Good morning, it's Paul here.

Due to jet-lag, I'm up bright & early again, ready to get cracking when the 7am RNS springs into life! As usual, please feel welcome to add your comments on any interesting announcements below.

I was adding this section below to yesterday's report, then decided to move it to today's so that more people see it.

Continuing my macro thoughts earlier this week, here is a summary of recent, detailed outlook comments from Next plc. This is not a small cap, but it provides unique commentary and transparency, which is of wider importance to the sector, and economy as a whole. Hence why I report on Next.

Commentary from Next (LON:NXT)

(at the time of writing, I hold a long position in this share)

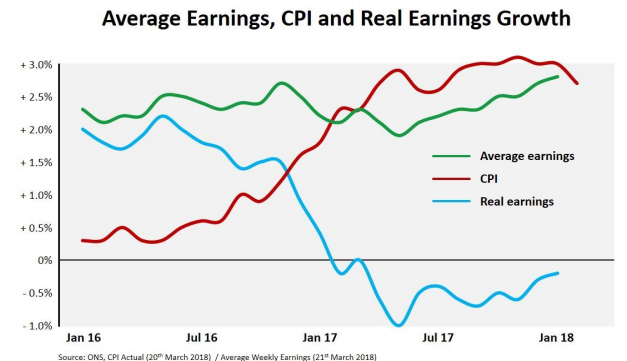

Earlier this week, I outlined here my current macro view - which is that I see reasons for a degree of optimism later in 2018, particularly as the squeeze on UK real incomes appears to be coming to an end.

Belatedly, I've been reading the utterly brilliant commentary which retailing bellwether Next plc produced on 23 March 2018. The version with colour charts is here. It makes fascinating reading, and if you get a moment, I strongly recommend reading at least sections 2 & 3.

Here are a few key points;

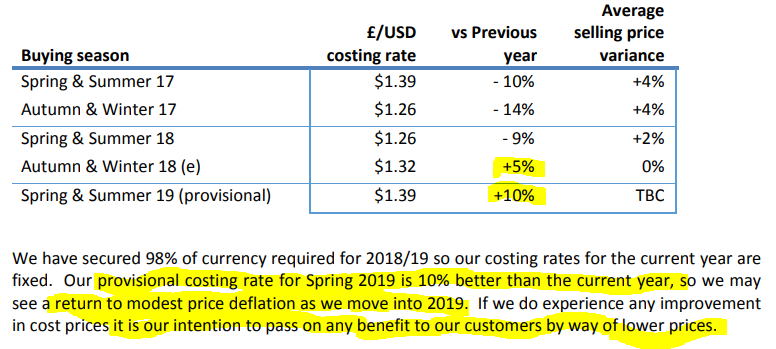

1) Currency is now becoming helpful - and should drive price deflation in 2019 - which could also feed through to better LFL sales, although Next doesn't mention that;

2) Real incomes should stop falling;

Outlook for Real Income in the Year Ahead

It appears that the easing of inflation in our own sector is being reflected in the wider economy, as other sectors benefit from stabilising currency rates. If that is the case and average nominal income growth remains at current levels, then we should expect to see little or no decline in real incomes during 2018.

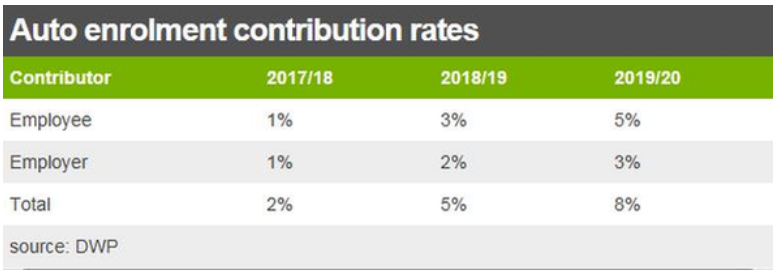

EDIT - Many thanks to reader "dfs12", who points out in the comments section below, that big hikes in contributions to auto-enrolment pensions look set to take a bite out of disposable incomes. I've just googled this issue, and the increases are indeed quite steep. Here's a graphic from a BBC article today;

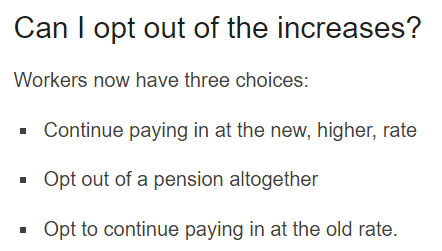

To gauge the impact of this, the key data is to find out what level of take-up there is for these pensions? Given that people can opt out, I wonder how many people will actually want to pay into pensions? Many younger people I talk to haven't even considered a pension, and see them as a bit of a con.

