Good morning, it's Paul here.

After spending the whole day on Sosandar (LON:SOS) yesterday, I was too tired to write about any other companies. So I've got up early this morning, to catch up with yesterday's other news, to get you started today.

Retail sector

I'm not sorry if a few people think I focus too much on retail here. That's my sector specialism, so that's what I lean towards & have historically made my biggest profits. Surely it makes sense for me to write about things I'm interested in, and understand best? Anyway, that's not going to change.

Also, retail has actually been a good sector for investors very recently. Buying good quality, but bombed out retail shares just before Christmas is often a very effective strategy. The market always seems to panic that Christmas is going to be a disaster, but it always happens in the end, just a bit later each year. I think Black Friday has skewed things negatively too - as canny customers hold fire on purchases in the autumn, waiting for desperate retailers to offer pre-Xmas discounts. It's a daft American cultural import, which should be sent packing in my view!

There have been excellent share price recoveries recently in some shares, on the back of a late surge in retail sales. E.g. I flagged that Superdry (LON:SDRY) looked tempting value at 380p here on 12 Dec 2018. It's now 545p - a 43% gain in less than a month, for anyone bold enough to buy on the market over-reaction to its profit warning. Catching falling knives is so difficult though, and often results in losses.

BMUS - my public portfolio

Just to defend myself on another point! Recent criticism that my portfolio (BMUS) performance in 2018 was dire, whilst true, overlooks the fact that it was spectacularly good in 2016 & 2017. Overall then, BMUS is up 155% since inception on 1 Jan 2015. Not too shabby! That excludes dividend income too. I think you'll find that beats most small cap funds & guru screens, by a country mile.

There's only really one stock currently in BMUS which has gone wrong, which is MySale (LON:MYSL) . I haven't decided what to do with that one. Realistically, knowing how my mind works, I'm just licking my wounds on it, and probably deferring a disposal. Although the market cap is now so low, that there's a decent probability of it being taken private (if the premium is OK, then that would be a satisfactory outcome in the circumstances).

As for Gear4Music, I sold those in 2017-18 between 680-800p (as disclosed in BMUS), and bought my apartment with the proceeds. So it's been a great success. It never occurred to me that the share price might fall right back down to where it started, almost. I've started buying again on the recent plunge, although not a big enough position yet to go into BMUS. Also, I have listened to bears on this, who do make a valid point that the wafer thin margins & intense competition on price, make it a less attractive business than higher margin growth companies. On the upside, its organic growth & overseas expansion are outstandingly good, and profit margins should rise once it has achieved greater scale.

Wey Education (LON:WEY) was a mistake, so I sold it. No great shakes there, everyone makes mistakes. I think if people are looking to me to be some kind of infallible guru, then you're going to be disappointed! Like everyone else, I get some share picks right, and some wrong. We're basically trying to predict the future, when we buy shares. Nobody can do that with certainty.

I don't have to update my portfolio publicly, I just do it for transparency, and because the boss asked me to do it in 2015. If it becomes a chore, and people attack me when it under-performs temporarily, then I'll just stop doing it (says he, flouncing off!)

I'll stop there, as this is pre-empting a full review of 2018, my winners & losers, and what I've learned from them, which I intend writing at some point fairly soon.

Shoe Zone (LON:SHOE)

Share price: 201p (up 12% yesterday, at market close)

No. shares: 49.9m

Market cap: £100.3m

Shoe Zone plc ("Shoe Zone", the "Company" or the "Group"), the leading UK value footwear retailer, is pleased to announce its Preliminary Results for the 52 weeks ended 29 September 2018.

Graham covered the trading update here on 15 Oct 2018, which related to the same 52 week period which is being fully reported today. Let's compare the flash figures in the Oct 2018 trading update with the actual figures today;

- Revenue expected: c.£161 . Actual: £160.6m

- Profit before tax expected: greater than £11m . Actual: £11.3m - slightly ahead.

This doesn't look good enough to have triggered a +12% share price reaction, so there must be something else positive.

Dividends - this is the main attraction of holding SHOE shares. There's a bumper payday for shareholders, with the final divi being raised a healthy 17.6% to 8.0p per share. This is on top of a 3.5p interim divi paid in Aug 2018.

Better still, the company has also announced an 8.0p special divi. This follows the previous pattern of special divis - it paid 8p in Mar 2017, and 6p in Mar 2016.

