Good morning!

Wrapping it up there, thanks everyone.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Unilever (LON:ULVR) (£116bn | SR46) | Underlying sales growth +3.5%, with 1.5% volume growth. Adj op profit -1.1% to €10.1bn, adj EPS +0.7% to €3.08. €1.5bn buyback, dividend +3%. Outlook: expect sales growth within guidance of 4% to 6% with modest improvement in underlying op margin. | AMBER/GREEN = (Roland - I hold) [no section below] Unilever shares have not been the most exciting investment in recent years. However, the group still owns a large portfolio of valuable consumer brands. These collectively generated €50bn of sales and an 18% operating margin last year – not a terrible result. The divisional breakdown shows recent trends continuing, with Personal Care, Beauty & Wellbeing outperforming Food and Home Care. Guidance for the year ahead is for sales growth at the lower end of the target range, but margins are expected to hold firm and management do expect at least 2% volume growth. I also would not rule out further disposal activity under newish CEO Fernando Fernandez. He is tilting the business further towards Beauty, Wellbeing and Personal Care ranges, which are seen as having stronger growth potential. A forward P/E of 19 and 3.3% yield is slightly above the long-run average, but I think it’s fair to remain broadly positive on this business on a long-term view. | |

British American Tobacco (LON:BATS) (£96bn | SR69) | SP down 2.5% Revenue -1% to £25.6bn, adj op profit +0.4% to £11.6bn. Adj EPS +0.7% to 352.1p, dividend +2%. 2026 Outlook: expected industry volume down c.2%, outlook at lower end of medium-term guidance: 3-5% revenue growth, with low double-digit New Category revenue growth. - 4-6% adjusted profit from operations growth, H2 weighted. - Expected c.1% transactional FX headwind. - 5-8% adjusted diluted EPS growth1,2 growth. | AMBER/GREEN = (Graham - I hold) [no section below] The market doesn’t love the outlook here but there are a few positives that I think are worth pointing out. Firstly, in terms of the debt load, they are “on track to reduce leverage to within 2.0-2.5x by end 2026”. For context, this leverage multiple was 2.75x at the end of 2024, and has already reached 2.55x as of the end of 2025. So they are going to have a reasonable financial structure from now on (assuming no new acquisition is announced). They do need a permanent CFO, with a search ongoing since August 2025, but the credit rating here is investment-grade. On the whole I think these results are fine, including full-year revenue growth of 2.1% before a currency headwind. New Category growth of 7% is not overly inspiring but at least it was running at double-digits in H2. Looking forward, cigarette volumes will continue to fall but EPS should grow slowly, helped by New Category growth. Overall I think that little has changed here and at 12x earnings the company continues to perform steadily and offer reasonable prospects. | |

Relx (LON:REL) (£37bn | SR54) | Revenue +7% to £9,590m, adj op profit +9% to £3,342m. Adj EPS +10% to 128.5p, constant FX. 2026 outlook: see positive momentum, expect a year of strong underlying revenue and profit growth. | ||

South32 (LON:S32) (£11bn | SR85) | Underlying revenue +4% to $4,008m, underlying earnings +16% to $435m. | ||

Magnum Ice Cream NV (LON:MICC) (£8.8bn | SR86) | Revenue -0.5% to €7.9bn, with 1.5% underlying volume growth. Op profit -22% to €599m, in part due to separation costs. Outlook: external environment uncertain, expect sales growth of 3% to 5%, with slight improvement in adj EBITDA margin. | ||

Schroders (LON:SDR) (£7.4bn | SR82) | Nuveen has made an offer for up to 612p per share, consisting of 590p in cash per Schroders share and up to 22p in dividends per share. | PINK (Graham) | |

Morgan Sindall (LON:MGNS) (£2.4bn | SR85) | All divisions performed well in 2025 and the group is on track to deliver 2025 results in line with exps. 2026 opening order book +17% to £19.1bn, strong growth in Fit Out means 2026 outlook is now ahead of expectations. | GREEN = (Roland) Today’s upgrade should help to narrow the gap between 2025 earnings forecasts and (lower) forecasts for 2026. I suspect that this is at least partly due to shorter visibility on Fit Out work, which was the catalyst for both October’s upgrade and today’s. While the valuation here is not as cheap as it was, I can’t fault the excellent management, quality and balance sheet of this business. On the basis of today’s upgrade, I’m going to retain our fully positive view. | |