This is also from the BBC article;

(End of edit)

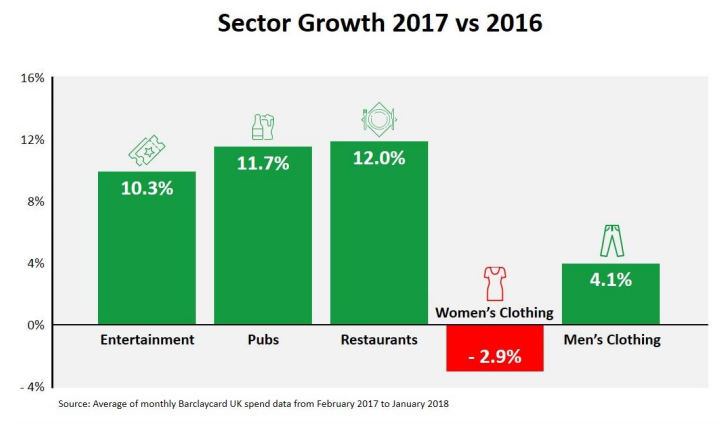

3. Sectorial shift in consumer spending patterns

This data below is from Barclaycard, so has probably been boosted by a tendency for consumers to use contactless cards in preference to cash. Nevertheless, the shift away from clothing is remarkable;

At the moment, people are seeking experiences rather than objects.

Interestingly, Next believes this is cyclical, and at some point should reverse. But it doesn't see that happening in the short term necessarily.

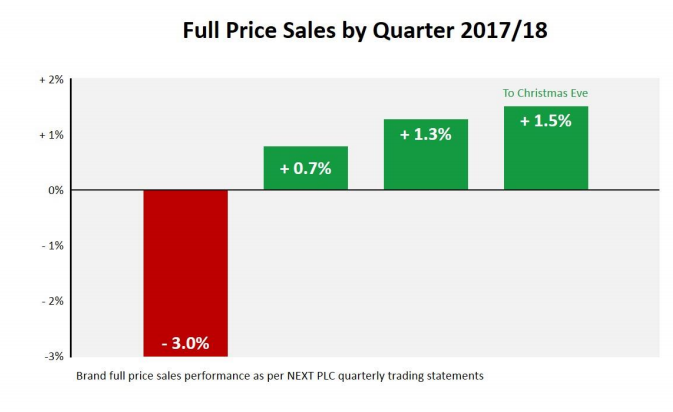

4) Weak Q1 & Q2 last year = soft comparatives for this year

Self-inflicted problems last year (gaps in their product ranges) gives an opportunity to report stronger LFL sales this year. Mind you, the terrible weather in Q1 this year will have negated that, I imagine. However, Next looks set to report stronger figures in Q2 - which could be a good reason to be more optimistic for the share price as this year progresses.

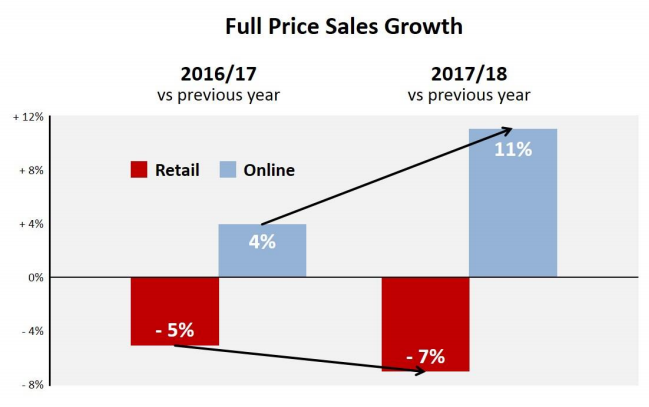

5) The shift towards online sales is accelerating;

It's a good thing then, that Next is an accomplished online retailer. This is taking up most of the slack from its declining sales in store.

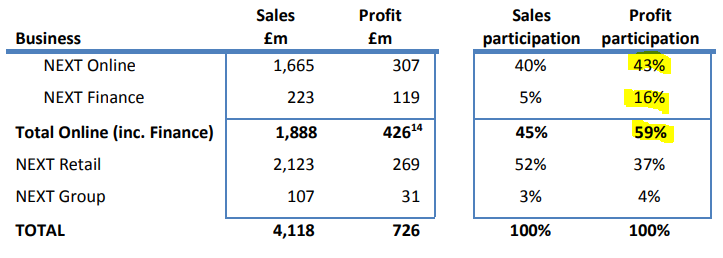

Many people may not be aware of this, but Next now makes more profit online, than it does from physical stores. Note also the significance of its consumer credit division;

This trend is set to continue. Next's current year forecast a further drop in retail profits of £74m, and a rise of £61m in online profits. However, this is based on an extremely pessimistic forecast of -8.5% LFL sales fall in stores. I think there could perhaps be an upside surprise on that figure.

