Good morning!

Lots of interesting stories to digest today.

- Duke Royalty (LON:DUKE)

- Churchill China (LON:CHH)

- Xaar (LON:XAR)

- Arrow Global (LON:ARW)

- HSS Hire (LON:HSS)

- Strix (LON:KETL)

- Crawshaw (LON:CRAW)

- Orosur Mining Inc (LON:OMI)

Duke Royalty (LON:DUKE)

- Share price: 45p (+1%)

- No. of shares: 198 million

- Market cap: £89 million

Please note that I currently own DUKE shares.

Duke is an unusual investment vehicle. I wrote about it last month, when it raised £44 million in new equity.

It has raised £79 million (gross) in total from investors so far, at 40p and 44p.

As I have written previously, it won't be a very confident hold for me until I feel happy with its level of diversification.

Today we have news of a £10 million deal, including the temporary option to increase the investment by a further US $5 million. I guess it will do that depending on progress with other deals over the next few months.

The yield is fantastic: over 13% in cash, received monthly. The payments will vary in future years depending on revenue generation by the investee's parent.

The investee is a Canadian company, operating internationally. It specialises "in the development, commissioning and management of healthcare facilities and services using a public-private partnership model. "

Payments will be received for 30 years unless the investee exercises its buyback option. Note that there is no repayment of principal at the end of 30 years. It works more like an annuity.

My opinion

The Duke portfolio has five investees now - it is gradually improving its diversification. My confidence is very slowly improving, the longer we go without a mishap. There is a long way to go yet.

The main attraction for me is the high yield that Duke achieves with each deal, and the possibility that it could compound this wealth over time by reinvesting the proceeds.

The dividend yield is of less importance, but it doesn't hurt. The most recent quarterly dividend was 0.7p, implying a forward yield of 6.2% on the current share price, if that dividend can be sustained.

Something I've done personally is to create a spreadsheet and use a little bit of financial maths. It's possible to estimate the value of Duke's individual investments, and the portfolio as a whole, using Excel's PV (present value) formula.

For example, take this £10 million investment. Suppose Duke gets an annual payment of £1.35 million for the next 30 years. If the payment never changes, and we apply a discount rate of 10%, then that investment is worth £12.7 million today (unless I've applied the formula incorrectly - please make sure to do your own research!)

If the payments to Duke were to grow by 1% annually, the investment is worth £14 million in today's money.

Or if the payments stay flat but we are happy to use an 8% discount rate, then the investment is worth £15 million.

We can flex the assumptions to be more or less conservative, and plot out a range of possible outcomes.

The bear case scenario is that investees will default at a greater frequency than we expect. While the portfolio remains concentrated, there is a risk that such a default in the short-term would blow a nasty hole in the portfolio.

I've been happy to buy a big chunk of Duke shares because even in its current rather concentrated state, I'm not terrified by the prospect of a default or two. It would hurt, but it wouldn't be the end of the world. On the other hand, the upside potential could be outstanding.

As I said before, there will be an element of luck required for us to avoid any defaults in the first couple of years.

Churchill China (LON:CHH)

- Share price: 1012p (+1%)

- No. of shares: 11 million

- Market cap: £111 million

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its interim results for the six months ended 30 June 2018.

There's no excuse for me not to own a few shares in this family-run business by now, after all the nice things I've said about it. There's always been something else I've wanted to own just a little bit more.

Some of the highlights from today:

- sales up 6% at constant FX

- operating margin increase to 11.9%

- PBT up 24%

- interim dividend up 18%

Exports are doing great while UK revenues are down, "reflecting low levels of new investment by end users", i.e. restaurants and hotels being cautious about new spending.

Outlook - confident. The company again mentions the importance of replacement sales, i.e. repeat sales to existing customers.

(from the 2017 Stonecast Brochure)

My view - I am still interested to add this to my portfolio, the next time I am shopping for equities and presuming that it is still around the current share price.

A simple family business with a fine reputation, strong balance sheet, cautious management, great returns on capital and a large addressable market. It has a Quality Rank of 99.