Ashmore (LON:ASHM) (£1.86bn | SR76) | AUM +10% to $52.5bn during 6mo to 31 Dec. Net inflows of $2.3bn. Adj revenue -16% to £67.5m, adj PBT -41% to £26.2m. Adj EPS -35% to 3.1p. | GREEN = (Graham) I've been GREEN on this for quite some time and I'm happy to stay that way, now that AUM flows are moving in its favour. But I do accept that it's no longer in value territory, with the share price having doubled since the low last year. | |

Griffin Mining (LON:GFM) (£565m | SR64) | Gold production commenced in Zone III of Yuan Long orebody at Caijiaying Mine. Initial stopes contribution c.5-10% to daily mine production. Drilling within YL continues to return high-grade gold intercepts. | ||

Alfa Financial Software Holdings (LON:ALFA) (£564m | SR53) | Andrew Dickson will join as CFO on 6 July 2026. Dickson is currently CFO of software group Cerillion (LON:CER). | ||

Custodian Property Income Reit (LON:CREI) (£404m | SR74) | EPRA earnings per share 1.7p, up 13% thanks to a surrender premium on an industrial property in Hamilton. Like-for-like ERV up 0.5%. Q3 NAV total return per share 2.4%, NAV per share increased to 99.8p (last night’s close: 88p). | ||

Guardian Metal Resources (LON:GMET) (£322m | SR26) | Pre-revenues, $4.8m loss from continuing operations. In July, awarded US$6.2M from the U.S. Department of War to support the rapid advancement and Pre-Feasibility Study for the 100%-owned Pilot Mountain tungsten Project in Nevada. Plans to pursue a US listing in the first half of 2026. | ||

Helical (LON:HLCL) (£242m | SR40) | Helical and Places for London have entered into a £220 million development financing facility with PIMCO Prime Real Estate, acting on behalf of institutional investors, to fund the acquisition and delivery of the Paddington Over Station Development. | ||

Cab Payments Holdings (LON:CABP) (£195m | SR57) | This announcement provides CAB Payments shareholders with further background to the (rejected) increased Possible Offer ($1.15 per share, c. 84p). | PINK | |

Treatt (LON:TET) (£129m | SR50) | The interim CFO becomes permanent CFO, while also being interim Group Managing Director. The Search for a permanent CEO continues. | ||

Trifast (LON:TRI) (£105m | SR85) | On track to deliver FY26 results in line with market expectations against a backdrop of continued challenging trading conditions. Consensus revenue £214m, underlying EBIT £16m, underlying PBT £11.6m. | AMBER = (Graham) [no section below] Trifast is an "international specialist in the design, engineering, manufacture, and distribution of high-quality engineered fastenings." Stockopedia categorises this as a "Super Stock" so perhaps we are being a little ungenerous with our neutral stance. However, there is no growth to speak of and the in-line trading statements confirms that revenues are falling. Credit to management for eking out some further profit growth despite falling revenues (underlting EBIT was £15.6m last year, with consensus this year of £16.0m). But this is not a type of business where I would automatically assume high ROCE or ROE, and Trifast's history shows that it has rarely achieved impressive returns. Combine that with shrinking revenues and I think our neutral stance continues to have some merit. | |

Strategic Minerals (LON:SML) (£95m | SR37) | “Results from CRD037 intersected the core of a high-priority section of the Exploration Target, demonstrating the continuation of SVS high-grade mineralisation through this previously untested section.” | ||

First Tin (LON:1SN) (£92m | SR39) | Recent drilling, metallurgical testwork and a review of historical data indicate the presence of silver and copper mineralisation associated with, and spatially proximal to, the existing tin mineralisation. First Tin intends to undertake further technical and economic work to assess the upside potential of these metals to the overall project. | ||

| Synthomer (LON:SYNT) (£48m | SR36) (issued 11th Feb pm) | Statement re potential refinancing | Confirms recent media reports that Synthomer is considering a capital raise to support debt refinancing due next year. No decisions have yet been made. | RED ↓ (Roland) [no section below] Synthomer’s share price fell by almost 50% yesterday following this announcement, which was issued at 1.46pm. The debt risks have been clear for a while, with leverage reported at 4.7x-4.8x in a January trading statement that was covered here by Mark. Hopes that the company will be able to deleverage without an equity raise appear to be diminishing. This may be shutting the stable door after the horse has bolted, but I’m downgrading our view to be fully negative today. I think the risks of dilution are high and would not consider the shares until there’s some clarity on refinancing. |

