Good morning!

The agenda is now complete.

Update 14.20: today's report is now complete.

Spreadsheet accompanying this report: link (last updated to: 5th September).

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£175bn) | Phase III trial of Fasenra did not achieve statistical significance in a trial in patients with COPD. Subcutaneous administration of Saphnelo demonstrated statistical significance in a trial in patients with Lupus. | ||

GSK (LON:GSK) (£59bn) | GSK to invest $30bn in R&D and manufacturing in the US over next five years. Includes $1.2bn today. | ||

Barratt Redrow (LON:BTRW) (£5.25bn) | Completions +18.3%, rev +33.8%. Adj PBT +26.8% to £488.3m. Outlook unch, cites political risk. | AMBER (Roland) [no section below] Today’s results seem to be broadly as expected and show a return on equity of just 4.4% on an adjusted basis, or just 2.4% on a reported basis. I expect this to gradually improve over time, but with FY26 forecasts suggesting ROE will remain below 6%, I think the current discount to book value is probably fair. As I discuss in my piece on brick producers today, profitability is under pressure at housebuilders, even if volumes do rise. I’m going to remain neutral on Barratt Redrow today. | |

| Games Workshop (LON:GAW) | Dividend | Trading in line with exps for y/e 31 May 26. Dividend of 85pps declared, FY26 YTD total 225p. | |

Supermarket Income REIT (LON:SUPR) (£980m) | Rental income +6% to £113.2m, div +1% to 6.12p. “Positioned for materially improved earnings” | ||

Moonpig (LON:MOON) (£642m) | Momentum continued with trading in line. On track for FY26 guidance; adj EPS +8%-12% | AMBER/GREEN (Mark) [no section below] I am interested in looking at this because I own shares in Card Factory, who have just bought FunkyPigeon from WH Smith. While that deal makes sense from a pure synergy POV, I am wondering if it is negative for Moonpig having a more motivated and ruthless competitor.

These up the average order size and the partnerships that Moonpig has developed in the gifting space as the market leader show that there is quite some work for Card Factory to do if they want to really compete here. | |

PRS Reit (LON:PRSR) (£575m) | Sale of portfolio for £646.2m, net proceeds £633.2m (c.115pps). Plan to return net assets and liquidate PRSR following sale. | PINK | |

SolGold (LON:SOLG) (£517m) | Results “support the emerging strategy” for developing open cut resources at Tandayama project. | ||

IP (LON:IPO) (£500m) | “Encouraging portfolio developments” but NAV -7% to £883m ( 96.2pps) in H1. | ||

Young & Co's Brewery (LON:YNGA) (£490m) | LFL sales up 5.6%, total sales +5.3% during 24 weeks to 15 Sept. H1 outlook in line. | ||

Advanced Medical Solutions (LON:AMS) (£454m) | Rev +63% to £110.8m (inc acquisition). Adj PBT +11% to £16.4m, FY exps unchanged. | ||

Galliford Try Holdings (LON:GFRD) (£441m) | SP +10% Dividend +22.6% to 19p per share. | AMBER/GREEN (Roland) [no section below] It looks like I may have been a little too conservative with this construction group, whose infrastructure focus is supporting strong growth in sectors such as Water and Highways. Today’s results are ahead of expectations and unlike Kier yesterday, Galliford appears to have a genuine net cash position – albeit I think this is needed for the business to operate securely, as I’ve discussed before. The pros and cons of this sector are well rehearsed. An operating margin of 2.1% leaves little room for error while the 25% ROCE highlights the capital-light nature of the balance sheet, which has over £600m of payables and negative working capital (see McBride today for more on this). Having said that, I can’t really fault these results for what they are. On an adjusted basis at least, profit margins improved last year and the group’s cash generation is genuine. Forward visibility seems fairly strong, with 92% of FY26 revenue secured and 75% for FY27. I’d argue that the current strong performance has only really been in place for the last two years. On a longer view, Galliford needs to show it can continue to win work through varying political conditions while maintaining or improving current margins. Personally, I wouldn’t want to pay much more than the current forward P/E of 14 for this stock. But I have to respect the strong momentum and currently sound fundamentals, so I’m going to move up our view by one notch to AMBER/GREEN. | |

LSL Property Services (LON:LSL) (£304m) | H1 trading in line, rev +5%, adj op profit +3% to £14.8m. FY exps unchanged. | ||

PZ Cussons (LON:PZC) (£284m) | Rev -2.7%, PBT -8.1% to £41.1m. FY26 YTD trading in line, expect adj op profit £48-53m. | AMBER (Roland) Today’s market reaction seems a little generous to me. The main highlight from today’s results seems to be the prospect of rapid debt reduction when various asset sales complete. On the other hand, underlying trading seems mixed and some of the company’s brands appear to be struggling with declining demand. I can see the case for a turnaround here and think the stock is fairly value and reasonably described as Contrarian. But I don’t have enough conviction to turn positive, so I am leaving my previous neutral view unchanged today. | |

McBride (LON:MCB) (£187m) | Rev +0.7%, adj PBT +2.7% to £54.9m. Dividend reinstated. FY26 YTD volumes in line with exps. | AMBER (Roland) Strong results and good cash generation support the current valuation, in my view. However, the near-term outlook for earnings is flat and today’s commentary highlights continued pressures on both price and cost. While net debt has fallen, I’d like to see it reduce further given the negative working capital at work in this business. A neutral view may be a little conservative, given the impressive improvements in profitability here in recent years. But I’m leaving our view unchanged today. | |

Symphony International Holdings (LON:SIHL) (£141m) | NAVps +2.7% to $0.88 vs Dec 24, due mainly to increased value of unlisted investments. | ||

Trufin (LON:TRU) (£109m) | Net rev +29% to £15.4m, PBT +15% to £4.5m. Strong back catalogue sales. £4m buyback. | ||

Quadrise (LON:QED) (£63m) | Successful completion of proof-of-concept and emissions testing programmes for its MSAR® and bioMSAR™ fuels at the Sparkle plant in Panama. | ||

Centaur Media (LON:CAU) (£59m) | Revenue -7% to £11.1m, Adj. Operating Loss £0.9m (24H1: £0.4m), Net cash £9.4m (30 Jun 24: £8.9m, 15 Sep: £24.7m following sale of MiniMBA). “Continued work on the future strategy including progress on other disposals, transferring marketing brands into stand alone entities and planning for reduced central costs.” | AMBER/GREEN (Mark) | |

