Good morning!

Thanks to Roland for taking care of the report today! See you tomorrow.

Spreadsheet accompanying this report: link (last updated to: 15th October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£195bn | SR66) | Approved for the treatment of symptomatic, inoperable plexiform neurofibromas (PN) in adults with NF1. | ||

HSBC Holdings (LON:HSBA) (£172bn | SR84) | Adj PBT up 3% to $9.1bn, w/ adj RoTE of 16.4%. Reported PBT down 14% due mainly to $1.1bn Madoff provision (see y’day). | ||

GSK (LON:GSK) (£66.6m | SR89) | Has delivered “encouraging early clinical data” showing potential for treatment of small-cell lung cancer. | ||

Anglo American (LON:AAL) (£33.4bn | SR65) | Copper and Iron Ore are tracking to 2025 guidance. Steelmaking Coal is progressing towards a return to normal, sale process will be restarted in coming months. | ||

Airtel Africa (LON:AAF) (£8.4bn | SR88) | Rev +25.8%, op profit +35.9% to $959m. Customer base +11% as smartphone penetration increased to 46.8%. | AMBER/GREEN (Roland) Last year’s currency ructions have faded away and I’m left admiring strong, structural growth in both mobile usage and money services. The group’s profitability is significantly stronger than BT/Vodafone and cash generation is also good, underpinning upgraded capex guidance. There are some risks here – concentrated ownership, volatile currencies/economies and leverage. But momentum has been strong and earnings have been upgraded steadily this year. The valuation isn’t outrageous. I am inclined to agree with the StockRanks and take a moderately positive view, with the caveat that I would not view this business as a buy-and-forget stock. | |

Yellow Cake (LON:YCA) (£1.30bn | SR67) | Completed £130m placing, purchased further $100m of uranium. NAVps +5% to 606p. | ||

C&C (LON:CCR) (£504m | SR64) | Rev -4%, adj PBT +12% to €32.1m. FY26 outlook in line with exps. Tennent’s and Bulmers gained share. | ||

Next 15 (LON:NFG) (£395m | SR81) | These US-based capital markets advisory businesses have been sold to their founders/mgt teams. NFG retains a minority interest. | ||

Auction Technology (LON:ATG) (£376m | SR54) | FY25 to be in line with revised exps, with organic H2 rev +4% and EBITDA margin 42-43%. FY26 trading in line. | ||

RWS Holdings (LON:RWS) (£348m | SR93) | FY rev broadly in line with prior year, adj PBT to be at lower end of guidance, c.£60m. Significant H2 growth vs H1 (£18.0m). | AMBER/GREEN (Roland - I hold) Today’s year-end update shows adjusted profits at the bottom end of guidance, so the statutory figures are likely to be lower still. However, I think the group is moving in the right direction and am encouraged by the strong profit performance in H2 versus H1. New medium-term guidance will be provided with the FY25 results in December. I’m happy to remain patient ahead of that date as I continue to believe the business has a significant opportunity to be an AI winner – and is cheap enough to offer genuine value. | |

Idox (LON:IDOX) (£260m | SR54) | 71.5p, 26.8% premium to yesterday’s close. The proposed buyer is a US-based firm that already owns 12% of IDOX. Irrevocable undertakings to support the deal from 23% of shares, plus the buyer’s existing stake. | PINK | |

B.P. Marsh & Partners (LON:BPM) (£239m | SR92) | Sells its 28% stake for CAD $51.9m (£27.8m) net of transaction costs. 21% uplift to carrying value. Defcon is also payable in 2026. | ||

Evoke (LON:EVOK) (£187m | SR68) | Q3 revenue +5% (4% CC). Successful refinancing of 2027 EUR fixed rate notes. Reiterates FY25 adj. EBITDA margin guidance, says adj. EBITDA to be ahead of market expectations. | (Graham holds) | |

IG Design (LON:IGR) (£55m | SR40) |

Confidence in full-year guidance (full-year revenues $270-280m). H1 revenue c. 13% lower, adj. op profit c. $5.6 million. CEO search underway.

| AMBER (Roland) [no section below] Today’s update seems fairly neutral to me. It’s encouraging that full-year revenue remains in line with guidance, but it’s worth remembering that full-year revenue is expected to be c.13% lower than the prior year on a pro forma basis. This is due to headwinds reported earlier this year, such as softer UK demand and pricing pressure in Europe. Operating margin guidance for the current year is unchanged at 3-4% today, but that equates to an adjusted operating profit figure somewhere between $8.2m and $11.0m based on consensus revenue estimates of $274m. That’s a fairly wide range of potential outcomes. It will be interesting to see if IG Design can regain its historic success and market share, now that it has divested its US business. The valuation seems fair to me and I will be keen to review the business again after this year’s peak festive trading period. At this stage, I don’t have a strong view either way, so will retain our neutral view. | |

