Good morning!

Today's news flow is not particularly exciting, so why don't we have a quick roundup on markets in general?

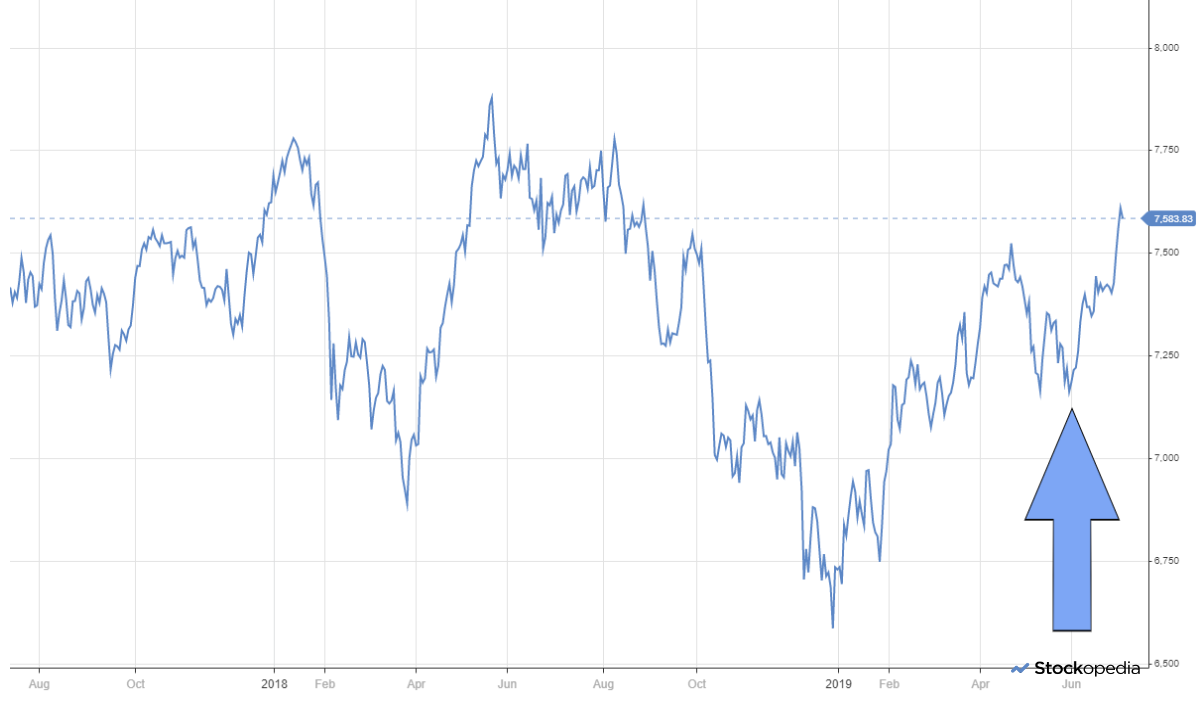

The FTSE-100 has had a rocket under it since the beginning of June (this is a two-year chart):

As you can see, we are stll belows the highs of H1 2018. But for how much longer?

