Good morning, it's Paul here!

To get you started today, here is the link to yesterday's completed report. I added new sections on Filtronic (LON:FTC) and NWF (LON:NWF) in the evening (EDIT: extra bits added re NWF, after talking to an adviser to the company, who helped me with understanding the business model)

On to today. I see that yet another outsourcing company has run into trouble. Capita (LON:CPI) this time. The RNS today says that it needs to raise c.£700m in a Rights Issue, has suspended divis, and is to make non-core disposals, and cost savings. It's become too big & complex. I don't know the company at all well, but it seems to me there are 5 clear lessons to be learned from Carillion, Capita, and previous failures in the outsourcing & support services area;

- It's a lousy area for investors, unless the business is focused in a specialist niche area, and is very well managed.

- Operating a group with a weak balance sheet, loaded up with debt from acquisitions, is very often an accident waiting to happen.

- Contracting businesses often mess up contracts in one way or another. This is bound to happen, as offering to build something large, or provide a complicated service for multiple years, is fraught with risk. Yet contractors often under-estimate the risks & costs, in order to win the contract, sometimes at an uneconomically low price.

- Investors are often sucked into shares in this sector due to a high dividend yield. Companies with weak balance sheets, lots of debt, and paying big divis are an accident waiting to happen. I only go for high yield shares if the balance sheet is bullet-proof.

- The accounts in this sector cannot really be relied upon. Reported profits often turn out to be illusory, once problems with contracts later emerge.

Overall then, my resolve is stiffening to avoid this sector like the plague.

Best Of The Best (LON:BOTB)

Share price: 255p (unchanged today, at 11:31)

No. shares: 10.12m

Market cap: £25.8m

(at the time of writing, I hold a long position in this share)

Interim results - for the 6 months ended 31 Oct 2017

Best of the Best runs competitions to win cars both online and at retail locations

This is the well-known supercar competitions company, which has been operating from UK airports for many years. Its business is now mostly online, at 82% of revenues. Total revenues are only flat vs H1 LY, at £5.54m. Although reduction in airport revenues has masked an increase in online revenues of 6.8%, to £4.44m.

I'm rather disappointed with this pedestrian rate of online growth. The reason I hold this share, is because I think it has an excellent product, which has the scope to be many times larger. However, management seem to prioritise profits over growth. That has resulted in a nice stream of special divis, but I can't help feeling that a big growth opportunity is not being suitably developed. Hence why I don't see PER as a particularly relevant way to value the share - it has considerable latent value, and many years' reputation, which could be worth multiples of the current valuation, if better exploited.

Other points;

- Strong profit margin - £0.95m H1 profit, on £5.5m revenues, is 17.1% net margin

- Cash of £2.05m (no debt)

- Another special dividend (hoorah!) of 7.5p

I'm pleased to see that the company is spending more on online marketing - but is it enough? There's a strong argument to really go for it, and stimulate strong growth. That would send the share price into orbit, then a say £5-10m fundraising could be done, to turbocharge the next phase of growth.

Growing investment in online marketing to increase player acquisition, with encouraging numbers of new customers

Valuation - H1 EPS is 7.67p (up only 2.3% on H1 LY). We cannot simply double that figure to get a full year estimate, as there's a complicating factor here. This is the change in tax status of the company, which was explained in this RNS on 13 Dec 2017. Instead of being subject to VAT, the company will now pay Remote Gaming Duty.

The company very helpfully spelt out the impact this would have on future profits, in its Dec 2017 announcement;

The payment of RGD, as opposed to VAT will result in the payment of higher taxes and will negatively affect the Company's operating margin. The impact on profit in the current financial year is expected to be mitigated by the old tax regime's ongoing application in H1 and a solid start to H2 and therefore the Company confirms that it expects to report profits before tax of not less than 1.4m (2017: 1.5m). The impact on FY19 is expected to be more pronounced with forecasted profits before tax of not less than 1.2m.

