Morning!

This list is final:

- AO World (LON:AO.)

- Focusrite (LON:TUNE)

- Dialight (LON:DIA)

- SRT Marine Systems (LON:SRT)

- Kape Technologies (LON:KAPE)

Online Scams - Jonathan Paul Brown & John Roncalli Sammon

I thought I'd share a story with you about something that happened yesterday afternoon.

Without warning, I received 8 premium text messages to my phone, for a fitness service ("Vfit Guru") that I had never heard of before and certainly didn't want to buy for €20.

If you google "Vfit Guru", you'll find that this is not a legitimate service. Most people who google it are simply trying to find out how they got scammed.

€20 is not a lot of money in the grand scheme of things. But many thousands of people across the UK & Ireland have been the victim of this sort of scam over the years, which relies on the victims not having the time or the ability to get their money back.

I'm disappointed that regulators have allowed it to happen. Here's the profile for the company which scammed me, on the Irish communication regulator's website.

The company is SP TWO LTD, registered in Milton Keynes, whose directors are Jonathan Paul Brown and John Roncalli Sammon.

SP Two's parent company is SB Media Group, also in Milton Keynes, with the same two directors. At December 2018, SB Media had retained earnings of £5.6 million. How many scam text messages is that?

I called SP Two to get my money back, and was amazed at the terrible quality of their phone line. They certainly don't want any callers!

I also emailed them, demanding a full refund. And for good measure, I contacted the communications regulator this morning, to let them know that they must stop permitting this brazen theft.

Does anybody remember Zamano (ZMNO)? It was able to make money for a while, until the introduction of PayForIt put an end to its business.

Hopefully the regulators can put an end to SB Media's business, too. Companies which charge consumers for things they never asked for should be prosecuted for theft. It's that simple. Just because it happens online doesn't mean it's not theft.

Is there an investment lesson from all of this? The lesson from Zamano was that it, like SB Media/SP Two, provided a service which nobody would pay for, if they had a real choice.

At the end of the day, a company which relies on legal loopholes for its survival is not going to be around in the long-term. And companies which tend to provoke anger among their so-called "customers" (in reality, victims) won't be around for the long run, either. Eventually, consumers will learn to avoid them or, if that is impossible, the regulator will step in and protect them.

Good businesses which delight their customers. That's what we should be looking for!

AO World (LON:AO.)

- Share price: 61.2p (+7%)

- No. of shares: 478 million

- Market cap: £292 million

This is an old favourite of mine (on the bear side).

AO World plc ("the Group" or "AO"), a leading European online electrical retailer, today announces its unaudited interim financial results for the six months ended 30 September 2019 ("HY20").

The opening blurb tells us that the Netherlands operation is closing, as part of "our relentless focus to accelerate profitability in Europe".

(If they shut down the European operations entirely, that would be even faster!)

In this interview, CEO Roberts says "we just do not have the management bandwidth to both fix the German business and the Netherlands at the same time". He acknowledges that they went into the Netherlands too early, but categorically rules out leaving Germany.

Results

The group operating loss is flat at £10.6 million. Even on a pre-IFRS 16 adjusted EBITDA basis, the loss is £6.2 million. worse than last year.

- UK revenue +20% to £403 million.

UK revenue growth was driven by commission revenue at AO Mobile, which was acquired in December 2018 (known as "Mobile Phones Direct").

On a like-for-like basis, UK revenue growth was a more modest 4.5%.

Gross margins were flat on a like-for-like basis (c. 21%), but fall to 19% if you include the mobile phones business.

- UK adjusted operating profit of £5.1 million, up marginally compared to H1 last year. So the UK business is doing OK.

- Europe revenue down by a few percentage points to £67 million.

AO World says that it changed its pricing policy, to get a better margin at the expense of growth.

Expressing a sentiment which echoes that of Gear4Music (G4M), it says that it wants to ensure "long-term sustainable and profitable growth", even at the expense of lower revenues.

Unfortunately, the improvements didn't happen soon enough to benefit the H1 result. AO's European gross margin actually deteriorated and turned negative. Great news for Dutch customers, who I'm sure appreciated the donation!

In Germany, the company says that gross margin improved to 0.5%, and it is trying to get better terms from its suppliers.

- Europe adjusted operating loss of £14 million, which is worse than H1 last year. And there are some adjustments, so the actual loss is bigger than this.

In summary: the UK is still doing ok, and Europe is still struggling. But I'm glad to see that the company is trying to improve strategy, rather than ploughing on with the previous strategy which wasn't working.

Liquidity

From a cash perspective, AO has been a major guzzler of financial capital.

