Good morning, it's Paul & Jack here with Thursday's report. Today's report is now finished.

Agenda -

Paul's Section:

Revolution Bars (LON:RBG) (I hold) - festive season was hit by pandemic issues, as we've heard from other bars. It's still in line with full year expectations though (set low). I see a very positive second half (Jan-June 2022) being likely, and explain why.

Gear4music Holdings (LON:G4M) (I hold) - peak trading Q3 (Oct-Dec 2021) has gone OK in the UK, but sales are well down in Europe- Brexit challenges being blamed. We're told to expect a recovery in EU sales, due to 2 new distribution centres ramping up. Overall, G4M reassures, with EBITDA guidance in line with market expectations. Some good catalysts for growth - e.g. acquisition of AV.com. Share price looks about right to me.

Superdry (LON:SDRY) - I have a good rummage through interim results, and for the first time see signs of a potential turnaround. Management seem to have stabilised the business around annualised breakeven. Solvency looks OK. Might be worth a punt, if you think management can recover former glories, but that won't be easy with big cost headwinds coming in 2022.

Jack's Section:

Wincanton (LON:WIN) - FY profit to be ahead of expectations. Good control over costs and new contract wins, so the group is executing well. Financial risks remain though, which is a shame, as the valuation here is modest and the shares could well rerate at some point. So we have to consider the potential risks against the likely reward.

Wickes (LON:WIX) - Q4 sales down -5% on tough comps, but up 14% on a 2Y basis. It’s the cheap valuation that has attracted me to this recent demerger, which used to be a part of Travis Perkins. There’s a lot of competition, so the group needs to prove it can defend and grow market share.

Time Finance (LON:TIME) - modest levels of growth here but the shares offer good value, so not much is currently expected from the market. The new CEO has been in place since June 2021 and the strategy has shifted from buy and build to organic growth. It’s a micro cap now, but one in which the investment case is beginning to look more favourable.

Market comments from Paul

I've been following US markets a lot more closely of late, and it seems distinctly bearish at the moment - in particular for tech stocks. Many former tech darlings are now down hugely in the last year, many by more than half. That's been disguised by the mega techs doing well, but even those are coming under pressure now.

Commentators blame it on rising interest rates, the perception is the Fed is likely to raise 3-4 times in 2022. Each raise is only 0.25%. So even after these increases, interest rates would remain incredibly low by historic standards. Will the Fed actually go through with it? Remember that a couple of years ago, when rising interest rates spooked the markets, it reversed course. It seems to me we're addicted to permanently low interest rates, and QE.

In recent Q&A to Congress, Fed Chairman Powell indicated that the Fed would react to the next proper recession (i.e. not a specific crisis, like 2008 or covid) with "asset purchases". I.e. more QE, and super-low interest rates.

Whatever the reason, I welcome the scrubbing off of excessive valuations, and the unwinding of highly speculative activity (e.g. many IPOs, the nonsense of SPACS - premium prices for blank cheque companies, influx of (millions of) naive speculative traders through platforms such as Robinhood, Bitcoin mania ["crypto" currently valued at around $2 trillion! Just worthless pieces of code, whose sole real world function is financial speculation], traders chasing momentum and ignoring fundamentals & valuation). Maybe the bear market in speculative tech shares is a good thing, which is scrubbing off excess, thus making the market more stable going forwards, instead of risking a sudden crash?

Whilst in UK small caps, it strikes me how many companies are exceeding expectations. We had 5 such companies beating expectations yesterday alone (SIS, Midwich, PCI-Pal, Christie, and Centaur). Plus 6 companies that were in line, with only 1 profit warning (BOTB - I hold).

My style of value/GARP investing feels like it's coming back into fashion. Hence I think it's good to focus on decent, reasonably priced companies, and be more resistant than ever to story stocks, and growth priced for perfection.

The big UK retailers reporting so far, have generally done well.

