Morning folks,

Today's report covers:

- Mello

- Innovaderma (LON:IDP)

- Games Workshop (LON:GAW)

- Charles Taylor (LON:CTR)

- Castings (LON:CGS)

- Scottish Mortgage Investment Trust (LON:SMT)

Mello London

Let me remind you once again that Mello London is coming up next week, on Tuesday and Wednesday.

Many companies which get covered in this report will be there, e.g. Creightons (LON:CRL), PCF (LON:PCF), Franchise Brands (LON:FRAN), UP Global Sourcing Holdings (LON:UPGS), Ideagen (LON:IDEA). And for the first time, there will be a presentation by IG Group (LON:IGG). (Disclosure: I'm long CRL, PCF, IGG!).

I'll be speaking three times at the event (don't know why I do this to myself!):

- Tuesday at 11.30, Mello Theatre - Small Cap Value Report for Stockopedia

- Tuesday at 14.00, PrimaryBid Room - "IFRS 16, what it means and how to use it!"

- Wednesday at 16.50, Allenby Room - "Crash-proof: Investment strategies for recessions & bear markets" for Cube.Investments.

Mello conferences are terrific networking opportunities and are unique in the calendar of investor events. I'm sure many of you are already planning to be there, but perhaps this reminder will help to nudge one or two more people to go!

This has been a big year for movies - with Once upon a Time in Hollywood by Tarantino and The Joker already. Tonight, I'll be there for the opening night of The Irishman.

It's reportedly 3 hours and 30 minutes long - I already feel bad for anyone who orders a large Coke with their popcorn.

Final list:

- Innovaderma (LON:IDP)

- Games Workshop (LON:GAW)

- Charles Taylor (LON:CTR)

- Castings (LON:CGS)

- Scottish Mortgage Investment Trust (LON:SMT)

Innovaderma (LON:IDP)

- Share price: 63p (-1%)

- No. of shares: 14.5 million

- Market cap: £9 million

I covered this share recently (on Wednesday).

On that day, its share price fell 9% to 72p despite an "in line with expectations" trading update.

I did a bit of digging, and found a few additional reasons to be wary - huge insider selling and accounting practices which looked to be on the aggressive side.

It didn't smell right, and I continued to stay away from the shares despite a very "cheap" valuation and good operational progress.

Yesterday afternoon, the day after the AGM, we got two new RNS announcements, shedding light on the situation:

Directorate Change - the founder and former Executive Chairman, Haris Chaudhry, who has been a big seller of shares, "informed the Board of his decision to leave the Company with immediate effect".

Browsing the bulletin boards, I've seen a lot of negative attitude toward this individual, although I'm not entirely sure why - perhaps the sliding share price is the main reason?

In an interview with Proactive Investors yesterday, the new Executive Chairman (previously the FD) says:

"We as a Board were aware that Haris had got to a point in his lifecycle that he wanted to move on and do other things... Haris, as an entreprenur, knows when he makes his mind up, and then things happen. He's a visionary, he likes to move on".

Director/PDMR Shareholding - Mr. Chaudhry dumps 4.1 million shares (c. 28% of the company) at an average price of 52p.

My view - if Mr Chaudhry simply wants to move on for personal reasons and to found his next company, then this suggests that the shares might really be undervalued at current levels. Whenever someone sells for reasons not based on the fundamentals, this can create a lovely buying opportunity for others.

The problem is that nobody knows more about Innovaderma than him, and he seems to have been desperate to sell out, quickly, and for nearly any price. Before his tsunami of shares hit the market, and before the in-line trading update, the share price was not far off 80p.

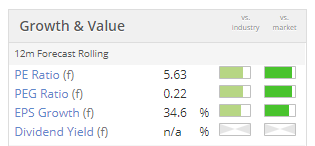

Here's a reminder of how cheap the shares are, versus forecast earnings:

My primary objection to IDP's reported earnings, as discussed on Wednesday, is its capitalisation of customer acquisition costs. This seems out of line with what a conservative accounting treatment would do. The new Executive Chairman, who will have been responsible for this accounting treatment, makes an unprompted reference to the issue in yesterday's interview:

The business spends a lot of money on online marketing, cost to acquire customers. We do put a part of our efforts into acquiring customers as a comparison to acquiring sales, and hence we treat that appropriately. But it's in no term a reflection of how we operate. We're a really solid, well-constructed business.

