Last week I wrote about the SIF portfolio’s heavy exposure to cyclical stocks. The cyclical companies I was referring to are mostly stocks dependent on consumer spending or the construction market.

One cyclical sector SIF isn’t currently really exposed to is the energy sector. Although the portfolio has made some money from the the mining sector in the past (PAF, CAML, S32 & RIO), it’s never owned an oil and gas stock.

Why is this? When I last looked at oil stocks in October 2016, OPEC and Russia had just agreed on joint production cuts. At the time, I said that my screen “isn’t intended to pick up cyclical stocks exiting a major downturn. The screen is designed to identify companies that are already profitable and have the potential to deliver above-average returns.”

Nearly two years later, oil companies are in a very different place. The OPEC-Russia deal was very successful. The price of a barrel of Brent Crude has since risen by more than 50% to about $74 (at the time of writing). Oil companies’ costs are down, cash is flowing and profits are rising fast.

Russia and OPEC are in the headlines again this week, ahead of a meeting where they’re expected to consider whether to increase production. Despite this, there are still no oil stocks which qualify for my screen. Do I need to consider tweaking my screen so that SIF can invest in oil? Or is this a tricky sector that’s best avoided?

Bad timing or a bad business?

The oil sector doesn’t have a great track record of generating the kind of sustainable, above-average returns I’m looking for.

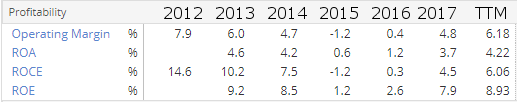

While oil traded above $100 per barrel almost continuously from 2011 to mid-2014, Royal Dutch Shell’s return on capital employed fell from a peak of 18% in 2011 to 7.5% in 2014.This was accompanied by a fall in operating margin from 9.1% to 4.7%, as both costs and spending ballooned:

It was a similar (or worse) story elsewhere in the sector. This suggests to me that by 2011, it was probably too late to profit from the last oil bull market. When oil prices flattened out, it was an early sign that the cycle was turning.

This view…