Total divis for the year are therefore a whopping 19.5p per share, yielding 9.7%

Totting up all the divis (including the 2* 8p announced yesterday) since it floated, in May 2014, it will have paid 67.1p in divis to shareholders by 20 Mar 2019. That's pretty remarkable in under 4 years.

Therefore, shareholders who bought at IPO in May 2014, paying 160p per share, will have received almost 42% of that investment back in dividends in under 4 years. Plus a capital gain at today's share price of almost 26%. That has to be seen as a considerable success, particularly for income seekers, such as retired folk.

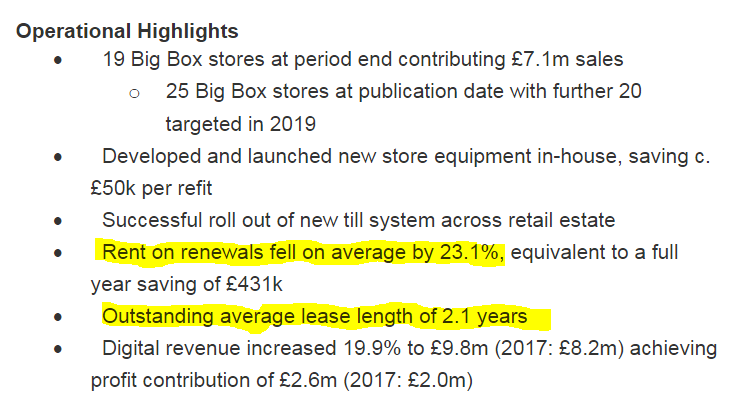

Operational highlights - I particularly like the bits in yellow - rents reducing, and very short leases, is the ideal scenario;

Outlook - we get a positive update on current trading too;

Shoe Zone has made a solid start to the year and is trading ahead of previous market expectations. We are making good progress against our strategic objectives and the Board remains positive about the outlook for the remainder of the year.

Balance sheet - is strong. Note the £6.3m pension deficit. No other issues at all, it looks fine.

Cashflow statement - is a thing of beauty! This is a lovely, consistently cash generative business. That may be surprising, but there it is.

My opinion - what an excellent report. These figures almost look too good to be true. However, the track record of paying out bumper dividends, shows that the cash generation is real.

Flexibility on leases is key here. With short leases, and relatively low fit-out costs, SHOE can relocate to cheaper units very easily. Landlords are in pandemonium at the moment, with rents tumbling, and that is definitely set to continue. In some cases, landlords are offering zero rent deals, just to get a tenant into a shop & paying the business rates & service charge. SHOE is clearly a beneficiary of this, offsetting cost pressures (e.g. wages).

The big box format seems to be going well, and is expanding.

I'd like to meet management here, as they are clearly highly entrepreneurial. They're delivering excellent results, considering how tough retail is. So definitely a long term winner, as weaker competitors will inevitably fall by the wayside.

So a big thumbs up from me, for today's figures.

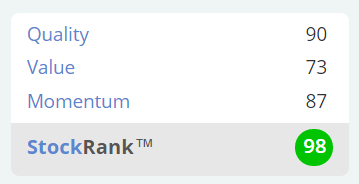

Stockopedia loves it too;

Topps Tiles (LON:TPT)

Share price: 65.7p (up 3% yesterday, at market close)

No. shares: 194.9m

Market cap: £128.0m

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 13 week period ended 29 December 2018.

Revenues - LFL sales in Q1 are down -1.4% - not great, but not a disaster either

Directorspeak - this announcement is light on specifics, but it sounds as if (by default) the business must be trading in line with expectations. Why couldn't they have said so? By not saying so, it introduces doubt in my mind;

Matthew Williams, Chief Executive Officer, said: "Against a challenging market backdrop and a strong period of performance in the prior year we believe the business has performed robustly over the first quarter.

We remain excited by both the opportunity for profitable growth that our expansion into commercial segment will bring and the continued opportunity to further strengthen our market leading position overall."

My opinion - I do like this business, and the expansion potential into commercial tile sales could be good.

There's more operational detail given in today's update, which I won't repeat here.

The dividend yield is good, at just over 5%, almost twice covered.

Fwd PER of about 10, looks about right.

Balance sheet is adequate, but not strong. Relative to earnings & cashflow, it looks satisfactory.

Very high StockRank of 94.