Therefore, if we are to be conservative, we should probably value the company on a run rate of £1.2m PBT, which would be roughly £1.0m after corporation tax, divided by 10.12m shares = 9.9p EPS.

The house broker is a bit more conservative (and dilutes for share options, which I haven't done), and forecasts 9.3p EPS for 04/2019. That's a PER of 27.4 - which looks expensive for a company which is not generating much growth at all. Although as explained above, I think there's considerably more latent value in the company's future, so a PER valuation basis looks too simplistic to me.

If the company hits on an effective digital marketing strategy that stimulates growth, then (in a bull market) we could see the rating double, and earnings forecasts double - that's the type of situation I look out for - and it's exactly what happened at Gear4Music, for example, proving very lucrative. That's the upside potential anyway, but I'm not totally convinced that it's likely to happen. A more sedate pace of growth seems to be the plan;

We have continued to grow our investment in all forms of marketing which has helped drive revenues and increase awareness of the BOTB brand and the Dream Car competition. It is our intention to gradually accelerate the rate of this investment to build on these results.

VAT reclaim - this is still up in the air, but the house broker reckons that BOTB's £4.5m (before costs) VAT claim is strong, and likely to succeed. If that happens, then I imagine the company would probably pay another special dividend. Although my preference would be for the company to instead use any such windfall as a big new marketing pot, to be focused on (hopefully greatly) scaling up the business, using predominantly digital marketing. That's where the opportunity is, in my view - same with all online businesses.

Outlook - management seem happy with performance, so I wonder if there might be upside potential on the forecasts?

The business is well placed for future growth and is trading in line with management expectations. We look forward to updating shareholders on progress in due course."

My opinion - as you can probably tell, I'm somewhat frustrated that a big opportunity has been created here, but isn't being pushed forwards as aggressively as it could be.

Joules (LON:JOUL)

Share price: 324.5p (down 0.15% today, at 12:57)

No. shares: 87.5m

Market cap: £283.9m

Interim results - covering the 26 weeks ended 26 Nov 2017.

This is a distinctive fashion retailer/wholesaler/online - website is here.

It's good to see the interim figures from this company today, as its trading updates are almost completely useless - failing to provide the key information that investors need. I explained my complaints about badly-written & confusing trading updates here on 12 Dec 2017, and again here on 9 Jan 2018. The company tends to just talk about revenues (which are obviously going up, because it's opening new shops). However, it often fails to state how it is trading relative to market expectations. That's the vital information, so to omit this renders trading updates largely useless.

I'm pleased to say that the interim results provide a much better indication of how things are progressing, with this clear outlook statement today giving us some of the information we need;

The Board now anticipates that full year profit will be slightly ahead of the range of analysts' expectations

I say "some" of the information we need, because the company has failed to state what it believes the range of analysts expectations actually are. Companies & their advisers need to remember that, post MiFID II, many investors are no longer able to access analysts' notes.

Reuters website shows a range of EPS estimates from 11.0p to 12.67p for 05/2018. Although my worry is whether these estimates might start to dry up, if brokers stop providing their figures to financial websites? So I'm treating all forecasts with great caution at the moment, and am sense-checking them myself.

This seems to me to be suggesting that full year EPS of c.13p seems likely. That works out at a current year PER of 25. Not cheap, but not outrageous either, for a decent growth company, in a bull market. Although I have to say that UK small caps are feeling more like a bear market at the moment, with lots of things selling off quite badly.

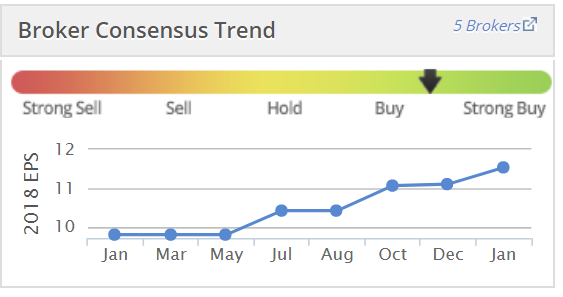

House broker notes for JOUL are available on Research Tree. They've upgraded forecast earnings by 3% today, on top of a 6% upgrade after the Christmas trading statement. I think it's often worth paying a highish PER for companies which have a track record of beating estimates, as this one has. The actual PER in 12 months time ends up being cheaper than you thought at the time of purchase - because the forecasts were too low.

