Good morning!

The dust is settling on the Budget news, and there is consensus that this is a high-tax, high-spending set of measures.

Sticking to the narrow question of how it will affect most of the companies we cover in this report, my view is: probably not that much.

Last year's Budget included higher National Insurance contributions, from a lower threshold, that were a direct cost to every business, and a very significantly increased cost for labour-intensive businesses.

This Budget represents a more generalised set of tax increases, with much of the burden falling on individuals (especially through the long-term freezing of personal tax thresholds).

While this will of course have long-term economic effects, the direct impact on businesses in the short- and medium-term is perhaps not that high.

The removal of stamp duty for newly-listed companies, and the shrinking of cash ISAs for under-65s, are measures that I do think will directly impact (in a small but positive way) stock market activity.

So that's my initial take: a very important Budget for the economy, but not one that is likely to make a very great difference to the majority of companies we cover here. The major exception to that is the gambling industry.

We've run out of time for today, tomorrow I'll make an attempt at the backlog! Cheers.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Flutter Entertainment (LON:FLTR) (£26.5bn | SR28) | Adjusted EBITDA impact before mitigation is expected to be approximately $320m in FY26 and $540m in FY27. 37% of this could be mitigated in FY27. Flutter may see market share gains. | ||

Pennon (LON:PNN) (£2.49bn | SR41) | “Robust start”. Statutory PBT £65.9m (H1 last year: £38.8m loss). Targeting 7% return on regulated equity during the 2025-2030 regulatory period. | ||

Pan African Resources (LON:PAF) (£2.06bn | SR73) | Completion of Feasibility Study on Soweto Cluster Tailings Storage Facilities | Completed a feasibility study to process the Group’s Soweto tailings storage facilities. An integrated 600ktpm Soweto Tailings Retreatment circuit at the Mogale Tailings Retreatment Complex was identified as the preferred option. | |

Safestore Holdings (LON:SAFE) (£1.56bn | SR90) | Like-for-like revenue at CER up 3.3%. “We… continue to expect to deliver in line with EPS consensus expectations for FY 2025.” | ||

Sirius Real Estate (LON:SRE) (£1.47bn | SR85) | Acquiring multi-tenant business park in Hamburg for €31.9 million. EPRA Net Initial Yield of 6.1%. | ||

Serica Energy (LON:SQZ) (£702m | SR86) | Production rebounded in November to once again average above 50,000 boepd. Expects production for FY 2025 to average 27,000 to 28,000 boepd. Capex around $250m, in line with guidance. | AMBER/GREEN = (Mark) Specific production guidance wasn’t given at the last update, just that it would be below 29kboepd. Today’s update looks in line with what I’d expect from that statement. This has been a poor year for Serica’s production, as ongoing issues at both Bruce and Triton have cost them. They say production reached 50kboepd in November. However, there are further planned works before the end of the year. While 2026 is certainly looking better, and will benefit from acquired assets too, I think it would be naive to assume that there won’t be some further issues with production. However, the company still looks cheap, clearly has ambition to grow production and pays a 9% dividend yield. The Budget may not change the short-term outlook but does provide clarity over the long-term fiscal regime. It makes sense to keep our mostly positive view. | |

Marshalls (LON:MSLH) (£448m | SR53) | CEO steps down with immediate effect. He is thanked. Chief Commercial Officer appointed interim CEO. Full year expectations remain unchanged. | ||

Capita (LON:CPI) (£377m | SR76) | Three-year contract extension worth £33 million with a leading UK financial services provider to continue delivering critical contact centre services. | ||

Halfords (LON:HFD) (£314m | SR90) | On track to deliver FY26 expectations following a strong first half. H1 like-for-like revenue +4.1%. Underlying PBT +1% (£21.2m). | AMBER/GREEN = (Graham) It’s a close call, but I prefer to prudently leave this on AMBER/GREEN rather than taking a more optimistic stance. At the end of the day, a P/E multiple of 10x might be reasonable for this sector, and that’s where Halfords is trading currently. Thie current financial year is looking good, with the upper limit of of company-compiled range of analyst expectations rising since the last update. | |

Pensana (LON:PRE) (£278m | SR24) | Company has identified the scope to increase the content of heavy rare earths within its high-value Mixed Rare Earth Carbonate product by more than five times. | ||

B.P. Marsh & Partners (LON:BPM) (£235m | SR90) | Invested £5.3m for Cumulative Preferred Shares representing approximately 26.67% of the equity in Sodalis, a newly formed insurance intermediary. | ||

Anglo Asian Mining (LON:AAZ) (£228m | SR50) | ACG Metals Limited is in the early stages of considering making an offer for Anglo Asian. Trading in the company’s shares to be restored today. | ||

VP (LON:VP.). (£221m | SR86) | “Solid” H1. H2 continues to be impacted by challenging market conditions and economic uncertainty, but FY26 is currently expected to be in line with market expectations. | ||

