Good morning!

Not many of our usual types of companies are reporting today. With the May half-term, lots of people are away at the moment, and the mood is quiet on the RNS.

This list is evolving:

- Management Resource Solutions (LON:MRS)

- Totally (LON:TLY)

- Audioboom (LON:BOOM)

- Lookers (LON:LOOK)

- Stride Gaming (LON:STR)

- Charles Stanley (LON:CAY)

Management Resource Solutions (LON:MRS)

- Share price: 2.95p (unch.)

- No. of shares: 223 million

- Market cap: £7 million

This share lies outside my investable universe of stocks: it's an Australian mining services group. Not my bag.

But I've been aware for some time of a grassroots shareholder campaign to eject the Chairman and the Finance Director.

This campaign was catalysed by certain transactions, in particular the purchase of a start-up company for £1.3 million from individuals described as "close business associates" of the Directors.

In the end, the campaign failed at a general meeting, on a high voter turnout. Its motions were defeated by 16 million votes, less than 10% of shares outstanding. Close, but no cigar.

Today, the Board confirms there will be an independent legal review of the controversial deal. This is on top of an independent valuation report.

What do I think of all of this? Well, I try my best not to get involved in this sort of thing. If I think that the wrong people are running a company, that will pretty much ruin my interest in it. Why go to all the effort of running a campaign to replace management, when there are plenty of decent management teams running other companies that we can invest in?

So the most obvious strategy is to avoid and sell shares in companies with the wrong people running them.

There certainly is a place for shareholder activism to remove directors, but I would use it only as a last resort, and with great reluctance.

The MRS campaign nearly succeeded, so it's understandable why the activist shareholders thought that they had a chance and went to the effort of organising it. Now that it has been shown they are in a minority, perhaps they are better off just selling out and moving on?

Totally (LON:TLY)

- Share price: 10.05p (-9%)

- No. of shares: 60 million (pre-placing)

- Market cap: £6 million (pre-placing)

Proposed acquisition of Greenbrook Healthcare

This is also outside my investable universe - a "buy and build" operator in the healthcare market, doing contracts with the NHS. Definitely not the type of thing I would feel confident that I could analyse or get a good return from.

It has gone ahead with a reverse takeover for £11.5 million, buying a provider of NHS urgent care centres. The deal has been funded by a £9 million cash payment (this money having been raised in a placing at 10p) and £2.5 million of shares. It's a reverse takeover because the company being acquired is bigger than Totally!

A "transformational" deal such as this means that prior calculations become almost worthless, and investors have to start again with a completely new analysis. I like situations where I can analyse the risks - this is not one of those situations.

So it's outside my investable universe for multiple reasons.

The StockRanks don't think I'm crazy, assigning it a score of ZERO.

Audioboom (LON:BOOM)

- Share price: 2p (-13%)

- No. of shares: 1401 million

- Market cap: £28 million

This podcast platform has achieved "cash flow breakeven" over a three-month period. It had already reported that in January (see Paul's commmentary).

It has been burning cash for years, and delivering disappointment after disappointment. I have put it on my bargepole list.

In today's statement, the new Chairman says that the company "continues to enhance its position as the leading global podcast company."

This may seem rude, but that alone is sufficient to make Audioboom uninvestable for me. I produce a podcast, and have listened to podcasts for years. Objectively, Audioboom is not "the leading global podcast company" - at least not in terms of its popularity!

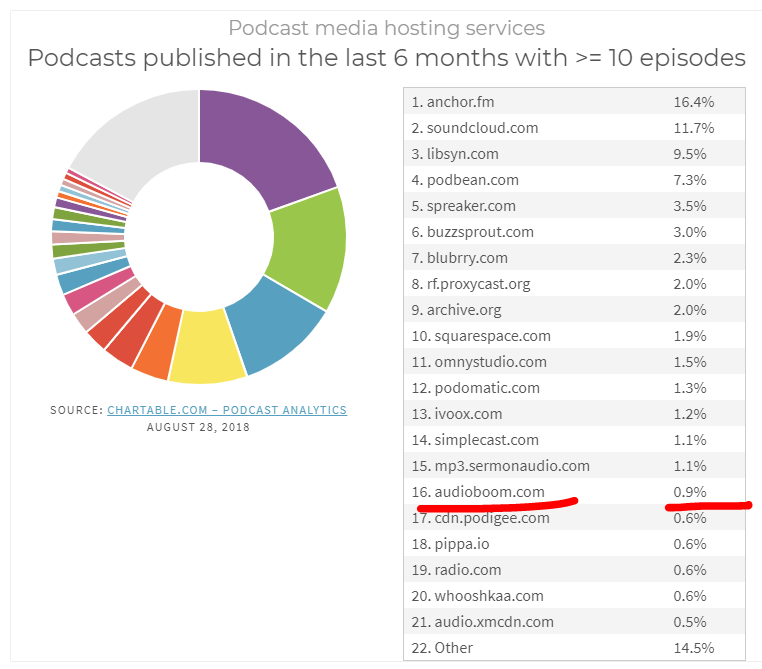

Click here for analysis by Chartable of the top podcast hosting providers, published in August 2018. The question of "who is the biggest host" is a surprisingly complicated one, but it's clear that Audioboom is not the answer.