This effect has been shown dramatically with both Boohoo.Com (LON:BOO) and Fevertree Drinks (LON:FEVR) which have established remarkable track records of thrashing original forecasts. So when they looked so expensive during the rapid growth phase - actually they were cheap! The lesson I've learned from that, is to stop treating analyst forecasts as fact, and instead remember that they are just one person's best guess. They are often very considerably wrong. Predicting the future is not easy, especially when profit is a leveraged number. So profits can swing up & down a lot, on fairly modest changes in sales, at many companies.

The earnings upgrades at JOUL are not quite so dramatic, but they're worthwhile, and repeated;

Balance sheet - I would say is satisfactory, but not strong.

My opinion - overall, I like the good track record of profit growth that JOUL is establishing. It's a fashion business, with a very distinctive look, so it carries a heightened risk of going out of fashion, compared with other retailers.

I think the current price can be justified, based on strong growth. I don't see enough short-term upside to want to buy any shares myself though.

Stock screens based on earnings momentum

I've focused on earnings momentum a lot over the past 2 years, with excellent results. The stock screening section of Stockopedia is very useful to find potentially good shares. This section shows a couple of screens which I follow, that have performed very well over the last 5 years. You can click on this picture to go to the relevant page;

I often find that stocks I like appear on Tiny Titans, based on James O'Shaughnessy's investment approach. It's also a near shortcut to find new stock ideas. Although having a look at its latest selections, there are not many that I rate.

