Good morning, it's Paul here with Friday's SCVR.

It looks as if there's going to be more pain today for shareholders in retailers, as evidence gathers that only the best had an acceptable period of trading over Xmas.

Estimated timings today - I've done most of the report now, but have to pop out for a meeting. I'll be back after lunch to do some more, so final finish time today is c.4 pm.

Edit at 15:31 - today's report is now finished.

Early snippets - before 8am

I'm not sure whether it's a good idea to be doing this, as my initial reaction to MKS yesterday was not how the market saw things. But let's do it anyway.

Joules (LON:JOUL) - profit warning. 7 weeks to 5 Jan 2020 saw retail sales (stores + ecommerce) down -4.5% vs last year. That's a big step backwards from H1, which saw +3.1% retail sales.

It blames website problems. Stores & concessions are said to have traded in line with expectations. It will be interesting to see how the market reacts to this, but the only question is how big the sell-off today is going to be.

Cost headwinds - due to China-US tariffs, and logistics changes (although that should deliver longer term savings).

In conclusion -

Taking the above into account, the Board anticipates that FY20 Underlying PBT² will be significantly below market expectations³.

Brace for a nasty day, my commiserations to shareholders.

Superdry (LON:SDRY) - this looks pretty grim too, I'll elaborate once the market has opened (it's 07:58 at the time of writing this).

Joules (LON:JOUL)

Share price: 179p (down 21% today, at 09:27)

No. shares: 89.4m

Market cap: £160.0m

Trading update (profit warning)

Background - Joules is a nicely differentiated brand, with distinctive fashion products. To get up to speed, there are some useful articles in our archive, here;

Graham covered the last trading update here on 5 Dec 2019

I covered the last full year results FY 05/2019 in quite a bit of detail here.

Reading through both those articles to refresh my memory, a key point to note is that online is about half of Joules's sales - similar in proportion to Next (LON:NXT) and a very important factor in my view. Fashion retailers that also have a strong online offering, are usually more likely to be winners - since the growth from online can offset declining physical store sales. There are exceptions though, like Primark, which doesn't sell online (not comparable with Joules of course, in terms of product or price).

Profit warning -

There has been a sharp deterioration in retail (stores and ecommerce combined) sales trend from +3.1% in H1, down to -4.5% in the 7 weeks to 5 Jan 2020.

This has obviously hit profits;

... the Board anticipates that FY20 Underlying PBT² will be significantly below market expectations³.

²Underlying PBT before share-based payments, exceptional items and impact of IFRS 16

³Company compiled consensus of £16.7 million

It's great that the (now defunct) consensus forecast profit figure is provided as a footnote, well done to whoever wrote the RNS. But why can't they give us a figure, or a range, for the actual shortfall in profit? Instead of all this daft coded wording that companies use in trading updates, I would much prefer specifics. E.g. something like this - we expect profit to be approximately 10-15% below expectations (with a footnote giving expectations). That would save investors & commentators so much time. Other companies do it - plenty of companies give specific profit guidance, so why can't everyone else? It doesn't have to be a precise figure, a range of possible outcomes is perfectly acceptable.

I think maybe that people who write RNSs forget that many of us have to read hundreds of them, from many companies, so we really need clarity, not fudge! Over the years I must have wasted thousands of hours trying to unpick what trading updates really mean, when companies could have said so clearly in the first place.

This is actually not at all fair, because it means that private investors are put at a disadvantage. The big name brokers get preferential access to profit warnings, the night before, so they can put out precise figures to their clients at 7am. It takes the rest of us until maybe lunchtime to properly understand what's going on. In the meantime, big investors with privileged information through their relationships with brokers, might have been dumping their stock in the market.

This system is highly questionable actually - you could argue that it amounts to insider dealing and hence could be illegal, when privileged data is provided to some brokers, who then restrict their research notes to preferred clients only - clearly giving those clients an unfair advantage when making buy/sell decisions.

Reasons behind profit warning -

The cause is blamed entirely on some (unspecified) problem with online stock availability;

This was a result of disappointing online sales performance due to an internally generated stock availability issue through the important end of season sale event, the cause of which has now been addressed.

Whilst this sounds like a one-off factor, it actually worries me a lot. A business that generates half its sales online simply cannot mess up something as basic as stock availability. I think the company needs to explain this in much more detail, specifically;

- What went wrong?

- Who was responsible? Are management changes needed?

- How could management allow such a basic thing as stock availability, at peak trading, to go so wrong that it causes a profit warning?

- Has the business grown too fast & become operationally inefficient?

- Are logistics & computer systems up to scratch, or was this human error (or both)?

- Could this (unspecified) problem happen again?

