Good morning!

Some things on my plate today:

- Distil (LON:DIS) - final results

- Codemasters Group (LON:CDM) - full year results

- Woodford Patient Capital Trust (LON:WPCT) - company update

- Triad (LON:TRD) - final results

- Accrol Group (LON:ACRL) - trading update

- Allied Minds (LON:ALM) - directorate change

- Avanti Communications (LON:AVN) - final results

Cheers!

Graham

Distil (LON:DIS)

- Share price: 1.775p (-7%)

- No. of shares: 502 million

- Market cap: £9 million

(Please note that I do not have a holding in Distil, having sold my holding today.)

I've been at my desk for a couple of hours already this morning, prior to writing this, trying to generate a firm view on Distil's results.

In the end, I've sold out my entire position.

Regular readers will know that I hate selling things. Especially illiquid micro-caps with a wide spread. My default position is to hold on to things for as long as possible.

Indeed, this is my very first sale of 2019. I was proud of having gone nearly six months without making a single disposal.

What's happened?

Distil is a small developer of alcohol spirits brands, and has delivered results today which are in line with the forecasts from Progressive Research. Sales are up 19% and the company has generated profits for the second consecutive year: £160k in operating profit, around the same as last year.

I can summarise the good points in today's statement:

- Growth in sales volume of Redleg Spiced Rum accelerates to +45%. Has attracted a loyal customer base. "Very positive" reponse to the new Caramelised Pineapple flavour.

- Again with respect to Redleg: there is "increased availability across all trade channels but especially in the growing number of independent bars, pubs and restaurants serving RedLeg Spiced Rum."

- Group gross margins (before advertising costs) improve to 60%.

- The cash balance improves slightly and continues to stand in excess of £1 million.

Unfortunately, there are a few reasons for concern, in my view.

Firstly, the non-Redleg brands performed very poorly. I didn't place much value on them, anyway, but even so: revenue from Blackwoods Gin has turned down by 12% and two vodka brands fell by 39% and 68%, respectively. These are worth very little, in my view.

Secondly, there is no progress on US distribution. Last year, the company said:

We are in talks and negotiations with potential US distributors for our brands... We are seeking a long term, strategic partner for this market.

Today, it says:

"...we are seeking a long-term strategic relationship in the USA and have explored several options. We will keep shareholders informed"

It's possible that a US deal could be announced tomorrow, but an investment thesis can't rest on something that has been promised for years and never been achieved.

Next up, and most importantly, I have to consider the lack of profits growth due to high marketing spending.

For 2019, this had already been flagged and there was no reason to believe that today's reported numbers would be anything different.

The "contribution margin" (gross margin less advertising costs) has increased by 5% to £741k. This figure approximately represents the amount which is available to cover fixed costs.

The reason for the modest increase in contribution margin is that advertising costs nearly doubled, far outpacing the percentage growth in sales.

The simple truth is that financial progress hasn't been as fast as I anticipated when I opened this position nearly a year ago. Although if you read my analysis of this stock from last month, you will see that until then, I was willing to be patient with it.