Overall, I'll add this to my watchlist of possible purchases once the Brexit uncertainty is out of the way. It looks a good business, that is proving resilient, both in its trading, and its share price. So worth a look.

Majestic Wine (LON:WINE)

Share price: 264p (up 5.6% yesterday, at market close)

No. shares: 72.1m

Market cap: £190.3m

This is a rather strange combination of wine retail warehouses, and an internet wine production incubator thing called Naked Wines. The idea of Naked seems to be that wine buffs are connected with producers, and can sponsor production runs of special wines. Something like that. I find it very confusing, and don't see the point of it really. So for me, it's impossible to value Naked, and therefore the whole group.

Overall performance is slightly below expectations. Maybe the share price rose in relief that things were not worse than this?

While the Christmas trading period was more challenging than expected for Retail, the Group expects to report Group adjusted PBT for the full year broadly in line with current market consensus4.

Naked remains on track, and we will continue to seek additional investment opportunities which we will execute if proven.

Hoorah for footnote 4, thank you Majestic, this is very helpful;

4) As of the date of this announcement, Majestic compiled consensus for adjusted PBT is £11.7m, with a range of £11.0m to £12.8m

Outlook - more of the same;

While trading has been challenging over the Christmas period, the trends we reported in November are the same (namely strong growth in our overseas markets and our digital propositions but headwinds for our UK Retail stores)....

My opinion - this one is filed in my "too difficult" tray. I'm not sure how to analyse, or value, this share, so it's not of interest to me.

If you do like the company, then the recent sell-off could be a buying opportunity, who knows?

The chart below looks like it might be one for the traders out there - is it ripe for a bounce maybe? Possibly.

Mothercare (LON:MTC)

Share price: 16p (up 3% yesterday, at market close)

No. shares: 341.7m

Market cap: £54.7m

Mothercare plc, the leading specialist global retailer for parents and young children, today issues the following trading update, which covers the 13 week period to January 5th 2019.

I honestly don't know where to start with this. It's a perennial turnaround situation, and it's quite amazing that the company still exists at all.

There's a nice summary from FinnCap, available on Research Tree, which covers all the main facts & figures, so I can just point you in that direction, there's not really any point in me duplicating it. Plus I'm hankering for a sausage & egg McMuffin, so would rather spend the next 20 minutes popping out to McDonalds, than regurgitating FinnCap's research note!

The crux here is whether you think there will be a business worth having after all the restructuring has completed? The problematic UK store estate is rapidly shrinking, and will be down to only 79 stores by end March 2019.

Outlook doesn't sound too bad. Although I notice it uses the word "plans", and not "profit"!

Plans for the full-year remain unchanged and in line with our previous guidance

My opinion - doesn't interest me at all. The trouble with retailers that need to drastically restructure, is that they're no longer viable formats. So even if they can shrink down to a core of just-about-profitable stores, it's arguably just prolonging the agony.

MTC's international operations have historically been very profitable, so that's the area to focus on, when doing research. Maybe there is value there, I don't know?

Great, we're up to date now from yesterday's updates.

From now on, I'll be looking at Thursday's announcements, once I've refuelled!

Good grief, there are absolutely loads of updates today, and I only have about 1.5 hours time available before having to set off for a meeting. So let's go into quick fire overdrive!

John Lewis Partnership has issued its Christmas trading update today, here.

It looks to be one of the winners, actually reporting positive LFL sales.

As usual though, competitive pressures mean margins tightening.

Heavy IT spend.

Marks and Spencer (LON:MKS) - shares have already rebounded from a recent low of 240p, to 280p last night. Today's Q3 update strikes me as reassuring. Key points;

- UK LFL sales are down 2.2%, which it calls "steady"

- Full year guidance remains unchanged

My view - is positive. Why? Just look at its cashflow statements, then you'll get it. This business remains a massive cash machine, and is paying a huge & sustainable dividend yield. The turnaround plan is the most serious to date, and store closures are proving very effective at eliminating losses, and driving a 20% increase in sales of nearest remaining store. MKS will also benefit when rivals such as DEB eventually go under, gaining market share in future.

Proactis Holdings (LON:PHD) - unusual announcement. The CEO (brought in with a big recent acquisition) is stepping down, to be replaced by the long-serving CFO, Tim Sykes, who previously seemed to me a CEO-in-waiting.

Trading update says in line with expectations.

My view - not keen, due to over-geared balance sheet. Has made too many acquisitions, and too quickly, in my opinion.

