Good morning!

To get started, we have a backlog section on vet group CVS (LON:CVSG) from Graham.

The agenda is complete (07.49).

Today's report is now complete (13.25).

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Whitbread (LON:WTB) (£5.6bn) | Rev -2%, adj PBT -7% to £316m. Reports flat UK sales and positive momentum in Germany. Confident in full year outlook. | AMBER (Roland) [no section below] Whitbread is converting underperforming UK restaurant space into hotel rooms that should provide higher returns on capital employed. However, this has created some growth drag in the short term, given the subdued overall demand in the UK. At the same time, it sounds like growth in Germany slowed during the second quarter. This has resulted in a slight downgrade to FY26 profitability targets for Germany, from adj PBT of £5-10m previously to “up to £5m” in today's results. I haven’t stayed in a hotel in Germany for 20 years, so I’m not sure how many brands are competing against independents in the value space occupied by Premier Inn. But my understanding is that it’s far more fragmented than the UK, similar to the UK before Premier Inn and others gained so much market share. More broadly, I think Whitbread’s strategy of improving returns on capital in the UK and taking market share in Germany is sensible and could deliver decent long-term results. My main concern is that some improvement may already be priced in. Whitbread’s model of owning and operating its hotels means it’s a capital-intensive business. The StockReport shows return on capital employed running at about 6%, with net assets of £3.2bn. For this level of profitability, I’d argue the current valuation (1.6x book value) is high enough. The other niggle I’d point out is that leverage has been rising due to buybacks being partially funded by debt. Leverage reached 3.2x EBITDA in H1, with £75m of buybacks correlating to an £80m increase in net debt. For these reasons, I’m going to echo the StockRanks and take a neutral view today. | |

Croda International (LON:CRDA) (£3.7bn) | Rev +6.5% (ccy) in “challenging environment”. FY outlook unchanged for op profit £265-295m. | ||

IG group (LON:IGG) (£3.7bn) | Sold to Kraken for $100m (£74.9m), will partner with Kraken on distribution of new crypto products. | GREEN (Graham holds) [no section below] I wanted to suggest that this disposal was just a tidying-up exercise, but the end result is not so tidy: IG is being paid mostly (£50.6m) in the form of stock in Payway, which owns the crypto exchange Kraken. Being paid in stock in a private company always brings some special risks - and Kraken has a colourful history (Wikipedia). But given IG’s overall size these days, the deal numbers and therefore the total risk is small (IG’s forecast net income this year is £384m). What’s most interesting to me is IG’s ongoing appetite for crypto exposure. Today’s deal is accompanied by a strategic partnership with Kraken, and the company points out two other crypto transactions over the past year. While personally I’m not a crypto investor, I have no problem with IG building up a modest exposure to this asset class, so long as it doesn’t dilute shareholders again. Overall this remains one of my favourite shares and I’m a long-term holder here. The forward P/E ratio today is still a moderate 10x. | |

Canal+ SA (LON:CAN) (£2.4bn) | 9M revenue -2.4%, with organic growth of 1.2%. FY outlook confirmed for EBITA of c.€515m. | ||

Travis Perkins (LON:TPK) (£1.4bn) | Rev +0.3%, with LFL sales +1.8%. Merchanting sales improved, Specialist Merchants “remains subdued”. | ||

Workspace (LON:WKP) (£775m) | Occupancy down 2.3% to 80%, as expected, with LFL rent roll down 3.2% to £107m. £2m cost savings, rolling out upgrade projects. | ||

XPS Pensions (LON:XPS) (£722m) | Rev +13%, +8% organic. Advisory +18%, Administration +6%, SIP +10%. FY outlook in line. | AMBER/GREEN (Graham) [no section below] I’m impressed to read that H1 has seen 8% organic growth here, as the growth outlook has been a little cloudy due to very difficult comparatives (the previous year was exceptionally busy because of work on the “McCloud” pension issue, whereby younger public sector workers needed to have their future pension benefits recalculated). XPS’ “Administration” revenues have continued to grow by 6% despite McCloud revenues rolling off. This is seriously impressive to me but I must bear in mind that the full-year outlook is only in line, i.e. there is no upgrade, although with the share price up 3% today I might not be the only one who is impressed. At a P/E ratio of 16x, we do tend to think that XPS’ winning formula in consulting and administration is priced in, but with successful, growing companies that under-promise and over-deliver, it pays to stay positive. So I’m leaving our existing stance in place. | |