6) Lower rents are happening

As I've mentioned previously, High Street & shopping mall rents have to come down, by a lot. This is the only major cost which can move down significantly, unless shops start using robots instead of humans (which can't be ruled out, longer term).

Next says that its net rents are reducing by 28% on lease renewal. Plus landlords are funding the bulk of store refits too. Average new leases are only 7 years (whereas not long ago the standard term was 15 years).

So the commercial property market is clearly undergoing major changes. To reiterate, this is definitely not a good time to be investing in REITs which own shopping malls. The rents, and hence capital values, are coming down considerably. Hopefully the inflexible 5 year upward-only rent review system is also coming to an end, as it's simply not fit for purpose any more. To avoid bankrupting their tenants, landlords are going to have to be a lot more flexible in future.

7) Next's store portfolio will not become a liability

The skill with which Next is managing down its lease liabilities is outstanding. It has once again shown figures which demonstrate how, even in extreme conditions of -10% LFL sales compounding for the next 15 years, it could exit from its stores portfolio with ease, and little cost.

I don't believe sales falls of that magnitude are likely, so in my view there is upside potential here. The High Street won't disappear, as clothes shopping is a leisure activity which many people still enjoy.

As Next indicates in the section called "stress test", the impact of the declining High Street should be at least partially offset with lower rents.

8) Developing online sales

Lots of information is given on this. There are a number of initiatives that I really like. In particular, Next plans to merge its inventory management between online are stores. It amazes me that this hasn't been done before. Currently it dispatches all customer online orders from the central warehouse. In future, the computer system will check first to see which stores have excess stock, and give a specific store instructions to dispatch the item(s) to the customer from its surplus stock. The customer is also given the option of being able to collect the item from their nearest store within 1 hour of placing the order. This should help manage overall inventories much better, fulfilling more customer orders (fewer out of stock problems), and should also reduce the amount of discounting needed at end of season sale time. Clever. Obvious, but still clever.

There are lots of other clever initiatives, including the introduction of RFID tages onto all stock, which should greatly speed up the weekly in-store stock count.

Overall

I'm so impressed with all of this, that I've decided to dip my toe back in, with a recent fresh purchase of Next shares. It is clear that Next is successfully morphing into an online fashion business. The retail stores are being skilfully managed, so should not become a liability.

There's no overall net debt, because the store card receivables book is greater than the group's other debt.

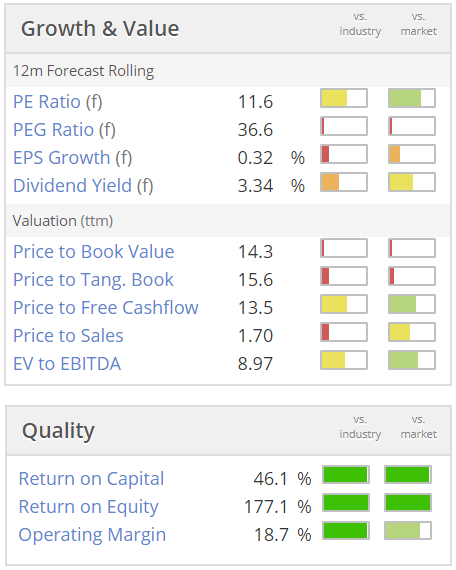

This is undoubtedly the best managed fashion retailer in the UK, and has been for many years. Yet you can pick up the shares on a forward PER of just 11. The share buybacks have resumed in earnest, so EPS should begin rising again, even if profits just remain static. I also think there's potentially quite good upside on the current year forecasts, which don't seem to factor in any benefit from improved product ranges.

Why buy any other retailer, when you can get the best one at this attractive valuation?

Stockopedia agrees, with a "Super Stock" style, and a StockRank of 96.

Just look at the quality scores below!

Treatt (LON:TET)

Share price: 410p (up 1.0% on yesterday's trading update)

No. shares: 57.5m

Market cap: £235.8m

Treatt, the manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer product industries today publishes a trading update for the half year ended 31 March 2018.

I'm just re-reading previous coverage here of this share, to refresh my memory. I last looked at it here in May 2017, on publication of impressive interim results. At the time I held the share personally, intending to keep them for the long term. However, I became wary of an increasingly stretched valuation, and subsequently sold them. So it's not one I currently hold, but is on the watch list, as I like the company. I think it was talk of a possible equity raise, to finance large capex, which spooked me a little.