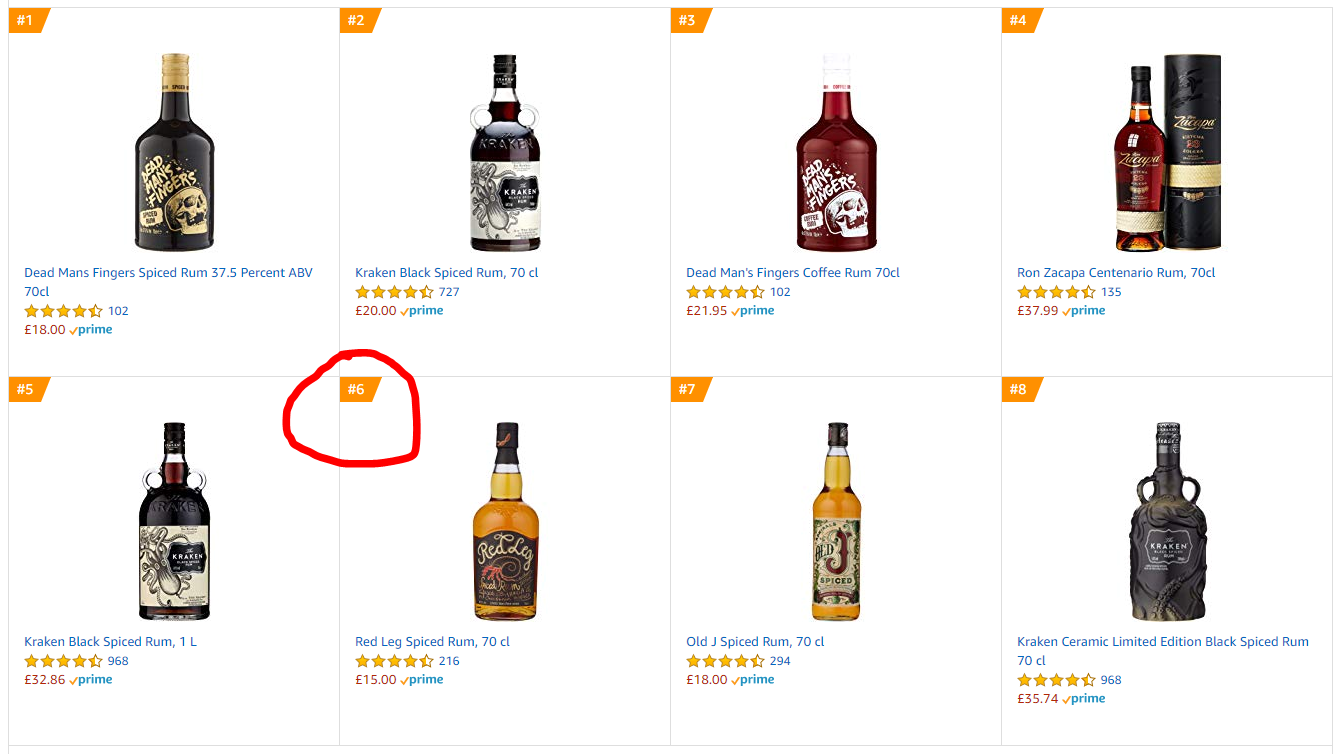

Scuttlebutt informed me that Redleg remained popular among drinkers. It is a bestseller on amazon.co.uk, with a 4.5 star rating from over 200 reviews:

What changed

The company has allowed its paid-for researchers to slash forecasts for 2020 and 2021.

The pre-tax profit forecast for the current year (2020) has been reduced in half, from £400k to £210k.

According to the official forecasts, we will now have to wait until 2022 to see PBT of £500k. Progress has been put back by more than a year.

The research note mentions the effects of Brexit and protectionism and other macro factors, but I prefer a simpler explanation. The rum and gin markets, while growing, are also increasingly crowded, and market share comes at a very expensive price in terms of advertising cost.

Even if Distil hits the 2022 PBT, that would still make for a hefty P/E multiple (normalised for taxes) at the current market cap. And that is three years away, when the spirits market is likely to be even more competitive!

My view

I was willing to be patient, and still have a fondness for this company.

However, with the forecasts having been slashed and deadlines for significant financial progress being put back, I have to admit that I was too optimistic and that the competitive position is probably more difficult than I realised. It was a minor position for me, but I no longer wish to hold it.

I would be willing to revisit it a lower share price or at some future date when financial progress is more readily apparent. It will remain on my watchlist.

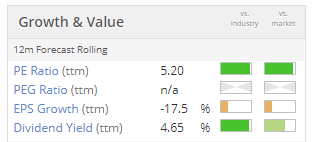

The StockRanks consider it to be a Falling Star - high quality, but very low on value and with poor momentum. Sounds about right.

Codemasters Group (LON:CDM)

- Share price: 251.5p (-1%)

- No. of shares: 140 million

- Market cap: £352 million

Codemasters (AIM: CDM), the award-winning British video game developer and publisher specialising in high quality racing games, announces full year results for the year ended 31 March 2019 ("FY 2019").

I covered this company's admission to AIM last year. See the previous report for my initial impressions.

This statement includes plenty of old news. Focusing on the outlook section, there is:

- a "strong schedule" of games to be released this year (Formula 1 and GRID).

- more digital sales growth and opportunities from streaming and next generation consoles.

Digital sales are higher-margin and increasingly popular. Bad news for physical retailers like GAME Digital (LON:GMD).