Volex (LON:VLX) (£655m) | H1 revenue >$575m (+11% organic). Op margin in upper half of 9-10% target range. FY expectations unchanged. | AMBER/GREEN (Roland) Volex reports strong trading in the EV and data centre markets, with the latter presumably driven by AI projects. Elsewhere, demand for healthcare and consumer electricals looks more subdued. Volex’s own tariff-related relocation projects are also said to have caused a “small number” of project deferrals. The company’s guidance appears to suggest slightly lower revenue in H2 and I estimate earnings could be broadly flat this year. I am slightly more cautious than the StockRanks, but the forward P/E of 14.5 doesn’t seem unreasonable to me given the group’s track record of growth in recent years. My moderately positive view remains unchanged. | |

GB (LON:GBG) (£594m) | H1 rev +1.8% (ccy) against tough comparatives. New Identity platform launched. FY outlook unchanged. Small (£7.9m) acquisition. | ||

Allergy Therapeutics (LON:AGY) (£381m) | No safety issues observed in VLP Peanut peanut allergy vaccine trial. Early results suggest vaccine is reducing allergic response. | ||

Sabre Insurance (LON:SBRE) (£321m) | Gross Written Premium -18.7% to £152m as pricing discipline maintained. FY profit guidance unchanged & in line with FY24. | ||

Norcros (LON:NXR) (£260m) | Full year underlying operating profit to be in line with market expectations (£47.2m to £48.7m including Fibo). | ||

Anglo Asian Mining (LON:AAZ) (£220m) | Q3 copper production of 2,287 tonnes (Q2 2025: 654 tonnes). “Overall negative cash flow of only $1.2 million in the Quarter” (due to start-up capex), increasing net debt to $14.2 million. | ||

Capital (LON:CAPD) (£211m) | SP +12% Panmure Liberum updated forecasts: | AMBER/GREEN (Roland) Today’s revenue upgrade is the second in four months. While the company doesn’t comment on profitability, broker Panmure Liberum has upgraded its earnings forecasts quite meaningfully today. Capital’s recovery under returning co-founder Jamie Boynton appears to be gathering momentum, but the shares don’t look too expensive to me on a FY26 view. One caveat to this is the company’s double exposure to the gold market – both through its customer base and its investment portfolio. We were neutral on this business following a profit warning at the start of the year. However, given the run of recent good news and fair valuation, I think it’s reasonable to (belatedly) upgrade our view by one notch today to become a little more positive. | |

Cornish Metals (LON:CUSN) (£103m) | Filed a technical report for its wholly owned and permitted South Crofty tin project in Cornwall | ||

Synectics (LON:SNX) (£50m) | Trading Update & New Contracts - Traction in Broader Energy Sector | FY 2025 is expected to deliver revenues of c. £67m (FY24: £55.8m) and PBT of no less than £5.7m (excluding SBP) (FY24: £4.7m). These figures are ahead of the latest Shore Capital forecasts we can access (Jul ‘25) for revenue of £65m and adj PBT of £5.3m. | AMBER/GREEN (Roland - I hold) [no section below] Today’s FY guidance implies 21% adjusted PBT growth and appears to be slightly ahead of broker Shore Capital’s July forecasts. The company does not explicitly use the word ahead in today’s RNS, but the StockReport doesn’t show any upgrades to forecasts since February so I am inclined to see this as a modest upgrade. Management says trading for y/e 30 November has been “positive”, with extensions and renewals secured in addition to a large, one-off gaming contract in Asia. My only concern with this commentary might be that it suggests a lack of major new wins, potentially putting pressure on growth in FY27 as the benefit from the Asia contract drops out. However, we do have some news on contract wins today. Synectics has won two new contracts in the energy sector – a £1.2m deal for “advanced surveillance” of a carbon capture and storage project in NW England, and a deal to supply COEX cameras for offshore use in the North Sea. I’d hope that products suitable for use in such demanding environments carry some pricing power, supporting margins. I’ve been moderately positive on this SIF portfolio stock this year, with the slight caveat that I’d like to see Synenctics' profitability improve. I think a lack of upgrades and modest profitability may have held back the share price this year, but with the stock trading on a P/E of 10 and boasting a strong net cash position, I’m happy to maintain our AMBER/GREEN view. |