James Latham (LON:LTHM) (£207m | SR70) | The second half of 2025/26 has started with similar volumes to the previous six month period, with similar margins. | AMBER/GREEN = (Mark) These results look consistent with achieving (recently-trimmed) market expectations for the full year. Volumes are up, revenues a bit less so, but increases in costs and lower interest earned means EPS is down. The valuation doesn’t look particularly compelling at 11x earnings and the bulk of the cash will be spent on a new National Distribution Centre, meaning investors can no longer rely on it looking cheaper on a EV basis. The new NDC may be the right thing to do, but I would have liked to see a much clearer business case as to why this is necessary and how it will benefit earnings. Despite these concerns I think where we are in the cycle for building products means that demand will be higher in the future, and with consistent pricing this will drop through to the bottom line. As such, I’m happy to keep our mostly positive view. | |

Activeops (LON:AOM) (£169m | SR64) | Well positioned for a strong second half, with continued momentum expected to deliver full-year results in line with the recently upgraded market expectations. | ||

Boohoo (LON:DEBS) (£162m | SR7) | Group Turnaround Scheme & Results for the six months ended 31 August 2025 | GTS is an incentive scheme, gives management 6% of the growth in the market cap of the company for share price growth between 35p and £3. (Current SP 11.6p.) Full year EBITDA to be c. £45m. Net debt £111m. | RED = (Graham) This still looks very high-risk to me, for a number of reasons. And one problem that it never seems to shake off is an unusual corporate governance setup, which continues to this day. At least the new operating model is more promising than the old one, and I am open to upgrading my view on this eventually. But while it remains overly leveraged, loss-making and with a major shareholder that it accuses of attempting to disrupt its operations, this is not a share that I'd be willing to touch. |

Camellia (LON:CAM) (£129m | SR75) | Historical land claims call for the surrender of c. 3,200 acres of agricultural land holdings. Kakuzi (of which CAM owns 50.7%) has been advised by legal counsel that it holds clear and valid title to the subject lands. Camellia considers that this matter will not affect delivery or outcome of its Value Enhancement Plan or have a material impact on its financial performance. | ||

Macfarlane (LON:MACF) (£104m | SR64) | Performance for the year ending 31 December 2025 will be in line with full year expectations as set out in its trading update dated 22 October 2025. Operations at Pitreavie are gradually recovering following the death of an employee. Committed £1.2m in new equipment to aid recovery. Looking to get pension scheme buy-in costing £2-3m. | AMBER/RED = (Mark) | |

DP Poland (LON:DPP) (£70.8m | SR18) | The new Facilities comprise: • a five-year non-revolving loan facility of up to PLN 5 million • a one-year overdraft facility of up to PLN 7 million • a one-year revolving framework agreement of PLN 3 million. | ||

Andrada Mining (LON:ATM) (£65.5m | SR26) | H1 Revenue +12% to £12.2m, Op. Loss £0.9m (25H1: Op loss £1.5m). Net debt £19.1m (25H1: £13.3m net debt). | ||

Gelion (LON:GELN) (£44.2m | SR11) | FY Revenue +36% to £2.7m, Operating Loss $6.0m. Cash 30 Jun £2.7m (FY24: £3.8m) after raising £4.4m in FY25. Raised £10.5m of equity in Nov 25. “As we enter FY26, we do so with focus and determination, acknowledging both the potential and the challenges ahead.” | ||

Palace Capital (LON:PCA) (£40.4m | SR71) | Adj. PBT -48% to £1.1m. EPRA NTA/share -3% to 244p. Assuming that the properties currently under offer are sold, it is anticipated that the Company will return further cash to shareholders through another tender offer in the first quarter of 2026. | ||

hVIVO (LON:HVO) (£39.8m | SR44) | Merck will acquire Cidara, a hVIVO client. The Company continues to support Cidara through Phase III development, acting as a major clinical site for the ongoing multi-site trial. | ||

Jersey Oil and Gas (LON:JOG) (£37.4m | SR35) | “With clarity on the longer-term tax regime now provided, the Company will be working with the Buchan joint venture partners, NEO Next Energy and Serica Energy, to assess the impact of these changes on the Buchan project.” | ||

EnSilica (LON:ENSI) (£35.3m | SR21) | Overall revenues for the year declined, driven by customer-induced delays on two contracted projects, which impacted the timing of NRE revenues. With recent new business momentum, has contracted visibility of more than 95% of FY 2026 consensus revenue forecasts and remains well placed to achieve FY 2026 guidance. | ||

Blencowe Resources (LON:BRES) (£34.3m | SR19) | ·Proven Reserve: 1.29 Mt @ 5.13% TGC ·Probable Reserve: 21.78 Mt @ 5.18% TGC ·Total Ore Reserves: 23.08 Mt @ 5.18% TGC Represents the final key technical input into the Company's Definitive Feasibility Study, to be published shortly. | ||

Ariana Resources (LON:AAU) (£33.9m | SR33) | 2,769 metres across 31 holes drilled. Best result: 4.90m @ 4.53g/t Au + 118.3g/t Ag from 24m. Extensions of the known vein systems remain prospective and have the potential to add to the resource opportunity at this deposit. | ||