Supply chain costs/delays are an ongoing issue, but it generally feels as if companies are adapting, and coping. The cost headwinds & delays in 2021, could turn into the tailwinds of reducing transport costs & easing of supply chains in 2022, who knows? Many companies have increased inventories, and brought them in earlier - thus compounding the overall pressure on supply chains. But again, stocking up is something that only happens once, then eventually reverses when supply chains normalise. Someone on CNBC was saying that semiconductor chip shortages now, are likely to turn into a glut in future, once production has increased, which takes time apparently. That's certainly the pattern in the past.

Years ago (late 90's, early noughties) there were shortages of electronic components, I've mentioned this before here. My neighbour Steve used to tell me about it down the pub. He described his job as moving from selling, to allocating limited production to key customers (similar to what's happening at the moment). A couple of years later, he was unemployed, because new Chinese factories had flooded the market, and there was now over-supply, and greatly reduced prices.

The same thing happened with solar panels - remember all that kerfuffle with PC Crystalox, which along with the rest of the sector, was forced to pretty much shut down, because China made so many solar panels, and so cheaply (dumping at below cost apparently, to ensure full employment), to destroy the industry everywhere else and corner the market. I seriously worry about how dependent we've become on China - a hostile, dictatorial regime, that doesn't operate to the same rules Western companies do (i.e. subject to scrutiny, and needing to seek profits due to shareholders wanting divis).

Best Of The Best (LON:BOTB) - thinking about eCommerce companies, what struck me about BOTB's profit warning yesterday, is that its business model is so dependent on online marketing. Players churn constantly, although they do have some "whales" - i.e. longtime customers who play every week, regular as clockwork. Other players see an ad online, have a punt, then lose interest. So the company has to constantly advertise to generate replacement players, let alone growth.

The cost of that online advertising has shot up, thus greatly reducing BOTB's profits. It's now having to scale back marketing quantity (for the same cost), and hence the H2 guidance provided yesterday was for a sharp slowdown in revenue & profit, since the marketing spend now delivers less bang for the buck. This problem shows that purely online businesses are lambs to the slaughter for Google & Facebook/Instagram in particular - who set the prices at whatever they like, because they dominate online advertising so much. Many companies have told me that these 2 companies control the most effective marketing, so companies are effectively forced to use them. Rather than looking for growing eCommerce businesses, maybe we should just buy & hold shares in Alphabet and Meta? They're not expensive, and have stunning growth, and completely dominate online advertising. There's regulatory risk though.

Are all eCommerce businesses doomed then, to suffer falling profits, as the mega tech US companies price-gouge their captive customers, and remove their profits? It looks a big threat for companies that have to constantly generate new customers. But there are better online business models, e.g. -

Sosandar (LON:SOS) (I hold) uses a variety of marketing approaches, split equally between online, TV, and printed magazines posted out. All are effective. Moreover, once they've acquired a customer, then they can communicate for free using email. Customers also tend to be sticky, and loyal to the brand, as it has a distinctive product, and brand. This strikes me as a very much better business model than others. The cost of customer acquisition has roughly halved, as the company becomes more savvy about what works.

Next (LON:NXT) and Shoe Zone (LON:SHOE) (I hold) - what both these companies seems to have achieved, is to reap the benefit from having both online operations, and physical stores. I'm coming round to the view that this could be the optimum business model. SHOE for example recently said that its growing online operations have a low returns rate (about 11% from memory), and that the bulk of these customer returns are taken to a physical store - hence no postage costs for SHOE. How good is that? It's fantastic, I think. Hence why I dipped my toe in with an opening size stake recently.

Next is just a superb operator, as we've been saying here for years. It seems to be using the stores as mini warehouses. I really like this approach, as it would allow an advanced IT system to fine-tune the stock holdings in the physical stores. So if a particular store is over-stocked, then online orders for those particular lines could be routed to the store which has excess stock. Staff are then utilised at quiet times to fulfil online orders. Plus there's less terminal stock at end of season in the stores, to clear at a discount. There's so much potential in that approach I think, but the challenge would be merging the IT to be capable of handling the stock in this way.

