Good afternoon! It's Paul here.

I had another second wind in the evening last night, and added more sections to yesterday's report, which now comprises comments on;

- Patisserie Holdings (LON:CAKE) - decent interims

- Foxtons (LON:FOXT) - trading update

- Altitude (LON:ALT) - results & placing

- Zotefoams (LON:ZTF) - trading update

- Ideagen (LON:IDEA) - trading update

On to today, the header above shows the companies that I'm aiming to report on today.

Obviously the backdrop this week is a bit of a market wobble in the USA yesterday, driven by political events surrounding Donald Trump's chaotic presidency. I think a stock market correction is overdue, so sometimes the market just looks for any excuse to sell off.

Personally, I've de-geared, and opened some shorts in my spread bet accounts. However, I've not made any significant changes to my ungeared, long-term portfolio.

Churchill China (LON:CHH)

Share price: 1068p (up 1.2% today)

No. shares: 11.0m

Market cap: £117.5m

AGM Statement - covering the first 4 months of the current financial year (ending 31 Dec 2017).

This is a UK-based manufacturer of crockery, mainly for restaurants.

Today's update is short & sweet!

"I am pleased to report that we have made further progress against our objectives in the first four months of the year. We have continued to benefit from strong export demand and our new product launches have been well received.

As a result we continue to anticipate that we will meet our target performance levels for the year."

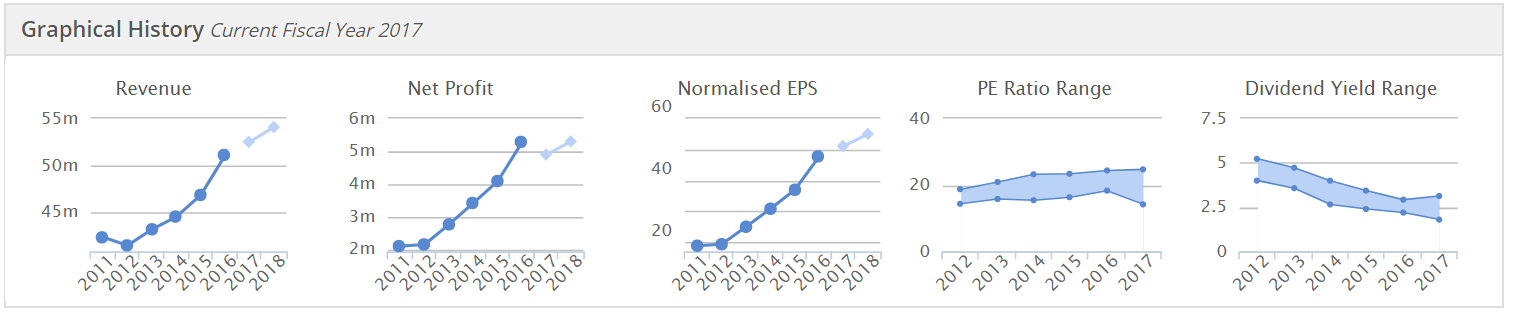

Looking at the Stockopedia graphical history (which is my shortcut for getting a handle on how any company has performed), we can see that there is a steady progression of revenues. Plus there seems to be good operational gearing, as profits & EPS have risen considerably more in % terms, than revenues;

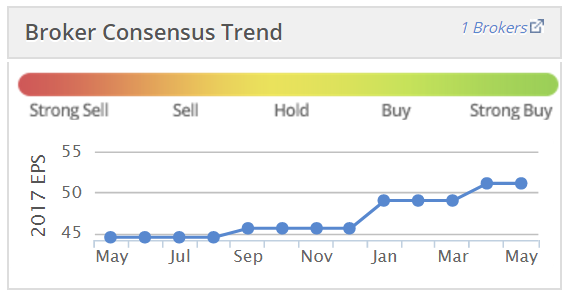

There's also been a positive move in forecast EPS in the last 12 months, which is another thing I like to see. Companies which are seeing earnings upgrades are usually on a roll, so there's probably less risk of a profit warning;

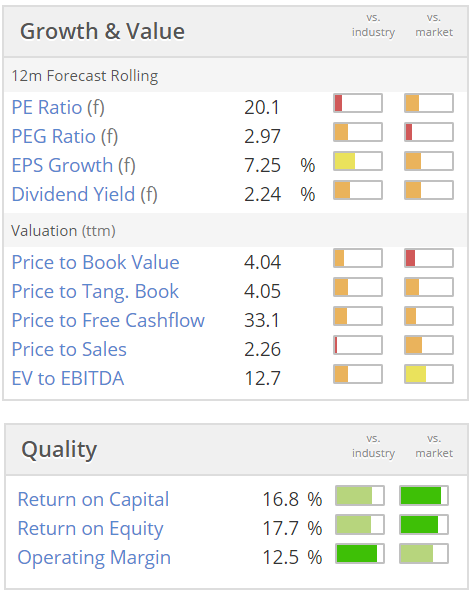

So far so good. However, as regards valuation, it's certainly not cheap;

Hospitality sector - there's been tremendous growth in the UK hospitality sector in recent years. The problem is that many operators are now reporting more difficult conditions. Therefore, some are shelving expansion plans. Weaker players could go bust.

