Good morning!

It feels like news has been speeding up again in recent weeks, with so many interesting company-specific stories to accompany the sharp correction in equity markets.

Sentiment among the trend-chasing US retail investor community has been a casualty of events, with the celebrated FANG group of tech giants down between 14% and 24% so far this month and in aggregate down by over 20% since July. But the NASDAQ still has a long way to fall.

Closer to home, the AIM All-Share Index is down by 12% this month. Like the NASDAQ, it became top-heavy in highly-rated, popular shares such as ASOS (LON:ASC), Burford Capital (LON:BUR) and Fevertree Drinks (LON:FEVR). When sentiment turns, it's inevitably the highly-rated shares which bear the brunt of the correction.

We've also had accounting scandals at Patisserie Holdings (LON:CAKE) (still suspended) and Yu (LON:YU.), as if investor sentiment wasn't low enough. All in all, it has been a torrid time for investors.

The FTSE Index looks good value to me at c. 7000, though there are a lot of low-return businesses in this index (banks and resources, basically) which are unlikely to make for the most rewarding long-term investments.

If the US enters a bear market then FTSE sentiment is likely to remain weak in the medium-term, but personally I think the smart thing to do is accumulate shares during this period of market weakness (assuming that your time horizon is long enough).

If you're still a buyer of equities (and I know I am!), then consider coming along to Mello London in Chiswick on November 26th and 27th. The discount code "MLStocko25" gets you £25 off whichever ticket you choose (single day or both days). Paul and I and many other full-time investors and analysts will be there, along with a big selection of companies.

Right, time to talk about some individual shares.

Paul added an important section on Victoria (LON:VCP) to his report late last night. So I'd recommend checking that out, too. Here's the link.

Shares I am interested in today include Tesla, IG Group (LON:IGG), Duke Royalty (LON:DUKE), Proactis Holdings (LON:PHD) and Ascent Resources (LON:AST) (this last one as an example of an uninvestable company, not as a potential investment).

$Tesla

Apologies for continuing to talk about this big-cap US name, but it's one that I'm having trouble taking my eyes off of.

Last night, as usual, I was browsing the $TSLAQ twitter feed, i.e. looking at recent tweets with the dollartag TSLAQ.

Why not $TSLA, using the company's actual ticker code?

The reason is that when a company files for bankruptcy, NASDAQ puts a "Q" at the end of its ticker. This serves as a warning that the stock might be worthless.

Tesla bears have pre-empted what they (perhaps I should say we) view as the company's inevitable bankruptcy, by cheekily helping out NASDAQ and putting the Q at the end of ticker code in advance.

Anyway, I digress. As I was scrolling the feed, I saw that certain bears had made a fun discovery: that the references to Elon Musk as Tesla's Chairman, Product Architect and CEO had been scrubbed from the Tesla Investor Relations website.

Some of the edits to his bio were subtle, but the bottom line is that all references to his job titles were gone.

The CFO's bio did at least refer to his job title, but the CTO's bio had also been scrubbed of any reference to his title.

This set off the bears on a whole lot of speculating as to what might be going on. Of course, we already knew that Musk was going to lose his Chairman job (for a fraudulent tweet which he said in the last few days was "worth it", even though it cost $40 million in fines and his Chairmanship of the company).

But is Musk also going to lose his CEO job?

We also learned in the past week that the FBI is probing the company's production forecasts going back to last year. The Department of Justice has also been investigating the company. And I wonder how the SEC feels, now that he has expressed his view that it worth making the infamous "funding secured" tweet, even after his $40 million settlement with them?

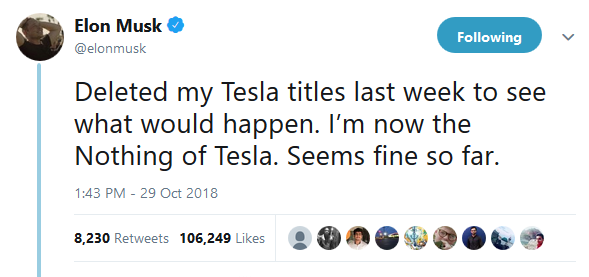

Tesla bears had a lot of fun speculating on events last night, for about an hour. Then Musk showed up with the following tweet:

It's hilarious, for sure. He is the Nothing of Tesla. Perhaps they could make him the Food and Beverage Manager.

At the same time, the company has a market cap of over $50 billion and wouldn't you expect that a company of that stature would behave a little differently?

As in, wouldn't you expect that changes to the CEO/President/Product Architect would be announced in a more formal way and would be done for specific reasons, not just to "see what would happen"?

It's a fascinating soap opera. Despite the miracle Q3 release, I remain very sceptical for the long-term outcome for shareholders, and hope to find another opportunity to short the stock.

Shorting is an extremely dangerous business, however. Through dumb luck, I managed to exit my short positions for a small profit at a share price of $255. The shares are now at $334. Very unpleasant for the bears, but perhaps the night is darkest just before the dawn.

Volvere (LON:VLE)

- Share price: £10.85 (unchanged)

- No. of shares: 3.1 million (after buyback)

- Market cap: £34 million

Result of Buy-Back, PDMR Dealing and TVR

(Please note that I currently hold VLE shares.)

A quick word on this investment vehicle. It recently made a huge divestment relative to its size, leaving it with too much cash. As I said at the time:

Whatever happens, I expect that the managers will want to do something with a war chest of £40 million+. And if they can't find acquisition targets, I would warmly welcome another share buyback.

The company's cash balance was in fact a little lower than I expected, coming in at £39 million. But that's still too big, relative to the size of the vehicle.

Management's decision for now has been to distribute £6 million via buyback, which I welcome.