On a side note, I've been thinking about adding Alphabet ($GOOG) to my portfolio, and I see that two of its subsidiaries are mentioned in this outlook statement, as part of the gaming infrastructure:

1. Stadia, a new game streaming platform.

2. YouTube, where gaming content is huge.

The other content platform mentioned is Twitch, owned by Amazon ($AMZN).

Anyway, let's get back to Codemasters.

My overall impression of this company is positive - it seems to deliver high-quality games on behalf of its franchisors.

However, I definitely wouldn't bother using its "adjusted EBITDA". This leaves out the cost of developing its games, so it's a meaningless number.

Might be worth researching in greater detail.

Woodford Patient Capital Trust (LON:WPCT)

I just thought I would mention this in passing. It has released a company update in response to its own falling share price. It doesn't say anything significant, but seems designed merely to reassure shareholders that the Board is awake:

The Board is closely monitoring the situation and is engaging with its shareholders and advisers. Separately, the Board is in regular dialogue with the portfolio manager. The Board wishes to emphasise the long-term approach of the Company and will continue to keep shareholders updated as necessary.

Neil Woodford is under the microscope at the moment with the suspension of his Equity Income Fund, and some clever people have been shorting WPCT and its holdings.

Not sure how this will end but I imagine that it will get worse before it gets better. Selling illiquid holdings from a position of distress is every investor's worst nightmare, and it's what Woodford is doing in the EIF right now.

Triad (LON:TRD)

- Share price: 42.5p (-1%)

- No. of shares: 16 million

- Market cap: £7 million

I cover this stock once a year, at results day, although this might be the last time.

For the last while (see my Triad coverage last year), I've avoided buying into the recruitment and professional services sectors, and I now spend very little time analysing them. For this reason alone, Triad falls outside my investable universe.

One particular red flag that I noticed last year was Triad's exposure to a few large customers. The top three customers accounted for more than half of its total revenue.

It turns out that in FY 2019, two large customers reduced the amount of business they did with Triad, resulting in a revenue decline of almost 20%.

While the loss of low-margin work boosted the company's gross margin, the lower turnover and higher fixed costs resulted in a deterioration of operating profit by almost 40%.

My view - this sector holds no appeal for me, so I am unlikely to say much about Triad in future.

It does boast a ValueRank of 90, but I reckon that it is cheap for all the right reasons.

Accrol Group (LON:ACRL)

- Share price: 25.5p (-1%)

- No. of shares: 195 million

- Market cap: £50 million

I've been trying to come up with a clever pun for this toilet paper company's results. Maybe that's a bad idea.

It has been a mostly disastrous share for investors in the 2016 IPO, and restructured last year.

This update is in line with expectations. It claims to be achieving "acceptable" levels of adjusted EBITDA.

As far as the balance sheet is concerned, its net debt was recorded at £27 million at the end of April.

Accrol's broker is now forecasting EBIT of £5.2 million in the current financial year (to April 2020), rising to £7.3 million thereafter, adding that "further momentum in strategic recovery" is needed to hit this forecast.

Given the debt load and the sensitivity of results to FX rates and commodity prices, the current market cap looks more than generous to me.

Allied Minds (LON:ALM)

- Share price: 84p (+10%)

- No. of shares: 241 million

- Market cap: £202 million

Woodford owns 27% of this venture capital outfit, while his former employer Invesco owns 23%.

It reached a ludicrous valuation a few years ago, but is now back around more reality-based levels. It is no longer making investments, instead working on its existing portfolio.

Today we learn that the CEO of the past two years is walking. She is replaced by two co-CEOs who will also keep their jobs as General Counsel and CFO.

Given that the company has ceased making investments, there will be no new LTIP awards.

That's good news for shareholders including Crystal Amber, who ran a campaign to stop management taking home large pay and bonuses despite little evidence of success in the portfolio.

Avanti Communications (LON:AVN)

This satellite company reports another huge operating loss for 2018. It's hard to imagine that it will ever achieve anything for shareholders.

Despite shareholders having already been diluted to smithereens, there remains "a material uncertainty that may cast significant doubt on the group and the parent company's ability to continue as a going concern".

Bargepole treatment is justified.

That's all for today! Hopefully some better news tomorrow.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.