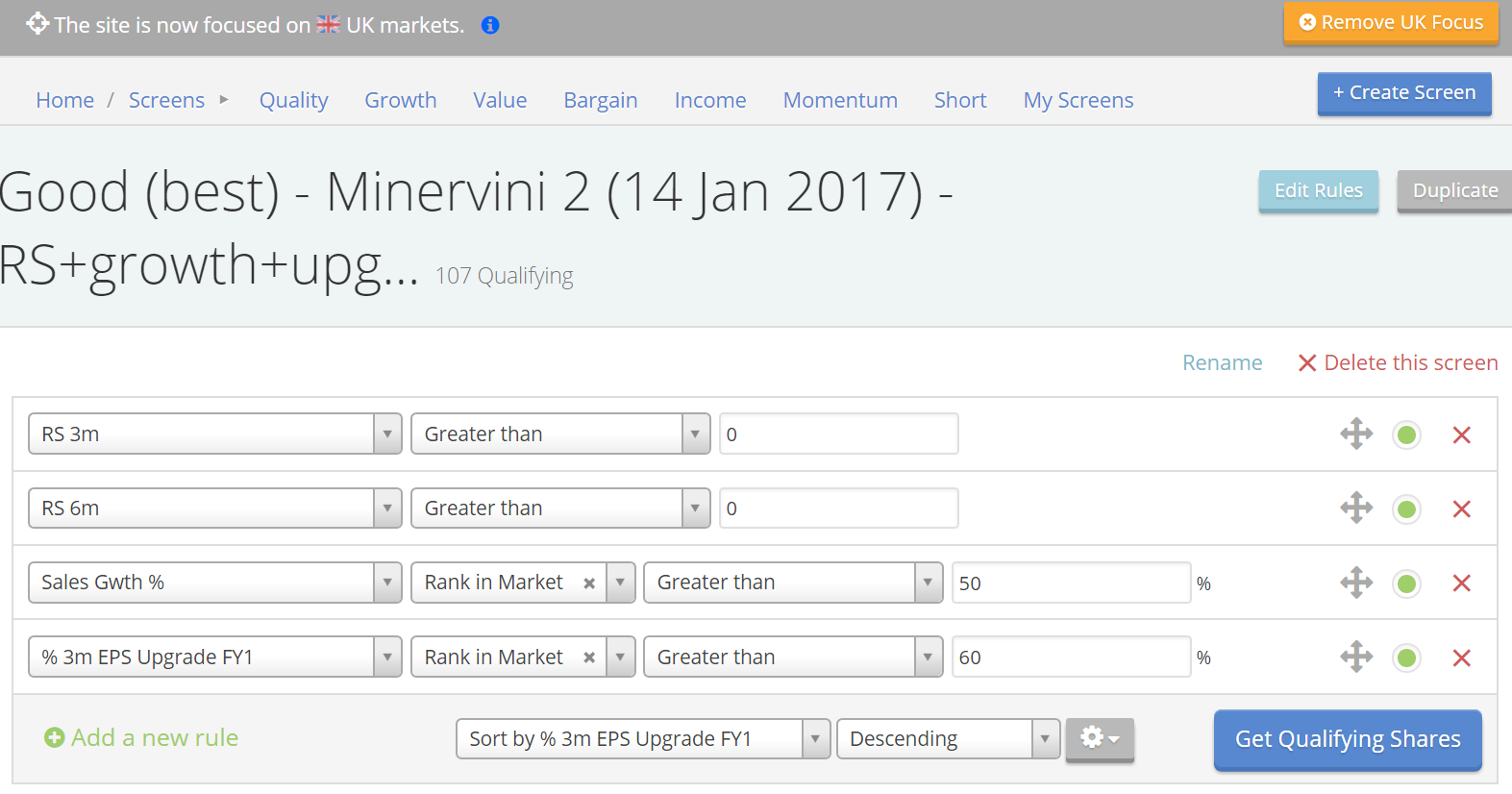

I create lots of screens on Stockopedia, and see which ones work best. Most don't work consistently. However, one screen that I created a year ago does tend to come up with some smashing stock ideas. It's based on Mark Minervini's approach, and looks for shares with moderate to good share price momentum, with good sales growth, and (crucially) forecast upgrades in the last 3 months. People have asked me for the criteria in the past, so here you are;

I'm not sure that a Minervini style approach will necessarily work in more bearish-feeling UK small caps at the moment. In a bull market though, it worked a treat - helping me to identify some cracking risers last year.

Big Sofa Technologies (LON:BST)

Share price: 13.97p (down 3.7% today, at market close)

No. shares: 65.1m

Market cap: £9.1m

Trading update - for calendar 2017. I didn't realise the market cap was so small, but as Magnus Magnusson used to say, "I've started, so I'll finish".

Big Sofa (AIM: BST), a fast-growing international video analytics provider to consumer brands and market research agencies, is pleased to announce a trading update for the year ended 31 December 2017.

It's a jam tomorrow company, so not really my kind of thing at all.

Revenues in 2017 were up 72%, but were still only £1.3m.

The narrative today is mainly about big name clients, and future potential.

However, it seems to me that the apparently positive update today seems to be glossing over very poor financials. Here is a summary P&L from H1;

Full year revenues are £1.3m, so that means £0.8m revenues in H2. If the cost base remained the same as in H1, then this suggests an operating loss of a whisker under £2.0m in H2, for a full year loss of over £4m.

Cash position - looks extremely precarious. As at 30 Jun 2017, the company had only £397k in cash, less borrowings of £628k, so net debt of £231k. It raised £1.4m after costs in a placing at 18.5p in Aug 2017. Given the likely cash burn in H2, I reckon that by now the company must be running on fumes - i.e. it probably needs an urgent, immediate cash injection to keep trading.

Outlook - jam tomorrow basically;

"We have begun 2018 with an established client base that has already extensively stress-tested and validated Big Sofa's technology in 2017 and is poised to increase spend in the current year. The board is highly encouraged by the progress demonstrated in 2017 and the platform Big Sofa has established for material revenue growth in 2018."

