Good morning!

A very busy morning in terms of the supply of updates. I will need to be very tactical about this!

I'm not covering all of these, but am mentioning them for completeness:

- RM (LON:RM.) - interim results

- Science in Sport (LON:SIS) - trading update

- AdEPT Technology (LON:ADT) - final results

- Begbies Traynor (LON:BEG) - final results

- Premier Asset Management (LON:PAM) - trading statement

- Elegant Hotels (LON:EHG) - update on Hodges Bay Resort

- Synnovia (LON:SYN) - final results

- Robert Walters (LON:RWA) - trading statement

- Finncap (LON:FCAP) - final results

- Young & Co's Brewery (LON:YNGA) - AGM statement

- Knights Group (LON:KGH) - final results

- K3 Business Technology (LON:KBT) - interim results

- Renold (LON:RNO) - postponement of AGM

- Sports Direct (SPD) - offer update re: GAME Digital (LON:GMD)

- ClearStar Inc (LON:CLSU) - trading update

Elsewhere, in big-cap land, Ocado (LON:OCDO) shares are up more than 6% on the back of interim results. Bloomberg reported that short interest ticked up recently, so there might be a few bears licking their wounds this morning.

Please note that your suggestions make a difference - I will allocate more time to stocks which you have suggested.

Thanks,

Graham

RM (LON:RM.)

- Share price: 259.5p (+2.6%)

- No. of shares: 84 million

- Market cap: £218 million

This educational group says that it is #1 in the UK, in the markets in which it operates, and it has major international activities, too.

Its three divisions are:

- Resources - curriculum and other resources for schools and nurseries. It distributes 50,000 products, of which it has designed 4,000.

- Results - "global high-stakes e-assessments". Processing exam scripts.

- Education - software, services and technology. Outsourced IT and digital platforms.

Paul and I have covered this from time to time. See Paul in Feb 2019 and myself in July 2018.

Results highlights

The outlook is to deliver full year expectations.

- H1 sees a small (1%) growth in revenue. There is a "difficult" UK schools market, with concerns around schools budgets and teachers' pension contributions.

- 33% international growth versus 3% UK decline.

- adjusted operating profits +17% to £9.7 million, thanks to timing benefits from the new accounting standard (N.B. there is no change in the value of the business from this!) and progress in Results and Education divisions.

- Net debt reduces by 10% to £21.2 million versus a year ago.

It wouldn't surprise me if this was a seasonal business, and some big cash flow swings can be seen in this RNS. Over the six-month period, there was a £7 million outflow of cash from operating activities, worse than the £4.6 million outflow in H1 last year.

Investing cash outflows were also a lot bigger than last year. Dividend payments were heavier, too. All of this means that RM had to draw down £14 million of borrowings during the period.

(Deleted a graphic here due to formatting problems.)

RM confirms that this is indeed due to "seasonality of the organisation's working capital cycle across the year", which is hardly surprising given the academic calendar. I'd expect this to reverse in H2.

Accounting Standard - IFRS 15 has boosted these H1 numbers, and will help to smooth out revenue throughout the year. But the overall effect will be negative, so it could be a headwind to revenue recognition for the full-year. This doesn't change the value of the shares, it's just something to be aware of!

Acquisition - a £7 million acquisition was completed in June, of an Australian SaaS platform.

RM has paid more than 2x trailing revenues for this company but the strategic rationale sounds reasonable.

My view

I'm warming to this share.

The balance sheet remains an object of curiosity. It has net assets of £42 million, but this includes non-current assets of £83 million of which intangibles are £64 million. So there is a reliance on payables (including deferred income from customers) and bank borrowings to plug the hole.

Thankfully, the banks have been supportive. Barclays and HSBC will allow RM to borrow up to £100 million, and it looks like RM has only borrowed a small fraction of this. £21 million was outstanding at the end of H1, prior to the £7 million acquisition.

Looking at the descriptions of RM's Results and Education divisions, RM talks about having a high visibility of revenue and annuity-like income (respectively) in these business units. That being the case, perhaps the balance sheet has been optimised rather cleverly and is not shaky as some might think?