Iofina (LON:IOF) (£44m) | Q3: Iofina Resources produced 215.8 metric tonnes ('MT') of crystalline iodide. | ||

EnSilica (LON:ENSI) (£44m) | “While still targeting a substantial increase in revenues and profitability in the current year.. now expects to deliver revenues of between £28 million and £30 million” for FY May 2026, EBITDA £3.5 - £4.5m. Market exps: revenues £33m, EBITDA £5.1m. | BLACK | |

Insig Ai (LON:INSG) (£39m) | H1 revenue expected to be marginally higher at just under £440k. Recently raised £1m, considering digital assets. Convertible loan notes (£1.5m) have been extended by 15 months to December 2026. | ||

Videndum (LON:VID) (£36m) | SP +31% Net debt £139m. “Any plan to deleverage the business will require alternative new sources of liquidity.” EBITDA and deleveraging covenants have been agreed with expectation that they will be waived or deferred if necessary. | RED (Roland) [no section below] The market has reacted favourably to today’s update, which suggests trading has improved relative to last year. Q3 revenue was down by only 8% (vs a 25% YoY drop in H1). Further improvements are said to be possible and the company notes inventory levels in the market are low. However, the big picture has not changed at all, as far as I can see. Net debt of £139m is slightly higher than at the end of June. The company remains in discussions to agree a deleveraging plan by the end of October. In the meantime, lenders have requested a TTM EBITDA covenant of £10m for October – that’s equivalent to an eye-watering net debt/EBITDA multiple of 11x, excluding leases. Today’s commentary reiterates previous guidance that deleveraging won’t be possible without new sources of liquidity. An equity raise seems most likely to me, unless profitability improves dramatically. With the risk of significant dilution on the horizon, I continue to view this as a stock to avoid. | |

Cirata (LON:CRTA) (£27m) | “Management's outlook communicated in March 2025 remains unchanged”. Bookings back end weighted, similar profile to FY24. | ||

Fusion Antibodies (LON:FAB) (£15m) | Revenues for HY26 c. £838k. Cash at 30 September 2025 was £251k. Cash runway into FY27. | ||

GEO Exploration (LON:GEO) (£15m) | Rapid advancement of the Juno Project. Loss after tax of US$1.09m. Year-end cash balance US$1.07m. Raised c.£1.11m in Sep 2025. |

Backlog: CVSG

Graham's Section

CVS (LON:CVSG) (Backlog)

Up 6% to £14.89 (£1.07bn) - Response to CMA provisional decision announcement - Graham - AMBER/GREEN

Thank you to several readers including jamesalastair and BnB for interesting comments yesterday on the topic of the vet industry. I do not own a pet so cannot analyse this topic from personal experience, but I wanted to get something into the DSMR archives on this story:

CVS notes this morning's publication by the Competition and Markets Authority ("CMA") of the summary of its provisional decision in the veterinary market investigation. The CMA is expected to publish its full provisional decision later today…

We are pleased to see that the CMA has considered our and the veterinary profession's feedback on the initial 28 remedies proposed in May 2025, which have been refined to 21 with no new remedies introduced…

As such, the Board continues to expect the Group to trade in line with market expectations.

Over at the CMA, five news articles were published yesterday in relation to their investigation into the vet industry. This was first launched in May 2024, so it has been hanging over the industry for some time!

Indeed, the CMA started consulting on a proposal to investigate the industry in March 2024, with the following impact on the CVS share price:

As we saw in motor finance recently, these regulatory cases typically don’t lead to a quick conclusion - if you are trading and investing around these shares, you may have to wait years (not months) for a resolution.

Anyway, here are the CMA’s provisional decisions.

