Good morning folks,

I only belatedly noticed this horrible RNS from Taptica International (LON:TAP). It says that Uber has filed a complainst against two Taptica companies, along with dozens of other companies, alleging "fraudulent concealment, negligence and unfair competition".

While there may be limits to any potential damage, given the US-centric nature of the complaint, this adds a risk that is difficult to quantify to a share which already lay outside my investable universe.

I would remind readers that Taptica insiders sold 10.6% of the company at 140p, when the P/E multiple was 5x.

Taptica International (LON:TAP)

- Share price: 99p (+19%)

- No. of shares: 127.6 million

- Market cap: £126 million

Update re Uber lawsuit and Proposed Share Buy Back

This sounds like it's in response to angry calls from shareholders, looking for more clarity. Why not provide this detail with the original RNS?

What it says: In 2014, Taptica was retained by another company, "Fetch", to run a campaign for Uber.

The revenue to Taptica from this campaign is not "a material portion of Taptica's revenue". So perhaps the associated liability is not too large? (I am not a laywer.)

Taptica then points out that Uber and Fetch have had a troubled relationship. See here for prior coverage of the $40 million lawsuit filed by Uber against Fetch. I think the implication is that the situation turned ugly for multiple parties and that Taptica might be an innocent scapegoat.

Buy-backs: Taptica is "actively considering" another buyback programme. With the shares trading at an EV/EBITDA multiple of 2x at last night's close (Stocko date), that is a relief.

My view: It is beyond my ability to analyse this company's investment merits, but I am fascinated to see how it works out. The ValueRank is 97. Good luck to all holders.

Other stories today (this list is final):

- Park (LON:PARK)

- Ramsdens Holdings (LON:RFX)

- Castings (LON:CGS)

- Norcros (LON:NXR)

Park (LON:PARK)

- Share price: 68.1p (-0.6%)

- No. of shares: 186 million

- Market cap: £127 million

(Please note that I have a long position in PARK.)

These are ok results from Park, which I hold on the basis that it is a unique part of the retailing infrastructure, with leading positions in gift cards and shopping vouchers.

The numbers are flat/slightly lower, and nothing to write home about. Performance has been steady at Park for the last few years.

Rather than squeezing the profitability of its existing business lines and leaving it at that, however, Park has expressed a lot of ambition to keep innovating.

Management has been overhauled and a new CEO has been in place since last year, who was previously the CEO at MBNA in the UK (a credit card company with a £7.5 billion loan book). He has been rolling out various productivity initiatives, to make the company more efficient.

Development work - Since last year, Park has been working on a top-secret new product, and shareholders still don't know what it is. Our null hypothesis should be that it's worthless, but I'd love to see a positive surprise emerge.

The product is being developed "to target currently untapped demand from a broader audience". It will move from development to market testing in H2.

Christmas Hampers - this is now a separate entity with its own managers.

Love2shop - 70 online retailers and 20 restaurants/experiences have been added to this gift card. Sales of the associated Mastercard have grown "very strongly".

The overall gift card market grew 12% in H2: this number says to me that Park experienced a loss of market share, though Park says that market trends played to its strengths in B2B and digital.

Outlook - I approve of the stated goal to build a "robust and scalable platform" for the continued development of the business, but we do need to see more tangible evidence of this going forwards (perhaps with the release of the new product).

Costs are expected to rise by a net £2 million in the current financial year, with a mix of one-off costs (running two offices at the same time, temporarily) and recurring costs (technology and marketing).

My view

This share hasn't achieved anything for me yet, with a holding period of about 18 months so far. I'm not married to it, and could dispose of it in future, but I would like to see what the new managers can achieve first.

In the meanwhile, it pay out reasonable dividends (yield is 5% according to Stocko) and it qualifies for two Stockopedia Screens: Best Dividends and Greenblatt's Magic Formula.

It passes a short-selling screen too - I think this is because of the unusual structure of its balance sheet, with £100 million of monies held in trust.

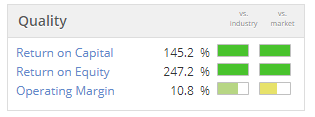

Reflecting its status as a piece of the economy's digital financial infrastructure, the return on capital is c. 145% (according to Stocko).

Ramsdens Holdings (LON:RFX)

- Share price: 173.3p (+2%)

- No. of shares: 31 million

- Market cap: £53 million

Annual Results for the year ended 31 March 2019

I always keep an eye out for results from this "diversified financial services provider" (a rather grand description of the business).

Ramsdens had a good year, underlying PBT up by 4% to £6.7 million.

Including the cost of share-based payments, PBT is up by 3% to £6.5 million.

Pawnbroking - Ramsdens generates 25% of its gross profit from pawnbroking, and grew the loan book by 20% to £7.6 million in FY 2019, helped by The Money Shop acquisitions.

FX - 38% of gross profit is here. Fewer foreign holidays last year hurt the result in this division, with the result that there was only very modest growth in this division (despite the increase in the number of stores).

Return on Equity / ROCE falling

The company's average net assets during FY 2019 was £29.2 million, up by 14.5% compared to FY 2018. Similarly, I calculate that average capital employed increased by 14% in FY 2019.