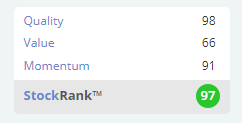

The Stockopedia algorithms reckon that the balance sheet is ok according to the Altman Score:

Doing a few other quick checks, I see that quality metrics such as ROCE and ROE are above-average, and I'm struggling to find many red flags.

Overall, while I can't claim to have a strong understanding of RM's activities, it gets a passing grade from me in terms of its financials. So there is no need for me to change what I said last time - this is worth looking into.

Stockopedia rates it highly, too:

Science in Sport (LON:SIS)

- Share price: 61.5p (+2.5%)

- No. of shares: 123 million

- Market cap: £76 million

This is a "performance nutrition" company. It has been losing millions of pounds through its marketing budget for years, in the hopes of eventually creating a sustainable business. I've been keeping an eye on it, just in case it ever succeeds!

Shareholders have been amazingly supportive, even helping it to make a £32 million acquisition late last year.

This is the first H1 period during which the acquired company - PhD Nutrition - has been owned. Trading is in line with expectations.

- PhD sales are up 16% (pro forma). SiS sales up 25%.

- Underlying like-for-like sales growth is in the middle of these two numbers, at 21%.

- Both brands growing very quickly (>50%) outside the UK, while growing at 10% or less inside the UK. Good growth in sales from the SiS website.

- Successful product launches during the period and more planned for H2. Both SiS and PhD brands launching vegan bars.

My view

I'm increasingly optimistic about the PhD acquisition. The valuation multiple at the time looked reasonable (13.5x trailing PBT) and if it performs well, and helps to improve the SiS performance with some synergies, maybe this share can finally turn good?

Official forecasts suggest that SiS could finally turn a profit in 2020. This assumes that the sales target is hit this year and that we get further growth of 21% next year, i.e. a continuation of the growth rate which has just been reported for H1.

The big unknown variable is how much marketing spend will be required. SiS has spent massive amounts on marketing for many years, and has never been able to "turn the tap off" even a little bit, to allow itself to generate some profits.

The cash position is £5 million, down from £8 million at December 2018, and this says to me that we could see yet another equity raise before all is said and done.

So I'm still on the sidelines, intrigued to see how this one works out.

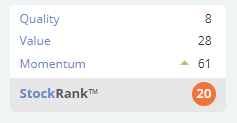

Stocko is not impressed, calling it a Momentum Trap and saying that it qualifies for a short-selling screen. The numbers aren't very pretty yet, that's for sure!

AdEPT Technology (LON:ADT)

- Share price: 350p (-3%)

- No. of shares: 23.7 million

- Market cap: £83 million

This is a managed services IT group.

I tend to avoid these companies, thinking that they are labour-intensive and mostly undifferentiated from each other (similar or equivalent IT services are available from many different providers). They are brilliant companies to work for and provide critical services, but I'm just not very comfortable with the idea of investing in them.

These results look fine at first glance. Revenues are up 11%, with the help of 2 acquisitions, and there's a 6% increase in adjusted EPS.

Debt is up as well - as a general principle, we need to be careful about acquisitions and other capital investments boosting EPS while also increasing financial risk levels. EPS is not a risk-adjusted measure.

Dividend is up 12%. AdEPT want to have a progressive dividend which is covered at least 2x.

Profit - statutory PBT is actually down by almost 50%, to £2.44 million. This is blamed on the factors which can't be adjusted away:

- the prior year including one-off credits from Openreach

- increased finance costs

- acquisition and restructuring costs

- acquisition-related defcon

- increase in amortisation from acquisitions

Regular readers will know that I try to avoid messy situations involving a lot of acquisitions, a lot of acquired intangibles, and debt.

Debt - sources of borrowing include a £40 million RCF from Barclays/RBS and a £7 million convertible loan (convertible at 393p).

RCF utilisation was £35 million at the end of the period, and then the company made a £5 million acquisition. So I suspect that it was very near the limit of its facility. Hopefully, the deleveraging process has already started.

