Good morning,

Thanks for all the kind comments to start off the day - much appreciated!

The main things on my mind today are Plus500 (LON:PLUS), Games Workshop (LON:GAW) and Bonmarche Holdings (LON:BON).

Plus500 (LON:PLUS)

- Share price: 530p (-26%)

- No. of shares: 113 million

- Market cap: £601 million ($790 million)

It's going to be difficult for me to avoid a triumphant tone with this one, as I have been very critical of its business model, and how it presents its results.

- See the Stocko archives for all the SCVR comments by Paul and I over the past year.

- See my original description of Plus500 as a bucket shop that profits directly from client losses.

- See my follow-up article discussing various elements of its business practices

- See my subsequent article after it was finally revealed how much customer P&L it was exposed to.

The bottom line is that it didn't explain properly how much customer P&L it was exposed to.

This customer P&L exposure makes its results inherently volatile. It is incentivised for its clients to lose money, but its clients can enjoy unlimited upside when their bets go the right way.

In 2017, for example, Plus500 lost $103 million to customer profits. Then in 2018, it made $172 million from client losses. This is possible because it doesn't run a comprehensive hedging program like other CFD providers do (its competitors do have some customer P&L exposure, but it is much smaller).

Another key element of this story is that Plus500's marketing efforts target the least knowledgeable beginners, who tend to waste their accounts quickly and then give up.

This is problematic when it comes to the EU's ESMA regulations, which are designed to protect amateur traders from using too much leverage. Last year, Plus500 bullishly claimed that 12% of its European customers "may be eligible" for professional accounts, and that these accounts were responsible for 75% of its revenues.

Today's update

Today we learn that Q1 2019 revenues (to March) have collapsed by 65% quarter-on-quarter, to just $54 million. It would have been $82 million, except for $28 million of client profits eating into the result.

The quarter-on-quarter comparison doesn't give us the complete picture. Why not do a year-on-year comparison?

Compared to Q1 2018, revenues at Plus500 are down by over 80%. Worth noting that bitcoin collapsed in Q1 2018, probably hurting its clients but boosting revenues.

IG Group (LON:IGG) (where I have a long position), by contrast, saw its net trading revenues fall by only 30% in the quarter ending February 2019, using a year-on-year comparison.

Both companies blamed a lack of market volatility for their weak performance but I don't think it's a stretch to assume that the ESMA regulations, along with the reduction in crypto trading, are having a disproportionate effect on Plus500 (LON:PLUS). After all: the ESMA regulations are designed to stop beginners from blowing up their accounts with too much leverage, and that is a large part of Plus500's business model!

Other metrics:

- The number of new accounts at Plus500 is much diminished: there is a 10% quarter-on-quarter increase, but a 70% year-on-year decrease.

- Active customers: down 55% compared to a year ago.

- Average revenue per user: down 60% compared to a year ago.

Insiders have already cashed in their chips in a huge way, leaving a few fund managers and retail investors holding the bag on this one.

Outlook

No guidance is given, because the company doesn't have revenue visibility. The company is looking to expand geographically and keep finding valuable customers through efficient marketing spend.

My view

There are reputable companies that I am confident will be around for the long-term (namely IG Group (LON:IGG) and CMC Markets (LON:CMCX), where I have long positions), so I don't see any need to dabble in this company's shares.

For what it's worth, if Plus500's Q1 revenues (excluding customer P&L) were annualised, we'd get a pro forma revenue result of c. $330 million. I guess that annual administrative expenses might be in the region of $200 million - $230 million.

Renewed market volatility and positive customer P&L could help to boost the revenue picture in future periods, but the erratic nature of those profits means that they probably don't deserve a generous earnings multiple.

As usual, there are arguments that Plus500's shares now represent value, but why take the risk when its more reputable peers are also at attractive valuations?

Games Workshop (LON:GAW)

- Share price: £36.70 (+11%)

- No. of shares: 32.5 million

- Market cap: £1,193 million

Trading Statement and Dividend

Maybe I should change the title of today's article to "Mid Cap Value Report".

Many of you are familiar with Games Workshop. It's reponsible for Warhammer, the collectible tabletop game.

There has been a disconnect at GAW between what the broker thinks and what its investors think.

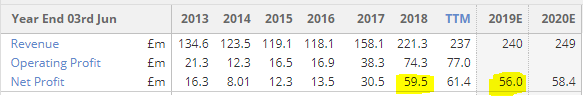

The broker has been working on the basis that profits in FY June 2019 will be lower than FY 2018. See here:

The consensus forecast was for pre-tax profits of only £70 million, compared to £74.5 million in FY 2018.

Many investors, on the other hand, have been much more bullish about FY 2019, and it turns out that they were right:

The Board's current expectation is that profit before tax for the year ending 2 June 2019 will be c. £80 million.

Sales, profits and royalties receivable are all ahead of the prior year.

On top of this, there is a 35p dividend coming at the end of May. This feels like a special dividend: recent payments were in a pattern of January / March / July / October (or November). But the dividend policy is informal, with surplus cash being chucked out to shareholders whenever it is available.

My view

I first wrote on this back in March 2017 when the shares were at £9.00. The company would go on to make profits of £30 million that year, versus perhaps £65 million (after-tax) this year. The share price has quadrupled since then.

Not much for me to do other than congratulate those who've participated in its success and who continue to own a high-performing enterprise. Based on management's long-term perspective and sense of stewardship, I reckon the outlook for shareholders remains positive.

Bonmarche Holdings (LON:BON)

- Share price: 15p (unch.)

- No. of shares: 50 million

- Market cap: £7.5 million

Response to mandatory cash offer

Paul discussed this on April 2nd.

Philip Day picked up most of loss-making Bonmarche's shares at 11.445p and was compelled to make an offer for the rest of them at the same price.

If I was a Bonmarche shareholder, I would accept this offer as a reasonable outcome, under the circumstances.

The existing board of Bonmarche, however, says that it "materially undervalues Bonmarche and its future prospects". It says that it has been planning cost reduction measures - seems a bit late for that, I'm afraid.

Fridays are usually a bit quiet in RNS-land, and I'm not sure there is anything else worth commenting on today.

Paul will be with you next week.

I will close by saying thank you to all of our readers for your support!

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.