My opinion - there's only one thing I dislike more than jam tomorrow companies, and that's jam tomorrow companies which have run out of cash. So personally I'll be watching from the sidelines, and waiting for the company to;

- Get proper funding to take it through to profitability

- Demonstrate that it has a viable business model.

I don't see either of those things yet. So it's extremely high risk at this stage, and hence best avoided, in my view.

Should the company have issued such a bullish-sounding update, yet make no mention of its cash position and cash burn? If a placing is done at a significant discount, then I think people who bought on the basis of this trading update would have serious grounds for complaint against the company.

Trading updates should not be ramping exercises. They should instead give a balanced and informative view of the company's position. I can't see anything like that in this update. It might be worth a closer look, if and when the company raises enough cash to give it c.2 years' breathing space, and if/when the promised increase in customer spend really does happen.

Satellite Solutions Worldwide (LON:SAT)

Share price: 8.56p (up 1.3% today, at market close)

No. shares: 682.6m

Market cap: £58.4m

Satellite Solutions Worldwide Group plc (AIM: SAT), the global leader in the delivery of alternative super-fast broadband services, announces its unaudited trading update for the 12-months to 30 November 2017.

I remember talking to the CEO of this company a couple of years ago, and being struck by what a good business model he seemed to have come up with. This company is buying up lots of little satellite broadband companies, which are uneconomic as standalone businesses. Put together, they do become viable. Margins increase as the cost of satellite data transmission reduces, but customers are charged fixed monthly fees.

From tiny beginnings, it's starting to look like a sensible business, with recurring revenues, emerging;

Like-for-like organic revenue1 increased 12% during the period, with total revenue, including acquisitions, increasing 104% to around 44m (FY16: 22m). Recurring revenue2 increased 119% to around 40m (FY16: 18m), representing 90% of total revenue, providing improved visibility of earnings for the coming financial year.

However, there are 2 problems which make it uninvestable for me;

1) It doesn't really make any money. EBITDA sounds good, but most of this is consumed by depreciation & amortisation;

Gross profit margin expanded to 36% (FY16: 34%) with EBITDA3 expected to be above 4.5m (FY16: 1.2m) despite continued investment in the Company's products and services to underpin future growth.

2) The balance sheet is pretty awful. Although it did do an £8m placing, announced in July 2017. Despite this, net debt rose to £12.8m. The last published balance sheet at 31 May 2017 is one of the worst I've seen for a while.

My opinion - I can't make the numbers stack up here at all. Having said that, it's possible that the company could grow its way into decent profits. The current valuation seems to already factor in a lot of future success. It's not for me - I can only base my opinion on the numbers as they are today. What happens in the future? Who knows?

A few quick comments to finish off;

Renew Holdings (LON:RNWH) - down 7.8% to 415p today. The Q1 (Oct-Dec 2017) trading update is in line with expectations.

This bit might have rattled some investors today?

The Group's term loan will be fully repaid by 31 March 2018. A slower than usual payment profile with certain customers in the public sector has led to an increase in work-in-progress in the first half. Nevertheless, cash balances as at 30 September 2018 are forecast to be broadly in line with the previous year end.

Renew has no financial exposure to Carillion's insolvency.

This does lead me on to the sector - engineering support services. Who would really want to invest in this sector, given all the bad news for other contracting companies?

My opinion - In fairness, Renew seems to have navigated the pitfalls very well, and has a good track record. It seems to be more of a niche business, rather than a sprawling & out of control group like Carillion or Capita.

However, Renew's balance sheet is awful - with negative net tangible assets, and the whole business is financed on advance payments from customers. Therefore I see this as a high risk share, with the potential for big problems at some stage, if any large contracts go wrong. And/or if customer up-front payments dry up. It's not anywhere near as safe as bulls imagine it to be, in my reading of the balance sheet. So considerable caution is needed. It might all turn out to be fine. However, my job is to flag up risks when I see them.

SCS (LON:SCS) - in line H1 update.

Run out of time, sorry.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.