Good morning!

Let's see what the RNS has in store today.

A few announcements worth commenting on:

- Keywords Studios (LON:KWS) - final results

- Impax Asset Management (LON:IPX) - AuM update

- Local Shopping REIT (LON:LSR) / Thalassa Holdings (LON:THAL)

- Totally (LON:TLY)

- Aukett Swanke (LON:AUK)

Graham

Market comment

I thought I'd take a step back for a moment and point out that the FTSE-100 is up by over 700 points this year - what a result! Up by 10.7% so far in 2019, or 12% including dividends.

During this period, GBP has actually appreciated against the US Dollar and the Euro.

So the gains have been spectactular and not caused by currency depreciation.

Also worth noting that retail fund flows have been weak/negative in the first couple of months of the year. This suggests to me that the buyers have been big, institutional money. Retail investors will follow later.

As for the rationale behind all of this bullishness, markets seem to be pricing in a long delay to you-know-what. Since big money loves certainty, I think they are taking the view that nothing is going to happen for the foreseeable future, and maybe never. As far as they are concerned, then, it's "safe" to pile in to UK equities again and return the FTSE to its pre-referendum trajectory.

Please note that this is just speculation on my part! - but I have seen broker notes expressing a lot of confidence that there will be a long delay and/or a second referendum. So I think this is what institutional money currently expects. They have been wrong before, of course!

There's also the small matter of interest rate expectations collapsing, bond yields tightening again, and other major equity markets rallying hard, too. The S&P 500 Index has gone up almost in a straight line over the past three months. According to Stocko, it's now on a (median) trailing P/E ratio of 21x and a forecast P/E ratio of 17.5.

As usual, the US markets carry a significant premium to the FTSE, whose forecast P/E ratio is just 14x.

Life has been tougher in small-caps: the AIM All-Share Index has rallied by just 7.4% year-to-date. On a long-term view it undeperforms major indexes like the FTSE-100 and the S&P500, so I suppose we shouldn't be too surprised.

For what it's worth, I'm happy with my current positioning of 91% equities and 9% fixed income, with a little bit of surplus cash on the sidelines.

Keywords Studios (LON:KWS)

- Share price: £12.955p (-1.9%)

- No. of shares: 64 million

- Market cap: £829 million

Watchers of this share will know that a lot of the air got squeezed out of its valuation in Q4 2018.

Since bottoming out in Febuary, shareholders have witnessed a rally of over 40% from the low.

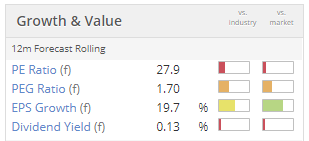

While I wouldn't go so far as to say that I'm a bear on this company, I am a bit of a sceptic as far as the valuation is concerned. It has usually traded at very high multiples, and this is true again today.

Keywords provides outsourced technical services to the video game industry, and has been created via a large,international M&A strategy. As a consequence of all the M&A, there is €154 million of goodwill on its balance sheet and when you strip out intangibles, it has tangible balance sheet value of just €12 million.

Fortunately, the earnings progression has been very good and this is confirmed again today with operating profits of €23 million (up from €16 million).

The company measures and reports its ROCE - this is something I always like to see. It reckons that it achieved ROCE of 19.4% in 2018, up from 15.8% the year before.

Note, however, that this figure is based on ignoring the effects of amortisation - these calculations can get complicated.

Show me the money!

Cash flow from operations, before working capital movements and taxes, was impressive at €44 million. I suppose this is the best and the simplest argument in favour of the company's valuation: it has a good track record of generating plenty of cash from the companies it buys.

The video games industry has strong fundamentals and Keywords enjoyed overall like-for-like revenue growth of 10.1% despite the "Fortnite effect", i.e. the difficulties experienced by all publishers who didn't make Fortnite.

The Fortnite effect was so strong that it has even been blamed on a couple of other publishers going bust, resulting in a few bad debts to Keywords.

Keywords tends to spend all the cash it generates, and more, on internal and external investments, and that was true again in 2018. Whereas in 2017 it mostly raised equity to fund deals, in 2018 the emphasis was on borrowing. Internal capex spending increased signicantly to €9.4 million.

Outlook

Key points:

- Q1 2019 performance is in line with expectations

- 2 deals done already and more in the pipeline

- Capex to reduce in 2019 (meaning that free cash flow should improve)

- "Well placed" to benefit from demand as disruptors Apple, Google and Microsoft roll out video game platforms.

My view

I have a balanced view on this share.

The negatives:

- Provider of outsourced services, not an IP owner.

- Possble disruption from waves of change in the video game industry (e.g. Fortnite in 2018, streaming services in 2019).

- A vast number of M&A transactions leading to complexity and a lot of integration work.

The positives:

- Has generally achieved what it set out to do with acquisitions over the years - excellent track record.

