Good morning!

Today there are updates relating to:

- IQE (LON:IQE) - trading update

- Prime People (LON:PRP) - final results

- FairFX (LON:FFX) - new licence

- Goals Soccer Centres (LON:GOAL) - statement by Sports Direct.

Also, a few words on £RDL (in which I have a long position).

IQE (LON:IQE)

- Share price: 43.9p (-39%)

- No. of shares: 791 million

- Market cap: £347 million

Wow, commiserations to holders at this one.

We are going to have a sales miss for FY 2019. Revenue will be in the wide range of £140 - £160 million, failing to hit consensus of £175 million.

Comment:

This is a larger impact than the previously guided risk related specifically to Huawei, due to the far-reaching impacts on other companies and supply chains that are now becoming evident.

Shareholders are right to be disappointed that management failed to predict the "far-reaching impacts" of Huawei's problems.

There has been a reduction in forecasts from a number of chip customers - I wonder if Huawei is the only major phone manufacturer whose demand has receded, or if there are more? IQE refers to a "weak smartphone market" which has impacted H1.

Divisional Analysis

- Photonics - now forecast to have less than 30% revenue growth, versus >50% previous guidance. Lots of work being done to bring in new customers.

- Wireless - now forecast to decline by 20%-25%, versus previous guidance of a 15% decline. There are "significant global supply chain shifts".

- Infra-red - still doing well. Guidance unchanged for 15% growth.

For context, the main contributors to adjusted operating profit last year were Wireless (£12 million) and Photonics (£11.5 million). Infra-red contributed £3.4 million.

Profit Guidance/Outlook

This is where things start to look really bleak.

Adjusted Operating Profit Margin - "significantly below" previous guidance of over 10%.

I've spoken many times about the capital-intensive nature of this business. It is now forced "to avoid non-critical capital expenditure".

There will be "active management of all cash flows" to ensure the company doesn't break through the limits of its lending facility.

Outlook - "cautiously optimistic" (this phrase doesn't help much). Seems happy with the bigger picture outlook:

...we expect that the significant market drivers such as 5G, connected devices and LIDAR will regain momentum. IQE remains in a very strong position to capitalise on this with its unique breadth and depth of products, global production capacity and intellectual property.

My view

I've written about IQE many times, including twice this year (in March and May). I've been consistent, saying that it's a capital-intensive manufacturer with poor historic returns for shareholders and significant customer concentration risk.

Where I've been wrong is that I thought that the variable demand from Apple was the main source of risk. It turns out that Huawei has been the big disappointment, instead.

My overall view is unchanged but I now also think there is a small chance of IQE experiencing financial distress.

Net cash at December 2018 was £21 million, after £16 million of operating inflows during the year were offset by £42 million of investing outflows.

Guidance for 2019 was for capex of £40 million and capitalised development costs of £10-£15 million.

Spending over £50 million on investing activities using a £20 million net cash balance is a bad idea, given that profitability is set to collapse and its lending facility stretches to a maximum of $35 million (£27.5 million).

I'm not saying that IQE is destined to run out of funds, but the company itself has acknowledged that it needs to cut costs and slash the capex budget.

Some readers have believed in this company's prospects based on its unique IP and the growth in the photonics industry, and there may be a lot of merit in that point of view. Based purely on its historic results, however, I have always questioned the quality of this business.

In addition to (in my view) its poor quality, investors now need to factor in its greatly reduced growth prospects in the short-term and the small possibility of financial distress.

For these reasons, I think it is more interesting as a candidate for a short sale rather than as a candidate for a long position.

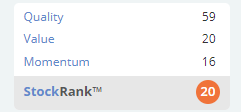

Stockopedia has called it quite well: a Falling Star.

RDL Realisation (LON:RDL)

- Share price: 396p (+4%)

- No. of shares: 16.1 million

- Market cap: £64 million

(Please note that I have a long position in RDL.)

This RNS was issued after close of business yesterday. After digesting it, I've increased my position size in RDL today, raising it to 4% of my portfolio.

