Morning,

Paul added some additional companies to yesterday's report, so it now covers:

- Lamprell (LON:LAM)

- James Latham (LON:LTHM)

- ST Ives (LON:SIV)

- On The Beach (LON:OTB)

- HML Holdings (LON:HMLH)

It's at this link.

Cheers

Graham

Purplebricks (LON:PURP)

- Share price: 356.6p (unch.)

- No. of shares: 273 million

- Market cap: £973 million

Purplebricks adds Feefo to customer review choices

This online estate agency has had a few issues with customer reviews.

Allagents suspended its reviews of Purplebricks in September, with the following notice:

Due to repeated threats of legal action forcing the removal of content and negative reviews from our website, we have regrettably taken the unprecedented step in suspending the PurpleBricks profile page until further notice (as of the 18th September 2017).

This was a huge red flag for me (see SCVR here).

Today, Purplebricks announces a new initiative which is supposed to ease concerns on the review front:

Purplebricks Group plc ('Purplebricks' or 'the Group') is pleased to announce a new partnership with customer review site Feefo, providing customers with even more opportunities to review the Purplebricks' service.

Feefo is widely regarded as being transparent, independent and secure, and is trusted by consumers as a vocal advocate of honesty in the reviews industry. It is only available to genuine customers, who are provided with a unique review link, ensuring only authentic reviews.

This all looks like suspiciously too much effort to me.

Fake reviews and bad reviews are a hazard to every company, not just Purplebricks. What makes Purplebricks different that it needs to pay a special company to verify its reviews?

As to the claim that Feefo "is widely regarded as being transparent, independent and secure, and is trusted by consumers as a vocal advocate of honesty in the reviews industry".

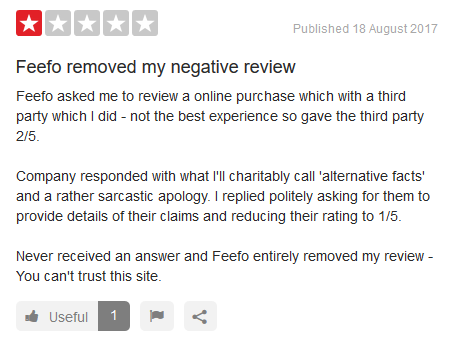

The funny thing about that that is, that Feefo itself has been reviewed by 39 people on trustpilot. See for yourself at this link. It is rated as "bad".

Examples:

There is a 5-star review from someone who reckons that the poor reviews are by trustpilot themselves, trying to do in a competitor.

I wouldn't rule that out, in the same way I wouldn't rule out the conspiracy theory that Purplebricks was unfairly treated on Allagents, and targeted by its rivals for bad reviews.

But in general, it is safer to assume that reviews are poor when products are poor. For now, I'm going to assume that the products are poor.

Games Workshop (LON:GAW)

- Share price: 2105.5p (+7.5%)

- No. of shares: 32 million

- Market cap: £676 million

Games Workshop, creator of Warhammer, has a fiscal year ending in May. So the H1 period has just ended, and it issues a H1 trading update. Results are in line with expectations.

Preliminary estimates indicate sales of c. £109 million in the first six months of 2017/18 and an operating profit of c. £38 million for the period.

Over the first half we have seen sales and profit growth in all channels in constant currency terms with the momentum continuing throughout period. These results are in line with expectations for the year ending 3 June 2018 although the Board is aware that it is still early in the 2017/18 financial year.

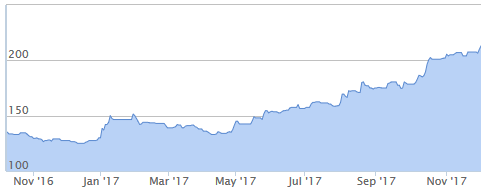

The share price has more than trebled this year, thanks to a surge in momentum flowing from newly-released kit.

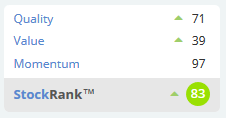

In August, Ben Hobson published a nice article showing how the company evolved from a value play to a "super stock"!

The company has a huge gross margin of c. 70%. Combine this with the largely fixed expenses of running a portfolio of physical stores, and you get a turbo-charged increase in operating profit from incremental sales.

Warhammer ran a huge and highly successful summer campaign this year.

And it's important to note that the product release cycle is somewhat lumpy. Customers can buy a piece of kit and enjoy it for six months, and then its up to Games Workshop to motivate new purchases with an update to the storyline and new characters.

So brokers are forecasting that profits will dip over the next few years. They reckon it will be hard for the company to match the huge performance this summer.

I can see forecasts for pre-tax profits of £65 in 2018 million, then £55 million in 2019, and £58 million in 2020.

That said, there is no denying the uniqueness of the franchise.

When I was a teenager, the choice was to play either Warhammer or Magic: The Gathering (owned by Hasbro, $HAS). I never played Warhammer, but it was a close run thing!

Clearly, some people continue to play these games long after their teens. They have an enduring appeal.

As Paul has pointed out, Games Workshop (LON:GAW) shares have appreciated mostly due to earnings upgrades, and not due to multiple expansion.