Their findings are that pet owners don’t know the prices of commonly used services, don’t know if they are dealing with a member of a group or an independent vet, are paying too much for medicines, can’t tell if they are getting good value from pet care plans, etc. That they generally lack information and are not getting very good value from vet businesses.

Looking at large vet groups, they say “For a substantial part of the market as a whole, profits are much higher than they should be if competition was working well.”

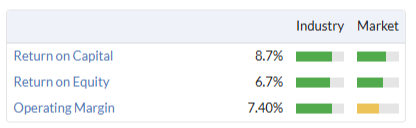

As readers were quick to point out, CVS is not an extraordinarily profitable business:

While a final decision is not due to be published until March 2026, the proposed remedies include the following

Comprehensive price lists and clear statements to pet owners on whether a business is part of a larger group.

Requirements to tell vet owners about savings they could make by buying medicines online, and automatic prescriptions (with the price of the prescription capped at £16) to enable pet owners to purchase the medicine elsewhere.

Clear price information when a pet owner is choosing a treatment, with prices in writing for treatments over £500.

Etc., etc.

Graham’s view

As others have said, this investigation has turned out to be a damp squib rather than the dramatic or revolutionary change that was initially feared.

CVS has nearly 500 vet practices in the UK, and has been expanding in Australia. Investors initially feared that they could be forced to sell some of their UK practices.

That is now off the table.

As a veteran investor in regulated activities (gambling, tobacco, alcohol), I feel the same way about an investigation as I do about a long hike: I enjoy it when it’s over. The great news is that a regulatory body, once it has finally completed its investigation, does not want to reopen another investigation very quickly - this would imply that the first investigation didn’t achieve much! And so the regulatory framework usually ends up being fixed for several years afterwards.

The proposals could take a small bite out of CVS profits but they don’t sound particularly threatening to me.

In fact, as a large chain, these proposals could even help CVS competitively: if there is substantial red tape involved in compliance, then CVS will be able to spread out its compliance costs among more vet practices - something that independent vets will not be able to do.

In conclusion: I don’t see any major net impact from these proposals, as I think the positive effects on the company (including higher consumer confidence) could offset the negatives. And they still have a few months to lobby the CMA for changes to the proposals they aren’t happy with.

We’ve been AMBER/GREEN on this (e.g. see Roland in February). At a P/E ratio of 15x currently, I’m happy to leave that stance unchanged.

Roland's Section

Volex (LON:VLX)

Up 7% at 377p (£700m) - Half Year Trading Update - Roland - AMBER/GREEN

Strong performance with revenue momentum maintained and continued margin resilience; full year expectations unchanged

When Volex published its FY25 results in June, the wiring specialist described trading for the current FY26 year as “very good”.

Today’s half-year update confirms that this strong momentum has been maintained through the first half of FY26 (April-Sept). Volex now expects to report organic revenue growth of “at least 11%” for the half year, with revenue expected to exceed $575m.

Looking across the business, management commentary suggests to me that EV and data centre (AI?) demand have driven most of the growth, with weaker results elsewhere:

EV: “grew strongly year-on-year due to our increasinglyu diverse range of products and customers”;

Medical: “as expected … demand was subdued”, with customers reacting to lower healthcare spending and reducing inventory levels;

Consumer Electricals: “revenue similar to H2 FY2025”, but lower relative to H1 FY25 on an organic basis. H2 revenue in this segment was slower than H1 revenue last year, so this suggests consumer spending remains subdued;

Off-Highway: “strong growth, benefiting from a one-off customer project”;

Complex Industrial Technology: significant growth, “with data centre demand showing a very strong increase” compared to H1 FY25. I assume this is being driven by the AI build out – so Volex could be another indirect beneficiary of this.

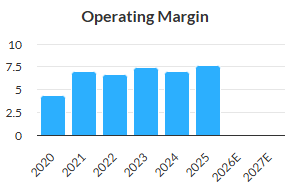

Margins: operating margin is expected to be within the top half of the Board’s through-cycle target range of 9-10%. This is an adjusted figure that’s translated to a statutory result of c.7.5% in recent times:

The consistency of the group’s margins is encouraging, in my view, suggesting Volex is able to manage costs and pass on price increases when needed.