Ten Lifestyle (LON:TENG) (£55.3m) | Net revenue +5% to £65.7m broadly in line with expectations. Adj. EBITDA +14% to £14.6m ahead of market expectations. Net cash £9.8m (31 Dec: £3.9m) | AMBER (Mark) | |

R E A Holdings (LON:RE.) (£42.5m) | Revenue +14% to $92.4m, EBITDA +55% to $33.4m, u/l PBT +43% to $11.6m. Net debt $159.1m (31 Dec: $159.3m) “Group’s financial position continuing to strengthen with an increasingly encouraging outlook” | ||

Cobra Resources (LON:COBR) (£30.7m) | Recently acquired tenements expand the resource potential of Boland across two regionally extensive palaeochannel systems. | ||

Hercules (LON:HERC) (£30.7m) | New contract awards from clients in the UK water sector totalling £6.5m over their duration. | ||

M Winkworth (LON:WINK) (£25.4m) | H1 Revenue +1% to £5.2m, PBT -19% to £0.83m, Cash £3.86m (24H1: £4.12m), Interim dividend +10% to 6.6p | AMBER (Mark) [no section below] | |

Premier African Minerals (LON:PREM) (£23.8m) | Plant has achieved Saleable Concentrate on numerous occasions, however the objective of this next test is to demonstrate that the Zulu plant can now achieve this consistently. Limited mining restarted. | ||

Facilities by ADF (LON:ADF) (£22.1m) | Revenue +14% to £17.4m due to acquisition, Adj. EBITDA -12% to £2.2m, LBT £2.0m (24H1:LBT £0.8m), 0.3p dividend (24H1: 0.5p). FY in line with expectations with H2 weighting. | AMBER/RED (Mark) | |

Zenith Energy (LON:ZEN) (£17.3m) | 6 MWp development project acquired for €750k including land and permissions in Italy. | ||

Prospex Energy (LON:PXEN) (£17.1m) | ”...completion of the workover of the Viura‑1B well, in the Viura gas field in northern Spain, has been delayed owing to an unforeseen event during the well testing.” | ||

Lexington Gold (LON:LEX) (£16.8m) | Step-out drilling has extended both the Red Hill and Middle Zones, which remain open along strike and at depth. Highest grade 2.27g/t over 8m. | ||

Fusion Antibodies (LON:FAB) (£15.9m) | NCI has asked to extend its use of the OptiMAL® platform for use against further targets in the coming years, beyond original Nov25 date. | ||

Eden Research (LON:EDEN) (£15.2m) | H1 Revenue -37% to £1.2m, Operating Loss £1.7m (24H1: £1.3m), Current cash £1.9m (30 June 24: £4.9m). Moving accounting reference to 31st March. Expects to meet 2025 expectations for £5m revenue over 15 month period. | BLACK/AMBER/RED (Mark) [no section below] | |

KRM22 (LON:KRM) (£15m) | H1 Revenue +10% to £3.6m, Adj EBITDA +33%, LBT £1.6m (24H1: £1.3m), Net Debt £3.7m (31 Dec: £3.0m) “...we remain confident in our ability to build on this momentum to become a cash generative and profitable business.” |

Roland's Section

McBride (LON:MCB)

Up 11% at 119p (£205m) - Final Results - Roland - AMBER

McBride, the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning/hygiene markets, announces its preliminary results for the year ended 30 June 2025.

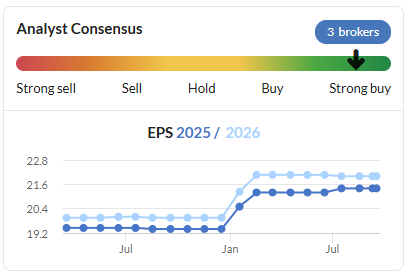

Today’s results from McBride show adjusted earnings of 22.1p per share, slightly ahead of Stockopedia consensus forecasts for 21.4p.

Debt is down, the dividend has been reinstated and forecasts (from the house broker) for FY26 and FY27 have been nudged higher. With McBride shares trading on a forward P/E of 5, this morning’s share price pop looks to be understandable.

Do today’s results justify a higher rating? Let’s take a look.

FY25 results summary

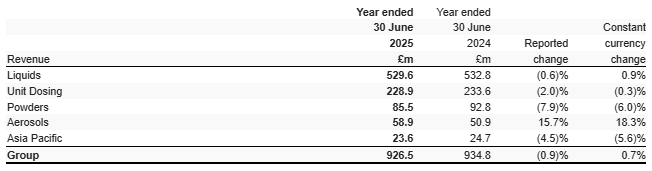

Today’s results are certainly positive, but also show signs of strain from external pressures. These figures are all at constant currency, to exclude the impact of exchange rate movements:

Revenue up 0.7% to £926.5m (slightly below consensus of £930m)

Adjusted pre-tax profit up 2.7% to £54.9m

Adjusted earnings up 0.3p to 22.1p per share

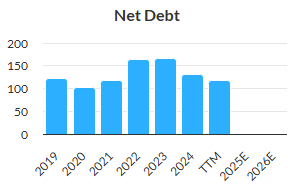

Net debt down £26.3m to £105.2m

Dividend: 3.0p per share (FY24: nil)

McBride says total volumes rose by 4.3% last year, with private label volumes up 1.4% and contract manufacturing volumes up by a chunky 48.9%. This reflects “a new significant long-term contract manufacturing agreement” secured in Q4, together with two further multi-year deals with “large FMCG clients” in the first half of the current financial year.

An increase in volumes on essentially flat revenue tells us that unit prices fell last year, or that the product mix changes to lower value items.

In this case, my feeling is that the answer is possibly a little of both. I’d guess that contract manufacturing may come with slightly lower unit prices, while in private label (e.g. supermarket own brands), McBride reports a tough competitive environment:

Private label demand remains strong with overall market share holding at current, all-time high levels. Promotional activity from branded competitors was particularly elevated during the year, impacting private label volumes, although this eased towards the end of the financial year, while retailers increased their emphasis on value for consumers in light of ongoing cost-of-living pressures.

I’d guess that customers may be altering pack sizes and perhaps reformulating slightly to cut raw material costs (my emphasis):

The inflationary backdrop continues to shape retailer behaviour, with many seeking value-led propositions and cost-reduction initiatives.