Xaar (LON:XAR)

- Share price: 179.3p (-27%)

- No. of shares: 78 million

- Market cap: £140 million

This printhead developer used to be in the FTSE-250. How the mighty have fallen!

We had a clue in June that the stream of bad news was likely to continue, as the company admitted that it couldn't predict the speed with which customers would adopt the latest technologies, and guided for an H2-weighting to meet market expectations.

Today it says:

Underlying trading since the end of June has been, and is expected to continue to be, below the levels previously anticipated by the Board in its announcement of 27th June 2018.

Customer adoption of one of its key products has been "significantly slower" than expected.

And you know things are bad when a comparison to last year's result is omitted.

We are told H1 revenues will be c. £35 million, or £25 million excluding one-off royalties.

Last year, H1 revenue excluding royalties was £40.5 million.

This means that ordinary income is down by close to 40%, year-on-year.

My view - it has always had volatile financial results and a volatile share prie. I'd love to be able to time the point of peak market pessimism, because I do think there will be a chance to buy these shares at a true bargain price some day.

Note that the company reported net cash of £44.7 million at December 2017.

This is worth keeping on the watchlist for a recovery, in my view. Particularly with that cash position (I look forward to seeing how much was left at the half-year).

Unfortunately, the latest developments in the market for industrial printheads tend not to make the 9 o'clock news. It's not exactly easy to figure this one out, nor is it exciting. If you're completely new to this company and would like to read about what it does, here's a link to get you started.

Arrow Global (LON:ARW)

- Share price: 265p (+3%)

- No. of shares: 176 million

- Market cap: £442 million

This collector of non-performing loans looked interesting when I covered it last month. I briefly opened a long position in it, but subsequently got cold feet. So I don't have a position in it now.

Lots of readers do have a position, so let's take a look.

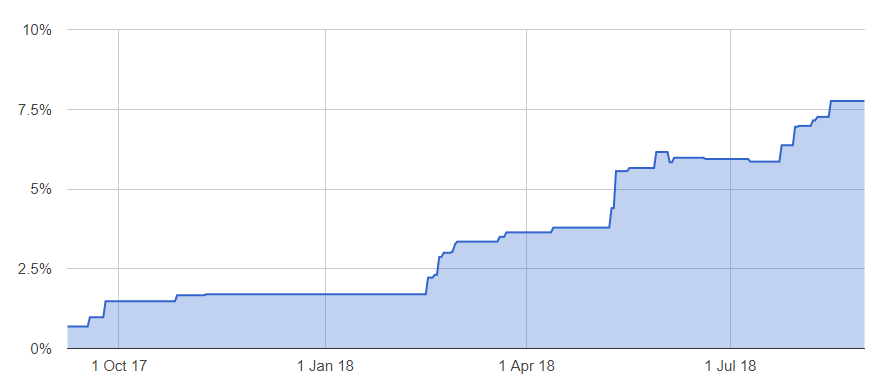

As an aside, we should bear in mind that funds have nearly 8% of shares sold short, according to publicly disclosed positions. This is in a firm uptrend:

(source: shorttracker.co.uk)

Scrolling through these results, I am struck by the following:

Fully refinanced balance sheet - WACD of 3.9% and no bond maturities until 2024; strong liquidity with £178.0 million cash headroom to fund organic growth

WACD = weighted average cost of debt, i.e. the average interest rate Arrow is paying. 3.9% doesn't sound bad at all.

That paragraph helps to back up management's claim to have a "prudent" approach to the balance sheet.

But there's more than one way of looking at it. Net debt is £1,077 million. in the region of 10x last year's operating profit. That would generally be considered a steep multiple.

Similarly, the net debt to adjusted EBITDA multiple is 4x, at the top of its target range. This would be considered highly leveraged by most analysts analysing most companies.

Another way of looking at it would be to say that balance sheet equity is just £173.5 million, supporting assets of close to £1.4 billion.

It's being run almost like a bank. with a sliver of equity supporting a huge portfolio of assets.

The justification for this, using the company's own words, is that it enjoys "predictable cash generation from resilient, high return assets".