I've just noticed that the company did a placing to raise £21.6m (pre costs) in Nov 2016, at 410p per share. That's a useful strengthening of the balance sheet, which I like.

Graham wrote a useful summary of its trading update, here on 2 Oct 2017, and seemed to like what he saw.

Moving on to yesterday's update, things seem to be going well;

The Board is pleased to confirm that following a strong result for the financial year ended 30 September 2017 in which profit before tax increased by 46%, the business has continued to perform well in the current financial year with revenue for the six months ended 31 March 2018 up by approximately 11% compared to the same period in the prior year.

Echoing my comments above about Next, the forex position has reversed at Treatt too, although the £0.2m impact on H1 2018 doesn't sound material.

Taxation - Trump's recent tax cuts will be beneficial for Treatt;

... it is expected that the Group's overall tax charge will be materially lower than would have been the case under previous US tax law.

That's obviously positive for earnings, which are post-tax profits.

Outlook - is in line with expectations;

The momentum which is being delivered by the Board's Strategic Plan, with its focus on core product categories and key geographical markets, is expected to continue in the second half of the current financial year and beyond.

The Board therefore continues to believe that profit before tax and exceptional items will be in line with its expectations for the financial year ending 30 September 2018.

That sounds fine. Nothing to get excited about, but nothing to worry about either.

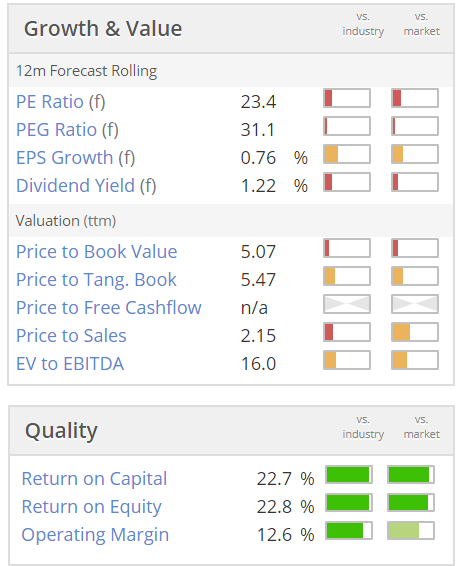

Valuation - for my personal taste, and given that we've had a big sell-off in lots of small caps recently (so there are plenty of bargains around), this looks too pricey;

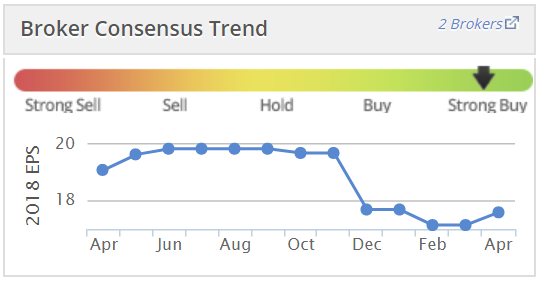

Note that broker forecasts have reduced somewhat, which partially reverses the previous trend of steady increases;

My opinion - this is a company which I regard highly, and in the long run it should prove an excellent investment. I'll probably buy back in, at some future point, but can't see any reason to rush in just yet.

Stockopedia calls it a "Falling Star", which seems a bit harsh. But there again, the computers don't know about the planned increase in capacity, so they may be missing a trick that we humans can spot!

The 2-year chart shows a wonderful re-rating in 2016-17 (along with loads of other small caps), which seems to have run its course for now;

Overall then, nice company, but the price is a bit too rich for me right now.

Motorpoint (LON:MOTR)

Share price: 234p (up 7.8% today, at 10:28)

No. shares: 100.1m

Market cap: £234.2m

Motorpoint Group PLC, the UK's largest independent vehicle retailer, is pleased to announce the following trading update ahead of its preliminary results for the year ended 31 March 2018 ("FY18").

This is a positive update, with the key bullet point being this;

The Board expects to report Underlying Profit Before Tax for FY18 at the upper end of market expectations

The only problem being, that the company doesn't state what those expectations are. On Reuters website, it shows the range as being between 16.3p to 18.6p EPS for 03/2018. So it sounds like we can bank on 18p EPS, or slightly more. That works out at a PER of 13 - cheap by market standards, but expensive for a car dealership - most seem to be on a PER of 7-8.

Is Motorpoint worth the considerable premium to other car dealerships? Possibly, as it has a different model - it only sells secondhand cars (mostly nearly-new) from large, outdoors + sheds premises. Its sites are mostly in the Midlands & North. There are other car supermarket operators, and it's a good way to buy a secondhand car, usually cheaper than from a conventional dealer.