Helium One Global (LON:HE1) (£43m | SR11) | Pinon Canyon Plant scheduled for integrated plant operations next week. Operations are progressing as planned. | ||

Tpximpact Holdings (LON:TPX) (£27m | SR96) | TPX is the successful bidder for a £39 million, 4-year contract with DEFRA. | ||

Ondo InsurTech (LON:ONDO) (£26m | SR2) | ONDO has signed its first joint insurance customer (The Co-operative Insurance Companies) via its strategic partnership with vipHomeLink. LeakBot will be launched across Vermont and New Hampshire. | ||

Inspiration Healthcare (LON:IHC) (£15m | SR43) | Strong H2, full-year revenue +24% (slightly ahead of consensus). FY January 2026 adjusted EBITDA in line. Net debt £5.1m. “We ended the year with encouraging sales momentum and a robust pipeline, providing confidence within the team as we look ahead to FY27." | ||

IXICO (LON:IXI) (£10m | SR28) | Announces the extension of an existing contract with an international pharmaceutical company. The extension is worth an additional c.£1.5 million in revenues over the next three years. |

Graham's Section

Schroders (LON:SDR)

Up 29% to 588.65p (£9.5bn) - Offer for Schroders Plc - Graham - PINK

It’s a big day in the history of UK fund management, as Schroders management have agreed to a US takeover.

Key points:

612p per share, made up of 590p plus 22p in dividends.

29% premium to last night’s close.

55% premium to average price over the last year.

Market cap of the offer: £9.9 billion.

The offer premium is calculated in two ways, both including and excluding the 22p of dividends. To be conservative, I think it makes sense to exclude the dividends. But if you do include them, you get a 34% premium to last night’s close, and a 61% premium to the average price over the last year.

Valuation: 17x adjusted operating profit.

Irrevocable undertakings have been received from 42% of shares, which means that the deal should be a shoe-in.

The buyers: “Nuveen, LLC ("Nuveen"), a Teachers Insurance and Annuity Association of America ("TIAA") company”.

Given the size of Schroders, I’m a little surprised that a buyer has been found.

Not only does the buyer need to be large enough, it also needs to be suitable.

But Nuveen and TIAA fit the profile.

Schroders has £824 billion of AUM as of December 2025.

Nuveen has $1.4 trillion (just over £1 trillion), over 90% of which is in the Americas, and only 4% in EMEA.

The combination will be formidable:

Nuveen and Bidco believe the Transaction provides a unique opportunity to combine two highly complementary businesses to create one of the world's largest global asset managers with nearly $2.5 trillion in AUM. The Combined Group will operate a powerful public-to-private platform with industry-leading investment capabilities, global reach and local presence.

Schroders will get US distribution, while Nuveen will get access to EMEA and Asia-Pacific markets.

The CEO of Schroders will remain in his position, and will report to the CEO of Nuveen.

Most jobs at Schroders will be safe for at least two years:

For a period of two years following the Effective Date, Nuveen and Bidco do not intend to make any material reductions in the employee base of Schroders, other than reductions arising from the removal of listed company-focused roles.

Graham’s view

This is an enormous change and I’ll miss following Schroders’ stock market updates.

But in asset management, bigger is nearly always better. I don’t see any economic argument against this combination, so long as the Schroders brand is protected. There is value in this brand:

Nuveen and Bidco recognise Schroders' position as a pre-eminent financial institution with a deep-rooted history and strong brand recognition, similar to Nuveen and TIAA… Nuveen and Bidco intend to maintain the Schroders brand to minimise the impact on clients and employees and to drive growth.

From the point of view of Schroders’ shareholders, clearly the Schroders family members are happy with this outcome. The price they are achieving might “only” be a 30% premium to the prevailing share price, but with a company of this size and profile I would say that it’s a considerable achievement, in the circumstances. The earnings multiple is 16x forward earnings.

So well done to anybody holding this - later this year, you should have the enviable job of deciding what to do with the proceeds. The takeover is currently expected to go through in Q4.

Ashmore (LON:ASHM)

Up 0.6% to 262.6p (£1.87bn) - Half-year Financial Report - Graham - GREEN =

Ashmore Group plc (Ashmore, the Group), the specialist Emerging Markets asset manager, today announces its unaudited results for the six months ended 31 December 2025.