So they are arguably still "cheap", but bear in mind that unless another amazing new campaign is launched, there is unlikely to be much earnings growth for the next few years.

But for a long-term buy-and-hold, given the strength of its reputation (and the loyalty of its fans), it looks reasonable to me.

£RM2

- Share price: 2.625p (-16%)

- No. of shares: 407 million

- Market cap: £11 million

Update on trading and financial position

This is a pallet designer which I called as a sell/avoid earlier this year. I do occasionally get things right, as it is down by over 90% since then.

In simple terms: it designed a product which has received very few orders, and it has no money with which to pay its outsourced manufacturer, who isn't going to make any of them if there is no way it is going to get paid.

On 27 September 2017, the Company stated it intended to confirm, subject to securing the necessary funding, a 12-month production forecast for its Chinese contract manufacturing partner, Zhenshi, by the end of November 2017. The Company today announces that it has not yet been able to secure the necessary funding to confirm this forecast.

It is forecast to run out of money in February, and I continue to suspect that this company has zero value beyond its quickly diminishing cash pile.

The cornerstone shareholder is a well-known fund manager - perhaps they will recapitalise it.

Premier Asset Management (LON:PAM)

- Share price: 213p (unch.)

- No. of shares: 106 million

- Market cap: £225 million

This is a mid-tier asset manager which has been listed since October 2016. The share price has done extremely well for investors so far.

Assets under management (AuM) have again increased by 22%, and are now at £6.1 billion. So the compounded gain in two years is pushing 50%.

Performance remains strong. Over 90% of AuM is above the median performance for comparable funds, and over 70% of AuM is in the first quartile, over both three and five years.

These types of statistic can mislead when poorly performing funds are closed or merged, but I don't think Premier Asset Management (LON:PAM) has done this.

The continued strong fund flows suggest that customers are happy. The year-end result is that £750 million (net) flowed in, a small reduction compared to the previous year.

This means inflows represented about 75% of the asset growth. It probably doesn't make much of a difference in terms of fees, but I prefer asset growth from inflows (i.e. from paying customers taking action) rather than from market movements.

These two things do tend to be positively correlated. Usually, both of them are favourable or both of them are unfavourable!

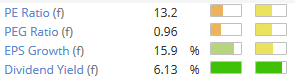

Dividends - Premier pays four quarterly dividends, with a total payout this year of 8p. The forecast yield, and other valuation metrics, are certainly attractive:

Browsing the company's list of funds (see here), we can see they are heavily income-oriented. The Chief Executive writes:

Many of our multi-asset and equity funds have income as a primary objective. Over the year, these funds have been able to grow their dividend distributions and continue to offer attractive yields against their comparative benchmarks and cash interest rates.

Given the low interest rate environment, maybe the income focus is what has helped to propel the assets under management over the past few years, as investors scramble for yield?

The only problem with this, of course, is that it's not going to last forever. If/when interest rates rise, then equities will go back to being equities, and income-oriented investors will go back to investing in bonds.

For now, though, investing in the likes of Royal Dutch Shell, HSBC, BP and Lloyds Banking Group (the top 4 holdings in the Premier Monthly Income Fund), is the most straightforward way to generate an acceptable income.

Reading through the commentary, most funds referred to are income funds of one form or another. Maybe we are at the top in terms of the demand for income funds?

Outlook statement is positive:

As always we face many challenges but we are performing strongly and believe we are well positioned for the future. We recognise that there is hard work ahead, but we have every reason to look forward with confidence.

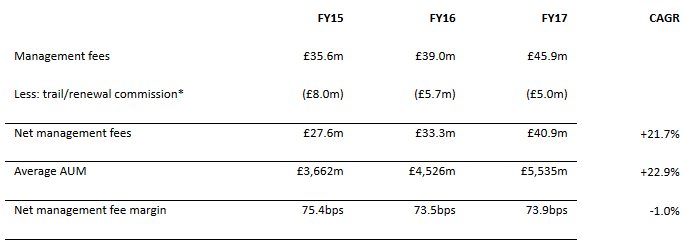

Management fees are responsible for the vast bulk of revenue, and we can see how they have evolved:

So the fees only increased by 18%, but net of commission they are up by 23%.

The impact of all the new AuM won't have been felt yet, so we can reasonably anticipate another uplift in 2018.

My opinion

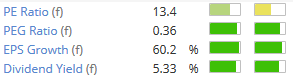

Premier Asset Management (LON:PAM) is now significantly more expensive than Impax Asset Management (LON:IPX), the other mid-tier asset management I've been writing about recently, on an AuM basis. Premier's market cap is c. 3.6% of AuM, versus 2.7% for Impax.

Impax only earned 52bps of revenue on its AuM this year, however, while Premier earned 74bps (see the table above).

What I'm struggling to understand is the niche which Premier is filling. Are customers simply hungry for something new? Is it the distribution capabilities which have powered inflows? Or is it all about the performance achieved over the last five years or so, in which case how do we know it can continue to be so good?

I don't know the answers to these questions but the company is certainly firing on all cylinders, and the shares aren't expensive by any means, relative to how it's doing at the moment. Worthy of further research.

I'm afraid that's all I've got for this week, see you next time!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.