Good morning!

Many executives and financial types are lying on a beach somewhere as I type, leaving us to soldier on without quite as many game-changing RNS announcements as we normally do.

Still, we have a couple of things worth looking at:

- Mulberry (LON:MUL) is down significantly after 'fessing up to its House of Fraser exposure (£3 million), so let's take a look at that stock.

- Countrywide (LON:CWD) has been rebuffed by shareholders after trying to introduce a new remuneration policy along with its refinancing.

- Keywords Studios (LON:KWS) has made another acquisition, so it's a good day to catch up on developments there.

Resource Stocks

There are requests in the comments for me to look at some resource stocks. Long-time readers will know that my policy is to avoid the sector. Sorry about that.

Mulberry (LON:MUL)

- Share price: 462p (-19%)

- No. of shares: 60 million

- Market cap: £277 million

House of Fraser and UK Trading Update

Another retailer comes clean on its House of Fraser exposure.

Earlier this month, Paul contributed a comment on French Connection (LON:FCCN), suggesting that its bad debt exposure to HoF was up to around £2 million (£50k at each of c. 40 stores).

Mulberry now says that it anticipates £3 million of exceptional costs, or about £140k per concession. This is a mix of bad debt, loss of value in fixed assets and potential restructuring costs. Perhaps this is a bad sign for French Connection - whose shares are down by about 3% today.

Mulberry's £3 million hit is, however, much smaller than its total decline in market cap today.

We also have a nasty trading update: the UK market remains "challenging", and if these trends continue in H2 then profit for the full year will be "materially reduced". No numbers are given, so investors are left to guess at how bad the situation might be.

My view

I've been interested in this share for a while. The problem is that it has always had such a high rating, it's been beyond the levels where I could justify a purchase.

But the share price is now at the cheapest level since 2010. Definitely helps to bring it back onto my radar!

In June, I covered the company's preliminary results statement. Excluding expansion costs in Asia, it made PBT of £11.3 million. If we assume a 20% tax rate for simplicity, this leaves us with £9 million of adjusted net income. Not bad.

The Asian expansion is critical to the long-term value of the business. I see it as potentially following in the footsteps of Burberry (LON:BRBY) (in which I have a long position), where 45% of the stores and 40% of sales are in the Asia Pacific region. Mulberry is still near the beginning of this journey.

In the short-term, the problem is the UK business (responsible for more than 80% of retail sales in FY 2018).

It had already been disclosed that Mulberry's UK like-for-like sales were down 7% for the 10 weeks to June. With today's announcement, we can presume this isn't getting any better.

Therefore despite being interested in this company, I'm not in any rush to buy these shares. I expect them to drift lower as the financial performance deteriorates in the short-term.

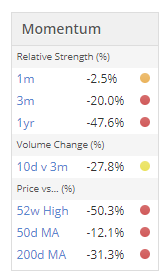

See the woeful Momentum rating (and Value is of course pretty bad, too):

The thing about Momentum is that it tends to persist for longer than people expect it to (on the upside and the downside).

So I expect there will be cheaper opportunities to buy this share as stale bulls from 2011-2013 head for the exits.

At some point in the future, it should be possible to buy this when earnings are rising, the brand is succeeding and the earnings multiple is reasonable.

One other hugely important factor is that 91% of Mulberry shares are held by just three entities.

This might help to explain the strange pricing of the company in recent years. Small investors who have wanted to participate have only been able to trade 9% of the company.

Finally, as an anecdote, I have noted that Mulberry.com is rated "Bad" by trustpilot, while Burberry.com is rated "Average", based on similar numbers of reviews. One other small reason why Burberry deserves a better rating than its smaller, handbag-focused competitor.

Countrywide (LON:CWD)

- Share price: 14.3p (-2%)

- No. of shares: 422 million

- Market cap: £61 million

Proposed Remuneration Policy and Countrywide AGP

One gets the feeling that there is lots unsaid with this announcement.

Following "constructive and supportive" consultation meetings with major shareholders, the Board has withdrawn its proposed new remuneration policy.

I've trawled through the Prospectus and managed to find details of the Aggregate Growth Plan - why not just call it a bonus scheme! It's on page 261 of the document (out of 315 pages).