Arrow Exploration (LON:AXL) (£33.1m | SR50) | Q3 Production +2% to 4,214 boe/d, Net YTD income of $4.8 million, Cash 30 Sep $6.3m. “The focus for the remainder of 2025 will be to drill low risk wells at the Mateguafa Attic pad in the Tapir block and to get all preliminary works in place to drill our first exploratory well at the Icaco prospect.” | ||

Cardiff Property (LON:CDFF) (£26.1m | SR27) | Net Assets/Share +4% to £30.53. EPS 29% to 132.9. Total dividend +17% to 27.5p. Unsure outlook due to budget and interest rate outlook. | ||

Cirata (LON:CRTA) (£25.2m | SR3) | Investigation into the Company has been closed and no action will be taken against the Company. | ||

Aptamer (LON:APTA) (£22.9m | SR34) | Order book of signed contracts for FY26 of £1.95 million with seven months of the year remaining. Confident that revenue will materially exceed the prior year's £1.2m sales. | ||

First Property (LON:FPO) (£22.9m | SR63) | 6m PBT +28% to £1.48m, EPS -13% to 0.79p due to higher number of shares. Adjusted net assets per share (EPRA basis) +6.6% to 38.07p.Markets and economy continue to be challenging. | ||

Revolution Beauty (LON:REVB) (£21.2m | SR28) | Revenue -32% to £49.4m, Ad. LBITDA £12.5m (25H1: LBITDA £6.3m). Net Debt £30.2m (25H1: 25.5m). Moved back to generating positive EBITDA in Sep/Oct. £16.5m of new equity raised in September, £4.0m used to reduce RCF from £32.0m to £28.0m. £2.1m transaction costs. Full year sales and Adjusted EBITDA will not match the guidance given on 22nd August. Will reach Adj. EBITDA guidance of £8-10m on a run-rate basis by the end of FY26 (28 Feb 26). | BLACK (RED =)(Graham) [no section below] The market cap has risen here thanks to a more-than-doubling of the share count, after a fundraise. As we said in August, the new money being raised was only planned to repay £4m of the debt load, with the other £11m being used to cover losses, make investments and restructure. Today’s interim results are for the period to the end of August, i.e. they include the effects of the August fundraise, and they show net debt remaining high at £30.2m. So I’m not surprised to see that there is another going concern warning. The company’s founders have returned to effect a turnaround, and I wish them well, but I view this stock as totally uninvestable given the current state of its finances. Adjusted EBITDA was negative £12.5m in H1. Also, in a separate announcement it is disclosed that one of the founders (who still owns 5.6% of the company) is going to be paid £160k annually for 2 days of work per week, as a consultant. There is an ongoing FCA investigation into potential breaches of market abuse regulations that might have occurred during this individual’s tenure as CEO. I’ve previously raised corporate governance concerns at REVB, and I think these concerns are equally valid reasons to consider the stock totally uninvestable. | |

Nanoco (LON:NANO) (£18.4m | SR17) | Shoei (who acquired substantially all of the assets from Nanosys, another manufacturer of quantum dots) issued proceedings in the US District Court in order to establish whether Shoei has or has not been infringing a number of Nanoco's patents. | ||

Facilities by ADF (LON:ADF) (£16.2m | SR38) | …expects to report FY25 results broadly in line with market expectations. Revenue and gross margin increased in the second half. Actions have also been put in place to reduce the cost base. £1.7m exceptional costs. 31 Oct net debt £13.8m (30 Jun: £13.2m). FY26 results will be slightly ahead of FY25. | BLACK (broker forecasts reveal a huge profits warning) (AMBER/RED) = (Mark) [nsb] Broadly in line, of course, means slightly below, and Cavendish take 3% out of their FY25 revenue forecasts. However, the impact increases as we go down the income statement. Adj. EBITDA (which is a poor measure for a company that rents out equipment as depreciation is a real cost if they want to stay in business) is reduced by 6% to £9.4m, Adj. PBT, PAT and EPS are all slashed by a whopping 39%. This isn’t just an accounting foible either. While these figures exclude £1.7m of exceptional costs (which turn FY25 loss-making on a statutory basis), with the cash flow impact of these, net debt is now going to be £3.5m higher than previously forecast. There is no doubt that this "broadly in line" is actually a huge profits warning. The market seems to be sanguine about it today with the share price barely moving. Presumably it was already known that the results would be bad, and 61% of bad is still bad! Or perhaps shareholders just read the headlines and missed the broker’s take on it. Cavendish have also introduced FY26 forecasts based on the company’s “slightly ahead” guidance. While these forecasts show EPS up 23% on FY25, these are still below what was forecast for this year before today’s warning. Net debt is also higher at the end of FY26 than it was planned to be at teh end of 2025. At the time of the HY Results in September, I concluded that this company looked materially overvalued on near-to-medium-term earnings. It looks even more overvalued today. | |

Altitude (LON:ALT) (£15.2m | SR56) | 6m Revenue +18% to $21.6m, Adj. Op Profit +8% to $1.6m, LPS 0.75c (25H1: EPS 0.11c). Net debt $2.3m (25H1: $0.8m). | ||

Kazera Global (LON:KZG) (£15.1m | SR14) | Engaging with three independent parties exploring the potential development or commercialisation of the Aftan mine. |

Backlog

Mobico (LON:MCG)

Unch. yesterday at 21.7p (£130m) - Q3 Trading Update - Graham - RED =

Quickly catching up on yesterday’s update in response to a reader request.