Skimming through the last results statement in Mar 2017, the company does indeed reporting softening demand in the UK. Although exports seem to be taking up the slack - driven by weaker sterling.

My opinion - this is a good quality company, which seems to be well-run. It also has a strong balance sheet. The products are widely used, and seem attractive & stylish.

The trouble is, I think the UK hospitality sector has peaked, and could struggle for the foreseeable future.

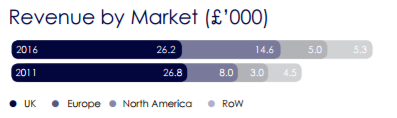

Although the company's growth seems to be coming from export markets. Whilst thumbing through the most recent Annual Report, I came across this interesting little graphic;

Look at how UK sales have slightly shrunk in the last 5 years, but exports have grown strongly.

So it seems to be the export growth which is justifying the rather toppy valuation. So shareholders will need to keep an eye on sterling exchange rates, as it's creeping back up against the dollar for example.

Overall, I like the company, but feel the valuation is too warm for me, given that earnings growth seems to be slowing.

Indigovision (LON:IND)

Share price: 211.9p (up 17.4% today)

No. shares: 7.6m

Market cap: £16.1m

(at the time of writing, I hold a long position in this share)

AGM Trading Update - covering the 4 months to end Apr 2017. The company now has a 31 Dec year end, having changed it some time ago.

This is an Edinburgh-headquartered mid to high end digital CCTV company. It sells products globally, and was an early pioneer in developing digital CCTV systems.

I've held this share continuously for 13 years now, and can tell you that positive trading updates are extremely rare. So what a pleasure to read this update today, which sounds a lot more encouraging than news for several years.

Summary of main points;

- Software licence & camera sales have shown decent growth in volumes

- Camera prices have stabilised (previously falling)

- Modest growth in overall revenues

- Good (over 10%) growth in Latin America, Europe, M.East & Africa

- N.American sales "well below potential"

- US sales teams have been restructured (yet again)

- New product called "CyberVigilant" detects if CCTV system has been hacked, and is patent-protected

Outlook/current trading - sounds encouraging;

May started well. In the first 19 weeks of 2017, overall revenues were ahead of the corresponding period last year.

The immediate outlook is more positive than it has been for some time, and the medium term prospects are promising.

The Board continues to expect that 2017 as a whole will see improvements over last year, with both sales and profits, as in recent years, second-half weighted, and the latter part of the year also benefitting from higher revenues in North America.

My opinion - as I am painfully aware, this company has little visibility over earnings. This is because just 1 big contract can make a massive difference to the overall results. So there's not really much point in looking at measures like forward PER, because nobody knows what the E is going to be.

That said, after years of disappointments, the company does seem to be getting its act together. I know that management have tried incredibly hard to rebuild profitability. There's plenty spent on R&D, which has enabled the company to keep innovating on product.

The balance sheet remains strong. Note that the company has hardly issued any new shares over the years, so there's good discipline there.

Perhaps this is the start of IndigoVision's renaissance? Time will tell.

Staffline (LON:STAF)

Share price: 1238p (down 1.0% today)

No. shares: 27.8m

Market cap: £344.2m

AGM Trading Update - the company updates us today on performance to date in this financial year (ending 31 Dec 2017).

This is a group which provides contract staff to customers (mainly food producers & retailers). Plus, it is a leading provider of UK Government welfare to work programmes.

Main points;

- Continuing to make "excellent progress" in 2017, after "record year" in 2016.

- Staffing division continues to grow - no impact from Brexit vote, on either demand for, or supply of workers.

- Employability division - "new business pipeline remains strong". "Continue to bid for and win new contracts".

Overall - this sounds reassuring;

As a result, we are pleased to confirm that current trading is in line with market expectations and the Board remains confident of the Group's growth prospects with the "Burst the Billion" £1 billion revenue target still very much on track."