Reasons why UK equity investors might not care about this situation:

- it's a lending vehicle

- it's US-based

- it's in run-off and is probably going to delist soon.

For these valid reasons, if you're not interested, please skip ahead to the next section!

Personally, I like finding special situations and unusual things in the stock market.

Also, I've run the numbers and I think there's a margin of safety in this, so am happy to hold it through to the final outcome.

I also note that Oaktree, which is one of the controlling parties, increased its stake from 19% to 27% this week, replacing Invesco.

Quick Review of The Numbers

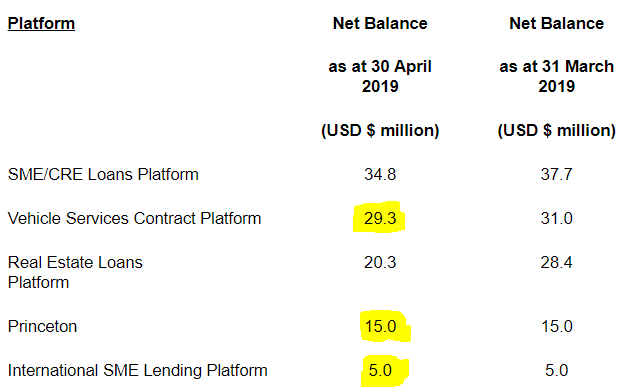

These are the key holdings:

There are problems with the three holdings highlighted in yellow.

The Vehicle platform is in default of covenants and had an LTV of 129% as of March 2019. A reserve of $9 million has already been recognised against it.

Let's write this down by another $15 million, assuming a lot more bad news with this one.

Princeton: this is in bankruptcy and some creditors want to run these proceedings differently (using a slower method) than how RDL wants to do it. RDL has had a lot of time to come up with this $15 million number so I still think there could be some truth to it, but let's conservatively write it down to zero.

International SME platform: RDL discovered that this platform had not been adequately servicing the loans, which are "venture loans to mainly small and early stage companies with underdeveloped profit profiles". Also, "current collection efforts include litigation". Let's write this down to zero, too.

Adding on these writedowns, I get a portfolio value of $70.5 million for April 2019 (rather than the $105 million value shown in yesterday's RNS).

We also see cash of $89 million.

Using this money, RDL is buying back its Zero Dividend Preference shares (£RDLZ) and paying a dividend to ordinary shareholders (like me) next month.

I calculate that this leaves about $15 million of cash left over.

This means a written-down value of $85 million, which we could also represent as £67 million or 416p per share. I have paid less than this for RDL shares today.

If these writedowns turned out to be unnecessary, the value would be in the region of 584p per share.

Please note that these calculations do not take into account the yield on the portfolio as it runs off, which boosts NAV, or the expenses to manage and wind up the company, which reduce NAV.

Summary

The problems in the Vehicle platform emerged after present management took control and have hurt. But I think my original RDL investment could still be profitable, taking into account the dividends received so far, if the values shown in yesterday's update turn out to be realistic.

My RDL investment today, on the other hand, should be profitable even if there is more bad news necessitating the additional writedowns I've suggested above. One of the key risks is that interest income is insufficient to pay for ballooning management and legal expenses to pursue all claims and shut the thing down.

Patience will be required, and I might end up owning unlisted shares for a while. There is no easy way to make money, sadly! But the risk/reward outlook with this seems favourable to me.

Prime People (LON:PRP)

- Share price: 88p (+8%)

- No. of shares: 12.1 million

- Market cap: £11 million

I covered this a year ago at its last results statement.

It's a recruiter focusing on these industries: "Real Estate & Built Environment, Energy & Environmental and Technology, Digital & Data Analytics".

After a difficult 2018, FY March 2019 has seen a return to form.

There is some work to do unpicking how much of the growth is organic, as a new subsidiary ("Command", which has been 60% owned since October 2017) is responsible for most of PRP's operating profit.