Personal Group (LON:PGH) - 2018 is "broadly in line", so a little below expectations. But ahead of 2017.

Problems include GDPR causing temporary delays in client signings, and a data security issue from 3rd party supplier which impacted client relationships.

Cautious outlook for 2019 - looks like a mild profit warning;

As a consequence, profitability is unlikely to grow materially from 2018.

I'm not keen on this sector, or company. Apparently, the reason it's called "Personal Group" is so that, when cold-calling, and asked which company they're from, it's sales reps reply, "It's personal", and usually get put through! Cunning.

Brighton Pier (LON:PIER) - the share price of Luke Johnson's bars & pier group is down 41% this morning.

Its bars division hasn't traded well over Xmas, and a refurbishment in Putney was protracted when structural issues arose.

Brighton Pier has also traded poorly. Weather, and protracted rail disruption are blamed.

Golf division (I didn't know it had one!) is trading in line.

Overall;

The Board now anticipates that, as a result of the reasons outlined above, profit before tax for the current financial year will be in the region of 18% lower than current consensus expectations.

It's good that a figure is given - why can't all trading updates do this, instead of using coded wording?

My view - it doesn't really interest me. However, with the shares now down to just 38p (it was 100p in Sept 2018), then there might possibly be some value here? Could be worth doing some more digging, possibly?

Debenhams (LON:DEB) - another big retailer whose Xmas trading falls into the "not too bad actually" bracket.

- In line with market expectations for the full year.

- Group LFL sales down -3.4% over 6 week Xmas period. Down -5.7% over 18 weeks to 5 Jan 2019.

- Cost cutting seems to be saving the day (for now), but how long can that go on for?

- Gross margin erosion from competitive pressures & canny customers

- Net debt of £286m at 5 Jan 2019 (almost certainly a seasonal best)

- Biggest issue - need to refinance bank facilities in next 12 months

- Needs to strengthen balance sheet

My view - this group clearly needs to restructure, to ditch its long lease liabilities. I think that makes some kind of insolvency procedure almost inevitable - CVA or prepack. Therefore existing shares are probably worth nothing.

Quartix Holdings (LON:QTX) - a highly cash generative telematics company.

- Says 2018 traded in line

- 2019 also expected to be in line with latest forecast

- Supplementary divi to be paid, due to strong free cashflow

- Expansion in USA & France going well

- UK performance improved in H2

My view - a very nice, cash generative company. The fwd PER looks a bit pricey at 22, but the positive tone of today's update could see broker forecasts rise as 2019 proceeds. I like it. Shares could recover, if earnings growth returns.

Card Factory (LON:CARD) - this is the hugely profitable (amazingly high net profit margin) retailer of greetings cards & associated items. I'm surprised share price dropped this morning, as the update reads quite well to me, given poor High Street footfall.

YTD LFL sales basically flat, at -0.1% - a creditable performance

Still rolling out new stores - 51 new ones opened in 2018, which is offsetting reduced profits from existing stores

Profit expectations unchanged;

Board's expectations for underlying EBITDA for the full year remain unchanged at £89m - £91m

Outlook - FY20 will be another difficult year - well, what did people expect?! Hardly a surprise.

EBITDA expected to be "broadly flat" in FY20.

My view - main attraction is the sustainable, high dividend yield of almost 8%.

Fantastic profit margins, so this will be a survivor in the High Street, long term.

Like SHOE, NXT, and MKS, I see CARD as a good stable company, paying great divis, which shows every sign of being one of the winners from the current High Street carnage. Remember rents will be going down over time, helping offset other cost pressures. Worth considering.

Indigovision (LON:IND) - (can't remember if I hold any of these, there might be a scrap of them somewhere in one of my accounts) - there's life in the old dog yet!

- 2018 sales up 9% to $45.9m

- Positive trend on gross margins

- Significant reduction in operating loss in 2018 - that's all very well, but it would be better to be making a profit

- Net cash $2.0m

- Talking to lenders to replace RBS overdraft facility, which expires on 28 Feb 2019 - cutting it a bit fine

My opinion - neutral. I've long since moved on! (financially, and mentally)

Tesco, Halfords & B&M have also reported today, I won't look at those, as no time, and they don't interest me.

I might come back to look at Halfords (LON:HFD) this evening or tomorrow, as I see its shares are down 18% today, so must be a profit warning.

Right, gotta dash! Have a good day.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.