Broker comments - there are two update notes available on Research Tree today, which I've had a quick look at. Both analysts sound encouraged by today's update, and think the shares are good value.

Valuation - Stockopedia shows the forward PER as 10.6 - which I think looks good value for a company with a track record of strong organic growth.

StockRank is excellent, at 97.

Note that the Stockopedia computers have also put Staffline into one of the winning investing styles;

My opinion - I've been positive on this share for years.

It's a well-run, entrepreneurial business. It looks reasonably-priced, in my opinion.

Interquest (LON:ITQ)

Share price: 47p (down 3.1% today)

No. shares: 37.6m

Market cap: £17.7m

Cash offer for Interquest - I mentioned this situation 2 days ago here. The Chairman, CEO & CFO of Interquest indicated they might bid for the company at just 42p per share. They issued another RNS today saying they are going ahead with a derisory 42p offer.

What complete scumbags! The way I see it, they've under-performed, and the share price has reflected that, plunging on a series of profit warnings in the last year. Now the company is cheap, management have decided to try to buy it on the cheap, at what is clearly an under-valuation.

The NEDs and broker (Panmures) have publicly said this offer undervalues the company.

The statement today from management is a joke. They complain that the low share price is damaging the business, and it would be better off privately owned. Yet the low share price is their fault - for their lamentable performance.

When a company under-performs, management has a duty to improve performance, and over time market confidence returns. Only a bunch of spivs would try to buy the company on the cheap, leaving shareholders with crystallised losses. It's clearly unethical. Meanwhile the performance of the company will no doubt improve, and greedy management will receive all the future benefit.

I suppose there's a chance this is a stalking horse bid, designed to smoke out higher competing bids?

Personally, I ditched my shares in disgust this morning at 46.6p. The problem is that the Chairman, Gary Ashworth, holds 33.3% of the equity. Together with others, this means there is already 42.2% support for the derisory 42p bid. So it might be difficult to stop.

I keep a black list of Directors that I won't ever get involved with again, who shaft outside shareholders. A good example was FDM (Holdings) (LON:FDM) - where (years ago) Rod Flavell forced out other shareholders, taking the company private at a laughably low price. Of course it re-floated a few years later at a massively high valuation. So for me, that one's a bargepole job. Perhaps a pity, as the shares have done really well, but if you can't trust management...

InterQuest now falls into the same bracket. So I'll certainly be avoiding any other companies these Directors get involved with.

A few snippets to round off with.

Bloomsbury Publishing (LON:BMY) - audited preliminary results - for the year ended 28 Feb 2017 - from this book publishing group.

Profit before tax and highlighted items is down 7.7% on last year, at £12.0m .

Although the company says this is above market expectations.

Divis of 6.7p are up 4.7% on last year, and provides a yield of 3.8% based on the current share price of 177p.

Balance sheet looks excellent, very strong, and includes £15.5m in cash, with no debt.

Cashflow also looks excellent, although of the £19.8m operating cashflow, £7.3m came from an increase in trade payables. That could reverse next year. However, cashflow still looks pretty good, and comfortably enough to finance the divis.

Note that this company continues to publish Harry Potter books. It would be interesting to find out what proportion of profits comes from those?

StockRank is exceptional, at 97, and this is classified as a "Super Stock" in the new styles classifications.

My opinion - it looks OK. The price seems about right to me - 15.3 times forward earnings.

Where's the profit growth going to come from though? Normalised EPS has been fairly flat in the last 6 years, so I'm not sure I'd want to pay 15 times, for a company that seems ex-growth, in a sector that's declining.

It's good to see that conventional books still have a future. Although it's not something I would want to invest in.

Mothercare (LON:MTC) - full year results for the 52 weeks ended 25 Mar 2017 are out today.

This is the third year of the company's turnaround, and to my mind, it's fairly unconvincing. I've had a quick skim of the figures, and am not particularly impressed.

The UK is still loss-making, at £4.4m underlying loss, on £459.4m UK sales. So a lot of work, for no return. What's the point?

International has always been the better part of the business, but underlying profit there is down 13% to £35.2m.

Underlying EPS is up a smidge, at 9.7p.

PER is 12.8, at the current share price of 124p (down 3.5% today).

My opinion - I can't see much in the outlook comments to give me confidence that future performance might radically improve. That's the only reason most people would invest here - i.e. if profits say doubled in the future, then the shares would do very well. How likely is that though? I don't know.

This seems to me a company that is maybe running to stand still. Internet disruption means margins are going to be under relentless attack. So this strikes me as a typical older-style retailer that may never return to the glory days of higher profits before the internet came along and messed everything up.

All done for today! Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.