Geographically, the company reports an improved performance in Germany and France, with lower volumes in the UK and “a challenging year” in Italy.

McBride describes its core focus as Germany and laundry products and I think this is reflected in divisional results, with the top two or three categories focused on laundry and related areas such as dishwasher products:

The picture is fairly flat overall, though, with no real growth in the largest two divisions.

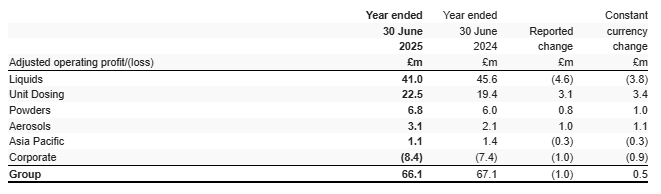

Unlike (too) many companies, McBride also choose to report divisional profits, giving us an insight into the relative profitability of these operations:

Profitability: Margins are highest at 9.8% in Unit Dosing (FY24: 8.3%), presumably as these convenience-led and more complex products carry slightly stronger pricing and retail margins.

Profit margins were lower in the core liquids business, though falling to 7.7% (FY24: 8.6%). This seems to be due to “an increased mix in favour of lower-value products”, plus some inflationary pressures.

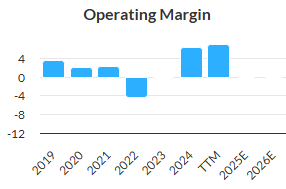

The divisional results above translated into an overall adjusted operating margin of 7.1% (FY24: 7.2%) or – if you prefer to include £4m of costs relating to a strategic review, restructuring, and environmental remediation – a reported operating margin of 6.5% (FY24: 6.9%).

Although lower than last year, this remains well above pre-pandemic levels:

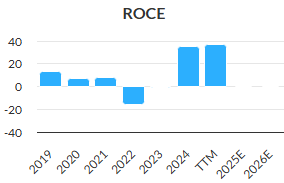

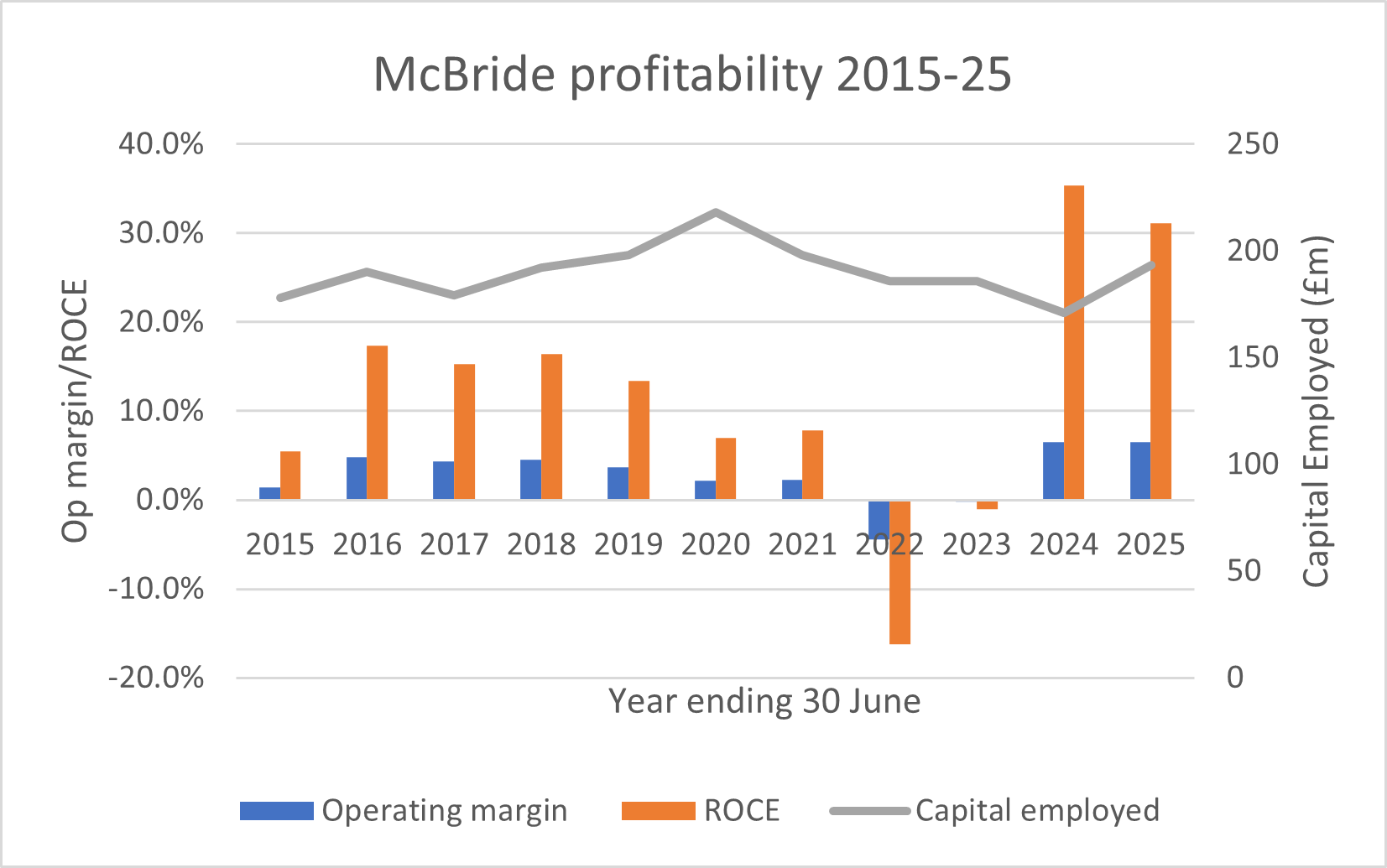

McBride’s returns on capital employed also appear highly impressive. I calculate a ROCE of 31% from today’s results, consistent with the improved performance reported last year:

This step change in profitability seems remarkable for what remains a lowish margin consumer goods firm.

Balance sheet & Cash Flow

Higher profit margins must be coming from stronger pricing power, improved product/customer mix or perhaps economies of scale and other efficiencies. I don’t know the company well enough to be sure of the exact contribution to the improvement in margins.

However, this is only part of the story and doesn’t fully explain the increase in ROCE.