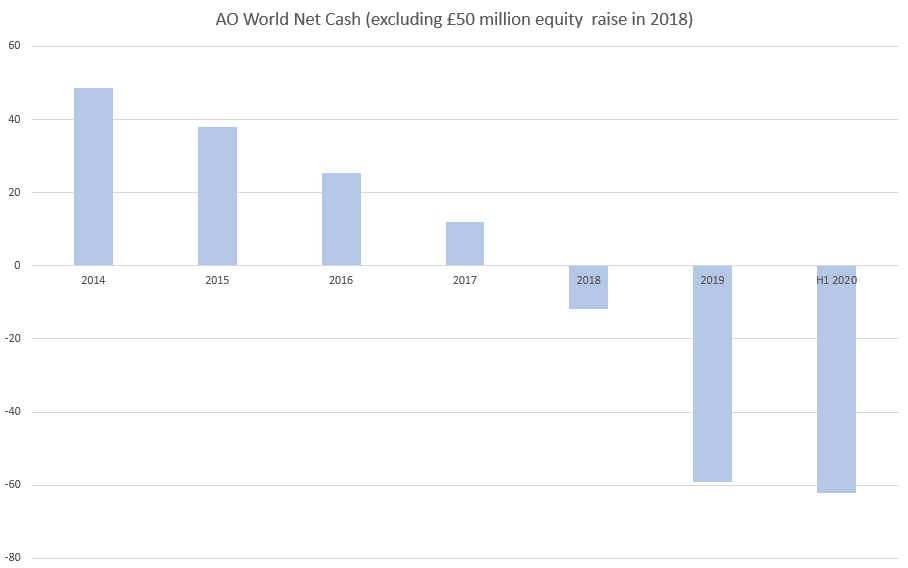

I've created a chart of the company's net cash, excluding the effect of the £50 million equity raise in 2018:

As you can see, lots of cash has disappeared, either in losses, capex or acquisitions.

Despite this, liquidity headroom of £80 million was available at the end of H1.

This is my main difficulty with shorting it: it has been very well funded over the years. It had net cash until 2018, and then investors were happy to put another £50 million in, to replenish the kitty.

Therefore, it has been unclear to me what the catalyst might be for a quick share price collapse.

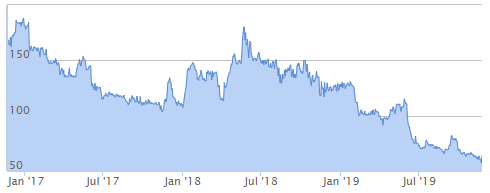

It turns out that if you were willing to hold a short position over the last 18-24 months, you'd have done alright:

Conclusion

While this company might provide a nice service for consumers and be a decent place to work for its employees, I don't see it having any competitive advantage. Real pricing power appears to lie with its suppliers. I therefore don't see any route for AO to earn a consistent return on capital for its stockholders.

If I could time its financial distress, I would short it again. But timing is the hardest thing.

Focusrite (LON:TUNE)

- Share price: 535p (-9.5%)

- No. of shares: 58 million

- Market cap: £311 million

Focusrite plc (AIM: TUNE), the global music and audio products company, announces Final Results for the year ended 31 August 2019.

TUNE's share price has been creeping higher in advance of these announcements, but high expectations have not quite been matched.

Let's skip to the outlook statements. Key points:

- the acquired German loudspeaker company, ADAM Audio, is trading ahead of initial expectations (but this is quite a small business)

- elsewhere, Q1 revenue is lower, due to a stronger GBP and tough comparatives.

- The CEO warns of risks, including competitive pressures, but says the company can navigate them.

Operations

This company's operations do impress me. For example, it makes audio interfaces which are designed to help people make music for the first time. The latest generation of these beginner interfaces have "resonated well with customers and provided an incremental increase in revenue".

The core Focusrite business saw revenue increase by 21.5% this year.

Other business lines were less successful. Focusrite Pro declined 1.2% and Novation, which focuses on electronic music, declined nearly 12%.

My view

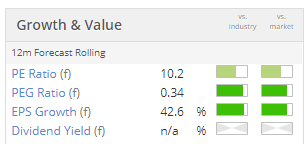

Like Paul, I feel priced out of this share. Diluted EPS comes in at 20p, in line with Paul's expectation after the September update.

It sounds like growth has stalled, in the short-term at least, as revenue for Q1 in the current financial year will be lower than last year.

Growth could pick up later in the year, with help of some product launches, and perhaps the company can beat the old FY 2020 EPS forecast of 20.1p.

Regrettably, I think this one is fully priced. Happy to keep it on the watchlist, though, for a possible future purchase.