The company formerly known as National Express is a shadow of its former self:

Its US school business was sold, but that hasn’t appeased the credit rating agencies.

Earlier this week Fitch downgraded the company from BB+ to BB, with a negative outlook.

In layman’s terms: they already had a “junk” rating, but now they have a worse one, and Fitch considers it more likely to receive another downgrade next, rather than an upgrade (emphasis added by me below).

Here’s the view of Fitch (emphasis added by me). Only the Spanish bus and coach business ALSA seems to be carrying its weight:

The downgrade mainly reflects a change to Mobico's debt capacity, driven by the weakening business profile and poor performance in recent years. Mobico's businesses outside Automóviles Luarca, S.A. (ALSA) have continued to underperform, resulting in overdependence on ALSA profits.

The Negative Outlook reflects heightened execution risks across divisions. Most of ALSA's Spanish contracts face concession renewal in the next two to three years (although the company has a strong renewal record), negotiations with German public transport authorities on German Rail are ongoing, and profitability at WeDriveU and UK Coach needs to recover.

That’s the backdrop for yesterday’s trading update:

Revenue +5.4%

Adjusted operating profit for 2025 towards the lower end of the £180-195m range.

They will not redeem their £500m perpetual bond (but how could they?)

CEO comment excerpt:

"We continue to focus on simplifying and strengthening the Group, taking decisive actions to improve operational and financial performance. These actions include a comprehensive cost savings programme, further leveraging ALSA's best practice across the business and exploring options to monetise the assets of the UK Bus business ahead of franchising. Discussions with German PTAs are continuing and we will provide an update in due course…

The regions have produced a mixed bag of quarterly results: Spanish ALSA up 4.1%, UK down 3.2%, Germany up 14.3%, WeDriveU down 0.9%.

Graham’s view

This competitive, capital-intensive sector is difficult at the best of times. Throw in poor trading and an expected net debt multiple of 2.5x by year-end (according to the interim results) and you have an unsustainable situation.

With the market cap being so low now, I do see it as potentially having option value to the upside, if it remains solvent - adjusted operating profit was £60m in H1. But net debt was £1.3 billion (June 2025), with about £300m coming in from the sale of US school bus to deleverage. So let’s call the net debt £1.0 billion currently. This means that the value of the existing equity becomes the difference between two large numbers (enterprise value and debt): due to what I perceive as ongoing high risk, especially considering Fitch’s view, I’m going to stay RED.

Graham's Section

Boohoo (LON:DEBS)

Up 42% to 16.45p (£145m) - H1 Results & Group Turnaround Scheme - Graham - RED =

It’s a rare day of positivity for this share:

We last covered this in August, when Mark was RED at a market cap of £195m.

Even after today’s very large gains, the market cap is only £145m.

Let’s explore the interim results before checking out their “Group Turnaround Scheme” (actually a bonus scheme for management).

Interim results

Key bullet points I’ve picked out:

H1 GMV (gross merchandise value) minus 19%

H1 adj. EBITDA +5%.

The company focuses on its Debenhams brand at the top of the report, downplaying the importance of its “Youth Brands” and Karen Millen.

Debenhams GMV is up 20% while the GMV of Youth Brands is down 41%. The collapse in Youth Brands is understandable in the context of a big change in their operating model.

Continuing:

32% of GMV was generated through their “marketplace”, enabling a large inventory reduction.

15% EBITDA margin achieved, with a 20% target within the next three years

“Decisive cost elimination programme is nearing completion”.

The new strategy sounds more promising than the old one:

Our marketplace model is at the heart of our go forward business. It is stock lite, capital lite, margin rich and highly cash generative. This will improve further as we continue to grow our take rate and realise the potential of our recent AI investments across the business.

Bottom line profitability: the company is still loss-making, with a statutory loss of £14.7m or £3.4m if we focus on continuing operations only.

The company is profitable at the adjusted EBIT level. However, that’s before interest costs, which are substantial.

Net debt has thankfully reduced year-on-year to £111m (a year ago: £143m). This has been achieved with the help of a large equity raise and disposals.

They are targeting a leverage multiple of <2x by February 2027. It looks to me as if the current leverage multiple is in the region of 2.5x (using the latest net debt figure and the EBITDA target for the current financial year, £45m). For an unprofitable business, that’s going to be uncomfortable.

The finance expense in H1 alone was £12m: far too high for a business that only generated a heavily adjusted EBITDA during the period of £20m.

I also note that there were £7m of share-based payments in H1, up from £6m of share-based payments last year. My understanding is that these entirely relate to employee bonuses. Again, this is far too high given the company’s level of profitability. And I'll have more to say on share-based bonuses in a moment.

Name change: they are still trying to get this over the line.

We operate as Debenhams Group. We will formally change the name of Boohoo Group Plc to Debenhams Plc, as we previously tried, as soon as all major shareholders agree, as we believe that is in the best interest of all shareholders.