Other eCommerce businesses might need to grapple with the problem of customer returns by analysing every customer's activity, and just closing the accounts of people who constantly return lots of items. Is free postage for returns viable? Could customers with low returns rate be rewarded with discounts, points, etc? I think companies will need to innovate in these areas, to gain a competitive advantage in a very crowded sector.

Meanwhile there's the looming threat of Chinese competitors trying to harvest our data, and offering product at uneconomical prices, because they don't actually need to make a profit. The same is true of venture-capital backed speculative new entrants into markets like BOTB's, and the online car retailers new entrants like Cazoo, Cinch. They're not viable business models (heavily loss-making), but have a ton of marketing money to rapidly gain market share, in the hope that they can scale up and become viable in future. That's obviously unfair competition, but nothing can be done about it.

Lots to think about, as always!

Inflation - Chairman Powell made an interesting point about the reasons for higher inflation (recently hit 7.0% in the USA). He said that supply chains have faltered because of covid, but also because demand for physical goods rose by 20% in the pandemic. That's because people diverted spending from holidays/leisure activities, into buying physical goods (e.g. home improvements). That's the main reason supply chains can't cope - excess demand, a lot of it fuelled by Govt stimulus. We saw a similar thing in the UK, with the Bank of England saying a lot of stimulus money piled up in household bank accounts.

Hence I remain of the view that what we're seeing is a mixture of supply chain disruption, but also excessive demand. Maybe that could sort itself out in 2022, as conditions seem to be returning to normal, with us now having achieved herd immunity, and the pandemic almost over?

As long as companies can raise their selling prices, then they should be able to protect profits. That's the main issue that I'm focusing on, and always asking management when I speak to them. Companies with low margins (gross and net) are just best avoided I think, as if they don't have pricing power, there will always be a delay in them passing on costs (as we've seen with Accrol Group (LON:ACRL) ). Companies locked into long-term supply contracts could be disastrous, so that's another good question to ask companies.

OK, on to today's news...

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Revolution Bars (LON:RBG) (I hold)

23.4p (y’days close) - £55m market cap

Revolution Bars Group plc ("the Group" or "the Company"), a leading operator of 67 premium bars, trading mainly under the Revolution and Revolucion de Cuba brands, today announces a trading update for the 26 weeks ended 1 January 2022.

Overall trading - still in line with (modest) full year expectations, despite taking a hit from covid disruption over the festive period -

Despite the government's response to Omicron, which in our view was overly cautious and caused a substantial loss of trade during the important festive season, the Board remains confident of achieving its full year expectations assuming that the Covid landscape does not significantly deteriorate.

We are encouraged by the strong performance pre Christmas and yesterday's welcome announcement from the Government about easing all restrictions but are nonetheless alert to and monitoring closely the inflationary pressures building across all elements of the supply chain and are taking action to mitigate these where possible.

Disruption over the festive period wiped out the previously strong growth from July-Nov, which is a pity, but a problem for the whole sector -

As previously reported, LFL sales for the majority of the half, from 19 July 2021, when restrictions were relaxed in England, to 13 November were very strong at +14% versus the comparable period two years ago. Overall, 2-year LFL sales for the period from 19 July 2021 to 1 January 2022 remained positive at +1.4%, with the business performing as well as could be anticipated given the additional restrictions imposed on our guests in the Christmas period…

LFL sales for the 6 week period ending 1 January were -23% when compared with the same period 2 years ago, the last unaffected Christmas period.

Corporate bookings - as other operators have indicated, covid disruption caused the cancellation of many office parties. However, as Nightcap (LON:NGHT) said recently, many are being rescheduled, which should give a boost to spring 2022 trading -

The impact of the Government actions was most felt in the cancellation of office parties. Pre Booked Revenue, an indicator of Corporate Christmas parties, was -39% for the 6 week period to the 1st January 2022 when compared to 2019/20. However, the total number of bookings during the 6 week period was at +19% highlighting that our young guest base were still keen to go out and enjoy themselves. Both of these metrics were significantly higher earlier in December before the Omicron variant and negative government messaging took hold. Pleasingly, many of the corporate parties have already been rebooked for early in 2022.