Reading between the lines, it sounds to me as if the warehousing side of things might have collapsed under the volume of Xmas trading. Because the company goes on to say this about its logistics;

To support further growth of the brand, the Group has taken strategic decisions in relation to its supply chain operations: establishing an outsourcing partnership with a leading logistics provider to operate and enhance the Group's UK logistics operation and also transitioning our US distribution centre to a new partner. These initiatives will incur incremental non-recurring costs during the transition phase but are expected to deliver significant cost benefits from the end of FY21 onwards.

That's good news I think. Outsourcing logistics makes complete sense - get the experts to handle this tricky area, which frees up a lot of management time to do what they're good at.

Rant about trading updates - Joules doesn't give enough information in its trading updates - i.e. it obscures performance by not revealing its LFL sales figures. This is poor reporting. New store openings boost sales, but also boost costs, hence the total sales figure doesn't give us the true picture. Why is the company so coy about revealing its LFL sales performance? Investors need full information, not curated highlights which cover up potential problems.

This is an ongoing theme, as Card Factory (LON:CARD) did something similar yesterday, by obscuring its LFL performance in Q4, providing only YTD figures instead. This is probably due to PR people trying to be clever. It doesn't work - investors see through it, and it's actually harmful, in undermining trust.

I think the best PR people understand that it's best to get bad news out immediately, truthfully, and in full. Then the share price gaps down, and everyone can move on. When bad news is obscured in announcements, it just undermines investor trust in future announcements (and management).

Forecast changes - Research Tree has an update note today, thus leveling the playing field for us, which is great. I should have read this note first, as it explains what went wrong - basically human error on product planning & allocation, so that the warehouse didn't have the stock they thought it had, for online orders. Poor management in other words.

However, the changes to forecasts are much larger than I was expecting.

FY 05/2020 - EPS reduces from 14.2p to 8.9p - a reduction of 37%. Ouch.

FY 05/2021 - also comes down from 15.9p to 12.7p, a 20% drop. Why? If the problems are a one-off, then I don't see why it should have a knock-on impact on the following year.

There's also a 17% drop in forecast for the year after that - again, why?

Maybe analysts are being prudent. Also, I get the point that spreadsheet models are built using incremental revenues & costs on the prior year. Therefore if you reduce the base year, then all future years automatically reduce too.

The small divis are also expected to be reduced.

My opinion - I was warming to this share, on the basis that this looks like a one-off problem.

However, the extent of the forecast reductions has taken me by (negative) surprise.

In the time I've been writing this section, the share price has bounced from its initial 30% fall, to about 20% now (at 09:39). I'm struggling to see why the share price should be any higher than this, as at 178p per share, the current year PER is now 20, dropping to 14.1 next year. That's probably about the right price.

Overall then, I can't see any reason to get involved here. It was on my watchlist as a possible purchase, but the only reason to buy now, would be if you're happy to take a long-term view, and see today's warning as growing pains.

Or, if you think the company can recover quickly from this setback, and beat the new, lowered forecasts.

I do like this company though. Its previous track record before today was excellent. I'll watch from the sidelines and see how things develop. As Graham, and others, have said - why get involved in retailers, since the sector is fraught with risk?

Superdry (LON:SDRY)

Share price: 404p (down 14% today, at 10:21)

No. shares: 82.0m

Market cap: £331.3m

Trading update (profit warning)

Here we have another struggling fashion brand.

Superdry announces today a trading update covering the 10 week period from 27 October 2019 to 4 January 2020 ("peak trading period").

This is an unusual situation, where the founder Julian Dunkerton took back control, and is now trying to re-position SuperDry as a mainly full price fashion retailer, rather than permanently discounting. That's a nice aspiration, but it can only be done if the product is perfect, and customers are prepared to cough up for it. It's customers who ultimately decide whether discounts are needed, by refusing to buy at full price. Hence my worry here is that by resisting the need to discount, Dunkerton may just be deferring the hit to profits, perhaps?

My review of the interim results, published here on 12 Dec 2019, is worth a quick recap, as it reminds me of the key issues. I had significant concerns (especially the going concern note), and decided this share was too risky, and the turnaround too protracted, to want to buy any shares at 479p at the time. Good thing too, as the price is now down to 404p.

Profit warning today - poor sales;

Despite a strong Black Friday event, peak trading performance has been lower than expected as we continue our strategic transition to a full price stance.