CEO comment:

Our turnaround is gathering real pace. We are making progress, we are moving fast, and we are transforming the business. We have returned all our brands to profitability and grown adjusted EBITDA. These results show that our strategy is working.

Group turnaround scheme: in a separate RNS, the company announces a new incentive scheme, because apparently the existing schemes don’t include the CEO and CFO. Current CEO Dan Finlay was appointed to his position a year ago.

Some interesting corporate governance considerations:

Debenhams notes that its Board has previously stated publicly that… seeking shareholder support for management incentive schemes of this nature is consistent with its corporate governance aims…

However, they are not going to seek shareholder approval for this scheme. They give various reasons for this, but the main reason seems to be Frasers/Mike Ashley:

…a major competitor who is a significant shareholder of Debenhams continues to seek to disrupt the Debenhams Group's growth strategy and operations rather than maximise its future success; at the Debenhams general meeting on the 28 March 2025, it voted against a simple resolution to change the Company's corporate name and at the annual general meeting on 19 September 2025 it voted against customary resolutions regarding dis-application of pre-emption rights, which are regularly recommended by boards as being in the best interest of all shareholders.

Looking at the details of the scheme, it sounds like the type of scheme that shareholders should definitely have a say on: it will give management 6% of the market cap increase that occurs between 35p and £3 per share.

Granted that the current share price is still far below 35p, but the amount of wealth that could potentially be transferred to management is extraordinary!

At a 60p share price (£838m market cap), the bonus would be worth £21m.

At a £3 share price (£4.2bn market cap), it would be worth £222m.

These aren’t Elon Musk numbers- the principles are similar!

Graham’s view

The share price gain here today is impressive but I still view this as a slam-dunk RED for a variety of reasons:

Turnaround in progress but it remains unprofitable for now

The leverage multiple is uncomfortable, with the interest burden itself being a big reason for the company’s unprofitability.

Some strange corporate governance features. If DEBS are correct and Frasers - their largest shareholder - are seeking to disrupt their operations, what does this say about DEBS’ ability to succeed?

Along similar lines, I think awards that hand out percentages of market cap gains do need to be voted on. It’s not ideal for a company to say that they aren’t going to put a bonus scheme like this to a vote, with the reason being that they suspect it would be voted down.

So in summary: the chances of the turnaround succeeding may have increased, but this remains too high-risk for me to get off RED.

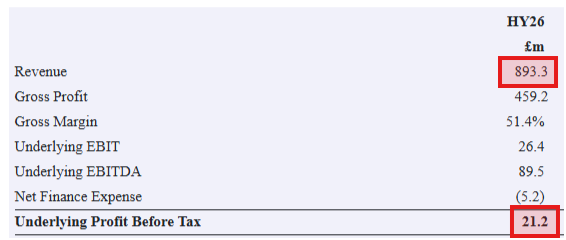

Halfords (LON:HFD)

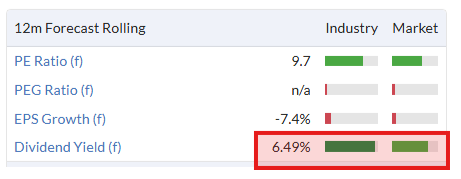

Down 3% to 139.5p (£301m) - Interim Results - Graham - AMBER/GREEN =

The key outlook statement seems fine here:

We are confident in delivering FY26 underlying PBT in-line with consensus and continue to expect capital expenditure for the full-year to be within the guided £60m to £70m range.

The company-compiled consensus figure is an underlying PBT of £36.0 - 40.7m.

And I note that’s a slight increase compared to the range that was given in October, at the trading update (£36 - 39.8m).

Other key points:

LfL revenue +4.1% (already known)

Underlying PBT +1% (£21.2m)

Net cash £18.6m, and no change to the dividend.

Free cash flow has been flowing into the balance sheet, which I think is always welcome for a company with lots of lease liabilities. (Even if lease liabilities aren’t considered “real debt”, they do create a less flexible structure, and so I always like to see some net cash on the balance sheet.)

The latest H1 period saw the net repayment of about £9m of borrowings, and £12.6m of dividend payments. So there has been a buildup-up in net cash excluding leases (from £10m to £18.6m), that has accompanied the dividend. A nice situation!

And the yield here is considerable:

Indeed, this share offers a ValueRank of 96.

CEO comment:

“I am very pleased to be announcing a strong set of HY26 results that show good financial, strategic and operational progress. Cycling was the stand-out performer, with LFL sales up 9%. Our consumer garages also performed particularly well, up around 8%, driven in part by the ongoing roll-out of our new format Fusion garages.

Looking ahead, there are significant opportunities for us to create further value through improvements in our technology and data capability, which are key areas of focus for us as we plan for the future. While the operating environment remains unpredictable, our combination of needs-based products and services, as well as market leading positions in both motoring and cycling, give us the confidence that we will continue to grow our business in line with our plans.”

Of course the overall profit margins are very thin:

And these margins aren’t improving, with a 4% increase in revenue only producing a 1% increase in underlying PBT.

However, I personally think this is an excellent result. The company has had to offset a large (£23m annualised) increase in direct labour costs in the current financial year. I was concerned that net profit margins might significantly deteriorate, but the company’s very tight cost control has prevented this from happening yet.