Ultimate Products (LON:ULTP) (£52m | SR70) | Results in line with expectations. Revs -3%, adj. EBITDA -31%. Current trading in line. “External headwinds are likely to persist in the short-term.” | ||

Colefax (LON:CFX) (£46m | SR94) | £6.1m tender offer after 11.7% of shares were validly tendered. The company offered to buy up to 15% of shares at 880p. | ||

React (LON:REAT) (£11m | SR48) | FY25 results ahead of previously revised market expectations. Revs £25m (exps: £24.5m), adj. EBITDA ≥ £3m (exps: £2.75m). | AMBER/RED (Roland) Today’s upgrade is positive in itself, but forecasts remain a long way below the levels expected before May’s profit warning. In addition, comparing today’s FY numbers with the financial stats given for Aquaflow prior to its acquisition suggests to me that performance of Aquaflow and/or the remaining business may have been disappointing this year. My sceptical view on this business remains unchanged and I think the low P/E rating is probably deserved. I’m going to maintain my cautious view ahead of January’s FY25 results. |

Roland's Section

RWS Holdings (LON:RWS)

Down 7% at 88p (£324m) - Trading Statement - Roland - AMBER/GREEN

(At the time of publication, Roland has a long position in RWS.)

Mark flagged up this week’s year-end update from translation and localisation specialist RWS in The Week Ahead, reiterating his view that established market leaders like RWS have the opportunity to become leaders in the implementation of AI, rather than victims.

This reflects my view too and I also hold the shares – albeit I bought into the recovery story far too soon and my position is somewhat underwater.

AIM-listed RWS is currently in the early stages of a turnaround under newish CEO Ben Faes. Today’s update covers the year ended 30 September and is in line with guidance provided with the half-year results – although only just:

FY25 reported revenue expected to be £690m, -4% vs FY24 (Stocko consensus £715m)

FY25 adjusted pre-tax profit to be c.£60m (previous guidance £60-70m)

I’m not surprised the share price has fallen, especially as this is an adjusted figure – RWS has a recent track record of fairly heavy adjustments, in my view, meaning that this figure could be masking a much weaker statutory performance.

There is some good news, though. Profitability appears to have improved significantly in H2, with today’s guidance implying a strong H2 profit weighting:

H1 adj PBT: £18m

H2 implied adj PBT: c.£42m

Net debt was also stable at £26m, versus an H1 figure of £27m and RWS says today it was able to refinance recently, extending its existing credit facility from $220m to $285m.

Divisional trading: a brief summary has been provided today suggesting mixed trading across the business, but with continued growth in AI-related activities:

Language Services: OCC (organic constant currency) revenue growth, “strong progress in TrainAI”

Language & Content Technology and IP Services: “flat compared with last year on an OCC basis”

Regulated Industries: revenue fell on an OCC basis, “driven primarily by reduced activity in our linguistic validation business”

Updated strategy: the group moved to a new operating structure on 1 October:

This structure streamlines how we sell, integrates our product and technology teams and organises our business into three segments: Generate, Transform and Protect.

CEO Faes says changes within the organisation are having an effect, citing “clearer focus” for sales and “greater collaboration” for the company’s technology teams. The level of post-acquisition integration and technical debt (old software that needs updating) that need addressing in this business is a long-standing concern for me.

RWS spent £41m on software in FY24 while also recording an amortisation charge (primarily software) of £55m. These are big numbers relative to profit, so I’ll be interested to learn more about capex plans in the full-year results.

Outlook: no update on FY26 trading or guidance was provided today – this will be provided with the FY25 results in December.

We intend to provide medium-term financial guidance and new performance targets when we release our FY25 results.

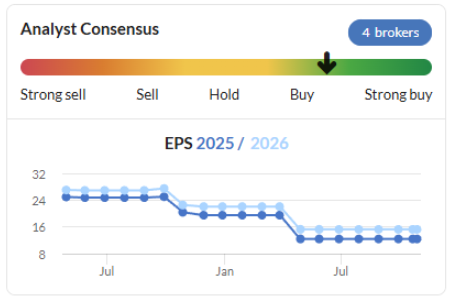

I don’t have access to any broker notes today, but my working assumption is that consensus forecasts will remain broadly unchanged following today’s update, suggesting earnings of 12.4p per share.