Equity and capital employed are outpacing the growth in profitability, so I reckon that return on average equity and ROCE have both fallen.

This might just be growing pains - the effects of setup costs and commencing operations in new areas - but I have said before that I have a question mark or two over the Ramsdens expansion plan. For example, see my coverage in November 2018.

Opening a significant number of new stores per annum could dilute overall returns, if the new stores can't match the profitability of the existing estate. This is a mature industry and it's not easy to find new territories where you don't run into difficult competition or cannibalise yourself. The Ramsdens store count has increased by nearly 20% to 156.

I'm not suggesting that the company is headed for some sort of catastrophe, I am just a little bit sceptical that ROE/ROCE will sustain their high levels as the company expands.

At the moment, Ramsdens has the lead over H & T (LON:HAT) (in which I have a long position) in these quality metrics. If these metrics deteriorate for Ramsdens, that in turns means that earnings growth and free cash flow growth could disappoint.

Overall returns are likely to be solid, however, given the cheap market cap relative to earnings and the c. 5% dividend yield.

Castings (LON:CGS)

- Share price: 435p (+2%)

- No. of shares: 43.6 million

- Market cap: £190 million

Castings is a solid industrial stock that's been around for a long time (25 years) and seems to know what it's about.

These are good results. The problem area recently was machining at CNC Speedwell (link). This business has now been "brought back under operational control" - which hints at how bad things must have been. it is still loss-making for now, but the loss has reduced.

The foundry business, meanwhile, has seen output increase 6% and sales increase 12.7%. Margins were unusually weak in H1, but recovered in H2.

Profitability

Adjusted pre-tax profit came in at £15.3 million, a 27.5% improvement compared to FY 2018.

However, investors should definitely take note that this enjoyed a £1 million boost from more aggressive depreciation assumptions.

This is disclosed prominently near the start of the statement, so there is no suggestion at all that management have tried to hide it. It just means that the profit result is slightly less impressive than it would otherwise be.

The reason for the change is that management now assume a useful life for recently acquired plant and equipment in the machining business of 15 years, rather than the 10 years which they previously used.

Is that a reasonable change? Maybe equipment lasts longer now than it used to before, with the proper maintenance? Management do say that they intend to maintain equipment for longer from now on, so they will need to replace it less frequently.

My view

My overall impression of this business is unchanged - a solid industrial stock.

I think it's fully priced around current levels, and Stocko agrees. The ValueRank was 41 as of last night.

Norcros (LON:NXR)

- Share price: 203p (+1.5%)

- No. of shares: 80.4 million

- Market cap: £163 million

Results for the year ended 31 March 2019

Norcros, a market leading supplier of high quality and innovative bathroom and kitchen products, today announces its results for the year ended 31 March 2019.

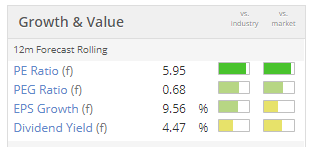

I wonder if this headline was written with the P/E multiple of 6x in mind:

"The group's tenth consecutive year of revenue and underlying operating profit growth"

Companies with such a track record aren't supposed to trade at derisory valuations.

As discussed before, e.g. in January, the Norcros valuation has been held back by certain issues:

the debt load (£53.5 million at September 2018), the pension liability (£29 million), the lack of organic growth, and the exposure to South Africa (one-third of revenues).

(The share price was 196p when the above was written.)

Let's review the latest data.

Debt load - net debt reduces to £35 million. Down by £12 million for the year.

The company's cash flow was reduced by the following key items:

- Capex £5.6 million

- Dividends £6.4 million

- Acquisitions £2.1 million

... and a few other items.

Dividends and acquisitions could be viewed as discretionary. If we add them to the £12 million, we can argue that the company could have reduced debt by £20.5 million, if it had wanted to.

Just after year-end, Norcros made a £12 million acquisition in South Africa, probably wiping out the debt reduction during FY 2019 and sending debt back to c. £47 million. But I suppose bulls can argue that cash generation in FY 2020 will be higher again, with the help of this acquisition, so we could see debt reduce at a faster pace this year.

Pension liability - now at £31.6 million (accounting basis), versus £48 million a year ago.

The measurement on an actuarial basis remains at £49 million, using last year's valuation.

Organic growth - revenue is up 2.3% on a like-for-like constant currency basis. Still very modest.

South Africa - this is "a challenging market and an uncertain political environment". Revenues are up but profits are down 10%, and this is blamed on a variety of factors including a weak currency, a one-off plant shutdown, power rationing, and competitive pricing pressures. So I think South Africa remains a worry.

Outlook - confident.

My view - of the four issues which in my view undermine this company's valuation, I think these results provide evidence of progress in two of them: net debt and the pension liability.

Net debt hasn't fallen, but cash generation has been good and should hopefully improve further. And the pension is also looking quite manageable.

The status of the other two issues, however, is unchanged.

My stance is unchanged. I continue to lean towards the view that this share is undervalued, though it does carry some unusual geographical risk.

StockRanks also see some value:

Sorry for the delay in finishing up this report - got there in the end.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.