Reasons given - I've converted the text into bullet points;

- Unprecedented levels of promotional activity [Paul - from competitors}

- Subdued consumer demand immediately after Christmas

- Shortages of some better-selling product

- The need to reduce our inherited inventory position [Paul - presumably by putting it into clearance sale at reduced prices]

Delay in turnaround - this comment concerns me, as it suggests poor performance and struggles to clear poorly designed product is likely to continue until c.Sept 2020 - so we should be braced for more profit warnings in 2020, I reckon - hence this share is best avoided in my view;

Whilst we are encouraged by response to the limited ranges that we have introduced, this challenge will remain until the new design philosophy and product can be fully implemented across the entire range, with full impact expected by the launch of Autumn/Winter 2020.

Revised guidance - JOUL should take note! SuperDry has at least given clear guidance;

The benefit of strong gross margins and cost initiatives will not fully offset the profit impact of the aggregate shortfall in sales.

Taking into account our revised sales expectations for the balance of the financial year, and the challenging trading environment in which we are operating, we now expect Underlying PBT(1) to be in the range of £nil - 10m.

This is grim, because H2 is meant to be the seasonally stronger half. H1 was a small u/l loss of -£2.3m. Therefore, H2 looks likely to be a profit of only £2.3m to £12.3m.

As I outlined last time I reported on SDRY, profitability is collapsing. With the current year FY 04/2020 only likely to be at, or just above breakeven, then the likelihood seems to be that FY 04/2021 may be significantly loss-making. Probably the only thing that might preserve profits, is if the new A/W 2020 season stock (due in Aug/Sep 2020) turns out to be a blockbuster range.

My opinion - this strikes me as high risk.

It's worth revisiting the going concern note contained within the interim results.

If SuperDry has another bad year, and moves into heavy losses in 2020, then it could be facing potential insolvency risk in 2021.

A key question is how much net worth does Mr Dunkerton have? The reason I ask, is whether he has the financial clout to take the company private? That could provide an exit route for existing shareholders. But with the business in an increasingly poor situation, why would he be generous with any potential offer?

It will be interesting to see if the turnaround plan works at SDRY. However at this stage, based on the information available, it's not working so far. Therefore I'll be giving this share a wide berth unless there is some evidence that performance is improving.

It's a horrible sector, with well-known upward cost pressures, but downward footfall in the High Street. Therefore turnarounds are generally not working. SuperDry certainly has an uphill struggle in current conditions.

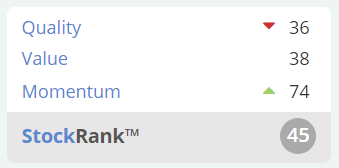

Stockopedia isn't impressed, calling it a "Momentum Trap", and the StockRank is lowish;

EDIT: Incidentally, I think there are some similarities between Superdry (LON:SDRY) and Ted Baker (LON:TED) at the moment, although TED looks to be in a much worse financial position. Therefore, I've opened a small short position in TED this week, since I cannot imagine it traded well over Xmas either. Thanks to the reader who posted a link from Sky News, suggesting that TED's banks had called in restructuring experts. That's usually a very bad sign. I rarely short anything, and only ever very small position size, as it's too risky. End of edit.

De-listing Risk

As mentioned many times in the past here, we have to be alert to the risk of usually the smallest companies de-listing.

The latest nano-cap to announce it intends to de-list (i.e. become a private company) is CloudBuy - Cloudbuy (LON:CBUY)

CloudBuy has been a complete basket case for years. I remember meeting management a few years back, and coming away from the meeting completely perplexed. They couldn't even explain what the company did, let alone what its prospects were. It just burned through cash every year, and achieved nothing of any significance.

So it's not really a great surprise that Cloudbuy is going to disappear from AIM. However, this triggered a c.60% drop in share price yesterday, and another 20% today.

Therefore, every time something de-lists, it's worth checking out our own portfolios for the smallest companies we hold, and ask whether the same thing could happen to them?

If something is a complete basket case, I think it's best to just chuck it out, even if you have to accept peanuts. It's much better to clear our worst mistakes off our portfolios, so we don't have to see a daily reminder of something awful, and cling on to some distant hope that it might recover.

Liquidity is such a problem with nano caps, that I reckon we'll see plenty more of the tiniest companies leave AIM. Good riddance too, I'd much rather have a smaller market, with more decent companies, than one clogged up with dross. AIM seems to have been badly managed, and brokers have generally done a lousy job in recent years - failing to find enough decent companies to float, and all too often instead floating speculative junk on AIM.

EDIT: I added the following in the comments section, then thought it would be useful to copy it here;

Re de-listings, off the top of my head, the companies most at risk are;

- Tiny mkt cap - I would say sub-£10m are most at risk, rather than your sub-£50m

- Run out, or about to run out of cash

- Struggling, or impossible to raise fresh funding from equity market, due to track record of failure, and investor fatigue

- Busted flush in terms of the story - i.e. a failed business model

- Almost no liquidity/trades in the shares - so why bother with the costs & hassle of a listing?