“Non-underlying items” - there are some adjustments, which are worth mentioning given the thin profit margins. £4m was classified as non-underlying in H1 this year, relating to problems at the Coventry distribution centre. Not a big deal perhaps, but it’s still 20% of underlying PBT that is lost.

Graham’s view

I like Halfords as a value share and as a retailer with a high proportion of service-based elements - I agree that this protects it from online competition.

However, it also drags on quality, as it’s difficult to earn high profit margins on this type of work.

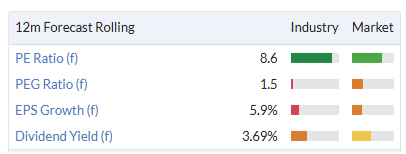

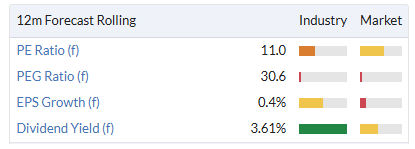

It’s a close call, but I prefer to prudently leave this on AMBER/GREEN rather than taking a more optimistic stance. At the end of the day, a P/E multiple of 10x might be reasonable for this sector, and that’s where Halfords is trading currently.

Mark's Section

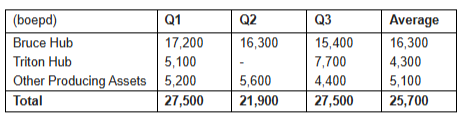

Serica Energy (LON:SQZ)

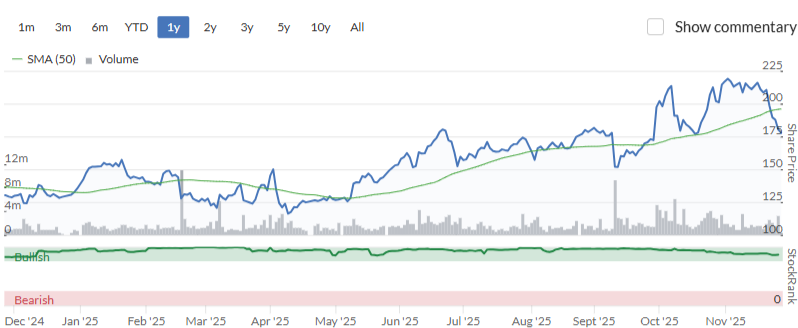

Down 2% at x177p - Trading and operations update - Mark - AMBER/GREEN

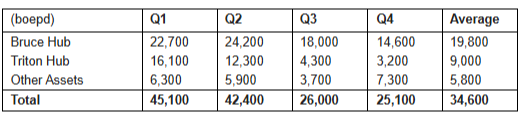

It’s not proving to be a great year for Serica production-wise:

And as regular readers of the DSMR know, this has been going on for over a year now. Here is the 2024 quarterly production:

The reasons are well known with problems with the Triton FPSO. However, it is worth noting that Bruce has suffered problems too:

Production from the Bruce Hub averaged 22,000 boepd in the period prior to planned annual maintenance, which began on 15 August. Following the completion of maintenance, bull-heading operations (in which gas is pumped into a well to reduce back pressure and enhance production) were only able to resume in November, resulting in curtailed production of 16,100 boepd in October. With the resumption of bull-heading, production has returned to over 20,000 boepd from the Bruce Hub.

The market is forward looking, though, and Triton is now back up to full production:

Production rebounded strongly in November, averaging 25,300 boepd net to Serica prior to the planned subsea work starting on 23 November. This work on the Bittern export pipeline requires production to be shut in from the Bittern, Gannet, and Evelyn fields, and is set to complete in mid-December.

It is this willingness to forgive short-term issues in the pursuit of longer-term gains, that explains why the share price has been strong over the last year, despite ongoing problems and a weaker oil price:

They say that “Production rebounded in November to once again average above 50,000 boepd, a level that more accurately reflects the potential of our portfolio.” but with further work on Triton over the next month, this isn’t enough to save them from a poor year of 27-28kboebp. In September, the guidance was 29-32kboebp (then reduced from 33-35kboepd). In October, they said they would be below this range, without providing specific guidance. Today’s range looks consistent with that previous statement, though.

Finances:

The reduced production and continued capex/dividend payments means that they are now in a net debt position:

- Borrowings of $231 million as at 30 September 2025 (30 June 2025: $231 million), resulting in a net debt position of $190 million as of 30 September 2025

- Total liquidity of $300 million as of 30 September 2025, comprising cash and undrawn committed RBL facility availability of $259 million

Partly this is timing, as no payments from Triton liftings were received in Q3. They also have plenty of liquidity. However, it shows that they have to get a handle on these production issues if they want to maintain their 9% dividend yield.

Production Growth:

As well as returning to planned production at their core assets there are a couple of opportunities for production growth:

The Belinda field being brought on stream. However, this requires Triton operator Dana starting two-compressor operations on the FPSO, which they have not been willing to commit a start date to.