Tariffs: the company’s comments on tariffs starts out on a positive note:

… the Group has been working closely with several key customers who in response, are reconfiguring their global production footprints. These activities are strengthening Volex's customer relationships and improving our competitive positioning for the medium term.

However, it looks like there has also been some disruption, with projects deferred as Volex relocates some of its own manufacturing activities:

A small number of new programme launches have been temporarily deferred in both the Complex Industrial Technology and Electric Vehicles end-markets as a result of relocating manufacturing to support our customers, with these projects expected to be delivered in FY2027 and beyond.

The company did mention “strategic site consolidations” in its FY results, so I assume this is a consequence of those plans. Even so, I think it might be worth watching for any further commentary on this in case the negative impact persists.

Outlook

Full-year expectations remain unchanged according to today’s update:

The Group expects second-half revenues to be broadly similar to the first half, reflecting stable trading across most end-markets.

The StockReport estimates suggest FY26 revenue of $1,141m. Based on today’s H1 figure of $575m, this implies a fall in revenue to c.$566m in H2.

Consensus forecasts for adjusted earnings of 34.8 cents per share seem to suggest earnings might actually fall slightly this year, relative to last year’s company-adjusted figure of 36.3c per share.

While there’s always the possibility that the consensus forecasts haven’t been calculated in exactly the same way as the company’s adjusted EPS numbers, in general these figures are intended to be comparable.

On balance, I see this update as indicative of a fairly flat result this year, at least in terms of profit.

This morning’s share price gains leave Volex on a FY26E P/E of about 14.5.

Roland’s view

The EV and data centre markets appear to offer opportunities for attractive growth, with relatively complex products that allow the company to add value (and support margins).

However, there are clearly some headwinds in healthcare and consumer-related markets, while Volex’s own site consolidation programme (in response to tariffs) also seems to have led to some temporary delays.

In addition, I wonder whether the lack of recent acquisitions – an area where Volex has performed quite well – is also contributing to slower growth.

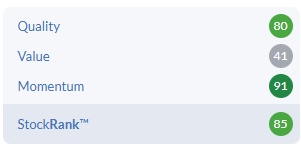

The algorithms style Volex as a High Flyer, with a StockRank of 85:

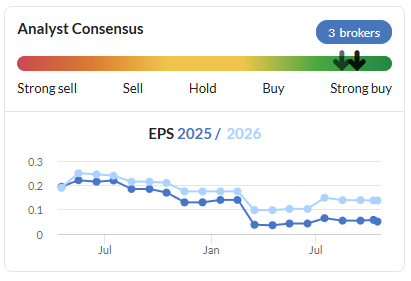

I have to admit my own view is slightly more cautious than this. Brokers have also become a little more cautious over the last year:

Despite these reservations, I think Volex continues to look like a well-run business with some attractive market positions.

I’m happy to leave my previous AMBER/GREEN view unchanged today.

Capital (LON:CAPD)

Up 12% at 122p (£237m) - Q3 2025 Trading Update - Roland - AMBER/GREEN

For the second time this year, we are increasing 2025 revenue guidance to USD $335 - $350 million, which includes increased MSALABS revenue guidance of $65 - 75 million.

We’ve held onto a neutral view of Capital (June, July, August) through the summer following its profit warning early in 2025. However, shares in this mining services group (which has heavy exposure to gold miners) have moved ahead regardless, recovered to a new two-year high:

Today’s update does indeed suggest to me that perhaps we should have turned positive a little sooner – perhaps in time to reflect the recovery in StockRank that’s shown on the chart above.

While Capital shares still look expensive to me on a FY25 forecast basis, FY26 forecasts (not that far in the future) now suggest a more reasonable valuation. Let’s take a look at what the company has to say.

Q3 2025 Trading Update

Capital’s operations are broadly split between the core drilling business, contract mining and MSALABS, the company’s assay services operation.