According to the plan, managers:

will share among them 10 per cent. of any value created above this hurdle, which will be paid in the form of shares at the end of the performance period which must then be held for a further two years.

The "hurdle" was going to be 15% per annum compound growth in the market cap of CWD until December 2021.

It's an example of a type of remuneration policy that I hate: handing over massive chunks of value to managers on the basis of increases in the share price. We do see this type of thing all the time.

I prefer to see managers being paid well in cash for achieving proper objectives like ROCE, net income or other KPI targets.

Countrywide also follows the common practice of excluding share-based payments from the "adjusted EBITDA" it reports to shareholders. So shareholders are asked to pretend that the dilution of issuing shares to managers doesn't happen.

It's good to see that in this case, the institutions finally said enough is enough.

It looks like a poor-quality business to me, so I'm not going to research the shares in any further detail.

Housing Market

In a separate but related development, I note that the latest asking price figures from Rightmove (LON:RMV) show the fastest ever drop for the month of August.

The main source of weakness was London, where prices fell by 3.3% and are now down by 1.2% year-on-year. Prices are still up year-on-year on a national basis.

What do readers think about the outlook for the UK housing market?

For example, I thought this was a startling statistic:

The number of EU-born workers in the UK increased by 7,000 from Q1 2017 to Q1 2018, compared with an increase of 148,000 from Q1 2016 to Q1 2017.

What a big difference.

The reduced inflow of labour is said to be contributing to rising salaries and better benefits in a wide variety of sectors, as employers struggle to fill vacancies.

Won't this also have an effect on the housing market, especially in London which many migrants automatically choose as their destination?

It's a complicated issue, but I feel safe in the assumption that everyone connected to the housing industry would have a financial interest in seeing more people coming to Britain, rather than fewer.

Keywords Studios (LON:KWS)

- Share price: 1831p (+3.5%)

- No. of shares: 63.6 million

- Market cap: £1,165 million

Acquisition of Studio Gobo and Electric Square

Keywords provides outsourced services to the video games industry. We last covered it in April. It has grown via a very long series of acquisitions.

This is an up to £26 million purchase of two related companies based in Brighton and Hove.

It marks further expansion in Keywords' game development capabilities, a key focus for it at the moment.

Gobo adds considerable expertise and scale to Keywords' new and growing video game development business. It significantly increases Keywords' access to the UK's talent pool of video games developers, growing our total UK game development team to 220, in combination with our existing 50-strong team at d3t, whilst also expanding our worldwide game development team, which includes Snowed In, Sperasoft, and GameSim, by over a third to 610 people.

Gobo's underlying EBITDA for the year ending July 2018 is expected to be £3.6 million.

Keywords is paying £15 million for this upfront, and a further £11 million if there is a "substantial increase" in EBITDA over the 12 months following completion.

My view

I'm impressed by Keywords' achievements. The pace of acquisitions has been dizzying - something like twenty since the start of 2017. So far, it appears to have executed them very well.

On the other hand, I don't know why the market values its earnings so highly. At the end of the day it is just doing the work that its clients (the video game publishers) don't want to do themselves, and that they prefer to outsource.

Video game industry fundamentals are good, and Keywords does have first mover advantage and the advantage of being the largest outsourced service provide to the industry. This is definitely worth something.

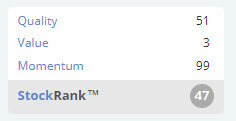

But I share Stocko's puzzlement at the pricing:

Suggestions

I appreciate all the comments/feedback! When it comes to suggestions, feel free to fire away every morning with your ideas. This is a team sport, after all.

There are no absolute rules about what we cover in the main report. In general:

- I usually don't cover resources/energy, pharmaceuticals/biotech or investment funds. I tend to focus on the financial and consumer goods sectors. Paul has his own favourite sectors (e.g. retail).

- We prefer companies in the £10 million - £400 million market cap range. Flexible on this.

- Interesting news that day, especially full-year or half-year results. Trading updates are often worth a mention, although if they only say "in line with expectations" then we will probably give them a miss.

- Companies we have written about before (i.e. that we know something about already) and genuinely think are interesting are more likely to get coverage.

- Companies which multiple readers have requested are more likely to get covered, too.

Going to call it a day there! Have a great evening.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.