Morning!

Thanks for the early suggestions.

I've just been catching up with the latest Tesla (US:TSLA) news.

Elon Musk wrapped up his latest call with Wall Street analysts by refusing to answer a couple of questions. Now perhaps there is a larger context which explains it better, but I've listened to an excerpt and it's quite extraordinary.

Analyst: Where specifically will you be in terms of capital requirements?

Elon Musk: Excuse me, excuse me. Next, next. Boring bonehead questions are not cool.

After the next analyst tried to ask a question about car reservations, Musk said "Sorry, these questions are so dry. They're killing me." And moved on to talk to retail investors, instead.

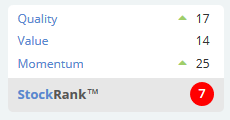

Ben wrote a nice article on Stocko looking at Tesla's red flags. All of the Stocko metrics have deteriorated since he wrote that article:

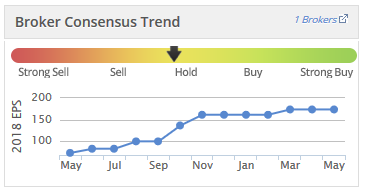

What's particularly interesting about Musk's attitude to analysts and to "bonehead questions" is that Wall Street has, overall, been good to Tesla. Even today, with the stock being one of the most heavily derided among the professional investor community, there are still more Wall Street analysts with "Buy" ratings than "Sell" ratings on the stock.

The other point is that if Tesla needs to raise more funds (that's a point of controversy), it will benefit from friendly relationships with Wall Street. Musk appears quite sure that he can afford to step on a few toes. It looks to me like the pride which so often precedes a fall.

Is this of any relevance for UK small-cap investors, I hear you asking. Perhaps not too much. But it is a $56 billion dollar company (in equity + debt), and for me it's a barometer of the general levels of exuberance in the marketplace. It's one of the reasons I'm happy to keep some powder dry for now.

Incidentally, Tesla is one of the most shorted stocks in the market - 30% of the float has been borrowed. This makes it a consensus trade in the bear community. It could also make a bear squeeze incredibly painful. There is no easy way to make money!

Games Workshop (LON:GAW)

- Share price: 2435p (-0.2%)

- No. of shares: 32.3 million

- Market cap: £787 million

Shareholders in this publisher of fantasy war-games must have already priced in the continuation of strong sales:

Following on from the Group's update on 5 February 2018, the good growth trends have continued to the end of April. Sales and, given the high operational gearing of the business, profits for 2017/18 to date are therefore slightly above expectations.

It's very easy to quantify operational leverage. All you have to do is compare the company's gross profits with its operating profits.

For example, here are Games Workshop's numbers for 2017, rounded to the nearest million:

- Revenue: £158 million

- Gross profit: £113 million

- Operating income: £38 million

Gross profit was about 3x operating income, so Games Workshop's degree of operating leverage was 3x.

This means that a 1% increase in sales, assuming constant gross margins and fixed overhead expenses, would translate to an approximately 3% increase in operating income.

We can verify this concept using hypothetical numbers:

- Revenue up by 1%: £159.6 million

- Constant gross margin gives gross profit of £159.6 million * 71.5% = £114.1 million

- Fixed overheads of £75 million leaves operating income of £39.1 million

Operating income increases from £38 million to £39.1 million, i.e. by 2.9%, close to our estimate of 3%.

Operational leverage is a risk factor that works beautifully in your favour in the good times, but can turn against you in the bad times.

The consensus forecast for Games Workshop's FY 2018 revenue prior to today's update was actually £211.4 million, a 33.7% gain versus FY 2017. Pre-tax profit was forecast to grow 74%.

Due to the fact that its product cycle is somewhat irregular, analysts are forecasting that sales will moderate to £199.8 million in FY 2019.

It has a super track record in recent years of beating forecasts, so it's understandable why some might feel that this is pessimistic:

I think that to get a fundamental edge in this stock, you need to plug yourself into the product cycle to understand the popularity/direction of their upcoming campaigns.

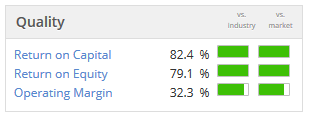

If you don't have the time/wherewithal to do this, and take a more quantitative approach, the stock still has plenty of attractions:

Personally, I regret not buying into it. It has a permanent slot on my watchlist.