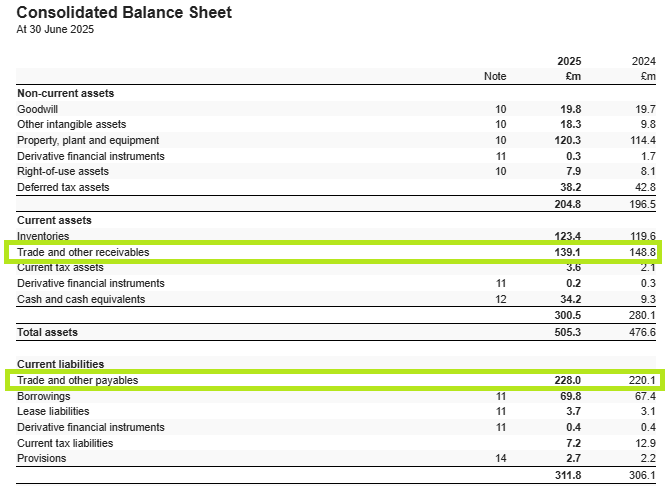

I think the other part of the story here is that the company is now benefiting from improved payment terms with its suppliers, so it’s able to run a negative working capital position. In other words, McBride receives payment from its customers before it needs to pay its own suppliers. This is a model used by supermarkets to great effect.

Looking at the historic balance sheet data in Stockopedia suggests to me that the recent growth in profits has been achieved without much additional capital being employed (rh axis):

Crunching the numbers in today’s balance sheet suggests to me that McBride receives payments from its customers in under 60 days, but may take over 120 days to pay its own suppliers. This naturally creates a very favourable cash flow – effectively a free float.

Here’s how this looks on the balance sheet. Note that year-end payables that are c.65% higher than receivables, with current liabilities exceeding current assets. This could lead to liquidity concerns, if it wasn’t for the apparent timing differences I’ve noted above:

Back in FY18 and FY19, for example, payables were only around 25% higher than receivables. If this ratio still applied today, McBride would have needed an extra c.£43m of working capital in the business at the end of last year to support the current level of sales. That would have reduced ROCE to c.25%.

The benefit of this approach is reflected in higher ROCE and falling net debt:

Net debt is reported at £105.2m today, or 1.2x adjusted EBITDA. I’d like to see this keep falling, as negative working capital is effectively a form of leverage. However, current borrowing levels don't look like a serious concern as things stand.

Negative working capital also tends to support strong cash generation. My sums suggest free cash flow of £26.5m last year, relative to net profit of £33.2m.

That’s not a bad result, but I estimate cash conversion would have been 100% if McBride hadn’t needed to make a £7m cash contribution to its final salary pension scheme. The deficit on this scheme was £23m at the end of June, down from £27.5m one year earlier.

Outlook

CEO Chris Smith says trading so far in FY26 has been in line with expectations. McBride’s private label market share is at a “recent all-time high” and there’s progress on customer partnerships, with a “robust pipeline of new launches”.

However, it doesn’t look like this positive sentiment has translated into upgraded forecasts.

Zeus has kindly provided an updated note on Research Tree today. However the broker has trimmed its forecasts slightly for the next two years, citing “pricing headwinds”, “increased competition from branded competitors” and “inflationary cost pressures”:

FY26E EPS: 21.6p (prev. 22.2p)

FY27E EPS: 22.5p (prev. 22.6p)

Roland’s view

The updated forecast for FY26 is essentially flat, in my view, given the inevitable uncertainty about trading over the next 10 months. But it certainly doesn’t look like the company is currently expecting a repeat of the upgrade seen at the start of the year:

I think this is a useful reminder of the difficult market in which McBride trades – squeezed from all sides on cost and pricing.

Even so, I think it’s fair to say the stock looks quite reasonably priced at current levels. Last year’s free cash flow gives the shares a 10% free cash flow yield, by my calculations. The forward P/E of five also seems undemanding to me, given the high returns being generated by the business.

For me, the risk that would concern me most would be the prospect that McBride could lose one or more major contracts and be unable to quickly backfill the capacity.

A scenario such as this could obviously lead to a sharp drop in earnings. But it might also cause an increase in net debt, due to lower cash inflows being available to service longer-dated supplier credit. This is why I’d prefer to see this business targeting very low levels of gearing, or ideally net cash.

When we last looked at McBride in July, Mark took an AMBER view to reflect the sudden drop in the share price on that day. Given the flat near-term outlook for earnings, I’m going to maintain that view today.

PZ Cussons (LON:PZC)

Up 12% at 74p (£316m) - Final Results - Roland - AMBER

Today’s share price gain looks generous to me, given the quality of today’s results from this venerable consumer goods company. PZ Cussons is trying to turnaround some flagging brands while facing difficult trading conditions in Africa. (I’ve covered this story in more depth previously, most recently here and here).

These results cover the year to 31 May 2025, so have taken nearly four months to produce. Unfortunately, the headline numbers are mostly moving in the wrong direction:

Revenue down 2.7% to £513.8m

Adjusted pre-tax profit down 8.1% to £41.1m

Adjusted operating margin 10.7% (FY24: 11.0%)

Adj EPS -8.5% to 7.34p

Dividend held at 3.6p

Net debt: £112m (FY24: £115.3m)

Leverage: 1.7x EBITDA (FY24: 1.5x)

Trading was also fairly unremarkable, in my view. The company reports like-for-like (LFL) sales growth of 8%, but this includes pricing action to address high inflation in Nigeria. Excluding this, LFL sales growth was just 0.3% last year, with volume growth of 0.7%.