Outlook

With a steady start, the Board looks forward to an exciting coming year and beyond. The focus for the coming year remains on developing organic sales through leveraging AdEPT's approved supplier status on the various public sector frameworks, encouraging further cross company collaboration and maintaining profitability and cash flow conversion, which will be used to either reduce net borrowings and/or fund suitable earnings-enhancing acquisitions.

My view

Not the sort of thing I would go for but the wheels at AdEPT are still turning and the managers seem very committed. For example, the founder and current Chairman of the business has given the lending banks a charge over his life assurance policy worth £1.5 million. What a terrific level of commitment! You don't see that sort of thing very often in companies of this size.

Stockopedia classifies it as a High Flyer, and the forward P/E multiple according to the Stocko computers is mild at 11x. So I can see why some people might be happy holding this one.

Begbies Traynor (LON:BEG)

- Share price: 75.5p (+3%)

- No. of shares: 114.5 million

- Market cap: £86 million

Final Results for the year ended 30 April 2018

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, today announces its final results for the year ended 30 April 2019.

This is another company which makes heavy use of adjustments relating to acquisitions.

Adjusted PBT comes in at £7.1 million (up 27%), while statutory PBT comes in at £3.5 million (+52%).

Organic revenue growth is encouraging at 9%, and the adjusted operating profit margin improves by 100bps to 12.6%.

All areas are said to have performed well, and the dividend gets an 8% increase.

Outlook

The Chairman says that Begbies is "better positioned than ever with multiple sources of potential growth", and highlights the counter-cylical nature of most of the company's activities (poor financial conditions increase the demand for restructuring services). 65% of income is counter-cyclical is nature.

The new financial year has started with positive momentum, so there is confidence that full-year expectations can be achieved. I can see analysts forecasts for adjusted PBT to rise to £8.4 million.

Insolvency market

Begbies' market share was maintained during a year in which corporate insolvencies increased by 10%. Last year, as a reminder, the number of insolvencies fell slightly.

Balance sheet

The financial position is strong: leverage (net debt/adjusted EBITDA) has reduced to 0.7x, and net debt is just £6 million (versus cash generated from operations of >£9 million.

My view

In May, following an earnings upgrade, I suggested that Begbies was priced "about right". The shares were at 68.5p and the P/E multiple was in the low double digits. For a professional services business, a valuation any higher than that would start to look unreasonable to me.

Little has changed: today's results are in line with the upgraded expectations and FY 2020 is running in line with expectations so far.

Therefore, I continue to view these shares as priced about right. Cash generation is attractive, which compensates for the lack of balance sheet strength after a long series of acquisitions. (The company has net assets of £60 million, but net tangible assets are approximately zero.)

As I've said before, this share might also play a useful role as a hedge, thanks to the counter-cyclical nature of what it does.

So I'm neutral on this at current levels.

Premier Asset Management (LON:PAM)

- Share price: 192.75p (-4%)

- No. of shares: 105.8 million

- Market cap: £204 million

This is a Q3 AuM update (in relation to the financial year ending September 2019).

It's a rather lame quarter. Net outflows of £55 million saw total AuM declining slightly to £6.7 billion (from £6.8 billion).

On the positive front, outperformance of AuM against the median of competitors ticked up compared to Q2. On a 3-year view, 78% of AuM was better than the median, versus 72% at the end of Q2.

The CEO admits there are challenging industry headwinds and "record low industry retail net flows", but says that the business is "well positioned for the future when sentiment improves". The quarterly dividend is unchanged compared to Q2, at 1.7p.

My view

The Woodford situation has rocked sentiment in the active management industry.

Personally, I think that the heyday of active management is over - in the future, funds and fund managers will have to be much more clear about what they offer and why it will work. The passive alternatives are cheaper and more efficient than ever, and consumer awareness is improving all the time.

According to Morningstar (via the FT), passive funds now have 18.3% market share in Europe, up 170 bps compared to a year ago. To catch up with the US, this will have to rise to 37.5% (and passive market share in the US is still rising).