In other words - if it's easy to forecast its returns, then it's ok to leverage up.

Operating profit for H1 is £52 million, slightly reduced compared to last year. After all is said and done (including a hefty interest bill), net income is £8.5 million.

My view

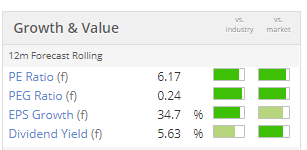

This is" cheap", there's no doubt about that. It gets a ValueRank of 71:

I'm still tempted to dabble in it. What's holding me back is that it has become a bit too large and complicated for me.

It's active in six different types of activity (ranging from consumer debt to real estate management) in five different European regions (one of which is Benelux, i.e. 3 different countries). And it has been making a lot of acquisitions.

International diversification is seen by some as risk-reducing, but the complexity that it creates, sometimes, makes it too difficult to analyse properly. That's true for me, in this case. There is simply too much ground for me to cover.

Good luck to those of you who are willing to give this one a chance.

HSS Hire (LON:HSS)

- Share price: 30.9p (+11%)

- No. of shares: 170 million

- Market cap: £53 million

This equipment hire group has made a big improvement compared to last year, although that's not saying much.

It produced an adjusted pre-tax loss of only £0.7 million in H1 2018, compared to a loss of £14.2 million in H1 2017.

It's also making a disposal to generate net cash of £47.5 million, to patch up its ugly balance sheet.

Net debt at 30 June 2018 was £225 million, so there will be plenty of debt even after this disposal.

I can't imagine this company's equity having much value. Probably still overvalued, I reckon.

Strix (LON:KETL)

- Share price: 166p (+1%)

- No. of shares: 190 million

- Market cap: £315 million

Another share on my watchlist for a future purchase, I'm encouraged by this new partnership:

The Company and its partner will focus on developing a new appliance that will produce a single cup of high quality coffee using Strix's patented technology, in particular benefitting from Strix's knowledge and expertise in relation to temperature accuracy and method of water dispense.

Sounds great! The partner is a "leading global consumer product company" - that's a bit vague, but we can imagine who it might be in terms of major coffee companies.

Strix has primarily been associated with kettle controls for tea production. This could prove to be a super strategic move into a new market. The StockRank is 88.

It has barely been listed a year, so "IPO risk" might be the main thing to worry about.

Crawshaw (LON:CRAW)

- Share price: 2.9p (-53%)

- No. of shares: 113 million

- Market cap: £3 million

The share price for this chain of butchers has the bad habit of halving.

I've been keeping an eye out for its updates, for the slim chance that it turns around.

Trading remains "challenging":

Rising shop rents and high business rates along with lower footfall and increased discounter competition, has directly impacted sales and profitability as expected. Half year like-for-like sales were -13.2% (-12.9% for the first 20 weeks).

Sounds like it just can't compete with discounters, and the external environment is awful.

And we have another example of the prior year comparative being conspicuous by its absence.

Underlying operating loss for the full year is estimated to be c. £3 million. The prior year's result, I have checked, was an underlying operating loss of £2 million.

This underlying loss keeps getting worse every year.

Cash at the end of July was £2.9 million, so perhaps it can carry on through the end of the year without needing to be recapitalised? There being no signs of a turnaround, I intend to cease coverage of this share from now on.

Orosur Mining Inc (LON:OMI)

- Share price: 2.45p (-21%)

- No. of shares: 118 million

- Market cap: £3 million

This is one of the very few mining companies I took an interest in. At one point, it had great free cash flow and was promising to pay dividends.

Its most important site, in Uruguay, is now ceasing production. It has run out of high-grade ore and is uneconomic at current gold prices.

In Chile, it has ceased all operations.

In Colombia, it is trying to finance some explorations.

Management have always appeared highly competent from an operational point of view, and have acted decisively in recent months as the company's luck has run out.

At the end of the day, however, they never paid a dividend. All the company's cash got ploughed back into speculative projects. Balance sheet equity has now been reduced to a pittance.

Game over, sadly.

All done for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.