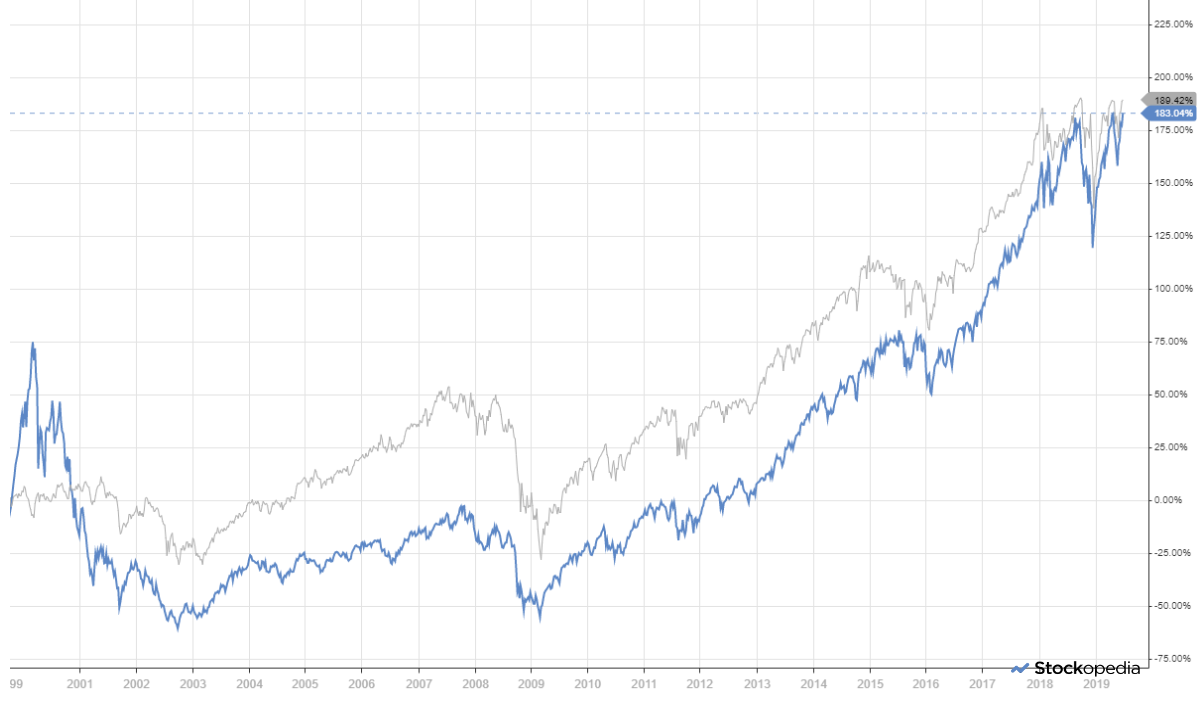

Other equity markets have been creating all-time highs. Here are the long-term charts for the Nasdaq (blue) and the Dow (grey):

One of the hedge fund managers I follow (thanks to his Tesla-related efforts) is Mark Spiegel. I should acknowledge that since inception in 2011, his fund has underperformed the major stock market indices.

But it has been a horrid era in which to run a long-short book, and Spiegel loves shorting: his fund is currently "very net short", according to his June letter!

The reason I mention him is that he has identified the Russell 2000 Index as "the most overvalued of all stock indices". This is the subset of the Russell 3000 (the top 3,000 publicy-traded US companies) that excludes the top 1,000. So we could think of it as a mid-cap index, a bit like the FTSE-250.

According to Spiegel, this index trades on a trailing P/E ratio of 35x, and 35% of its components are unprofitable! Those are quite amazing numbers (at least to me) and they suggest that the overvaluation relative to traditional metrics extends far beyond the FAANGS. So I remain extremely cautious about the valuation of US markets.

Turning closer to home, I'm becoming a lot more comfortable with the valuation of the FTSE.

The FTSE All-Share Index, for example, is on a trailing P/E ratio of 14.6x, while EPS growth of 3.2% is forecast to increase to 8.1%.

The FTSE does not have as many exciting growth companies as the US markets do, but I do think it can serve as a stable source of value.

Indeed, I've been picking up a little bit of extra income this year by making regular long bets on the FTSE. In the last few weeks, however, I've been cautious about placing any more trades - I've been comfortable doing it around 7100-7200, but am more reluctant with the market at 7600. Given the change in the interest rate outlook, and the apparent undervaluation relative to US markets, perhaps I should keep going?