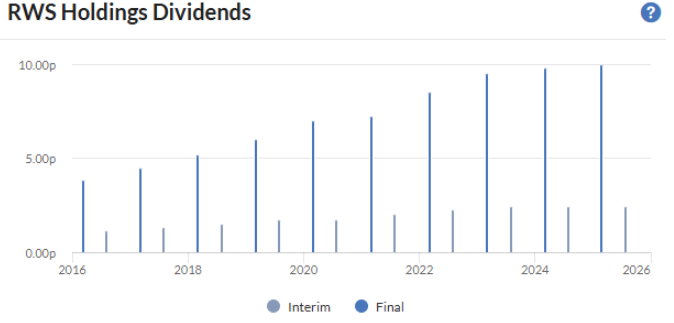

That puts RWS on a P/E of 7, with a potential 14% dividend yield – unless the payout is cut. I can see some logic in this, but equally I imagine that 24% shareholder Andrew Brode may be keen to see the company’s dividend record maintained:

Roland’s view

Today’s results are at the bottom end of profit guidance, but I am encouraged by the increase in profit in H2.

My view on the likely impact of AI remains unchanged – for large-scale commercial applications in areas such as media, travel and consumer goods, I think enterprise customers will be willing to pay for specialist service providers who can provide guaranteed quality, tailored models and content management tools.

RWS should be in a prime position to provide this service, with strong market share and existing relationships.

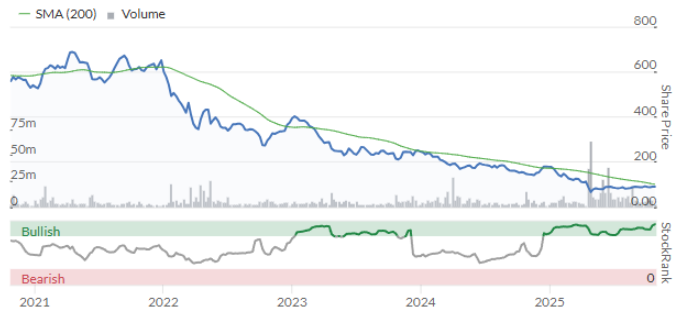

Of course, I am naturally biased as a shareholder and may be wrong. RWS could turn out to be an obsolete business that can’t change quickly enough to protect itself from smaller, upcoming AI-led operators. The market remains unconvinced:

For now, I am going to leave my AMBER/GREEN view unchanged on the basis that I believe the shares are cheap enough at present to be likely to offer value – after all, this is a business with £700m annual revenue and I believe it has a top-two market share globally.

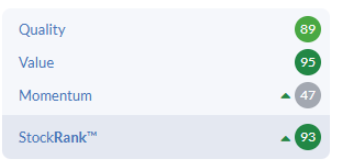

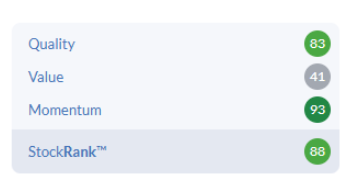

My view is also reflected in the stock’s Contrarian styling and high QV StockRank:

Airtel Africa (LON:AAF)

Up 6% at 246p (£9.0bn) - Half-Year Report - Roland - AMBER/GREEN

The big UK telecoms stocks have a well-deserved reputation for minimal growth and under-pressure profitability. The underlying reason for this is obvious enough – they operate in saturated, competitive and very mature markets.

The exception to this is Vodafone’s African business, which includes both mobile networks and a mobile money business. It’s profitable, fast-growing and a good business, in my view – but it’s subsumed within Vodafone’s wider business, so shareholders’ exposure to this growth is heavily diluted.

For investors who want to invest directly in a dedicated portfolio of African assets while staying within the UK market, Airtel Africa provides an interesting alternative:

Source: Airtel Africa website

We haven’t covered this stock much before, but perhaps we should have done.

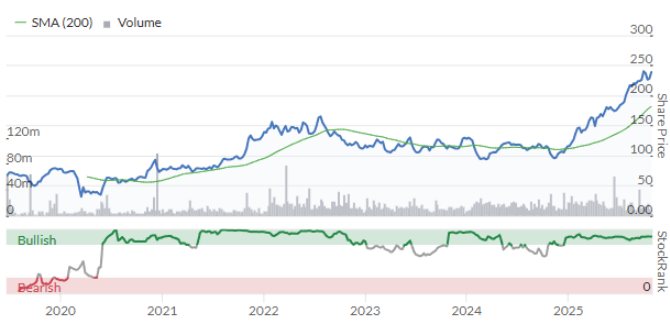

Airtel Africa’s shares have three-bagged since listing in 2019. The firm recently graduated to the FTSE 100:

Today’s half-year results emphasise the opportunity here. Many people in the company’s operating markets don’t yet have a smartphone and may not have access to the internet or banking services.