I've been trying to figure this out but in the interests of time and brevity I think I'll stop. The bottom line is that PRP's UK/Germany segment is struggling to grow, while the Asia Pacific Segment has grown well, thanks to the acquisition.

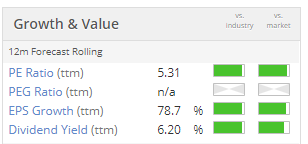

Small recruitment firms can pay their best employees very well, but they don't interest me much as a potential investor, due to their cyclicality and lack of differentiation. A cheap earnings multiple is needed to make up for these factors:

In line with what I said last year, I do think that investors could get a reasonable return from this share, so long as they pay a cheap multiple for it. The annual dividend has been increased to 5.2p, and is covered more than twice by earnings,

And there should be more dividends and more earnings growth via reinvestment to look forward to.

StockRanks love it, awarding it an almost-perfect 98.

FairFX (LON:FFX)

- Share price: 115p (+4.5%)

- No. of shares: 164 million

- Market cap: £189 million

FairFX Gains Credit Broker Licence

This currency group is about to start broking loans with the FCA's permission, through a subsidiary:

Clearing this key regulatory hurdle allows the Group to offer a wide range of loan products to both its business and retail customers.

As FFX highlights, it will not be making any loans using its own balance sheet, only directing customers to loans made by others.

This sounds very positive, although I would like to have the synergies with the FX services explained to me:

the Group expects to launch an innovative, highly digitised revolving credit product in partnership with iwoca - an award-winning specialist lender to SME's - in the coming months. It is intended that this will help small and medium sized businesses to apply and receive a decision in minutes and immediately receive funds.

The speed of the money transfer is possible thanks to FFX's membership of Faster Payments.

I remember when one of the major benefits of Bitcoin was supposed to be its speed. Surely that argument is irrelevant now, at least as far as UK domestic transfers are concerned? Faster Payments means that waiting around for money is not a big problem any longer, for these sorts of payments.

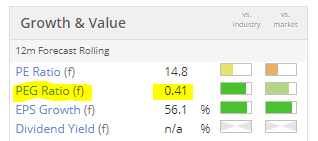

Anyway, I retain my positive impression of FFX and believe that it has now grown into its valuation. The PEG ratio is too small now, i.e. either earnings growth is unsustainable or the shares are underpriced. Tempted to have a nibble:

Goals Soccer Centres (LON:GOAL)

- Share price: 27.2p (suspended)

- No. of shares: 75 million

This has been suspended since the end of March, in the midst of a VAT scandal, and investors are facing a potential wipeout. See Paul's comments.

Sports Direct (under Mike Ashley's leadership) owns 19% of Goals Soccer Centres (LON:GOAL) and is unhappy.

Statement by SPD today:

It is Sports Direct's understanding that the Company has not appointed independent advisers to assist Goals in examining its historical treatment of VAT as well as its ongoing discussions with HMRC. Sports Direct understands that these advisers are a division of the Company's auditors.

SPD has offered to pay for a corporate investigations firm, Kroll, to do a "cradle to grave" report on GOAL's VAT treatment.

It hits out at the "perceived lack of transparency" at GOAL, and will vote against the reappointment of the entire Board at next week's AGM.

My view - there's not enough information to determine whether GOAL shares are still worth anything, so I won't bother speculating. Mike Ashley's intervention, if it doesn't cost other shareholders anything, probably can't hurt!

Tesla ($TSLA /$TSLAQ)

In the world of Tesla, in which I have a short position), the EV manufacturer has completed its first day of Model 3 deliveries in the UK.

Despite progress with the international expansion, including the rapid build of a factory in China, Wall Street analysts have been downgrading the stock. Goldman Sachs lowered their price target from $200 to $158,

The company will rush to hit delivery targets by the end of this month, as it does every quarter, and the delivery numbers might make uncomfortable reading for bears like me. But after multiple rounds of price cuts and a collapse in demand for higher-margin models, I think we can look forward to some tasty financial statements! Watch this space.

Ok, I'll call it a day there. Have a relaxing weekend!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.