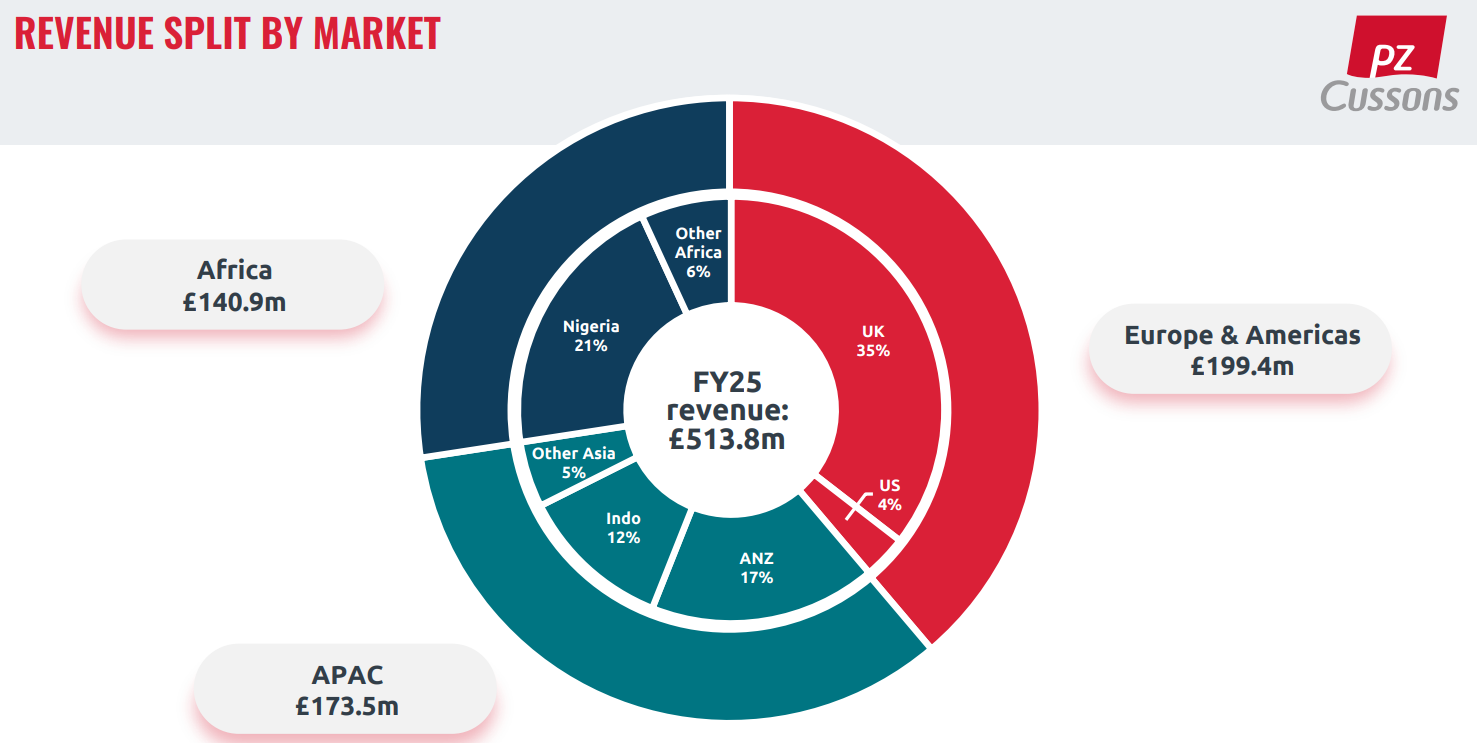

This remains a geographically-diverse business, especially relative to its size:

Looking at the group’s regional results provides a little more insight:

Europe and the Americas: revenue -0.6% to £199.4m, with adjusted operating profit up 12.9% to £36.8m (margin 18.5%)

Sales were held back by a double-digit drop for St Tropez and lower sales of “a number of our tail brands”. Cost savings in the UK drove most of the increase in profit, reflecting the integration of the Personal Care and Beauty divisions, together with some other incremental gains.

Interestingly, the company says the UK’s new Extended Producer Responsibility tax (which relates to packaging waste) caused a £3m hit to operating profit. The company is reviewing its packaging portfolio to see what can be done.

One possible bright spot was the £16.5m impairment write-back on the Sanctuary Spa brands. This partly reverses a £24m impairment charge last year, perhaps suggesting that the performance of this historic acquisition is improving.

Asia Pacific: revenue -1% to £173.5m, with adjusted operating profit down 10% to £25.2m (margin 14.5%)

In Indonesia, revenue grew strongly with volume-led growth across its Cussons Baby ranges.

In Australia, the picture was less positive – the company says it gained market share, but falling revenue due to weaker category sales.