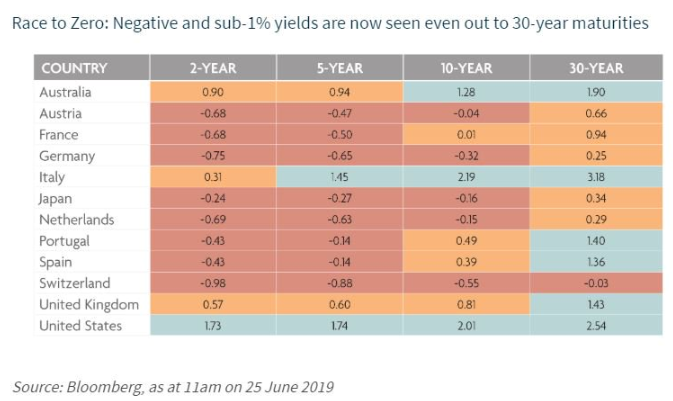

The bond market has also reached all-time highs. Some examples of the absurdity:

- 64% of Eurozone sovereign debt has a negative yield

- Swiss 30 year bond yields negative and Germany 15 year bond yields negative

- Italy 50 year bond yields 2.7%

- Austria 100-year bond yields 1.2%

In Ireland, credit unions have severely limited deposits from customers due to negative yields at banks.

Here's a recent yield table. As you can see, the US is the only market in positive territory for each maturity:

Meanwhile, the ECB still thinks that inflation is unacceptably low (who wants higher inflation?), and looks set to remain extremely dovish for the foreseeable future. The hiring of Christine Lagarde only confirms this.

And as far as the Bank of England is concerned, markets are now pricing in a greater than 50% chance of a rate cut this year.

What to do about this? Extraordinary monetary policy is good for investors in the sense that it pushes the prices up for everything we already own, but it's terrible in the sense that we can't make new investments at these higher prices without accepting a much lower prospective return.

But UK equities are a special situation, thanks to Brexit uncertainty. It seems that international investors are still waiting to see what happens, before embracing the UK markets again.

A resolution to the uncertainty could therefore lead to dramatic shifts in asset values. I think that the FTSE and the Pound Sterling could both rally in a big way, if we get certainty over the Brexit outcome in a few months. Or it might drag on even longer, of course!

In the UK small-cap world, we've seen a lot of the speculative froth get taken out of growth stocks, and there are plenty of stock-specific opportunities, as always.

Conclusion

I'm leaning towards the view that I will continue to make long bets on the FTSE Index (although I'd still love to see some sort of a pullback before going in again).

While I have selectively made a few investments in the US market, I would not currently make any long bets on US indexes.

As far as the bond market is concerned, there is still nothing in it that looks attractive to me at all, except US junk bonds.

On the currency front, I'm expecting that the monetary madness will see gold break out to new highs versus GBP, going to £1,200/ounce and beyond:

The best way to speculate on the gold price increasing is a difficult question. 8% of my portfolio is currently in H & T (LON:HAT). If anybody can think of other non-mining operating businesses with a positive exposure to gold, please let me know!

Ok, sorry for the interlude!

Today we have trading updates from Churchill China (LON:CHH) and Live (LON:LVCG), and a statement by Frontier Smart Technologies (LON:FST).