- By far the most important risk factor: shares concentrated heavily in one, or a few, large shareholders.

This would be an interesting project for an intern actually - to look at all UK market de-listings in last few years, and pick out the key risk factors. That could then produce a "risk of delisting" rating for each share. One for the Stockopedia tech boffins, possibly?

End of edit.

JD Sports Fashion (LON:JD.)

Share price: 826p (unchanged, at 14:02)

No. shares: 973.2m

Market cap: £8,039m

What an amazing success JD Sports has been in the last 10 years or so. Its shares have roughly 40-bagged, benefiting from that lovely combination of greatly increased earnings, and PE multiple expansion. The secret of its success seems to have been on focusing on the fashion element of sportswear, and snazzy shopfits rather than the pile it high & sell it cheap approach of others. Also its international growth has been stunning. So well done to everyone who spotted the potential & stuck with it.

Sales - sounds positive overseas. Implies that UK growth was modest, perhaps? Although the wording strikes me as ambiguous;

Against a backdrop of widely reported retail challenges in the Group's core UK market, it is encouraging to report positive like for like trends in the Group's global Sports Fashion fascias, particularly overseas.

It doesn't want to give any figures at the moment, for this reason;

Given the increasing significance of our international businesses in the overall Group result, and the fact that there is a differentiated timing of the post-Christmas sale period in a number of our key overseas markets, the ultimate outturn will reflect trading in these markets through the remainder of January.

Hmmm, that sounds a little concerning.

However, this bit reassures, and gets a thumbs up from me, for being clear in the guidance given (rather than ambiguous wording);

We remain confident that the full year Group headline profit before tax will be in the upper quartile of current market expectations which, after adjusting for the impact of the transition to IFRS 16, range from £403 million to £433 million.

That's quite a wide range of analyst forecasts, but upper quartile means the company is telling us that the correct range is now £425.5m to £433m.

Valuation - I can't find any broker research on this, which is surprising, given its large market cap.

The share price not moving today, indicates that the market is happy with this outcome, and buyers/sellers are in balance, so nothing much more to say about it.

The PER is 25 based on consensus forecasts. Given its track record of beating forecasts, that's not necessarily outrageous.

My opinion - it's done fantastically well, but with the market cap now up at £8bn, and as I understand it, mainly selling other people's product (big brands), as opposed to designing its own unique product, I think this business model could ultimately prove risky - if the big brands decide to concentrate on selling direct to customers through their own websites (at much higher margins).

Clearly my misgivings have proven horribly wrong in the past, and I overlooked a pot of gold sitting in front of me, so probably best to ignore everything I say!

In the context of looking at the retail sector generally, JD. seems to have done well mainly thanks to its overseas operations, not its UK operations.

Look at this for a remarkable chart! How much further can it go?

B&M European Value Retail SA (LON:BME)

Share price: 376p (down 5% today, at 15:09)

No. shares: 1,000.6m

Market cap: £3,762.3m

I thought it would be interesting to look at some of the mid and larger cap retailers too, so that we get a broader view of how retailing has performed over Xmas. One of my jobs for the weekend, is that I'm hoping to put retailers trading updates into a table, and see how they compare.

B&M European Value Retail S.A. ("the Group"), the UK's leading variety goods value retailer, today provides a trading update for the third quarter of its current financial year, relating to the 13 week period from 29 September 2019 to 28 December 2019.

I'm not familiar with this group, having never visited its stores. It has several fascias, in the UK and abroad. UK performance is what I'm interested in. It says;

B&M UK stores revenue growth of +8.8% including like-for-like ("LFL") growth of +0.3% for the quarter, against the backdrop of a challenging broader retail market and our decision not to engage in any early discounting activity

That's a similar ballpark level of LFL to the UK supermarkets. The +8.8% total growth shows that there must be a store expansion programme underway.

Heron Foods is the other UK brand, and it just says, "solid LFL sales growth", with no figure given.

This bit probably explains why the share price is down 5% today - a slowing of growth in Q3 (Oct-Dec 2019);

Cumulatively, B&M UK has achieved +2.3% LFL sales growth during the financial year to date, albeit with a slower performance than anticipated during the run up to Christmas.

Overall - unless I've missed it, I can't see any reference to full year profitability expectations, which is the main point of putting out trading updates! I'll see if there are any broker notes available, and what they say.

I've not looked at this business before, but quite like what I see. It makes a much higher profit margin than the big supermarket groups, and is rolling out new stores. I must visit one, to get a better handle on the main business unit of B&M UK.

I'm out of time now for today, thanks for reading & commenting, and have a smashing weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.