Good morning!

Let’s see what the RNS has in store for us today.

Today's report covers:

- Woodford

- Innovaderma (LON:IDP)

- CMC Markets (LON:CMCX)

- Science in Sport (LON:SIS)

- Record (LON:REC)

- Caffyns (LON:CFYN)

Finished at 3pm.

What Went Wrong at Woodford

This is a popular topic. I was calling out a few of Woodford's terrible companies years ago (Allied Minds (LON:ALM), discussed here yesterday, and RM2) but I never took the time to examine the structure of his entire portfolios.

Ed Croft has done that for the Woodford Equity Income Fund, and the results are fascinating. It turns out there were huge style shifts in this fund, and inconsistencies between the strategy that Woodford said he was going to employ, versus what he actually did.

The online webinar is here and Tamzin at PI World has also published the presentation of the results at Mello last week: here's the link. If you look carefully, you'll see myself and Mark Simpson (@DangerCapital) in the crowd!

Innovaderma (LON:IDP)

A quick note on Innovaderma, which I've been covering recently - most notably on 6 Nov, when I remarked that the company's capitalisation of its marketing expenses was "highly suspect". By capitalising these costs, and not amortising them, reported profits are higher than they would otherwise be.

The CEO, Kieran Callan has been in touch to offer me some insight on this point.

He told me that historically, the company capitalised about £3.50 per customer in terms of marketing spend, which was just a fraction of the total customer acquisition cost. They did this on the basis of the company's predominantly direct-to-consumer strategy involving lots of repeat purchases (i.e. they expected to get a healthy payback from the expense).

He acknowledged that there hasn't been any amortisation of this database yet, but said that this would change going forwards. He also said that the capitalisation of marketing costs would be lower this year, and in future, as the company has found diminishing returns from marketing spend as it grows.

As far as the auditors are concerned, he assured me that everything was above board and in line with IAS 38 (Intangible Assets).

My view - I appreciate Mr Callan reaching out to me, to offer some insights on an important point. If capitalisation is more modest in future, and is matched by reasonable amortisation, then I'll be happy to take a different perspective on the company's results.

CMC Markets (LON:CMCX)

Thanks to Leo (@LeoInvestorUK) for pointing me in the direction of CMC's investor presentation from yesterday.

After a strong start, CMC shares spent the rest of the day sliding.

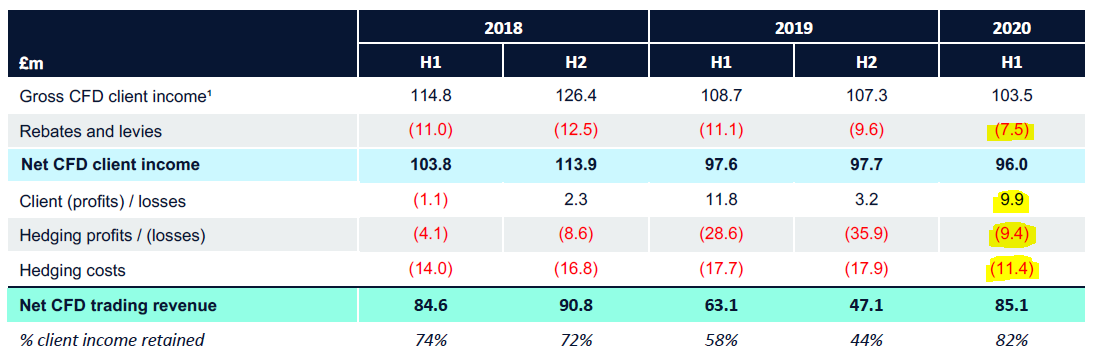

As pointed out to me by Leo, the reason could be this slide from this presentation (page 12):

Sorry if the text is a bit small.

As you can hopefully see from the above, rebates and levies only fell by £2 million compared to H2 2019.

The main boost to profitability came from reduced hedging losses, which were down by £26.5 million.

Reduced hedging costs (£6.5 million reduction) and increased client losses (£6.7 million increase) also played a part.

The explanation is as follows.

Under the revised risk management approach, we:

• Use technology to analyse data to make better informed hedging decisions

• Internalise a greater proportion of net client exposure over longer periods, resulting in lower hedging costs

CMC internalise client trades through the natural netting of client positions and hedge externally when board-approved market risk limits are hit.

• We still hedge a significant portion of our risk

My view

The huge reduction in hedging losses doesn't scare me - this number seems to have been disproportionately large in previous periods, which would back up the company's statement that their hedging strategy needed to change.

Hedging losses fell to approximately match the profits the company made from client losses (£9.4 million versus £9.9 million), and this also makes sense. I will be looking out for these numbers to track each other more closely from now on.

With hedging costs having dropped so dramatically, there is clearly less external hedging taking place. I suppose the worry for investors (and clients, for that matter!) is whether the new hedging strategy is sufficient to de-risk the business.

Many of you will remember that Plus500 (LON:PLUS) hid the extent to which it was exposed to client P&L. Instead of hedging externally, it relied primarily on internal hedging, preventing clients from trading when risk limits were met, monitoring correlations between related instruments, or simply booking their clients.

CMC have made a good effort to be transparent but what we're missing is a full disclosure of how much risk has been hedged and how much has been left unhedged. I've seen charts for this in CMC's previous annual reports - hopefully we will get another chart for this in the next annual report.