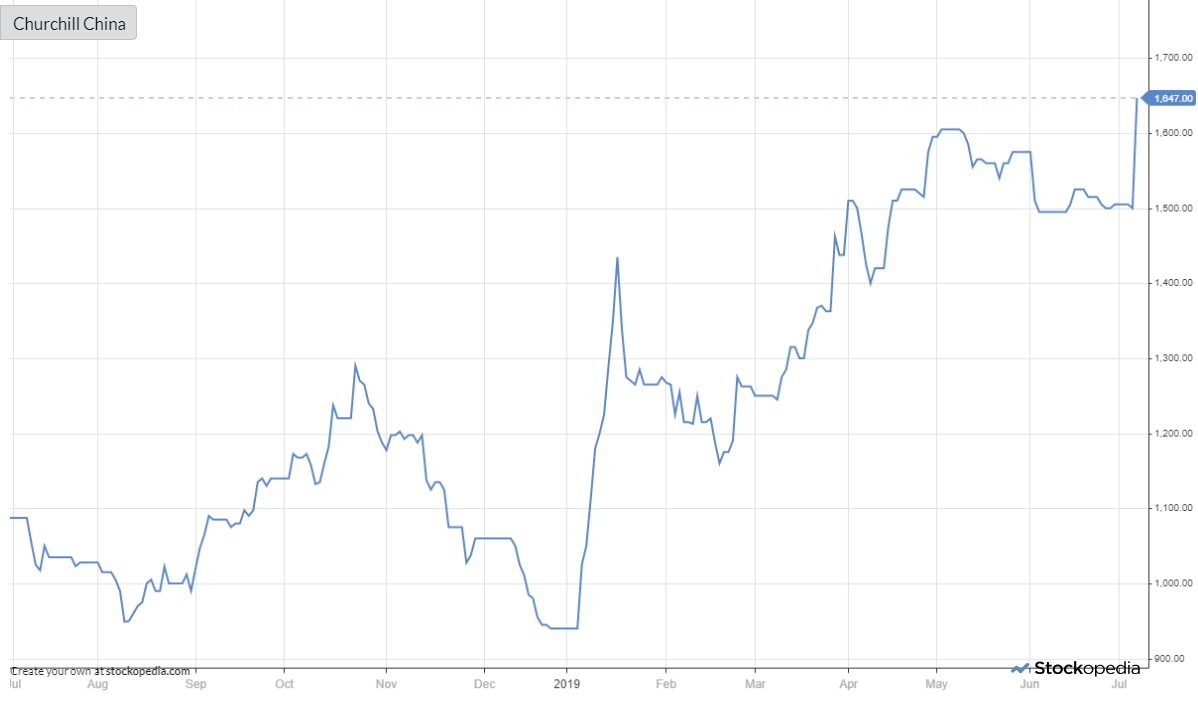

Churchill China (LON:CHH)

- Share price: 1647p (+10%)

- No. of shares: 11 million

- Market cap: £181 million

A brief, positive H1 update from this ceramics company:

Hospitality revenue growth has been ahead of our initial expectations, with the majority of this out-performance again being attributable to further progress in Europe. We now anticipate trading performance will be ahead of our earlier expectations for the full year.

Not much info given but for Churchill China to issue a positive trading update is in line with its trend over the past year:

This is one that I've failed to invest in, despite identifying it (along with Paul and many others) as a high-quality business. I was interested in it last August at 1000p, but it didn't stay at those levels for long.

It did drop back to 1000p during the long-forgotten slump of December 2018, but I was buying other things at the time. At a forward P/E multiple of c. 20x (assuming that today's share price increase matches increased EPS expectations), I suspect that it is currently around fair value.

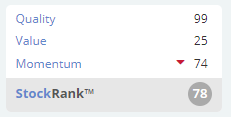

It's a High Flyer, which is a winning Stockopedia style:

Live (LON:LVCG)

- Share price: 50.5p (+4%)

- No. of shares: 70.4 million

- Market cap: £36 million

This is a detailed AGM statement. Trading is in line with expectations so far in 2019.

LVCG produces entertaining shows for children, with a Lego theme. Click here for more info.

Everything seems to be on track.

This bit is unusual. The CEO is refusing his performance-based bonus of 500,000 shares for the current year:

Whilst, I remain fully committed to achieving this performance target and driving value for the Group, I can confirm that should the performance target be achieved, I have decided not to accept the award of the Bonus Shares.

Checking message boards, the decision seems to be a reaction to shareholder anger at the creation of this additional bonus scheme.

I can't see any forecasts but this stock doesn't fit into my investment strategy, so I'm not going to search for them. It has no track record of profitability and the market cap is an aggressive multiple of revenues. Stockopedia calls it a Sucker Stock.

Frontier Smart Technologies (LON:FST)

- Share price: 35.5p (unch.)

- No. of shares: 40.7 million

- Market cap: £14 million

Further response to offer and update on discussion

The Board at FST still thinks that its joint venture negotiations with an unnamed 3rd party could lead to "material incremental value", so it advises shareholders not to do anything with respect to the bid from Science (LON:SAG).

It wants discussions with Science to agree a route forward, and provides reassurances in relation to its cash position, banking covenants and executive compensation.

I'm not sure what is going to happen with the takeover offer at 35p, but FST shareholders seem like a depressed bunch after many years of losses. It looks vulnerable to a bid, especially seeing as Science already owns about 30%.

Ok, I'll call it a wrap there. Have a great weekend everyone!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.