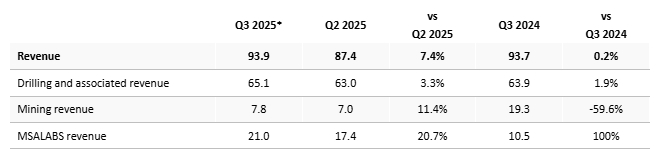

Revenues at MSALABS have doubled over the last year and this unit is the main driver of today’s upgrade. However, all three divisions delivered sequential revenue growth in Q3:

Capital Drilling: the net rig count increased by 1 to 134 in Q3, while utilisation edged higher to 76% (Q2 25: 74%). Management says this is in line with the long-term target utilisation rate of 75%.

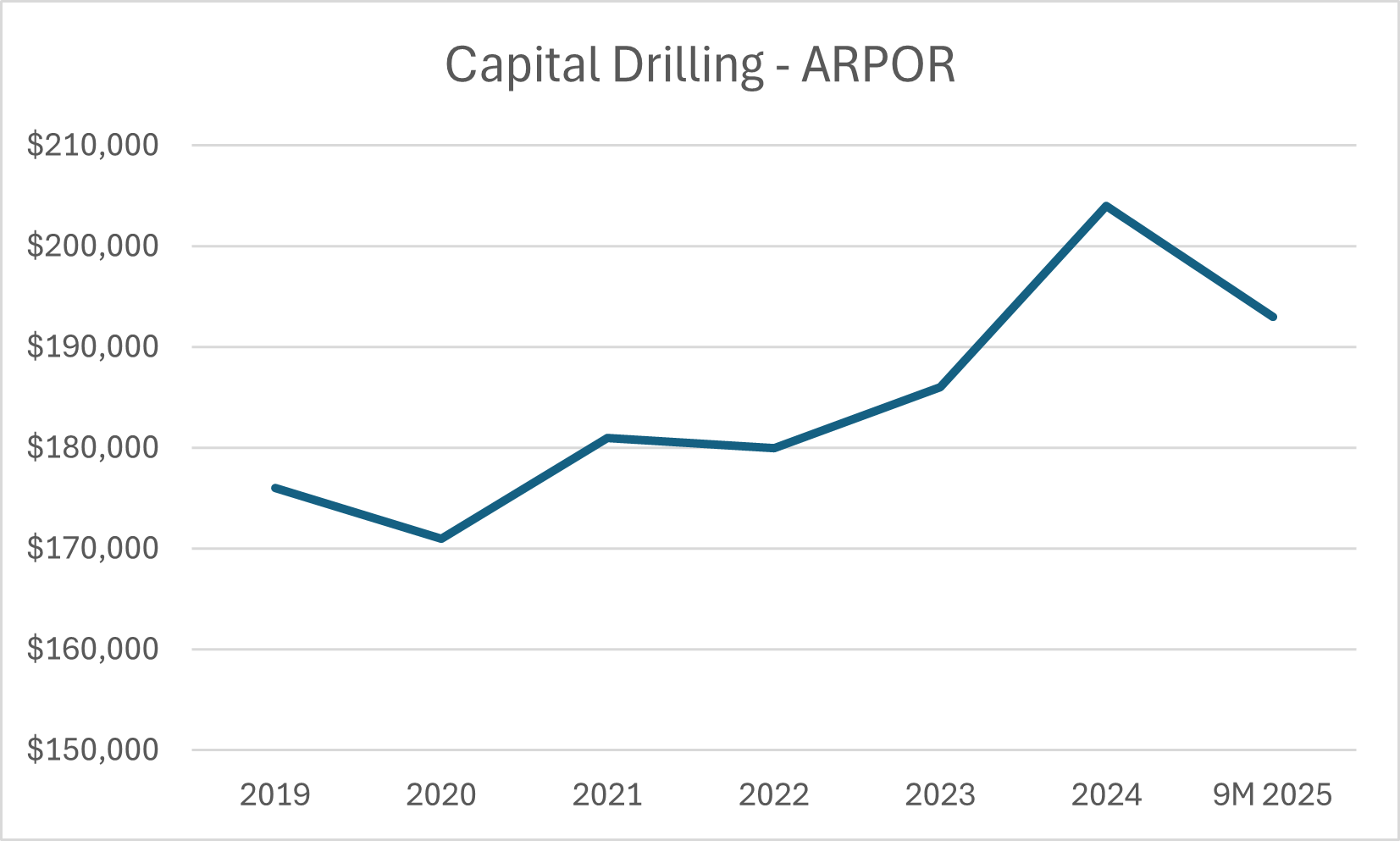

Average monthly revenue per operating rig (ARPOR) was stable at $198,000 on a quarter-on-quarter basis, but was 5.7% lower than the $210,000 achieved last year. This reflects the trend seen in H1 2025 vs 2024.