Ashmore already released its quarterly trading statement last month, so we knew how the company was doing in H2:

AUM rose from $48.7bn (Sep 2025) to $52.5m (Dec 2025)

Q2 quarterly net inflows were $2.6 billion.

The weak dollar and investor concerns re: the US have been assisting Ashmore:

Over the 2025 calendar year, EM fixed income indices returned between 9% and 19%, outperforming the 8% return for DM bonds, and EM equity indices increased by between 19% and 35%, comfortably outperforming the S&P500 return of 16%. Against this backdrop, Ashmore's active management continues to deliver alpha for clients across its equity and fixed income strategies.

Turning to today’s interim results, the H2 net inflows were $2.3 billion, so the strength was all in Q2.

Reflecting the fact that AuM growth came at the end of the period, with AUM having previously been on the decline, and also lower performance fees, Ashmore’s net revenues are down by some 16% year-on-year.

But the company has a large balance sheet with “£480 million of excess financial resources including £260 million of cash and deposits”. Its assets include seed capital investments (investments in its own funds), and these contributed £34m of gains in H2.

So in summary:

Ashmore’s H2 adjusted operating profit is down from £32m last year to £19m this year

But if we include gains on its investments (some of which are included within “finance income”), profit before tax is £81.9, up 64% year-on-year.

So the company’s own balance sheet has generated returns this year which easily offset the lower profitability from its fund management activities.

Let’s hear from CEO Mark Coombs:

Ashmore has delivered strong AuM growth over the six months, with broad-based net inflows and continued investment outperformance. It is clear that investors are acting upon the attractive risk/reward opportunities available across emerging markets and are benefiting from the continued performance of these markets. As a consequence of Ashmore's investment performance, the Group's financial results are also strong with returns on seed capital investments contributing to a 64% increase in profit before tax and diluted EPS approximately double the prior year.

As usual he is bullish on economic prospects in emerging markets, and he expects further weakness in the US dollar.

Graham’s view

There's been a doubling of the Ashmore share price since the low last April:

I’ve been GREEN on it, which hasn’t been a comfortable stance to take in the context of net outflows. There has been a very long period of investor indifference to emerging markets, in which Ashmore hasn’t really been able to capitalise on its specialism.

That now appears to have turned, with US politics and the overvaluation of US markets perhaps starting to tempt institutions to reallocate internationally.

Quarterly inflows of $2.6 billion were huge - 5% of AUM - and hopefully are the start of a new trend.

I’m going to stay GREEN on this although obviously it’s not the bargain that it was before.

Just bear in mind that the P/E multiple isn’t “real”, as it doesn't account for balance sheet strength:

Today’s balance sheet shows £770m of equity, or about £690m once we strip out intangibles. And what remains is quite liquid: £277m of cash and £421m of “investment securities”.

Even so, I must admit that the stock probably is getting a little expensive now. If we adjust for the strong balance sheet, e.g. if we treated it as having a true enterprise value (market cap minus surplus assets) of about £1.3 billion, the P/E multiple on next year’s earnings would still be 22x.

So I accept that this isn’t in value territory any more, but I’ve been GREEN on it for quite some time and I’m happy to stay that way, now that AUM flows are moving in its favour.

Roland's Section

Morgan Sindall (LON:MGNS)

Up 5.7% at 5,340p (£2.56bn) - Trading Update and Outlook for 2026 - Roland - GREEN =

Today’s trading statement from this FTSE 250 construction group upgrades guidance for 2026 while reiterating expectations for 2025:

2025: all divisions performed well and results are expected to be in line with current expectations

2026: “significant strategic progress” means the company is entering 2026 with a record secured order book and work at preferred bidder stage. These metrics (combined, I think) are up by 17% to £19.1bn compared to the prior year.

2026 outlook: management says that “confidence levels have increased” since the start of the year relating to Fit Out work (high-end offices, etc). As a result, visibility for the rest of the year has improved (my emphasis):

Fit Out's profits for 2026 are now expected to be significantly ahead of expectations and significantly above the top end of the medium-term target of £80-100m, driving a Group outlook for 2026 also ahead of expectations.

All of the group’s other divisions are currently “on track” to perform in line with expectations in 2026.

Fit Out ahead of target again! Interestingly, the Fit Out division was responsible for October’s upgrade to 2025 expectations. This business appears to be enjoying strong momentum at the moment, perhaps reflecting the very high office occupancy levels being reported by some of the big commercial property REITs.