I appreciate this attempt to make a defence, but it's unfortunate that there wasn't more time to get a more detailed explanation.

For now, I think investors would be wise to adjust eanings for a more conservative treatment of customer acquisition.

If we write down earnings to expense the online marketing costs, instead of capitalising them, then I suspect that the current valuation is not that far off fair value (e.g. high single digit or low double digit forward earnings multiple).

If that's true, it would in turn would explain why Mr. Chaudhry didn't hate selling shares at 52p. It would also explain why he was so happy to sell them last year at between 132p - 150p.

IDP shares might be at fair value now, with fairly-priced upside potential if it hits forecasts. I wouldn't mind buying a few shares at this entry point, but am in no hurry to open a position.

Games Workshop (LON:GAW)

- Share price: 5085p (+13%)

- No. of shares: 32.5 million

- Market cap: £1,653 million

(Disclosure: I have a long position in GAW, as of today.)

This is too big for the small-cap report, but it attracts a lot of interest (and rightly so).

As an aside, I've been thinking about deliberately targeting companies with unusually large share prices for investment. Companies with unusually large share prices tend to be those which:

- don't dilute their shareholders

- have generated high returns, historically

- don't care very much about the liquidity of their shares (otherwise they might do a stock split).

All of these traits suggest that they might be excellent long-term investments. Recall that the highest-priced ordinary share in the world is the Berkshire Hathaway 'A' share ($BRK.A), which is currently priced at $333,860.00. I've had to make do with $BRK.B in my personal portfolio.

Here are the top 12 most expensive shares in the UK. I'm inclined to bet that a "dumb" portfolio of these shares would outperform the index, over a 10-year period:

- Lindsell Train Investment Trust (LON:LTI) (run by one of the best UK investors)

- Personal Assets Trust (LON:PNL) (I really like their portfolio)

- Spirax-Sarco Engineering (LON:SPX)

- Flutter Entertainment (LON:FLTR)

- DCC (LON:DCC)

- AstraZeneca (LON:AZN)

- London Stock Exchange (LON:LSE)

- Ferguson (LON:FERG)

- Next (LON:NXT) (disc: long)

- Reckitt Benckiser (LON:RB.)

- Intertek (LON:ITRK)

- Games Workshop (LON:GAW)

Anyway, that's enough fluff. I need to get back to the GAW update, but there's not too much in it:

...trading to 3 November 2019 has continued well. Compared to the same period in the prior year, sales and profits are ahead. Royalties receivable are also significantly ahead of the prior year driven by the timing of guarantee income on signing new licences.

Our preliminary estimates of the results for the six months to 1 December 2019 are sales of not less than £140 million and profit before tax of not less than £55 million.

Last year, in H1, the company reported sales of £125 million and PBT of £40.8 million.

This gives us a lovely example of operational leverage: revenue is forecast to increase by £15 million in H1 this year, and PBT is up by almost the same amount.

Or to put it another way, H1 revenue is forecast to increase by 12% while H1 PBT is forecast to increase by 35%.

My view

As you'll have noticed from the disclaimer, I decided to buy into GAW today. It's a small starter position, for 1% of my portfolio.

As far as I can see, the major risk here is that which faces non-shareholders: what if the company continues to perform well, earning huge returns on capital (ROC = 75% according to Stocko) thanks to its royalty income? It has truly unique intellectual property and no obvious substitute products.

I've been watching it for a good while and always felt like I had missed the boat. See my coverage all the way back in December 2017.

But even after so many years of financial success, GAW's valuation has not stretched to outrageous earnings multiples: even if H2 is weaker than H1, due to the timing of royalty income, the company could still generate an impressive after-tax profit which would justify a £1.7 billion market cap.