The analyst at Chartable judged that the most meaningful metric for comparison was to look at the number of podcasts published on each host in the last 6 months which had at least 10 episodes. The results were as follows:

(Source: chartable.com)

If you can read the above, you can see that Audioboom arrived in sixteenth place, with market share of less than 1%. (For my business, I use Podbean, which is in 4th place.)

Audioboom's CEO continues the narrative in his review, describing the company as "one of the world's largest spoken word platforms".

The truth is that Audioboom is one of many podcast hosting service providers, and does not stand out particularly in terms of its size - Anchor FM and Soundcloud do. Such claims only serve to undermine management credibility.

I do accept that Aubioboom has grown significantly since August 2018, but it has not been "enhancing its position as the leading global podcast company". Even a doubling of its size would give it a market share of less than 2% using Chartable's approach, and that's assuming no growth at its competitors.

Other red flags:

- Despite achieving cash flow breakeven in the last three months of the financial year, Audioboom saw fit to raise another £4.3 million in "growth funding" after year-end. There is a steady pattern of big promises followed by dilutive fundraisings.

- Management were distracted during the year by an attempt to complete a reverse takeover of a Canadian company for US $185 million.

- Another huge operating loss is reported which equates to almost 44% of revenue for FY 2018, even on a heavily adjusted basis.

While I can't completely rule out the possibility that this might succeed for shareholders, it is dripping in too many red flags for me to consider its investment merits any further.

Lookers (LON:LOOK)

- Share price: 86.55p (+1%)

- No. of shares: 389 million

- Market cap: £337 million

This motor retailer and aftersales provider gives a Q1 update for its AGM.

Trading was "positive with a strong result during the important month of March". There is no reference to expectations.

Some highlights:

- Outperforming the wider market in new car sales (new car sales are declining). "On a like-for-like basis, revenue and gross profit were maintained at a similar level to last year".

- Used cars: turnover up 6% on a like-for-like basis, gross profit up 1%.

- Aftersales: turnover up 9% on a like-for-like basis, gross profit up 6%.

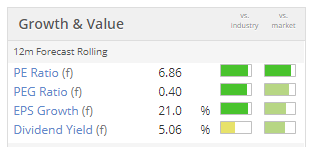

My view - one of several very cheap car dealership shares available to investors at the moment.

They might not be the most exciting of companies, but as a value play they seem to be worth a look. These shares were north of 150p in 2016.

Stride Gaming (LON:STR)

- Share price: 148p (+26%)

- No. of shares: 76 million

- Market cap: £112 million

There is a recommended offer at 151p from Rank (LON:RNK).

Rank was seen traditionally as an operator of physical venues (casinos and bingo halls), but has focused increasingly on its digital channel.

Stride, meanwhile, specialises in online bingo, and put itself up for sale earlier this year. Paul analysed it at the time. It was struggling with regulatory problems and increased taxation, and the shares had fallen to a very "cheap" rating. The share price was 102p on the day that Paul analysed it.

This offer seems like a good outcome for everyone concerned. Well done to anybody who bet on Stride recently!

Charles Stanley (LON:CAY)

- Share price: 311p (-2%)

- No. of shares: 51 million

- Market cap: £158 million

Results for the year ended 31 March 2019

This investment manager acknowledges that "it is taking longer than expected to reach our goal of achieving a 15% Core Business pre-tax profit margin".

It continues to work on its restructuring project, with £9.5 million of costs over three years to provide annualised savings in excess of £4.5 million.

For now, progress seems to be limited and the quality metrics are very average, so researching this share is not a priority for me at this time.

Stockopedia algorithms are equally unexcited, giving it a StockRank of 59.

On Twitter last night, President Trump announced 5% tariffs on all goods from Mexico, with the threat that this will increase gradually. Markets have reacted very poorly. My FTSE trade from Wednesday has now moved into the red - timing wasn't so clever after all!

Have a great weekend. Paul will be with you next week.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.