Given the fevered state of the gold mining market – Capital’s core customer base – I think these rates could be worth watching as an indicator of whether miners are increasing or decreasing their development activity. Is the top now in?

Capital Mining: this is a relatively new line of business for Capital. After the conclusion of contracts at Sukari and Belinga last year, operations are currently dominated by the Reko Diq gold mine in Pakistan, which the company is operating for its owner Barrick Gold.

Operations are said to be progressing well through the ramp-up phase and the company reports an expansion to the contract which is expected to increase run-rate revenue by “approximately $10 million” in the first half of 2026.

MSALABS: all-time high quarterly revenue and improving profitability are reported today:

MSALABS is now achieving positive net profitability driven by cost optimisation and higher utilisation at laboratories as we focussed on consolidating our growth and ramping up current operations

This division is also benefiting from the company’s presence at Reko Diq project:

Subject to final documentation, awarded a 3-year contract, with an option to extend for a further 3 years, at Reko Diq to build and operate an on-site prep and geochemistry laboratory.

Capital Investments: slightly unusually, Capital is also an active investor in the junior mining sector. This can lead to wide swings in reported profit as the company reports both realised and unrealised gains.

Today’s update sounds positive, with the portfolio value rising by 49% to $73.9m at the end of September (30 June 25: $49.5m). However, this sounds like quite a concentrated portfolio – presumably chosen with the benefit of extensive industry knowledge:

The portfolio remains focused on select key holdings namely WIA Gold, Asara Resources and Sanu Gold.

Management also reports “realised and unrealised” investment gains of $22.5m in Q3, but frustratingly do not distinguish between them. The difference is important, in my view. Realised gains = actual cash profits, whereas unrealised gains are on paper only and could potentially reverse.

Outlook

Revenue guidance has been upgraded today, but there is no comment on profitability or expected changes to earnings. Fortunately, we do have updated broker notes to provide some guidance on this – many thanks to Panmure Liberum and Tamesis Partners for publishing on Research Tree today.

Here’s what the company says:

Group revenue guidance increased to $335 - 350 million including increased MSALABS revenue guidance of $65 - 75 million (up from $320 - 340 million and $55 - 65 million, respectively

Panmure Liberum’s analysts have put through some meaningful upgrades to their profit forecasts in response to today’s update:

FY25E adj EPS: 5.9c (+12.7% vs 5.2c previously)

FY26E adj EPS: 16.6c (+7.1% vs 15.5c previously)

FY27E adj EPS: 21.3c (+8.3% vs 19.7c previously)

At a last-seen share price of 122p, these forecasts put Capital on FY25E P/E of 28, falling to a forecast P/E of 10 in 2026.

Roland’s view

Capital’s performance has improved markedly since co-founder Jamie Boynton returned to take charge as executive chairman.

Today’s upgrade is the second in four months, providing a timely reminder of how “ahead of expectations” updates often recur. Ed covered the topic of lagging broker forecasts in more depth in a new article this week and I think Capital’s performance could be a good example of this:

While I think it’s worth considering how Capital’s performance might be linked to the gold price and wider gold mining sector, I’m encouraged by this update. Capital appears to have good momentum at the moment and its expansion into contract mining and laboratory services is making a growing contribution, offsetting slower growth in the core drilling business.

Stockopedia’s algorithms are styling the shares as a Super Stock with a StockRank of 94. I don’t think the shares look too expensive on a FY26 view, so I’m happy to upgrade our view to AMBER/GREEN today to reflect the positive backdrop.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.