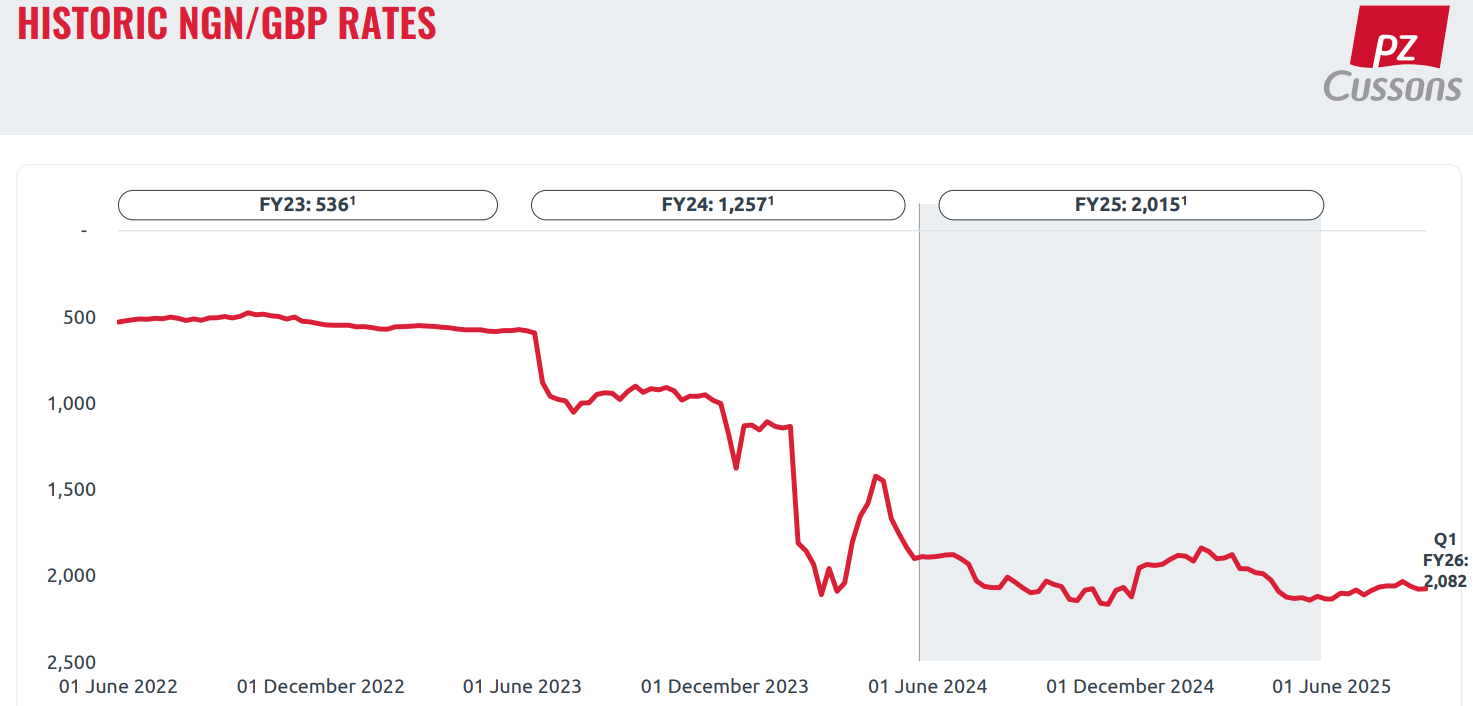

Africa: revenue -7.1% to £140.9m despite LFL growth of 34.9%, due to Naira depreciation. Adjusted operating profit down 22.8% to £23.4m (16.6% margin)

This business has been severely impacted by the depreciation of the Nigerian Naira and resulting high inflation in that country – historically one of the company’s biggest single markets.

Currency depreciation seems to have levelled out somewhat, but inflation is proving problematic and PZ pushed through 20 rounds of price increases last year, due to inflation remaining “elevated at over 30% for much of the year”.

Volumes fell by 12% last year in Nigeria as a result of these price increases, but the company says it has expanded its distribution reach to 200,000 stores to help compensate for this (FY24: 151k, FY23, 95k).

The PZ Wilmar joint venture (a palm oil business) contributed £7.1m to operating profit, but is due to be sold soon (see below). This will help with debt reduction, but reduces profit expectations for next year.

Profit margins: these divisional results all seem to highlight attractive adjusted margins. However, it’s worth remembering they all exclude group central costs, which totalled £30.5m last year on an adjusted basis.

Adding these back in brings the overall group operating margin down to a more average level of 10.7% on an adjusted basis.

Balance sheet & Cash Flow

Net debt was broadly unchanged at the end of last year, falling by just £3.3m to £112m. Thanks to the fall in profits, leverage actually rose to 1.7x EBITDA (FY24: 1.5x).

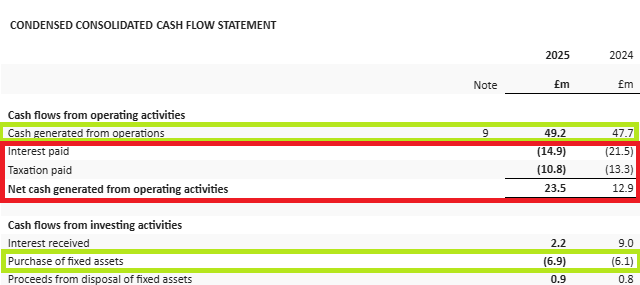

This change in net debt is consistent with my calculation of free cash flow at £20.5m, less £15.1m of dividends paid to shareholders.

However, not for the first time this week I find the company-calculated free cash flow measure is much higher, at £42.3m.

This appears to be a pre-tax, pre-interest figure that subtracts capex from cash generated from operations, rather than using net cash generated from operating activities. The difference between the two involves two large and non-negotiable items:

I’d argue this measure of free cash flow is useless for an equity investor – free cash flow is only of value to equity if it’s potentially distributable, which cash earmarked for tax and interest costs is not!

Current trading is evidently not strong enough to deleverage. This may explain the decision to sell the group’s stake in the PZ Wilmar JV. Expected cash proceeds of c.£47m suggest a sharp reduction in pro forma net debt.

Management also expects to raise c.£15-20m from the sale of further “non-operating surplus assets”, of which c.£8m has already been received.

Outlook

Trading so far this year is said to be “in line with our expectations”, with LFL revenue growth of 10% to the end of September, driven by +39% in Africa and +7% in Asia Pacific.

However, sales in Europe and Americas are down by 2%, “reflecting strong comparatives and challenging trading in St Tropez”.

We do at least have clear guidance on profit expectations for the year:

FY26 adjusted operating profit is expected to be £48-53m, excluding PZ Wilmar

Taking the mid-point, this would represent an 8% reduction in adjusted operating profit for the year.

That seems to be consistent with existing broker forecasts for a c.5% fall in adjusted earnings to 6.92p per share in FY26, pricing the shares on c.11x forward earnings.

Roland’s view

PZ Cussons appears to be slashing costs and selling assets for which it can find a buyer. Unfortunately, that hasn’t included St Tropez, which is now being kept in house.

While I think that some of the group’s core brands remain attractive, my feeling is that this remains a sprawling and overly complex group with too many underperforming brands.

The main positive I've taken from today's results is the expectation that net debt should fall significantly next year, reducing leverage and presumably lowering interest costs. However, the outlook for trading still seems fairly lacklustre.

For balance, the bull case here is that when the problematic parts of the business have been stripped out and the situation in Africa improves (or the whole Nigerian business is sold), then what’s left could be cheap at current levels for a branded consumer goods business. I can see this argument too, but I’m not sure I have that much confidence in the business or its current management.

On balance, I think the algorithm’s Contrarian styling is far and the current valuation is probably reasonable. Personally I don’t have enough conviction in the opportunity to be positive, so I will maintain my neutral view today.

Mark's Section

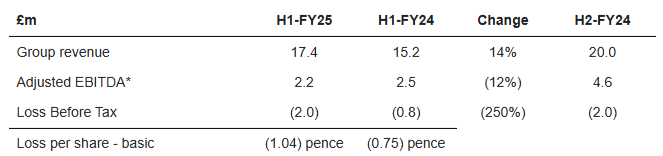

Facilities by ADF (LON:ADF)

Up 2% at 20.8p (£22m) - Half Year Results - Mark - AMBER/RED

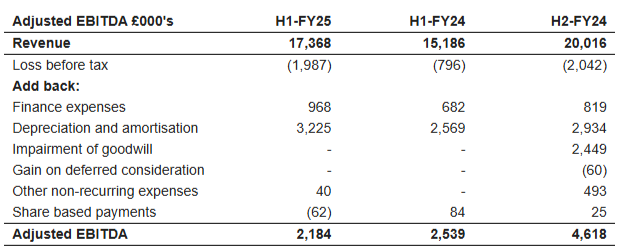

Revenue is up but Adj. EBITDA down at this specialist equipment hire company:

They point out that the revenue growth is not organic:

Revenue in H1-FY25 increased compared to H1-FY24 primarily as a result of the acquisition of Autotrak in September 2024.