We’re used to seeing medium-term targets used to gloss over weaker short-term performance. But that’s not the case here – in fact, the opposite is true.

Morgan Sindall has already said that 2025 Fit Out profits are also expected to exceed the medium-term target of £80-100m.

Today we learn that 2026 Fit Out profits are also expected to exceed this target range.

This suggests two possible conclusions to me:

Morgan Sindall is maintaining its reputation for prudent forecasting, later upgraded

Fit Out is enjoying an unusual boom in demand that may not be sustainable

I suspect that both of these explanations are true, to some extent, although I can’t be sure.

Updated estimates: sadly I don’t have access to broker notes for Morgan Sindall.

I would guess that consensus estimates might rise by c.5% based on today’s update, but what’s more important from my point of view is that this upgrade should help to close the earnings gap that’s developed over the last year between FY25 and FY26 forecasts.

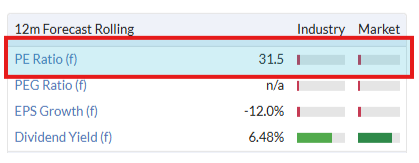

Prior to today, analysts expected Morgan Sindall’s earnings to fall by 13% in 2026:

An upgrade to 2026 forecasts should help to narrow this gap, although I don’t think it will close entirely.

Ed discussed this situation and Morgan Sindall in his October article “Why the best shares often have the worst looking broker forecasts”. His data-backed conclusion was that the trend in forecasts is often more important than the absolute value.

I share this view, although I think it’s also worth considering a couple of other possible explanations for the chart above:

The last two upgrades have been driven by Fit Out work, which may have less forward visibility than larger construction projects. Thus, 2026 upgrades have lagged 2025 upgrades – until now.

Alternatively, earnings may be nearing a peak, reflected by Morgan Sindall’s decision not to upgrade its medium-term target profit for Fit Out, despite expecting to exceed this range in both 2025 and 2026.

I’m not sure which view is correct. Again, I think it’s possible that the truth lies somewhere in the middle.

Roland’s view

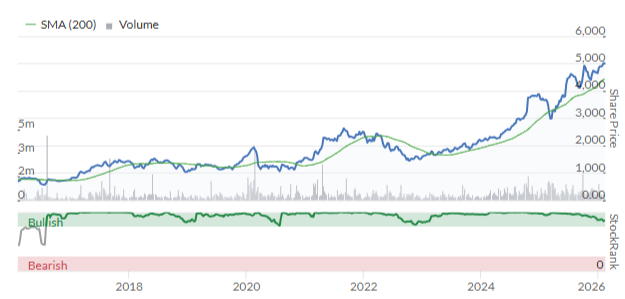

I’m on record as a long-term fan of Morgan Sindall, whose shares have risen by over 600% in the last 10 years:

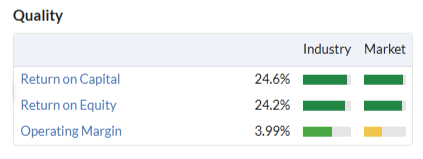

In my view this owner-managed business is the class of the field in the UK listed construction sector, with an outstanding long-term track record, strong balance sheet and excellent quality metrics.

Unfortunately I have never managed to persuade myself to follow the numbers and buy the shares for my long-term portfolio, always worrying that I was too late. As a result, Morgan Sindall has also been one of the biggest missed opportunities for me personally in recent years – perhaps a lesson in the power of a positive trend.

When Graham last commented on Morgan Sindall in January he lifted our view to GREEN but noted that the mid-teens P/E ratio was relatively high for this sector and this company.

In that sense, nothing has changed. I’d normally be a little cautious about the prospect of a fall in earnings this year, but given this early upgrade to 2026 forecasts I think it’s too soon to moderate our view.

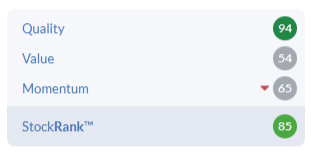

While Morgan Sindall’s StockRank has moderated in recent months, I suspect today’s upgrade and positive share price action will lift the stock’s MomentumRank. The publication of FY25 results later this month will also drive a refresh of the StockRank.

To remain consistent with our system and reflect today’s upgrade, I’m going to leave our positive view unchanged. GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.