Good morning, it's Paul here.

This is a placeholder article, for readers to post your comments & reader requests (small caps please!) from 7am. Then I will be updating the article throughout the morning & early afternoon.

Good morning properly! Thanks for your comments posted so far today. I'll have a look through those in a moment, and make a list of the small cap shares that readers want me to look at. I see that Interserve (LON:IRV) has dropped 31% on another profit warning, so that's already on my list of things to look at.

Here's the link to yesterday's report, in case you missed my afternoon updates on Foxtons (LON:FOXT) and Flybe (LON:FLYB) .

Zytronic (LON:ZYT)

Share price: 577.5p (down 4.2% today)

No. shares: 16.0m

Market cap: £92.4m

Trading update - this is a pre-close update for the year ended 30 Sep 2017.

Zytronic is a UK manufacturer of bespoke & innovative touch screens, for e.g. cashpoint, gaming, and vending machines.

Revenues have continued to show good progress over the prior period, and results are expected to be in line with market expectations.

Sounds alright to me. So why has the share price dropped 4.2% today? It should be emphasised that only 23,763 shares have traded so far today (although there could be more trades reported later - as bigger transactions are reported later). So the immediate share price reaction to news on lots of small caps is often just a knee-jerk reaction from small traders, who are notoriously fickle!

The other thing that strikes me, is that I wonder whether in line with expectations updates are enough, now that many shares have re-rated onto higher PERs?

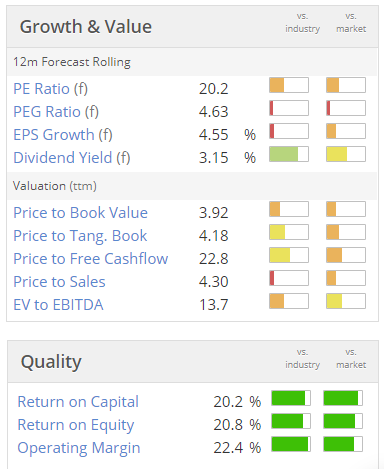

As you can see from the usual Stockopedia graphics below, Zytronic is a good quality company, but a PER of 20 is historically high for this share;

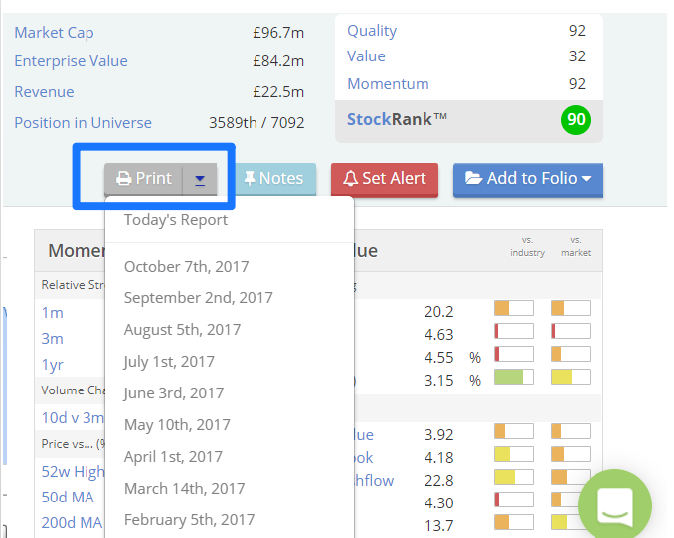

There's a really neat feature on Stockopedia whereby you can look back at historic StockReports for any company, by pressing the "Print" button, which then calls up a drop-down menu, allowing you to select any previous month's StockReport. This is really handy, to see how key valuation metrics have changed, and how actual earnings are compared with previous expectations, etc.

I've looked back to the StockReport from a year ago, Oct 2016, and the forward PER then was just 14.0, with the share price at 375p.

The danger is that investors think we're investing Gods, because our portfolios have risen a lot. However in many cases, as Zytronic demonstrates, the share price rise from 375p to 577p has been driven mainly by multiple expansion - i.e. the market valuing the company on 20 times, instead of 14 times future earnings.