There are other encouraging comments in the RNS, which I won't regurgitate here. It sounds like a business which is firing on all cylinders though.

Outlook - again, encouraging, and revenues/earnings should continue rising from the roll-out to more sites;

Notwithstanding the macroeconomic uncertainty, the Board remains cautiously optimistic about the UK used vehicle market and is confident that Motorpoint's flexible stock sourcing model ensures the Group is well placed to continue to grow market share.

The Group continues to evaluate opportunities for its 13th retail site, with a pipeline of new site options under review.

"We had a good end to our financial year and are pleased that our strong first half trading performance continued into the second half of the year, as we gained further market share across our sites.

"Motorpoint operates a compelling proposition and is well placed to continue building on the competitive advantages of its unique model. With four sites under three years' old and a number of potential new sites currently under review, we remain excited about the Group's prospects and the Board looks to the future with confidence."

Balance sheet - I've had a quick look at the last (interim) balance sheet, and it's not very strong. The business relies on borrowings to fund its inventories.

Net assets was only £19.9m when last reported at 30 Sep 2017. Therefore I question the wisdom of the company's share buyback policy. To my mind, companies should only buy back shares with surplus capital, which this company does not have. Management might rue this decision when the next recession kicks in, and borrowing facilities tighten up.

My opinion - overall, I like the business model of car supermarkets. It's a pile it high & sell it cheap type of business, with low overheads. That makes a lot of sense. There are not really barriers to entry, and there is competition. The stock turn with this type of business is usually quite rapid, so falling secondhand car prices shouldn't really matter, as stock comes in & out in about a month.

It's a pity I missed the two dips in share price last year, which would have made a decent purchase. I'm not inclined to chase it any higher now, so will pass. The current price looks justified though, after a decent update today, and positive outlook.

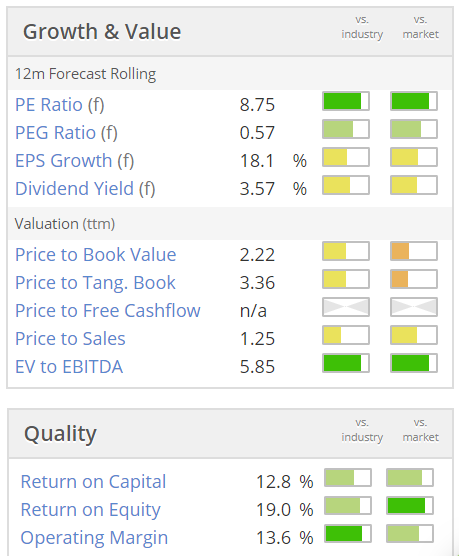

Note the StockRank of 90 is very good.

VP (LON:VP.)

Share price: 866p (up 5.6% today, at 11:46)

No. shares: 40.15m

Market cap: £347.7m

This is an equipment rental group, which operates in various niches.

It's an in line update;

The Board anticipates that the Group will report full year results for the year ended 31 March 2018 in line with current market expectations.

Other points;

The UK division has experienced consistent demand from its key infrastructure, construction and housebuilding markets.

... we have been working closely with the Brandon Hire team on the integration of the business within the Vp Group, a process which has started well.

Within the International division, the offshore oil and gas sector has remained challenging, whilst our Asia Pacific based test and measurement business has continued to perform well.

One of our regulars, gus1065, has posted a neat summary of the risk:rewards of investing in equipment hire companies, comment no.6 in the comments below. Good points, thanks gus!

My opinion - VP has always struck me as one of the better managed hire companies. The track record is excellent, and the balance sheet doesn't seem stretched (unlike say the car crash that HSS Hire (LON:HSS) has always been).

It looks cheap on a PER basis, and you also get a c.3.5% dividend yield.

The trouble is, looking at the chart, after a cracking re-rating in 2013, it hasn't really done much since. That's during a time when there have been plenty of opportunities to make double, or triple your money on other shares.

My concern is that ultra-low interest rates for 10 years, has led to over-investment in numerous sectors. Equipment hire could eventually turn out to be one of them, I don't know. These companies are very cyclical, and earnings tend to collapse in recessions. Therefore, I wonder whether this is the right time to be buying into this sector?

Having said that, if I did want to buy into this sector, then I think VP would probably be my top pick.

Right, that's me done for today, and the week. Sorry I didn't get round to looking at Next Fifteen Communications (LON:NFC) but I've run out of mental bandwidth now, so have to leave it at that.

Have a smashing weekend all!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.