Numis (LON:NUM)

- Share price: 409.25p (-0.2%)

- No. of shares: 107 million

- Market cap: £438 million

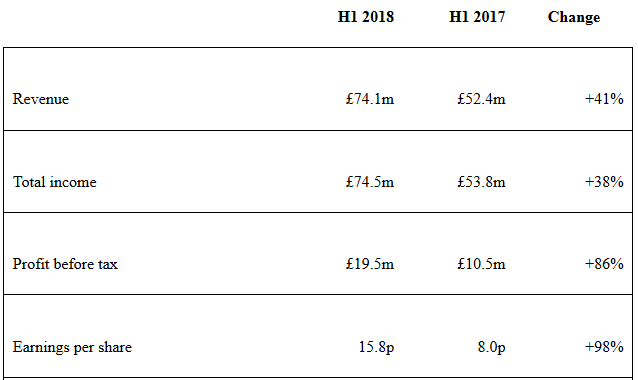

This mid-tier investment bank has had a good half-year:

I said in the previous section that GAW's revenues were irregular. It's vital to understand than an investment bank's revenues are not just irregular, but lumpy.

This means we can't (or shouldn't) put normal earnings multiples on their share valuations.

Fee income depends on corporate activity, which comes and goes with the business cycle, and on the pulling power of the firm's employees.

So I tend to view these shares as income plays only. I would buy in only when probable dividends are so high that they will be sufficient to produce an attractive return.

The interim dividend is maintained at 5.5p with the following rationale:

Our goal is to pay a stable ordinary dividend and re-invest in our platform, pursue selective growth opportunities and return excess cash to shareholders subject to capital and liquidity requirements and market outlook.

The balance sheet is very strong, as you might expect. A very large cash pile.

It's easy to argue for a bigger dividend than 5.5p, given EPS of almost 16p in H1. Caution on this front reflects the fact that earnings are so unpredictable.

If Numis delineated its broking income, we would probably see that a very large part of the increase during the period was due to the $546 million deal which it mentions in today's report.

So it is being conservative with its dividend policy, and that is fair enough.

With respect to regulatory compliance, MiFID II has been implemented:

We are pleased to have implemented MiFID II whilst experiencing no material changes to the breadth and composition of our institutional client base.

While MiFID II has been bad news for sell-side research analysts, this has been a declining sector for many years. The pressure on mainstream fund managers to justify their existence has been getting worse for many years, and outsourcing the research function to their broker doesn't help their argument. So MiFID II is just an accelerant for a trend which has been underway for a long time.

In any case, it has apparently had little effect on Numis.

Overall view

I like Numis, but my favourite stock in this sector is Cenkos Securities (LON:CNKS), which I think has been the most consistently generous to its shareholders over the years. (For the avoidance of doubt, I hold shares in neither company at the time of writing this article.)

DP Poland (LON:DPP)

- Share price: 32.25p (+6%)

- No. of shares: 153 million

- Market cap: £49 million

Nobody has requested this Domino's Pizza operator, but I have it on my watchlist since I have a speculative shareholding in DP Eurasia NV (LON:DPEU) (the equivalent in Russia & Turkey).

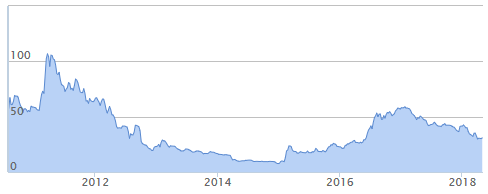

DPP hasn't done well for those who invested in its IPO back in 2010. It did provide a very nice trading opportunity in 2014:

The share count has risen very significantly over the years. It came to market too soon and/or failed to raise sufficient funds on Day One.

When I covered it in March, I warned that it might possibly need to raise more funds, due to ongoing losses.

Today's update is in line with expectations.

Some really positive noises:

- 17% like-for-like* growth in System Sales** Q1 2018

- 56 stores in 24 towns and cities

CEO comment:

"The first quarter of 2018 saw continued double digit like-for-like sales growth and improving margins at the store level. The buoyant Polish economy coupled with price deflation in the European cheese market have combined to provide healthy conditions for growth. "

Checking my notes, DPP is targeting 70 stores by the end of 2018, up from 54 at the end of 2017.

So far, it has opened 2 new ones and signed leases on 8. Sounds like good progress for Q1.

Unfortunately, it's still hard to picture the company being profitable in the short-term. Some analysts are even predicting that losses will expand this year to PBT of minus £3 million.

So I'm worried that DPP is still too small and doesn't have the finances to fund its growth and especially to fund more advertising campaigns.

When I have some conviction that it is fully-funded, I would considering buying in.

For now, I'm happy merely to keep watching its progress in growing its market share and brand recognition. It's an important comparable for the Russia & Turkey version which I do own shares in. Poland like-for-like sales have been growing faster than Turkey (where Domino's is mature), but not as fast as Russia.