Whereas earnings expectations have only risen from 26.0p to 28.6p. In other words, a 10% increase in earnings expectations fed through into a 54% share price rise in the last year. By far the largest factor for the 54% share price rise is expansion of the PER from 14 to 20. This is dangerous, as it's bull market stuff, which can very easily reverse back to normal (mean reversion) in a bear market.

My opinion - Zytronic is a nice little company, in a profitable niche. However, it is heavily dependent on several key customers. So every few years, an unexpected gap can open up, leading to a profit warning. That last happened in 2013, and it was an excellent buying opportunity, as you can see from the chart below. Isn't it funny how the best buying opportunities are often when investor sentiment is at it's low point?!

Upside could come from interesting new products, such as curved touch screens. Another plus point is that Zytronic has a decent net cash pile, so that if you strip out the cash, then the PER is somewhat lower.

Overall though, I feel that valuing ZYT on a PER of 20 is stretching things a bit. Historically it was typically priced on a PER of 12-14, and I really can't see that much has changed to justify a higher rating. Other than euphoric bull market conditions in the stock market. As we know, euphoric bull market conditions don't last forever. So some caution is needed here, in my view.

Interserve (LON:IRV)

Share price: 61.5p (down 31.7% today)

No. shares: 145.7m

Market cap: £89.6m

Trading update (profit warning) - this company calls itself an

...international support services and construction group

I've just refreshed my memory by reading my review of the last profit warning here on 14 Sep 2017. I came to the conclusion then that it was a catalogue of disasters, and that the share was uninvestable.

The share price rebounded nicely after the Sept profit warning, but that looks to have been a dead cat bounce, as today the share price is plumbing new lows;

Obviously as you can see from the longer term trend - this chart is 2 years - there's been appalling shareholder value destruction at this company. Anyway, let's look at what fresh horrors are revealed in today's update.

This sounds like there are numerous problems with the UK business;

Further to our 14th September trading update, our trading in the third quarter has seen a slowdown from that reported in the first half.

In UK support services, this was driven by the continued employment cost pressures in the business, the cost of contract mobilisations, margin deterioration driven by a cost base which has not been flexible enough and contract performance in the justice business.

Our UK construction business has seen further deterioration in operating profit as challenging market conditions and cost pressures as well as operational delivery issues have continued to impact performance.

Our equipment services business is performing well and as anticipated, the international support services business has started to improve versus the first half performance and in international construction we have maintained a stable performance.

The financial impact is given;

We now expect operating profit for the overall group in the second half to be approximately half the level of that which was reported in the second half of last year.

I really can't be bothered to look back to last year's figures, to work out what this H2 profit number is, because I won't be buying shares in this company at all - it's uninvestable.

Energy from waste contracts - these look to have been a massive historic mistake, which are now being run down. A further provision is needed, which was mentioned in the Sept update, but has now been quantified today;

...an additional 35m provision is required and significant uncertainty remains on the timing of commissioning. Based on this provision, our additional net cash outflow for the rest of the programme is expected to be 35m.

Banking covenants - in the Sept update, the company said it would meet banking covenants for 2017. However, it is now saying that a covenant breach is likely at end Dec 2017;

Taking all of these factors into account, we now believe there is a realistic prospect that we will not meet the net debt to EBITDA test contained in our financial covenants for 31st December 2017.

As previously announced, we are engaged in constructive and ongoing discussions with our lenders. We have engaged a financial advisor to assist us in these discussions, as well as looking at options to maximise the short and medium term cash generation from the business.

So, they're in trouble. It seems to me that there will probably need to be an equity fundraising, as well as disposals of parts of the group, in order to raise cash.

The group is also implementing a performance improvement plan, and reviewing all contracts. That's fine, but really that kind of thing should already be happening, on a daily basis, as a normal part of running the business. This looks very much like a group which has been out of control, and incompetently managed.

Upbeat comments are made about recent contract wins, and a £7.4bn order book.

My opinion - it's actually making me feel quite ill, reading this statement.

The balance sheet here is so weak (negative NTAV of -£142.6m at 30 Jun 2017), and with a breach of banking covenants imminent, that buying (or holding) this share looks extremely reckless. Why on earth would anyone take such a big risk? Far better to see how things go, and maybe participate in a discounted fundraising in future.