Net cash was £4.7m as at 19 Jan 2022 - very healthy indeed, so the company is fully funded to refurbish existing sites, and open new ones. It has large unused borrowing facilities too, so tons of liquidity for expansion - at a time when they should be spoilt for choice when the rent moratorium ends, and lots of vacant sites become available on attractive rents.

Refurbishments - 6 have been done already, “pleased with their early performance”, and 13 more to be done over the next 5 months to year end 30 June 2022. That means 28% of the bars being refurbished over a 6 month period - which should drive decent revenue & profit growth.

Too many bars became tatty, and this was the main problem RBG experienced before the pandemic - previous management focused too much on short term cashflow, and opening new sites, instead of properly maintaining the existing sites.

Late night bars have to be in tip-top condition, or the customers drift away to fancier competitors. Hence I see the refurb programme this year as being key to restoring shareholder value.

On my way home from mystery dining at TGI Fridays, I always check on Bournemouth’s “Revs”, and am pleased to see it is being refurbished as we speak. I’ll mystery drink the refurbished site once it opens, and Dry January is over. Peering through the window, work is underway, and I could see a builder wandering around -

.

A refurb should put at least 10% onto LFL sales, so that should be enough to mop up inflationary pressures.

Diary date - 1 March 2022 for Interims to 1 Jan 2022.

My opinion - the hospitality sector has a lot of cost headwinds coming through - higher wages, general cost inflation on ingredients, VAT returning to 20% (although limited impact on wet-led operators like RBG), and business rates resuming.

On the positive side, RBG has restructured its estate, ditching the loss-making sites, securing rent reductions on a consensual basis, and a CVA to eliminate the handful of landlords that refused to co-operate. A deal was also done to ditch the onerous 25-year leases on closed & loss-making sites. So it goes into the post-pandemic period with a clean estate, and with 19 refurbishments underway between now and June 2022, everything is lined up to deliver very good trading updates in 2022.

There are also deferred Xmas parties mentioned today, and pent-up demand, likely to provide months of positive, and highly profitable trading.

Forecasts are currently set ridiculously low (around breakeven) for FY 6/2022, so I’m expecting them to smash forecasts.

New sites, and new formats are also being created, e.g. the Founders & Co format which has been trialled in Swansea. There’s another new format, a retro-gaming themed bar that is in the pipeline.

Obviously the last 2-3 years have been really painful for anyone who just held this share, and did nothing. Whereas loading up at the lows proved lucrative. So maybe it’s more a share to trade, than buy & hold?

My price target remains 30-40p (I sold in that range previously), so at 24p currently, the share seems attractive to me. Everything is now sorted out, and it’s set up really well to generate good profits again, in my view. Both the CEO & CFO are highly regarded, hands-on, experienced, capable people.

There are other expanding bar groups, but they’re too expensive (e.g. Nightcap (LON:NGHT) ) with a premium for newness. Whereas RBG has a discount due to historic problems. If like me, you think the problems have been resolved, then it could be a good recovery share.

The re-opening trade is a key investing focus for me at the moment, now we seem to be genuinely at the end of the pandemic. There could still be very good upside on shares which have not yet properly priced-in a full recovery in profits. I see lots of opportunities out there at the moment, and RBG is one of them.

The chart won't get back to previous highs, because the share count has risen from 50m pre-pandemic, to 230m now. But obviously I have a much larger number of shares personally now, so only need a rise to 30-40p to recoup previous losses. Averaging down does work sometimes, if the fundamentals & outlook justify buying more shares. It's mindless averaging down that is disastrous - i.e. ignoring poor fundamentals, anchoring to the previous highs, and buying more for emotional, not rational reasons. Time will tell, but I think RBG looks like a sensible average down, not a mindless one! We'll see.

.

.