Minds Machines (LON:MMX)

- Share price: 9p (-11%)

- No. of shares: 700 million

- Market cap: £63 million

This hasn't been covered in the SCVR since 2014. I've been prodded into covering it by some reader requests.

The last time Paul covered it, he said "the risk:reward looks diabolical, so it's going on my bargepole list". Since then, it has hired a new CEO and finished a Strategic Review. So maybe it's a good idea to give it a fresh look.

It's an unusual company which owns and operates top-level domains such as .vip, .london and .yoga. Revenue is generated from registrars (such as GoDaddy) for the registration and renewal of domain names. Registrars are the entities who sell domain names directly to businesses and the general public.

It earned about 50% of sales from China last year, and has purportedly gained approval for the .购物domain (pronunced "go-oo"), which means shopping. The freedom to write URLs using Chinese characters has been in play for almost a decade, but I think it has been very rarely used until now.

Besides today's results, we also have news that MMX is buying another top-level-domain registry, for $10 million in cash and $31 million in new MMX shares. This is very significant compared to the size of the existing business.

The acquired registry own four domains associated with the adult industry. The idea is that internet users will more easily be able to predict when they are visiting adult content, because the website URL will end with .xxx or similar!

I like the financials surrounding this acquisition. It made net income of $3.5 million off sales of $7.3 million, and finished the year with total assets of $2.9 million. This implies a very high ROA. Most revenues were in the form of renewals (78%).

If this is dependable revenue for the long-term, with the potential for it to increase gradually over time, then I think it is easily worth the $41 million purchase price.

I like the overall plan:

As a registry business, MMX's strategy is to a build a strong, annuity based business of scale founded on recurring revenues.

Fees to renew domain names could be a really dependable revenue stream, and could last for a really long time, if not perpetually. Hence, the reference to an annuity-type income stream. These top-level-domains strike me as permanent assets where the ultimate customers (website owners) are locked in and face very high switching costs.

The number of website domains under management in the core business has increased from 820k to 1.32 million, with renewal billings at $5.6 million, about the same as the renewal revenue in the acquired business.

There is no dividend yet, but:

The acquisition of ICM, announced today, marks a major step forward in our ambitions both to scale and introduce a progressive dividend policy over the next 18 months.

The balance sheet looks ok to me on initial inspection - NCAV of $12.6 million with a heavy surplus of current assets over current liabilities, and no long-term borrowings. The share count has declined over the past two years.

I didn't expect to come away with a positive impression. It is certainly a complicated story. Having bought and managed various personal websites over the years, I think I have a slightly greater-than-average understanding of how registry systems work. I am certainly interested to research this in greater detail. The valuation on ICM looks cheap, but I'm not sure about the valuation on MMX's existing portfolio.

Charles Taylor (LON:CTR)

- Share price: 281p (+2%)

- No. of shares: 68.5 million

- Market cap: £192 million

Four announcements from insurance services group Charles Taylor yesterday. I think "Acquisition" is the main one.

Maximum consideration payable is $50.5 million (£37 million), including performance-related defcon.

The acquired businesses ("Inworx") are in Argentina, Peru and Mexico. It's all part of the "InsureTech" division's plan to become "a global insurance technology player"

The valuation for the deal is full, as you'd expect, but won't look too expensive if there are some synergies and if we get another couple of years of moderate growth:

Inworx reported revenue of US$14.7m and adjusted profit before tax of US$3.7 million[2] in the year to 30 September 2017. Inworx has achieved greater than 20% PBT margin and greater than 10% annual PBT growth over the last two years, and there is the opportunity to accelerate growth and improve profitability under Charles Taylor ownership.

And another deal might be along soon:

The Group is in discussions with another insurance services business, which may or may not lead to an offer by a member of the Group to acquire this business. This acquisition would expand the Group's service proposition and client base, building on the acquisition of Inworx and recent organic growth. It is currently expected that, if consummated, the proposed transaction will be classified as a class two transaction for the purposes of the UK Listing Rules.

"Class two transaction" means, roughly speaking, that the target will be less than 25% of the size of CTR, but probably more than 5% (using various measurements of assets, profits, etc). It would be a material transaction, though unlikely to be transformational.

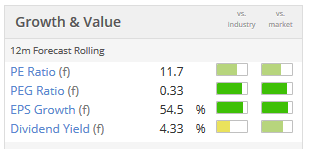

I maintain a broadly positive impression of CTR as a company, but don't see any reason to get overly excited about the shares. Valuation measures look about right:

Ok, that's it from me. I'm logging off for the week. Have a fine weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.