- Cash flow is real.

- Video games industry is undoubtedly fast-growing.

- Great international diversification.

- If the acquisition strategy works as planned, it will see Keywords cement its position as the "partner of choice" to video game publishers.

I have no plans to add this to my personal portfolio, but it is an interesting one to keep an eye on, all the same.

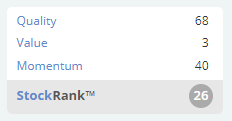

Lastly, I should note that the StockRanks aren't impressed by the lack of value or momentum on offer:

Impax Asset Management (LON:IPX)

- Share price: 240p (+2.1%)

- No. of shares: 130 million

- Market cap: £313 million

Nice work by this environmental asset manager. It grew assets under management by 4.6% of starting AuM (£529 million of net inflows versus starting AuM of £11.6 billion).

It also enjoyed a big uplift from rising markets and the net result was a 15% increase in AuM in just three months, for a total of £13.25 billion by the end of March.

This puts it back on a positive footing for the financial year after it suffered an 8% decline in AuM in the prior period, caused by the market sell-off.

My view - I still have a positive impression of this manager, and so does the market as a whole.

Having watched it do well for almost two years now, I don't hate the idea of owning a few shares in it. Fund managers need a specific area of expertise to survive in today's environment, and Impax certainly has that. So I could see myself owning shares in this at some point in the future.

Looks like it might take a year or two to grow into the current valuation (forward P/E 20x).

Local Shopping REIT (LON:LSR) / Thalassa Holdings (LON:THAL)

The battle between LSR (£23 million market cap) and Thalassa (£14 million market cap) continues.

If you've seen my previous coverage, you might remember that I hope LSR prevails.

Thalassa has just over 25% of LSR's shares, and has blocked LSR's plans to liquidate. Instead, Thalassa wants to take over LSR with an offer of cash and shares.

Latest news is as follows:

- Excluding Thalassa, 99.6% of votes cast at an LSR General Meeting were in favour of LSR continuing its efforts to liquidate, despite the obstacle presented by Thalassa and the overtures of its chairman, Duncan Soukup. A special petition may be presented to the Business and Property Courts.

- Thalassa has promptly fired back with a statement that highlights that there were many LSR shareholders who didn't vote. The Thalassa board has taken its own legal advice, and thinks the prospect of a winding-up order from the Business and Property Courts is "remote".

My view - No change, since we already knew that those LSR shareholders who use their votes (excluding Thalassa) want it to liquidate.

In my view, Thalassa is exploiting the rules in ways which aren't in the best interests of LSR shareholders as a whole, and I hope that the courts will agree.

Totally (LON:TLY)

- Share price: 12.94p (+6%)

- No. of shares: 60 million

- Market cap: £8 million

The Board of Totally plc (AIM: TLY), a leading provider of a range of out-of-hospital services to the healthcare sector in the UK today announces an update on trading for the 12 month period ended 31 March 2019.

I don't know too much about this company, but it seems to be a loss making, very low-margin provider of services to the NHS.

Why bother mentioning it? Well I imagine that some of you like to hunt for deep value among the micro-caps. Totally says that it has cash of £7.5 million in the bank (about the same as the market cap) and has won a bunch of "contract extensions, new business and pilot schemes" in the last few weeks, with a value of £7.7 million.

I don't know if the margin on these new deals is anything to write home about but perhaps someone reading this will be interested to look into it.

Please note that the Stocko algorithms consider it to be a value trap.

Aukett Swanke (LON:AUK)

- Share price: 1.68p (+1.5%)

- No. of shares: 165 million

- Market cap: £3 million

This little architectural practice remains an object of curiosity for me. I want to see if the equity will turn out to be worth more than a nominal sum, or if it will collapse under the weight of its fixed costs.

(To be clear, I don't doubt that the company does high-quality work. I am purely concerned with whether the shares are worth anything - a completely different question!)

Today, it informs us that it has a net cash balance of c. £200k, slightly improved versus six months ago. It has a £500k overdraft in place until November, so I guess it has some headroom.

A short and sweet trading update:

As trading continues to improve during 2019, in line with the guidance re-iterated in the AGM statement, the Board expects to show further improvement in the cash position by the year end.

My view - I remain extremely cautious here due to the paper-thin balance sheet and ongoing losses. See my comments in January, when I noted that tangible equity was just £1.2 milion. A loss is already baked in for H1, with hopes for profits in H2.

On the positive side, I am reliably informed that the company is enjoying its current London premises rent-free for two years, and the rent will be much cheaper after that.

If it can cut costs to the bone and enjoy a bit of luck in terms of growing the top-line, perhaps there is still hope for shareholders? Not something I'd want to bet on, I'm afraid.

The news was light today so I'm going to finish on that note.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.