Existing shareholders just look like lambs to the slaughter, with a very high risk of insolvency. So a financial restructuring, which could be ruinous for existing shareholders, looks urgently necessary. For that reason, it remains a bargepole stock for me. Even after the company is refinanced, I can't see any reason to get involved. It just looks a rubbish business - low margins on big, problematic contracts. Numerous operational problems. Why invest in something like that? This whole sector is a nightmare - these contract businesses are just best avoided altogether, in my view, as they nearly always seem to go disastrously wrong, sooner or later.

Games Workshop (LON:GAW)

Share price: 2190p (up 9.1% today)

No. shares: 32.1m

Market cap: £703.0m

Trading statement - this company designs, manufactures and sells fantasy miniatures and related products.

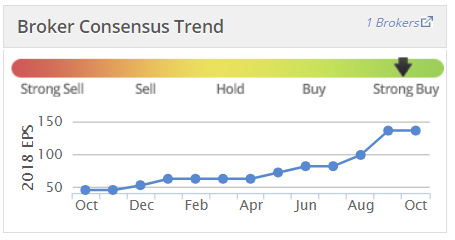

The company has had a remarkable resurgence in the last year. Just look at the amazing increases in forecast EPS over the last 12 months;

No wonder the share price has followed suit;

Actually, this is an interesting contrast to the multiple expansion which primarily drove up Zytronic (LON:ZYT) share price in the last year, as explained in the section above. GAW is rather different - it is very strongly rising earnings that has driven up the share price, and less to do with multiple expansion.

I've looked back to the StockReport a year ago, and GAW was on a forward PER then of 12.4 . The multiple has since risen, but not a huge amount, to 15.3 (as of last night). Yet the share price has risen from 563p a year ago, to 2190p now - a staggering rise of 289% - driven mainly by an increase in earnings forecasts of about 200%.

Personally, I feel a lot more comfortable with share price rises that are driven primarily by earnings increases (GAW) as opposed to an expansion of the PER (as with ZYT). Mind you, it all depends on whether this massive increase in earnings at GAW is sustainable or not? You'd have to really drill into the reasons for the big surge in trading. Are increased sales a passing fad, or new products with a long lifespan? I don't know, but am flagging this as the key issue to investigate.

Today's update is rather unsatisfactory, as it's too vague;

Following on from the Group's update in September, sales to date have continued strongly. Given the high operational gearing of the business, any movement in sales is directly reflected in profits.

Sales and profits to date therefore continue to be well above the same period in the prior year.

That's close to useless, and I wouldn't blame shareholders if they were to complain to the company, broker, and PR company, who have all failed in their duty to keep shareholders properly updated.

What investors require from a trading update, is to be informed how the company is performing versus market expectations. That is all. Everything else is background noise. So this update is entirely background noise! We already knew that trading was tracking ahead of last year.

Broker forecasts - thankfully, a broker note has dropped into my inbox on GAW, enabling me to understand things better. It's such a pity that so many companies withhold important information from investors, and instead brief brokers, who then pass on more detailed information to a select few. What a dreadful system.

Anyway, the forecast EPS for this year (5/2018) has been increased to 161.1p. That translates into a PER of 13.6 - which looks remarkably cheap for a company growing earnings so strongly.

The reason for this low PER, is because apparently current year earnings have been boosted from the summer launch of Warhammer 40k. This is expected to have a declining impact in future (plus of course presenting very tough comparatives for next year). So EPS forecast for 5/2019 is a fall to 136.3p. That equates to a higher, but still reasonable PER of 16.1.

Dividends - generous. One broker has today increased their forecast divi for this year from 100p to 120p, giving a decent (but perhaps not sustainable?) yield of 5.5%

My opinion - this was such a terrible missed opportunity for me. I bought some at about 850p, when MrC flagged a positive trading update to me. Then for some bizarre reason, I dumped them for a small profit - how stupid!

The crux now, is to find out how much of a boost the Warhammer 40K launch has given this year's numbers, and how quickly that is likely to wear off in future. I have no idea about that, so it's down to individual investors to find out, and estimate, for yourself.