The rapid pace of adoption of these services is driving enviable growth and supporting much stronger profitability than the UK’s legacy operators can achieve:

Half-year results summary: last year’s figures were affected by some big currency movements (mainly the devaluation of the Nigerian Naira). Happily, today’s are relatively free of exchange rate effects and show impressive growth. These results cover the six months to 30 September 2025:

Revenue up 25.8% to $2,982m

Operating profit up 35.9% to $959m

Operating margin: 32.2% (HY25: 29.8%)

Adjusted earnings up 69.9% to 8.3 cents per share

These financial headlines are underpinned by some very strong operational growth metrics. The group’s total customer base rose by 11% to 173.8m, while the number of data customers climbed 18% to 78m. Data is now the largest single driver of revenue, outpacing voice for the first time.

Banking growth also remained strong. The mobile money customer base rose by 20% to almost 50m, while the annualised total processed value was 35% higher, at nearly $200bn.

The company says smartphone penetration in its markets rose by 3.8% to 46.8%, highlighting the pace of growth and the remaining opportunity – this business could get a lot bigger yet.

To accommodate and maintain capacity for further growth, Airtel Africa is investing quite heavily in its network:

Our commitment to delivering a great customer experience is supported by ongoing investment in our network with the rollout of over 2,350 new sites to over 38,300 sites and an expansion of our fibre network by approx. 4,000 kms to over 81,000 kms. This investment continues to drive increased data capacity across the region as overall population coverage reached 81.5% - an increase of 0.7% from a year ago, with 98.5% of sites being 4G enabled.

Capex totalled $318m in H1 and guidance for the full year has now been increased to $875-900m (FY24: $670m) as the company aims to “accelerate our ability to capitalise on the significant opportunity” in its markets.

Balance sheet and cash flow: Net debt rose by around $350m to $5.5bn in H1, but leverage dropped from 2.3x to 2.1x thanks to the increase in EBITDA.

The localisation of the group’s debt profile also continued. This long-running process has been designed to reduce the group’s exposure to currency volatility and is now nearing completion. The company says around 95% of its operating company debt is now in local currency, up from 89% a year ago.

Cash generation also seems good. My sums suggest underlying free cash flow of around $500m, demonstrating good conversion from H1 net profit of under $400m.

Based on today’s reported numbers, the proposed increase in capex this year looks manageable to me.

Outlook: there doesn’t seem to be any explicit outlook guidance in today’s results and I don’t have access to broker notes. But I think it’s reasonable to assume today’s numbers are in line or slightly ahead.

Looking at existing forecasts, today’s adjusted earnings of 8.3 cents represent 54% of the FY26 consensus figure of 15.3 cents. I don’t think there’s very much seasonality to this business, so perhaps brokers will extend the run of earnings upgrades they’ve delivered this year:

Roland’s view

This is a relatively complicated business with quite a few moving parts. The planned IPO of the mobile money business next year adds a further layer of complication to any valuation.

In my view, the combination of leverage and extensive exposure to a range of emerging markets also adds some risk to this investment, when compared to Vodafone or BT.

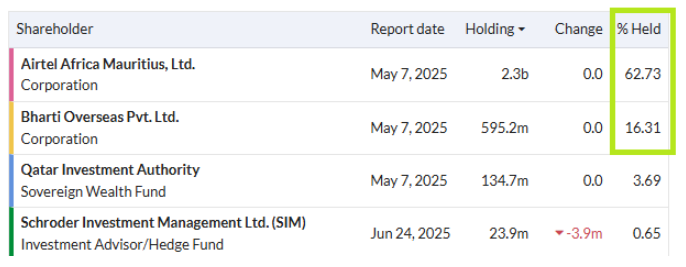

One final point worth making is that ownership remains highly concentrated. In effect, the business is controlled by Indian billionaire Sunil Mittall, who has direct or indirect control over nearly 80% of the stock:

All of this makes Airtel Africa a somewhat different type of investment than Vodafone or BT.

However, I think there’s a good case for arguing that much of this risk is offset by the strong, structural growth opportunities the company has in underdeveloped and (probably) quite lightly regulated markets, compared to the UK/EU.

I can’t see any real reason why the growth in use of smartphones and electronic banking won’t continue across most of Africa – that being so, leading incumbents like Airtel Africa could still become much larger businesses.

The shares currently trade on a FY26E P/E of 20, falling to c.14x in FY27. The dividend yield is less appealing than it used to be, at just 2.1%.