It deserves the postive classification as a High Flyer (though Momentum might take a slight hit after today's share price fall).

Dialight (LON:DIA)

- Share price: 248p (-18%)

- No. of shares: 32.5 million

- Market cap: £80.5 million

This update helps to show why lighting products are a scary place to invest.

Dialight predicts that full-year adjusted EBIT will be in the range of £5 - £8 million.

Which financial year is that, you might be wondering - FY June 2020, perhaps? Nope - FY December 2019!

With six weeks to go, Dialight doesn't know whether it will be reporting EBIT of £8 million or only £5 million for the year:

"The timing of orders is difficult to predict and after very weak results in October..."

Also, debt is running higher than expected:

During our recovery we have continued to increase finished goods inventory to demonstrate our operational recovery to our customers. These are high running lines that are able to be shipped in a matter of days. Accordingly, our inventory unwind is likely to take longer than originally anticipated resulting in a higher net debt than current market forecasts, however well within covenant levels.

Net debt at the half-year was £11 million. According to the interim report, the company had a £25 million RCF with another £25 million in an accordion feature, secured until December 2021. So hopefully there won't be any financial distress.

My view: LED lighting manufacture sounds like a difficult space in which to make consistent profits. Dialight's track record and the uncertainty around the full-year result help to highlight this.

Dialight shares are fairly priced at a cheap multiple.

SRT Marine Systems (LON:SRT)

- Share price: 40.05p (-4%)

- No. of shares: 155 million

- Market cap: £62 million

SRT, the AIM-quoted developer and supplier of maritime surveillance, analytics and management systems and products announces its unaudited interim results for the six months ended 30 September 2019 (the "Period").

This one occasionally produces a little jam for its investors. Last year, they were treated to £3.4 million of net income, after a very strong H2.

This year's H1 performance is not so hot. The company is in the red again.

But at least the H2 outlook is in line with expectations:

"...I expect to see our transceivers business benefitting from the increased sales channels and new product launches during the seasonal buying period. I also expect to see our systems business completing several major performance milestones on our existing contracts and, subject to customer processes and timings, the conversion and commencement of new system contracts.

My view

Relying on the unpredictable decisions of far-flung governments with respect to marine surveillance spending, this share has earned pride of place in my pile of "imponderable" businesses.

The Stocko system shares my caution, calling it a Momentum Trap (good momentum, but little else in its favour from a quantitative point of view).

Kape Technologies (LON:KAPE)

- Share price: 101.4p (+32%)

- No. of shares: 144 million

- Market cap: £146 million

Proposed acquisition of Private Internet Access

Thank you to Tamzin at PI World for publishing this video interview with KAPE's CEO. And thanks to readers for suggesting that I look at this one, which is an interesting deal.

KAPE is buying Private Internet Access (PIA) for $95.5 million (£74 million), with a mixture of cash and shares. The payments will be made in three phases over the next two years.

So what is PIA? It's "a security software business, based in Denver, Colorado, with a focus on the provision of virtual private network (VPN) solutions".

I've noted previously KAPE's strong growth in the VPN space. This is a product category that gets a thumbs up from me, as I had to use it in China and have some understanding of the benefits that it provides. A VPN lets let you access the internet "as if" you were accessing it from a different computer, in a different part of the world. It makes web browsing more private, and I reckon it will grow in popularity over time.

Benefits of the planned transaction:

- doubles KAPE's user base (PIA has over 1 million paying subscribers, nearly half of them in the US)

- enhances the total product stack (speeding up the internet. private web browsing, and encrypted web search).

- the combination will help to grow KAPE's brand awareness

- PIA will be able to build using KAPE's tech platform.

Million of dollars in cost synergies are expected. PIA is described as "highly cash generative", "generating $16.3 million of adjusted operational cash flow in 2018". If that's a fair reflection of earnings power, then it makes the acquisition look like good value for KAPE.

The planned result of the combination:

"The enlarged group is expected to generate consolidated proforma 2020 revenues of between $120 - 123 million and adjusted EBITDA of between $35 - $38 million."

Shareholder base: KAPE's largest shareholder, currently owning 70% of the company, will be diluted to 56%. It is described as "fully supportive of the deal" and will help to fund the deal by lending to KAPE at an interest rate of 5% over LIBOR.

My view: this sounds interesting. I already had a positive impression of KAPE and this deal makes sense to me.

Large, debt-funded acquisitions can be difficult to digest (see Proactis Holdings (LON:PHD) ), so there is that execution risk. But this one sounds much more plausible to me than the average deal that I come across - although I may be biased, because I like the product!

Either way, this looks worthy of further research.

Out of time for today, cheers everyone!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.