The acquisition of the Lancaster field from the administrator of Prax should add around 5,900 boepd when it completes in December. The associated deals involving TotalEnergies and ONE-Dyas anticipated to finalize in Q1 2026

As I pointed out when Serica announced a possible deal to acquire BP's 32% non-operated stake in the Culzean gas condensate field, if this completes, pre-emption rights would mean that existing owners didn’t want to increase their stake at the same price. As it happens , NEO NEXT exercised its rights, meaning Serica's acquisition of the Culzean stake did not go through.

Budget Impact:

As well as confirmation that the government will actually allow license extensions, and limited extensions into adjacent areas. Serica give us a nice summary of what specific changes are being made to the fiscal regime:

· As announced in the Budget yesterday, the Energy Profits Levy ('EPL') will be retained in its current form until 2030

· After EPL ends, or ceases due to average oil and gas prices falling below triggers set under the Energy Security Investment Mechanism ('ESIM'), currently Brent $76.12/barrel and 0.59p/therm, the government yesterday confirmed that it will be replaced by a new permanent mechanism, the Oil and Gas Price Mechanism ('OGPM'). Unlike EPL, the OGPM will be applied separately to oil and to gas and will tax only the proportion of revenue earned above new OGPM trigger levels, those being $90/barrel and 90p/therm (for 2026 to 2027, then rising with the Consumer Price Index), at a tax rate of 35% (as opposed to 38% for the EPL)

This seems like a sensible move. Especially given that the EPL was brought in as a “windfall” tax during a period of high prices and these conditions are gone. Like almost everything in the Budget, it seems to have very long implementation timeframe, and may not have a material impact on Serica on a NPV-basis.

Mark’s view

While I like the ability that serica has to acquire non-core NS assets from larger companies, I don’t think they always get as good a deal as some of the headline numbers would suggest. While there may not always be huge competition for assets, if deals complete, it means they wil have outbid others. Plus what they are buying is usually short-life fields with aging infrastructure. If these are non-core for existing owners, they may well have been under-invested in over a number of years. As both Bruce and Triton have shown, once issues are found they are often more extensive (and expensive) than first thought.

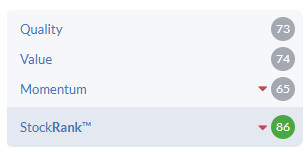

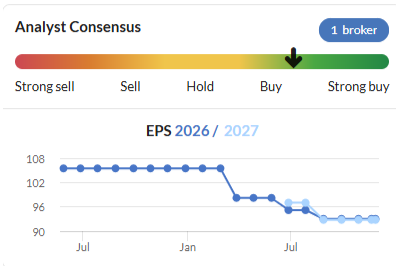

With weaker than expected production the StockRank has been declining slightly here:

However, it is still a high-ranked stock and with a 9% yield and greater clarity on the fiscal regime in the North Sea, it makes sense to be mostly positive and keep the AMBER/GREEN rating.

Macfarlane (LON:MACF)

Up 5% at 69p - Trading Update - Mark - AMBER/RED

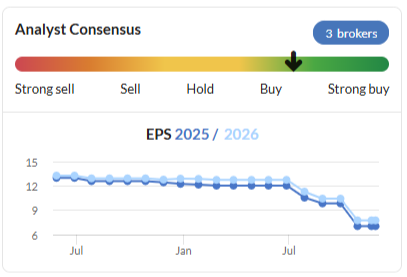

Given the recent halving of EPS forecasts since the summer, the market seems to have taken heart that trading is in line with expectations:

Helpfully, they give us these these revised expectations of £19.1m for FY adj. Operating profit. Most worryingly, the brokers didn’t see this as a one off affecting just the current year, but a multi-year deterioration of prospects and took around 30% out of all forecast years from 2025 through to 2027. As a corollary of this the forecast debt stays higher for longer.

Roland downgraded this to AMBER/RED on the last warning, and I felt that the initial market move here under-reacted to the scale of this miss. However, the shares have drifted down since the warning and the last big downgrade was at least partially due to them temporarily closing of one of their sites recently:

Following the tragic incident at the Pitreavie business, operations are gradually recovering. We have committed £1.2m of investment in new equipment to restore the business to full operational capability by the end of Q1 2026, helping to accelerate the process of recovery and creating capacity for growth.

Given that the tragedy was the death of an employee, I’d assume that this equipment is in order to improve safety. This will presumably be capex not operational costs, and this gives scope for a recovery in this business. I don’t think we can judge Macfarlane too harshly here as this was a recent acquisition. However, they will be on the hook for any HSE fine. The scale of any fine is hard to judge without details of the incident. Pressure Technologies (now Chesterfield Special Cylinders) had a similar case that cost around £1m when all costs and a £700k fine were applied. Offsetting this, you would hope that Macfarlane will not have to pay the full earnout on this business. Overall, this should not be material to a business of Macfarlane’s size, though.

The other thing the company choose to report on today is seeking a possible buy-in for their pension scheme. They say:

As part of this process a non-recurring accounting charge, currently estimated at between £2m and £3m, will be accrued to recognise an increase in the expected cost of historic equalisation of pensions.