It strikes me though, that collecting fantasy models seems to be a far more popular hobby than many of us knew! Fantasy television programmes like Game of Thrones also seem remarkably popular. For that reason, I'd probably be more inclined to expect positive surprises in future from GAW, than negative. So, even after such a stellar move up, who knows, this share could still have some more fuel in the tank? I might add it to my list of things to possibly buy on a sharp market correction, when we eventually, inevitably, get one.

Tristel (LON:TSTL)

Share price: 285.5p (down 3.2% today)

No. shares: 42.9m

Market cap: £122.5m

Final results - for the year ended 30 Jun 2017.

This company is a United Kingdom-based manufacturer of infection prevention and contamination control products. The Company's technology is a chlorine dioxide formulation.

Funnily enough, continuing my theme of the day on PER multiple expansion, this is another small company which has seen its shares steadily uprated onto a higher & higher PER. Although arguably there's a reason for that - investors hoping for a step change upwards in earnings from a future planned launch in the USA.

Two years ago, Tristel shares were bumping along around 100p, valued on a PER of about 20 times forward earnings.

One year ago, the forward PER had risen to about 23 times, and earnings had also risen, driving the share price up to about 158p.

Now, the share price has shot up to 285p, on higher earnings, but primarily a higher PER, now at about 36 times. So as with Zytronic above, I recognise that TSTL is a nice little company, that has shown good earnings progression in recent years. However, is the PER multiple expansion from 20 to 36 fully justified? Yes, if the USA launch goes well, and earnings shoot up. If that doesn't go well, then there could be a lurch back down to a lower rating. Therefore investors need to be very comfortable that the USA launch will indeed succeed.

There are some interesting comments on product, which are eye-catching;

The competitive advantage that we hold is that we are the only company worldwide using chlorine dioxide to disinfect medical instruments.

With this same chemistry, we have also established a bridgehead in hospital surface disinfection, the veterinary market, and the contamination control market.

We are developing a number of new products that could be "game-changers" in these disinfection applications.

The first paragraph raises the question of how all other medical instruments are disinfected? If chlorine dioxide is superior, why do no other companies in the world use it, and why are Tristel's sales so small?

Paragraph 2 confirms what the figures tell us - that 2 out of 3 of Tristel's divisions (surface disinfection, and animalcare), are so small as to be insignificant, at the moment.

Paragrpah 3 - "game-changing" new products sounds great, but it's jam tomorrow.

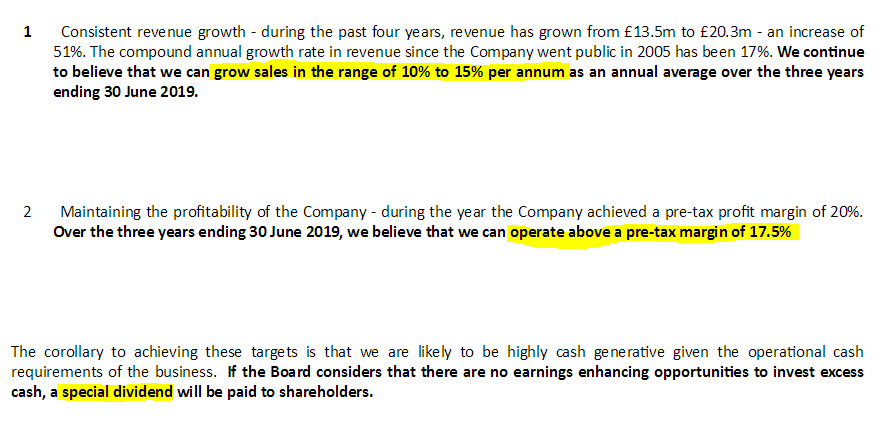

Key strategic financial goals - I absolutely love the clarity of this statement. If only more companies would set out & adhere to a simple & clear set of goals. This is indicative of sound management, in my view. Setting out simple, clear goals like this, means that everyone (staff, investors, management) know where they're going, and how to measure performance;

Key numbers for year ended 30 Jun 2017;

- Revenues up 19% to £20.3m. Given that about half sales are from overseas, then I reckon this figure will have been helped considerably from favourable forex movements - i.e. translating overseas sales into sterling, will show growth, due to sterling being a lot weaker in y/e 6/2017 than in y/e 6/2016. I cannot find any dislosure of the benefit from favourable forex movements.