I can see some arguments for taking a neutral view here, but equally I’m reluctant to go against such strong momentum and high profitability. The StockRanks view this as a High Flyer and I am also going to adopt a moderately positive view – AMBER/GREEN.

React (LON:REAT)

REACT Group Plc (AIM: REAT), the leading specialist support services provider to the facilities management (FM) industry, announces a trading update for the year ended 30th September 2025 ("FY25").

I’m relieved to see I took an AMBER/RED view on React in May, since when the shares have fallen steadily. Even after today’s pop, the price is still nearly 15% lower than five months ago.

Today’s year-end trading update flags up some promising sounding numbers and indicates that full-year results are now expected to be ahead of previous expectations:

Revenues expected to be approximately £25.0 million (FY24: £20.7 million)

Gross Profit expected to be approximately £8.0 million (FY24: £5.7 million)

Adjusted EBITDA expected to be at least £3.0 million (FY24: £2.4 million)

However, React’s management has not chosen to provide a split between organic growth and the contribution from last October’s acquisition of Aquaflow. Instead, they’ve included this vague comment (my bold):

Revenues increased by approximately 21% year-on-year to c.£25.0 million, driven by continued momentum across core service lines and the contribution from the acquisition of 24hr Aquaflow in October 2024.

Checking the acquisition details for Aquaflow, I find that it generated revenue of £6.1m, gross profit of £3.4m and adjusted EBITDA of £1.2m in the year to 30 April 2024 (prior to acquisition on 28 Oct 24).

React’s financial year started on 1 October, so the company should have had an 11-month contribution from Aquaflow in FY25..

However, plugging 11/12 of the FY24 Aquaflow numbers into today’s update just doesn’t seem to add up. For example, 11/12 of £6.1m is £5.6m. Adding this to React’s FY24 revenue would give a total of £26.2m. That’s greater than the revenue figure reported today, even before any organic growth within the existing group businesses.

I can only see two possibilities – Aquaflow’s performance has deteriorated this year, or there has been a significant contraction somewhere else in React’s operations. Remember that this business issued a profit warning with its interim results in May; we already know H1 was poor for some parts of the group.

The increase in net debt to £5.3m (31 March 25: £4.8m) also suggests to me that true profitability (i.e. cash generation) has not been very strong this year. Debt has risen in H2 despite the lack of acquisitions during that period.

Outlook: with thanks to Dowgate Capital on Research Tree, we have updated forecasts today:

FY25E EPS: 6.7p (prev. 6.4p)

FY26E EPS: 9.3p (prev. 9.1p)

These forecasts leave the stock on a FY25E P/E of 7.5, falling to a P/E of 5.5x for FY26. However, these new estimates remain well below expectations prior to May’s profit warning:

Roland’s view

In May I made the following observation about the business:

React has a patchy record of profitability. While its collection of operating subsidiaries may include some attractive businesses, management empire building has delivered very little for shareholders – the share count has tripled since 2019, but the share price has fallen.

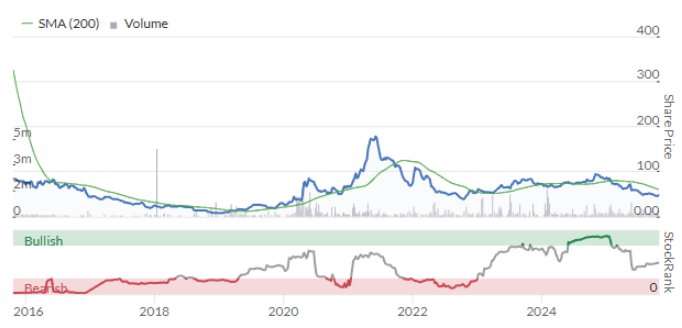

My view remains unchanged following today’s year-end update, as does the long-term share price history:

While this earnings upgrade is positive as far as it goes, I feel that today’s trading update raises questions about the contribution from Aquaflow since its acquisition and/or the organic performance of the group’s remaining businesses.

As an equity investor, I don’t see anything to interest me here. My overall impression is that this business may be run more for the benefit of its management than for its long-suffering shareholders.

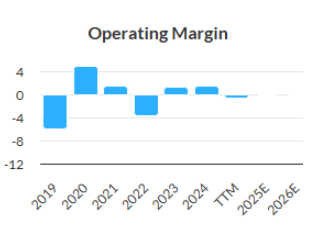

I could perhaps adopt a neutral view today, but React’s very poor history of profitability discourages me:

I’d like to see evidence that reported margins have improved before upgrading, so I’m going to leave my view unchanged at AMBER/RED today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.