While this may be a non-cash charge as part of this process, this will be reflected in the cost of any buy-in. The reasons for this move are to avoid any future cash contributions. However, looking at the last Annual report, they weren’t required to make any in the last triennial valuation:

The triennial actuarial valuation at 1 May 2023 was completed in February 2024. Due to the positive funding position of the scheme, there is no requirement for the Group to make further deficit repair contributions.

So this is a positive as a risk-reduction exercise, but the risk looked low anyway, and a buy-in won’t remove costs or free any surplus back to the company.

Mark’s view

While it’s good that is no further warning here. There is no sign of any immediate recovery in prospects. Pitreavie operations are gradually recovering, but are likely to face an increase in capex or costs and a possible HSE fine. Overall, this isn’t expensive for a company with a history of compounding EPS:

However, much of the growth has come from acquisitions and the recent warnings mean that they are not paying debt down as quickly as planned, limiting their scope for any significant additions. As Pitreavie has shown, acquisitions can also come with hidden risks. I wouldn’t be surprised if management are also more focussed on managing these risks at the moment than looking at expansion prospects. In light of this, I feel it is too soon to change our previous AMBER/RED rating.

James Latham (LON:LTHM)

Down 2% at 999p - Half-year Financial Report - Mark - AMBER/GREEN =

Revenue was up 5.5% here on Volumes that were up 6.8%. Gross margins were pretty much flat at 16.2% (25H1: 16.3%) but costs were up so Operating Profit was down about 2% to £11.1m.

The also had lower finance income due to higher capex and a pretty standard tax charge, which means that EPS fell by 5% to 47.9p. FY EPS forecasts have been reduced recently, and currently stand at 93p, which looks achievable with a similar H2 to H1:

This is what they say about this:

The second half of 2025/26 has started with similar volumes to the previous six month period to 30 September 2025, with similar margins. We expect that the stability in product prices will continue.

Our customers still have reasonable order books but there is a degree of nervousness about the economic outlook. The merchant sector is still finding growth difficult, in part due to the weakness of the DIY and House Building and Construction sectors.

The P/E of around 11 that this implies isn’t crazy but doesn’t stand out as particularly cheap amongst UK small caps:

Many consider this a high quality business that deserves a premium rating. However, this is only really true if it leads to a higher than market growth rate on lower capital requirements.

In the past, I would also have taken into account the significant cash balance in any rating. While it has reduced in this half due to capex requirements, it remains around a quarter fo the current market cap:

Cash and cash equivalents have decreased to £59.8m (2024: £67.5m) due to capital expenditure of £8m in the first half of the year, most of which relates to the National Distribution Centre. We continue to take advantage of additional early settlement discount opportunities with our suppliers as well as generating improved interest receipts.

The bulk of this cash balance is earmarked for spending on the National Distribution Centre, which they give us an update today:

Construction has now started on the National Distribution Centre, located in Chatteris, and we are pleased with the progress so far which is all going according to plan. Construction is anticipated to be complete by the end of 2026 with the aim of fully trading from the site by the end of 2027. During this period we have strengthened the senior management team by employing an Operations Director and a Business Development Director who will drive the development of the National Distribution Centre and the business opportunities that this will bring.

This is what they said about this in a recent announcement:

The Company's initial investment will be £6m for the land and then a further £39m over the next two years to construct and fit out the warehouse. This investment will create a purpose built 300,000ft2 warehouse in East Anglia, with good transport links, room to expand the Company's product offering and fitted with Warehouse Management System technology to provide operational efficiency. These costs will be funded from the Company's existing cash resources.

This means that (excluding any retained profits) after completion, their cash balance will be down to £20m, not enough to move the valuation needle. Indeed it sounds like there may be further inventory build needed to be funded beyond the construction cost for the NDC. All things being equal, their EPS will also decline due to lower interest income. It may be a low bar for a £45m+ investment to generate a higher return than cash, but I am a little worried that they haven’t spelled out the benefits of this strategy more clearly than this, from their previous announcement:

The NDC will provide more control and security over the storage of imported products, help support development of value-added products and allow the Company to increase its product ranges and improve stock throughput. The NDC will also improve the internal distribution service within the UK allowing depot locations to hold a wider balanced range of products and improve service and product availability for customers and the business to continue to grow through the existing depot footprint.

Balancing this, it is cleary a business subject to the construction market cycle and they may well be increasing range and throughput at exactly the right time at the start of a cyclical upswing.

Mark’s view

I struggle to get excited by the company at current rating, and with the bulk of their cash committed to building their NDC, I don’t think we can conclude this looks better on a cash-adjusetd basis. I’m not sure this is a business that tries to excite shareholders and the NDC is probably the right thing for the business in the very long term. However, there seems to be very little presented to shareholders in the way of a concrete business case that makes it clear that this is a strategy that will generate materially higher earnings when it is operational. For example, it could be necessary to protect their existing market share. It would still be the right thing to do, but not something that justifies the current rating.

Despite these concerns, I am of the opinion that demand for building products will be higher in a couple of years’ time than now and any company exposed to these trends will benefit. Like our view of almost all the well-run companies in the building products sector right now, my view remains mostly positive at this point in the cycle. AMBER/GREEN

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.