Gear4music Holdings (LON:G4M) (I hold)

690p (per market open) - mkt cap £145m

I should add (for full disclosure) that I’ve down-sized my G4M position from medium to small. That was partly due to another large founder CEO share sale, and also worries about the cost of online marketing, and supply chain. It’s a good company though, so I’ll be looking to increase my position size potentially in future, depending on newsflow. I can’t afford any more profit warnings, hence down-sized a few things late last year, also pushed by margin calls on my geared account, as mentioned previously.

G4M has been very open about benefiting in particular from lockdown 1, and it managed investor expectations well, with broker forecasts showing a big reduction in this year’s forecast profits early on. Hence the share price has held up quite well, since expectations were managed realistically, as opposed to hitting us with profit warnings, as other eCommerce businesses have done.

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a trading update for the three months to 31 December 2021.

The current financial year ends 31 March 2022, so today’s update is for Q3 (Oct-Dec 2021).

Q3 revenues - down 10% on 2020, but up 17% on 2019 (pre pandemic) - OK I suppose, but not madly exciting.

Geographic split is striking - Q3 revenues up 13% for the core UK market, but down -27% for Europe & RoW. The commentary explains this is due to “short-term Brexit-related challenges”, which surprises me given that G4M has had 2 distribution centres in the EU for several years now (Sweden & Germany). This issue has been mentioned before, so is nothing new. A fix is already happening, which could explain why the share price has not been punished for disappointing EU sales -

New European distribution centres are scaling up well to address post-Brexit challenges, which as previously reported have impacted European sales…

We are continuing to make good progress in scaling up our new European distribution centres in Ireland and Spain to strengthen our European customer proposition, and we expect European revenues to regain momentum as we head into FY23.

Gross margin - is just as important as sales growth, but often overlooked by investors. Note that the 2-year comparison is sales +17%, but gross profit +27%.

Gross margin of 28.4% is lower than last year (29.9%), but up on 2-years ago (26.2%). The company’s turnaround has been mainly based on improving gross margins, instead of chasing market share at any price. That’s the right strategy.

Profit guidance - annoyingly, the company quotes EBITDA, like so many other companies, which is not real profit. Note that £12.0m EBITDA becomes c.£5.7m adj PBT, so a big difference there. Hence why I dislike EBITDA so much. It's one measure of profitability, and does have some uses, but it shouldn't be the only profit measure disclosed in trading updates.

G4M does provide a footnote on market expectations though, which is important, and gets a round of applause from the SCVR -

FY22 EBITDA continues to be in-line with consensus market expectations*

* Gear4music believes that consensus market expectations for the year ending 31 March 2022 are currently revenue of £149.2 million and EBITDA of £12.0 million.

Summary/Outlook - there’s enough positive in here to keep me interested -

"We are pleased to report that financial performance during the FY22 peak seasonal trading period was in line with the Board's expectations, demonstrating good progress when compared with the same period in FY20.

UK sales growth continued to be robust against what were exceptional revenues last year, and as previously reported, European growth has been restricted due to short term Brexit related challenges. We are continuing to make good progress in scaling up our new European distribution centres in Ireland and Spain to strengthen our European customer proposition, and we expect European revenues to regain momentum as we head into FY23.

Following the successful acquisition of AV Distribution Ltd in December 2021, we were very pleased to have successfully launched AV.com as scheduled on 13 January 2022. AV.com is currently focused on retailing Home Cinema and HiFi equipment and accessories and significantly increases our addressable market size.

We have a strong pipeline of new products, e-commerce system developments and new website features due to be launched throughout FY23, and as such, we remain confident in our long-term profitable growth strategy."

Broker updates - we’ve got Singers and Progressive updating us today, many thanks.

FY 3/2022 EPS forecast is only 18.6p, way down on prior year’s lockdown-boosted 60.4p

FY 3/2023 EPS forecast is good growth, to 29.8p - a PER of 23 times, which looks about right to me, in an era where eCommerce companies are no longer attracting a large premium valuation.

My opinion - the disparity between UK sales growth, and EU sales contraction makes me wonder if UK sales might be gaining from a reduction in European competitors in the UK market? Musicians tell me that there are delays on product ordered from market leader Thomann (Germany), so they now order everything from G4M instead, for reliable next day delivery. The same could be working against G4M in Europe. So that would explain why the UK is doing so much better than Europe, maybe?