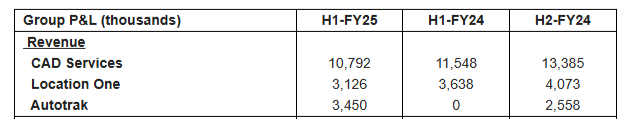

Looking at the breakdown of revenue, It is not just “primarily” but wholly due to Autotrak. Both CAD Services and Location One have seen declines in revenue compared to the prior H1 and significant drops compared to H2 last year:

Balance sheet:

One of the good things about equipment hire companies is that in the bad times they can simply turn off capex and generate cash flow. This makes banks relatively happy to lend relatively large amounts:

Net debt, excluding IFRS 16 leases at the end of H1-FY25 reduced to £13.2 million (FY-24 year-end: £13.8 million). Hire purchase liabilities reduced from £16.1 million at the end of FY24 to £14.6 million at the end of H2-FY25, and cash balances reduced from £2.3 million to £1.4 million.

And their addition of lease hire equipment has indeed been very limited, and they are clearly restricting capex as much as possible. However, their appears to have been a requirement to add capacity to support Autotrak customers:

During H1-FY25, ADF acquired new equipment with a cost of £2.8 million of which £2.3 million related to Autotrak, who acquired a further 2,000 aluminium panels, increasing their overall capacity by 12%. These panels were financed using ADF's hire purchase facility with HSBC, the Company's banking partner. Other capex was limited to essential maintenance spend only.

Capital expenditure for the remainder of 2025 is expected to be very limited, the only significant addition being a fully developed prototype of an Executive Single Artiste Trailer ("ESAT") for the top end of the feature film market

Their broker, Cavendish says:

ADF currently trades on a discounted FY25E EV/adj EBITDA of 3.5x versus its equipment hire peers on 5.9x

But this seems to be comparing apples with oranges, as Cavendish only include net bank debt, and in fact, their forecast for is reduced bank debt due to constrained capex.

The EBITDA the company quotes excludes the interest and principal costs of leased equipment, so the correct comparison is to include the IFRS16 debt, giving a total debt of £27.8m. TTM Adj. EBITDA is £6.8m:

This gives a net debt to Adj. EBITDA ratio of 4.1. Cavendish are forecasting £7.2m EBITDA for the FY, which would still give a leverage ration of 3.9x. Quite punchy. Given that this is leased equipment and includes debt secured on owned equipment, the banks will be relatively sanguine about this. However, it doesn’t give much scope to add equipment to grow the business when better market conditions return.

On top of this, there is £6.6m of contingent consideration as a liability on the balance sheet. If we include this, then leverage increases further. When they purchased Autotrak, they agreed to:

o Contingent consideration deferred over three years from Completion of an aggregate of up to approximately £4.2 million payable in cash in equal annual tranches contingent on maintenance of forecast FY24 levels of adjusted EBITDA performance from FY25 to FY27.

o Earnout consideration of up to approximately £4.0 million in aggregate payable in cash in FY28 based on growth in adjusted EBITDA performance from FY25 to FY27.

Given that this is the part of the business that is performing, they are in the slightly uncomfortable position of having to pay out for that success while they core business underperforms. It is perhaps unsurprising, after all this, that “Neil Evans, Chief Financial Officer, [is] to leave the Group on 31 October 2025.”

While banks may be happy to use adjusted EBITDA, this is not a good metric for shareholders to rely on. For an equipment hire company, depreciation is a real cost, even if it is deferred; and they have to pay for existing leased equipment, even if the don’t take on any new leases. The 2p Loss Per Share is the metric shareholders should be focussed on.

Outlook:

Although these are a particularly poor set of results, there is some cause for optimism. Equipment hire is all about utilisation of assets:

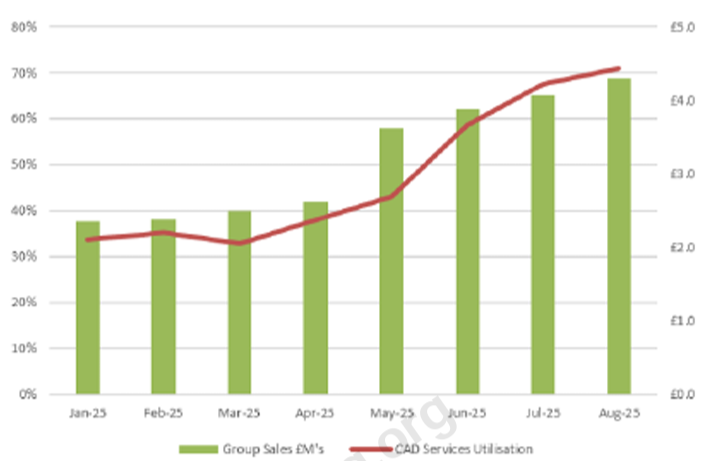

Utilisation rates over H1-FY25 reflected the slower market; utilisation rates in Q1 were 34%, increasing to 47% in Q2 (excluding the decommissioned fleet). Utilisation rates have improved since the period end and are expected to increase over the remainder of FY25.

It would be nice if they quantified this. However, they appear to have given the figures for CAD services over the last few months to Cavendish:

The good news is that in August utilisation here has increased at high as 70%. The bad news is that utilisation for such companies tends to top out around 70-80% as the need to move, check and maintain equipment means that it is hard to get much higher than this.

Valuation:

While this improvement isn’t enough to reach FY profitability according to Cavendish, it gets them to 1.8p EPS, and puts them on a P/E of around 12. Not too bad, but not great for a company with net bank debt. Cavendish don’t provide forecasts beyond FY26. However, with utilisation approaching the maximum that is possible over the long term with the current equipment, they either have to accept a period of low/no growth, or take on more debt to add to to their fleet.

