet and by its positive investment performance over the last year.

In a more neutral market, I’d argue that these would comfortably underpin the current valuation.

The key issue for me is that the company is continuing to suffer sizeable net ouflows – and I can’t see anyway to know when this trend might change.

On balance, I think Ashmore remains reasonably valued and conservatively financed. If net inflows return, this business should have the potential to deliver a strong recovery in profits.

However, I don’t think I can be fully positive at this time given the uncertain outlook and uncovered dividend. I’m going to move our view down by one notch to AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.