If European growth does resume in the new financial year (starting in April), then that could be a catalyst for the share price to rise. Plus the acquisition and relaunch of AV.com, bolts on more business.

In the meantime though, overall, I think the current share price looks about right, considering risk:reward.

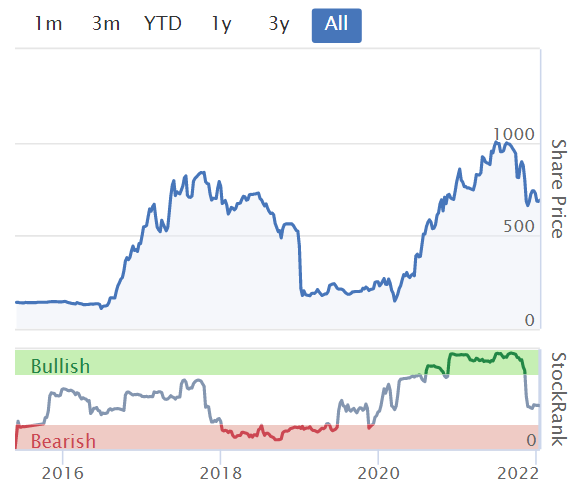

It's certainly been a rollercoaster ride since G4M listed in June 2015. Are we plummeting at high speed on the current downward leg, or about to pull several G's as the rollercoaster does an abrupt turn upwards? Or maybe coasting towards a gentler plateau, and the restraining bar lifting? Do we stay on, and go around again? (OK that's stretching the analogy too far).

.

.

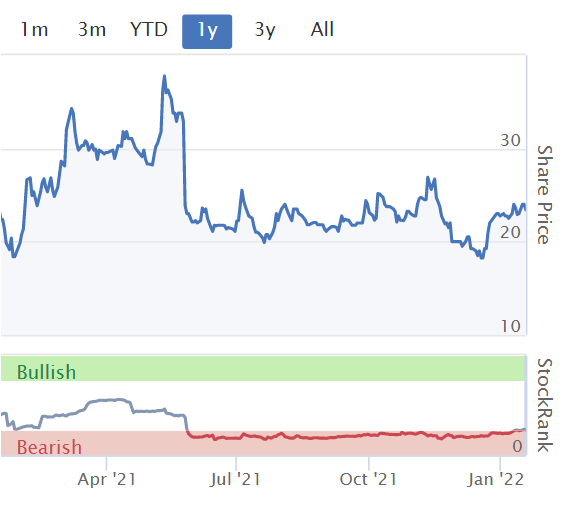

Superdry (LON:SDRY)

240p (down 3% at 10:34) - market cap £198m

The share price here is all over the place today - earlier it was up 8%, now it’s down 3%.

I’ll try to be impartial, but my existing view is that the company’s management have been trumpeting a turnaround which has so far delivered absolutely nothing in the reported numbers.

They’ve ramped it like an old hand on advfn, saying net margins will be better than ever. I don’t see anything at all to justify their optimism in previous reported numbers, so let’s have a look and see if the green shoots (facts, not aspirations) are coming through in today’s numbers?

Remember SDRY was in a mess before the pandemic struck, and has a legacy store estate which is a heavy burden.

Superdry announces its Interim results covering the 26-week period from 25 April 2021 to 23 October 2021 ("1H 22") and a trading update covering the 11-week period from 24 October 2021 to 8 January 2022. Where relevant, given the disruption to trading from Covid-19 and to provide more meaningful analysis, we have provided comparisons on a two-year basis.

PR summary -

Clear signs of brand and financial recovery

Oh yeah? I’ll be the judge of that, given the track record of overly bullish commentary.

Revenues - no sign of recovery here, £277.2m in H1 this time, down 2% on H1 LY, and down 25% on H1 2 years ago.