There is some scope for some further revenue without significant extra capex:

ADF held 33 units in the Assets Under Construction heading on the balance sheet at the end of H1-FY25. For operational reasons, these have not been put into service yet. The value of these units at the period-end was £3.2 million. These are fully paid for and will transfer to fixed assets as they complete their fit-out stage in FY25.

I’d imagine the reason that these have not been put into service is that the demand has not been there, but that could be about to change. This has never been a particularly high gross margin business, and I don’t see those cost pressures abating any time soon:

Gross margins reduced from 35.3% in H1-24 to 33.0% in H1-25 as a result of the competitive pressure on rental rates, together with rising costs including the increase in employers national insurance rates in April 2025. In addition, following the increase in the National Living Wage in April 2025, we increased rates of pay for our Base staff, to ensure pay rates remained competitive and to improve retention.

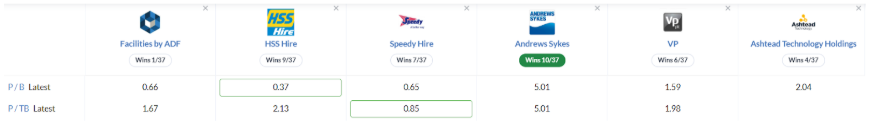

So, overall, I don’t see these assets changing the picture significantly, and while they may not be in fixed assets yet, they are on the balance sheet. Here the NTAV has declined from £13.3m at the year end to £12.1m, putting it on a P/TBV of 1.8. This doesn’t stand out amongst the equipment hire sector:

Overall, across all metrics, ADF compares badly on the Stockopedia head-to-head against other equipment hire companies.

Dividend:

While the balance sheet certainly looks stretched to me, the company must feel that they still have some capacity to pay a dividend, perhaps due to their very restricted capex commitments in the short term:

The Board has declared an interim dividend of 0.3 pence per share in respect of the six months ended 30 June 2025 (the "Interim Dividend"). The Interim Dividend will be paid on 30 January 2026, with a record date of 9 January 2026 and an ex-dividend date of 8 January 2026. The Board intends to pay an increased final dividend as part of its progressive dividend policy and in line with business performance in the second half.

They had a rather unusual moment following their final results where major shareholders made them reduce their dividend, perhaps fearing it was reckless, given their balance sheet. Here, they pay an interim dividend but at a reduced rate, and the long wait between today’s declaration and an end of January pay date is telling. Still this is a dividend yield approaching 5% and may be attractive to income investors who are willing to take the balance sheet risk.

Mark’s view

There are signs that the flagged H2 weighting may be realistic, but even if it is, the company will be barely profitable this year. If this momentum continues into FY26, results will be better, but they still look modestly overvalued, after adjusting for the debt. The longer term is more uncertain as the lack of capex as a result of the downturn in trading will either have to be reversed or the company will have to accept anaemic growth. The days of them raising equity at high multiples for acquisitions look long gone. While they continue to pay a reasonable dividend as a result of the current low capex commitments, this again may leave them between rock and a hard place in the future. Without the debt and lease liabilities, I think I’d be tempted to increase our view today on improved utilisation making 2026 forecasts look more achievable, but given the modest overvaluation on these forecasts and a reliance on assumptions beyond the forecast window to make a positive investment case (their brokers assertion that we take EBITDA pre-lease interest and capital payment and compare it only to banks debt, looks wild to me), I’m going to stay broadly negative at AMBER/RED.

Ten Lifestyle (LON:TENG)

Unch. at 58p - Full Year Trading Update - Mark - AMBER

This trading update starts off slightly worryingly:

The Group expects to report that Net Revenue for the year will be broadly in line with market expectations at c.£65.7m, up 5% on the prior year (FY 2024: £62.9m) and up 7% at constant currency to c.£67.1m.

Broadly, of course, means slightly below. Stockopedia has a £68m consensus for FY form a single broker, so this seems a reasonable-sized miss, even if currency appears to be the major factor. Things get much better at the EBITDA level, as presumably many of the costs are in dollars, too:

Adjusted EBITDA increased by £1.8m on the prior year to c.£14.6m (FY 2024: £12.8m), ahead of market expectations, and up £0.4m to c.£ 13.2m at constant currency. Adjusted EBITDA margin is expected to improve to 22.2% (FY 2024: 20.3%).

Of course, the word “Adjusted” can often do the heavy-lifting. In this case, it seems to be limited to share based payments in H1, which were modest. EBITDA isn’t a great metric for a company that capitalises intangibles, but in H1 capitalised expenditure was similar to amortisation, making the earnings a reasonable estimate of the economic value added. And there is cash generation, although given the capitalised expenditure, this is not at the same level as EBITDA:

Cash and cash equivalents increased to £11.2m (FY 2024: £9.3m), with net cash increased to £6.8m (H1 2024: £1.9m; FY 2024: £3.9m)

With £55.3m market cap, this is a £48.5m EV and a 3.3xEV/EBITDA, which seems reasonable value for a growing company, even if it can’t be compared to companies that don’t capitalise development spend. I can’t see any updated broker notes but assuming a modest upgrade matching EBITDA, then this should be slightly lower than the 15x earnings on the StockReport.

Things start to look more interesting if they hit their FY26 forecasts, putting them on a P/E of around 11. And they highlight that they have “continued to secure Material Contract developments that are expected to underpin profitable growth into FY 2026”. We have to take things like this with a pinch of salt:

…medium-term target of £100m+ of Net Revenue and Adjusted EBITDA margin target of 30%+.

But it is worth bearing in mind that this would represent more than double the current EBITDA. EPS would likely grow more quickly than this, and the multiple may expand if they deliver these sorts of growth rates.

Mark’s view

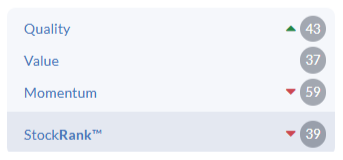

I always question what real value a concierge service provides, but I can’t deny that the company’s services are in demand, as evidenced by the continued signing of new material contracts. They seem modestly valued for a company that seems to have found a way to grow the bottom line at good rates, even if currency impacts mean that revenue is not as strong as expected. There is no dividend or other capital return, but you wouldn’t expect this from a company focussing on growth. There does appear to be modest free cash flow with net cash increase over the half. Graham and I were both AMBER on this recently, but I think there may well be a case to upgrade our view. However, the declining Momentum and StockRank mean I’ll play a game of wait-and-see.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.