- Nearly all revenue growth has come from overseas. UK revenue growth was only 3%.

- Operating profit rose from £2,568k last year, to £3,902k this year. Although this is flattered by a much lower share-based payments charge this year. So if I adjust that out, underlying operating profit rose from £3,242k last year, to £4,023k this year - not bad - comparing like with like, that's growth of 24.1% in operating profit. Also it's good to see share based payments of £121k being a lot more reasonable than the bloated figure of £674k in the prior year. If my memory serves me correctly, I think there was some kind of investor disquiet over excessive share based bonuses for Directors a couple of years ago. So I would suggest double-checking share options schemes in the latest Annual Report, to make sure there aren't any more nasties lurking.

- Diluted EPS for the year is 7.8p. That gives a PER of 36.6. That looks too high for me, for the company as things stand today. So clearly investors are factoring in further substantial profit growth. That's fine, providing the growth does actually come through as planned.

Balance sheet - absolutely fine. I can't see any funnies - same with the cashflow statement.

This is a genuinely cash generative business, which pays out surplus cash in divis - exactly what you want to see.

North America launch - the comments today sound positive, concluding;

In summary, we have developed a broadly-based business strategy for the North American market, which is built around the regulatory processes in the United States and Canada.

We are confident that our plan is proceeding very satisfactorily, and that we are on track to generate revenues in North America during the financial year commencing July 2018.

That form of wording gives wiggle room - probably very sensible!

So N.American revenues should start at some point between Jul 2018 and Jun 2019.

My opinion - I quite like it - an interesting & cash generative niche company. The N.American launch could provide nice upside, if it goes well, although a lot of that is probably already baked into the price.

Personally I find risk:reward too finely balanced here to want to buy back in (I held some in the past - obviously wishing now that I'd held on to them!). So this one goes onto my list of things to buy on a big general market sell-off, or on a not-too-serious profit warning, if e.g. there are problems with the N.American launch. But for me, the current share price does not present an attractive entry price, so I'll pass on this one. I can see why long-term holders might want to sit tight, and hope that growth continues, plus collect some divis along the way.

Oxford Metrics (LON:OMG)

Share price: 63p (up 7.2% today)

No. shares: 145.7m

Market cap: £91.8m

Trading update - for the year ended 30 Sep 2017.

This is a software company, with 2 divisions. The Stockopedia description (which comes from Thomson Reuters), describes the company like this;

The Company develops and markets analytics software for motion measurement and infrastructure asset management to clients in over 70 countries worldwide...

Today's update sounds positive;

The Group enjoyed a successful close to the financial year and expects to report both revenues and adjusted PBT slightly ahead of market expectations...

Growth plan - similar to the financial goals set out by Tristel (LON:TSTL) in the section above, OMG also has a clear financial plan;

The Board is pleased to report the Group has made good progress during this first year of the Group's five-year growth plan and is on track to achieve the goals we stated in December 2016 to double profits and triple recurring revenue by 2021.

The only problem with this kind of strategy, is that it can make a rod for management's backs. We saw that with Norcros (LON:NXR) - where even though the company was doing quite well, investors perceived things negatively because it was falling short of published revenues targets.

More detail is given about individual division performance, which I won't repeat here.

Balance sheet - the company today says that year end cash was £9.8m. I've checked the most recent (interim) results, and there doesn't appear to be any interest-bearing debt. Therefore this cash figure seems to be net cash - it seems odd that the company doesn't emphasise that it has not debt.

Anyway, all good, as the balance sheet overall is excellent. A small acquisition was made in the period.

My opinion - this is based on only a brief review. However, I've owned the share before, and have a generally positive view of it. I think it's good - the PER is still reasonable, even after today's decent rise. The balance sheet is excellent, with surplus cash. I like the growth plan. It's already decently profitable & cash generative - there's a lot to like here.

So it gets a thumbs up from me, and something that looks worthy of further research.

That's me done for today. I shall pass the controls over to Graham now for tomorrow's article.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.