Science in Sport (LON:SIS)

- Share price: 47.16p (-2%)

- No. of shares: 123 million

- Market cap: £58 million

I've been watching this for what feels like ages, wondering if it might eventually come good in terms of profitability.

Today it reports that it will make a small EBITDA loss for FY December 2019, rather than the expected £0.3 million EBITDA profit. An increase in the price of whey and FX exposures are blamed.

But it's not all bad. Sales are slightly ahead of expectations, and as such are continuing to grow very quickly. Synergies arising from the acquisition of PhD Nutrition are being achieved in line with plan.

Outlook:

The outlook for the remaining few weeks of the current year and for 2020 continues to be strong, underpinned by a robust innovation pipeline, the current year's operational progress and a continued strategic focus on e-commerce and international markets.

My view

The CEO is always very happy with this company's progress, but I've always been wary of its lack of profitability, due to very heavy marketing spend.

Maybe I'm too cautious, and building the customer base as quickly as possible will turn out to have been the right move, in hindsight?

But the share price is currently testing its all-time lows, and the vastly increased share count will have played a part in that. Regular dilution inevitably takes a toll on share price performance.

Perhaps dilution worries can finally begin to fade? Today's RNS also informs us that the cash performance is in line with expectations - the company will have around £5.3 million at year end. This is up slightly from £5 million at the half-year.

And the CEO says that "our cash position is healthy, allowing us to be confident in our long term growth trajectory."

If the cash position has indeed stabilised, and can start to grow from here, then I might finally be tempted to have a nibble on these shares. This is yet to be proven, and the shares remain on the watchlist for now.

Record (LON:REC)

- Share price: 38p (-6%)

- No. of shares: 199 million

- Market cap: £75 million

Please note that I have a long position in REC.

The market had been looking forward to these results, with the share price making some good gains over the past few months.

It turns out that they are indeed decent results, but the market may have priced in something a little better.

Record is a currency manager which offers a variety of hedging products to institutions.

H1 performance

As had already been disclosed in the Q2 trading update, there were solid inflows in H1, and assets-under-management-equivalent (bit of a mouthful!) ticked up to nearly $60 billion. Equity markets also helped to boost this number. The number of clients improved from 65 to 70.

Frustratingly, the company recorded no performance fees in the period (during the previous 12 months, these added up to £2.3 million). Again, this is something we already knew from the trading update.

In the absence of performance fees, revenues consisted only of the basic management fees, which declined by £300k to £11.1 million.

Record has consciously allowed its standard management fees to decline, but the hope was that these might be replaced by performance bonuses. It hasn't happened in this particular six-month period.

More promisingly, the company is branching out to new asset classes, beyond equity futures which it already executed on behalf of clients. I look forward to seeing a new source of revenue under "other investment services income".

Staff are well-incentivised, earning 31% of operating profits in a profit share. The CEO owns 2.6 million shares.

Numbers

Net assets remain strong at £26.5 million, including about £23 million in cash and short-term instruments. That accounts for a significant portion of the market cap.

PBT comes out at £3.2 million for H1, down versus £4 million last year. £2.5 million after tax.

Dividend is unchanged. REC currently yields around 6%, as most earnings are distributed.

My view

I no longer intend to hold this one for the long-term, as I am worried about competitive pressures on fees leading to a secular decline in profitability.

That having been said, the company remains in the black with a very strong operating margin and rock solid balance sheet. There has been a noticeable uptick in AUME and client numbers, which can't be denied. There are still some attractive features.

I was thinking about selling in it January, when the share price was around 28p - 29p. Not selling it then has turned out to be beneficial. But I will probably give in to the temptation to sell it before long.

Note that the StockRanks adore it, giving it a rating of 99/100. Quantitatively, it looks almost perfect!

Caffyns (LON:CFYN)

- Share price: 375p (-10%)

- No. of shares: 3 million

- Market cap: £11 million

This family-held motor retail business is proving to be the Value Trap which the StockRanks identified it to be a year ago.

Profitability has fallen close to zero in the latest H1 period, versus pretax profits of £700k in H1 last year. It was right to price this at a cheap multiple.

New car unit deliveries are down by 14.5%.

Used car unit sales are much flatter (only down 2%) and aftersales revenues are up 2%, but it's not enough to prevent a dismal result.

The company says there were supply problems for new cars, which is undoubtedly true. The EU's Real-Driving Emissions regime affected deliveries around the time of the September registration plate change.

Pension: one of the footnotes to this report tells me how much the pension deficit increased, and various other details, but it doesn't give the raw size of the pension fund.

Two minutes later, I am reading footnote 20 to the Annual Report for 2019. As of 2017, the actuaries measured pension scheme assets of £90.4 million and a deficit of £13.5 million, implying that there were liabilities of £104 million. Pretty big for a company with this market cap!

Litigation: there are legal proceeding in which Caffyns is named as a defendant, in relation to the VW diesel emissions defeat device. VW is indemnifying Caffyns, so this shouldn't hurt the company or its investors.

Net debt is £13 million.

My view: too small, too illiquid for most of us here. And the pension deficit and bank debt are a turn-off, too. I will continue to steer clear of this one.

That's it from me for the week. Thanks as always for your comments - I read everything, even if I don't reply to them all.

Have a good weekend!

Best wishes,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.