I hope they find fresh investment opportunities, with the remaining funds, but £39 million was too much for them to deploy with their strategy at this time. So I'm glad that part of it has been distributed.

I also think that 1102p has been a reasonable level at which to execute a buyback, as the (pre-buyback) cash balance was itself worth 1063p per share. On top of that, the company owns two businesses, one of which is of decent size. Therefore, I think that buying shares at 1102p creates additional value for remaining shareholders.

The percentage holding of the executive directors has reduced as a result of this buyback from 38.6% to 29.7%. I continue to believe that they are well-aligned.

This is the largest single position in my portfolio, and I have no immediate plans to sell.

Duke Royalty (LON:DUKE)

- Share price: 43.4p (+2%)

- No. of shares: 198 million

- Market cap: £86 million

Operational and Corporate Update

(Please note that I currently hold DUKE shares.)

This is another specialty investment vehicle I've discussed plenty of times before. I also conducted an interview with its Executive Director (in the podcast section of Cube Investments).

Today's news is very pleasing. Two of Duke's early investees have been performing well, and therefore the payments to Duke are increasing by the maximum amount of 6%.

The increased payments need to be backdated to the contractual adjustment dates - perhaps this is due to a delay while results were audited?

So the annual payments will increase to c. £1 million and £1.25 million (my spreadsheet estimates the original payment amounts as £960k and £1.15 million).

So the combined annual payments will be £2.25 million from the two investees. Not bad considering that £16 million was the original aggregate amount invested in these two.

Another two investees with adjustment dates coming up in March 2019 are said to be performing well, so we can also pencil in a positive result from those two.

In other news, the investment team is being beefed up as the company looks to deploys the fresh capital it has raised.

My view - my confidence in this investment is growing, but it's early days. There is still a heavy dose of concentration risk, and I'd prefer if the company retained and reinvested its cash flows at high returns rather than distributing them. But the signs are looking good so far that the royalty model can work with a combination of European and North American investments.

The Value Rank should improve as the company executes its plan:

IG Group (LON:IGG)

- Share price: 611.25p (+5%)

- No. of shares: 369 million

- Market cap: £2,254 million

(Please note that I currently hold IGG shares.)

It has been an exceptionally busy news day in my personal portfolio.

In response to this news, I've opened up the kitty and made my first equity trade since August, topping up my long position in IG Group (LON:IGG).

The company announced the rather abrupt departure of its CEO last month. No proper reason was given, but the statement strongly hinted that the Board had decided it wanted someone new with more technological and global experience, rather than UK-centric experience.

Today we get news of the new hire, and I'm impressed.

It's an existing Board member. She was previously the President of Verifone Europe. Verifone makes the terminals commonly used at retail point-of-sale.

She was also in charge of Global Enterprise Payments at Citi and Banking and Financial Markets at IBM.

You can see an interview with her at a fintech conference at this link.

My view: My first impressions of this appointment are extremely positive, and it has been enough to convince me that I need to make IG a bigger part of my portfolio.

Speaking more broadly about the company, I think perhaps the investment community hasn't appreciated the extent to which it is really a fintech play. Today's hire indicates its intention to focus on this aspect of its identity.

The truth is that it has been at the intersection of financial trading and tech-enabled communications for decades, ever since it started off with a telephone-only dealing service back in 1974. Over the decades, it has achieved a deserved spot as the number one CFD provider in th world.

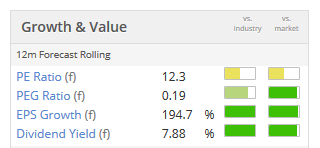

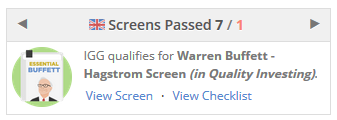

Besides the big-picture reasons to own the shares, there are also the quantititative reasons. It passes no fewer than six Stockopedia screens (and a bearish short-selling screen, for good measure).

What are the risks? Well, there is the threat of more regulation, and uncertainty over the impact of the regulations which were recently imposed.

There is the weaker-than-expected trading which was reported recently. And there is uncertainty over the CEO position (which I believe has been satisfactorily resolved today).

While I could be completely wrong in my belief that IG has a bright future, I am pleased to have had the opportunity to top up my position at a 36% discount to the share price it was trading at just two months ago.

Proactis Holdings (LON:PHD)

- Share price: 132.5p (unchanged)

- No. of shares: 95 million

- Market cap: £125 million

I'm mentioning this in passing because I know that it's of interest to some readers, but it's not something I can afford to devote lots of brain cells to.

As I remarked previously, it's an acquisitive B2B software business, and therefore I don't want to get involved. As a rule, I prefer to find shares which offer organic, B2C growth (except for investment vehicles, which I treat dfferently).

PHD's balance sheet is stuffed to the gills with intangibles, and has net debt of £38 million. It generated historic free cash flow of £8.5 million. Future periods should benefit from the latest acquisition.

It's just not something that fits into my universe of potential investments and is ranked as a Sucker Stock by Stockopedia, but if there are informed commentators with a bullish point of view I hope they will join us in the comment thread below.

Ascent Resources (LON:AST)

- Share price: 0.48p (-36%)

- No. of shares: 2.3 billion

- Market cap: £11 million

This little oil and gas company with an asset in Slovenia has been waiting for a permit for a long time, with no joy.

Today it announces that it is taking the Slovenian Environment Agency, its Environment Minister and the state of Slovenia to court in the EU. The lawyers will be delighted.

The CEO has been working part-time for a few months. I guess the company couldn't afford to keep him on a full-time basis.

According to the interim results, the company had cash at June 2018 of £577k, of which £351k was restricted. I'm not sure how it's going to be able to fund a lawsuit against Slovenia but it's hardly going to be pretty for shareholders.

That's all for today, thanks for dropping by!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.