Looking ahead, if royalty income continues to grow, this is more pure profit for GAW which requires little (if any) additional investment.

Stocko correctly values it as a High Flyer. It doesn't see much value, but this is partly due to expensive Price/Book and Price/Sales ratios. I'm happy to ignore those ratios for this particular share.

It's a nice feeling, to finally be on board with this share, even if my initial stake is very small. As I grow more familiar with it, I might increase position size.

Fingers crossed that GAW can have a good year, and that my buy is not the equivalent of a bell ringing at its peak valuation!

Charles Taylor (LON:CTR)

- Share price: 351.8p (+10.6%)

- No. of shares: 78 million

- Market cap: £274 million

Increased recommended cash offer

Well done to anybody who is still holding this, even after the 315p offer.

The offer has now improved to 345p.

There is still a bit of optimism about, as the share price reached as high as 360p this morning. It's still trading above the revised, higher offer.

Background from today's RNS:

Following publication of the Scheme Document, Charles Taylor received a renewed approach in respect of a possible offer from one of such parties at a higher price to the Original Offer Price.

So there is at least one other bidder who is happy to pay more than 315p.

Will this bidder come back at 350p-360p, perhaps? It's impossible to say, but it's another example of the rule that the best thing to do, as a shareholder, is often to do nothing. Simply identifying and buying good companies, and then letting events play out over time, is a solid strategy.

Castings (LON:CGS)

- Share price: 386p (+2%)

- No. of shares: 43.6 million

- Market cap: £168 million

Some nice progress by this heavy industrial company (consisting of two foundries and a machinist in the East Midlands).

H1 PBT has improved from £5.77 million to £7.34 million.

Foundry operations continued to perform well, while the machinist flipped from a loss to a small profit.

Outlook statement is mixed:

The commercial vehicle sector has reported a decline in order intake in Europe. Accordingly, we have seen a reduction in schedules from this element of our customer base, which represents 70% of group revenue.

The focus in the foundry businesses continues to be on productivity improvements within the production processes and the completion of the automation of finishing processes. We expect to see the benefit of this during the remainder of the current financial year and into 2020/21.

My view: a solid business (in all senses of the word), with an impressive cash pile (£26 million) and an attractive dividend stream. It deserves its StockRank of 90.

Due to the nature of what it does, it won't ever produce Games Workshop-like returns on capital. But if it continues to churn out returns in the region of 10% (as reported by Stocko), then I guess investors will be satisfied.

I don't know about you guys, but I've had a significant return on my portfolio since the beginning of October. Anecdotally, some of my friends are in the same boat. Things got way too cheap during the run-up to Brexit day, didn't they?

Big winners in the portfolio since the beginning of October:

- PCF (LON:PCF) +37%

- Goco (LON:GOCO) +25%

- Creightons (LON:CRL) +22%

- Record (LON:REC) +14%

- IG Group (LON:IGG) +9%.

Only two of my holdings have fallen by more than 10% during this period (Tandem (LON:TND) minus 11% and DP Eurasia NV (LON:DPEU) minus 23%). Luckily, they are two of my smallest positions.

Keeping your safer positions larger, and your more speculative positions smaller, is a simple way to manage risk in this business.

Scottish Mortgage Trust

On that point. Scottish Mortgage Investment Trust (LON:SMT) (managed by Baillie Gifford) produced its half-year report today.

Baillie Gifford is one of the largest investors in Tesla ($TSLA) and is also an investor in Elon Musk's "Space Exploration Technologies" (SpaceX).

Some of SMT's holdings are incredibly "racy" and speculative (e.g. the Chinese electric vehicle company, Nio).

But its top 10 holdings account for less than half of its portfolio value, and it has held nearly all of these major positions for more than 5 years.

While I would wonder about the fundamental analysis which might have justified a few of SMT's positions, and would worry about some of them surviving over the next few years, I respect the portfolio's contruction. A few big winners in its diversified list of long-term holdings could more than offset the damage caused by a few failures. In particular, I note that Amazon ($AMZN) is its largest holding.

All done for today. Have a great weekend, and I'll see some of you on Tuesday!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.