All of that having been said, the Woodford situation alone is not going to cloud sentiment forever, and it shouldn't: one "star" fund manager going through a very rough period shouldn't unduly damage the reputation of the entire industry.

Personally, I've always had a positive impression of Premier and I continue to think it could offer some value at current levels.

In a similar way, Jupiter Fund Management (LON:JUP) could be worth considering, but watch out for the bears: at least 6% of JUP shares are currently sold short. There is a legitimate bear thesis that undifferentiated fund managers have a dull future ahead of them. I prefer the likes of Ashmore (LON:ASHM) and Impax Asset Management (LON:IPX), with well-defined niches.

Elegant Hotels (LON:EHG)

- Share price: 68.5p (-5%)

- No. of shares: 89 million

- Market cap: £61 million

Update on Hodges Bay Resort and Spa

Some unfortunate difficulties for Elegant in relation to its property in Antigua.

Hodges Bay is only partially open, due to long construction delays. The management company has now sent in a termination notice, and I guess that this is due to frustration over the delays.

This is not an area in which I have any particular expertise - how serious is this matter? Can management companies be easily replaced?

The management company owes Elegant $1.7 million (£1.4 million) and this is immediately repayable on termination. Elegant, for its part, "disputes the validity of this termination notice and intends to take all action necessary to preserve shareholder value".

My view - I would prudently write down Elegant's market cap by £1.4 million and also make an allowance for the costs associated with replacing the contract (management distraction plus uncertainty over the terms of a new contract).

The 5% disicount applied today, worth about £3 million, looks sensible to me.

Synnovia (LON:SYN)

- Share price: 84.5p (-1%)

- No. of shares: 39 million

- Market cap: £33 million

This used to be known as Plastics Capital (PLA). It makes things like plastic films, sacks and pouches for food distribution, and plastic ball bearings.

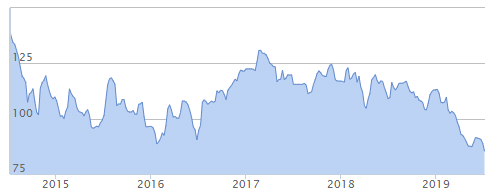

Paul and I have never found it attractive, and the 5-year price chart confirms that little has been achieved:

These results show a statutory loss of £800k. As usual, the company touts its sales and EBITDA numbers as signs of progress, leaving shareholders waiting for jam in some future period.

The cash flow statement shows £6.2 million of (pre-tax, pre-interest) cash from operations, but there was over £7 million of capex and capitalised development spending.

The company says that only £1.3 million of the investment was maintenance capex, so that free cash flow was £4.7 million.

If those numbers are accurate, they offer a ray of light for shareholders. Maybe the company could generate some free cash flow, if it chose to?

The Chairman defends the company's strategy:

To maintain our momentum, we have recruited and trained new staff, invested in new facilities and equipment, and refinanced our banking facilities post period-end. This has supressed our profitability for the year somewhat as we continue to invest for future growth. We consider this reinvestment policy to be the best approach for the creation of long-term shareholder value.

Balance Sheet

Net debt is £16 million, and Barclays has provided an updated facility with maximum drawdown of £25 million.

The company thinks that its interest cover is very high (by comparing interest to adjusted EBITDA), but I need to point out that the interest expense of almost £900k was not far off the company's statutory operating profit of £950k.

My view

Putting the company in the best possible light, and focusing on the £4.7 million of alleged free cash flow, the performance is not bad in terms of the return on tangible capital employed (average tangible capital employed was less than £20 million, according to my quick calculations).

The enterprise value is £33 million market cap + £16 million net debt = £49 million, and maybe that's fair. It would have to be a lot cheaper for me to get interested, but I now suspect that it is around fair value.

It gets a StockRank of 57, which I agree with.

I've run out of steam for today, but will be back tomorrow. If the RNS is a little quieter, I will scroll back and keep working on today's list, starting with Mercia Technologies (LON:MERC) which many of you have been discussing. Thanks for all your suggestions and comments.

Have a great evening!

Cheers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.