Stores revenue in H1 was up 21.5% on LY, and Ecommerce was down a very disappointing -30% - although this is explained as being due to more full price sales, instead of discounting. It’s still really poor though.

Gross margin - a good improvement against H1 last year, at 55.2% (LY H1: 51.7%). Getting close to pre-pandemic 56.3%. The commentary says sell-through was good, and there was no need for an end of season sale, which bolsters the company’s credibility in focusing on full price sales. My worry was that they would seek full price sales, but then be forced to discount to clear slow-moving stock at season end. I’m encouraged that has not come about.

Note that the stores gross margin is exceptionally high, at 71.7%, but further on in the commentary, it says stores gross margin is 69.6%, so not sure what the difference is, but they're in the same ballpark - very high.

Still loss-making, despite business rates relief, at £(2.8)m - better than the more heavily disrupted H1 LY loss of £(10.6)m

Note that the loss would have been worse by £8.1m due to a £2.0m gain from releasing a provision against trade receivables, and a £6.1m “Other gains” - what’s that for, I wonder? Possibly releasing lease provisions? These items were not adjusted out. Ah here we are, it is to do with leases -

Other gains and losses reflect modifications on IFRS 16 leases and royalty income and this net credit has reduced £(2.0)m year-on-year to £6.1m.

Whereas £6.8m gains on forward contracts (forex?) & £0.6m gain from founder share plan, were adjusted out. Hence the statutory pre-tax result was a £4.0m profit.

Net debt is negligible at £3.9m, but the net cash from last year has gone, as I suspected, as it came about from stretching creditors last year.

Current trading - this covers the peak trading period, and looks good - in particular a very strong improvement in stores performance -

.

Outlook - reassuring I think -

Our performance over the peak trading period has given us confidence that we will achieve current market expectations for FY22 adjusted PBT.

In line with the rest of the sector, we expect to be impacted by inflationary cost pressures. However, we expect to fully offset these headwinds through further gross margin improvement (via a reducing mark-down mix), together with some price realignments in selected categories and markets.

Annoyingly, I can’t find any broker notes. Stockopedia shows £670m revenues, and a tiny net (after tax) profit of £7m for FY4/2022. That’s 10.4p EPS.

With £277m revenues in H1, this implies £393m revenues in H2, a 42% uplift.

There’s a neat function here on Stockopedia, which splits historic results into H1 & H2. Pre-pandemic, SDRY achieved an H2 uplift over H1 of +17% in FY 4/2018, and +10% in FY 4/2019. This shows that the +42% forecast uplift this year for H2 over H1 seems very ambitious, and I don’t imagine that uplift is achievable.

Given management over-optimism in the past, I remain to be convinced that it actually will hit forecasts for FY 4/2022. There again, a loss of £(2.8)m in the seasonally slower H1, and FY forecast of £7.0m post tax, so maybe £9m pre-tax, needs a profit of £11.8m in the busier H2, so that’s possible I suppose. Maybe forecasts are achievable? The jury is out.

Going concern note - worth a read. The company gives itself a clean bill of health for going concern (12 months from signing the accounts is standard), but it’s would be sailing close to the wind in 2022 if trading were to deteriorate-

Under the reverse stress test, which tests for the breakeven point against our borrowing facilities, the October 2022 (Q2 23) covenant test would breach first. However, management considers the revenue shortfall required to cause this breach to be remote. The directors are confident that under the mitigated reverse stress test there is sufficient liquidity headroom over the going concern period.

If this scenario was to occur, management would approach lenders for a covenant waiver. Whilst there would be no guarantee that such a waiver would be made available, in making their assessment management notes that it currently has a good relationship with the Group's lenders and has held positive discussions throughout the year. These lenders have been made aware of all key inputs into the Base Case Plan, as well as the implications of the short-term disruption, and have agreed to re-gear the covenants on several occasions, to reflect the unforeseen duration and magnitude of the impact from Covid-19.

Balance sheet - overall it looks OK, not financially distressed.

The stand-out items are the large lease liabilities, which dwarf the Right of Use Asset, indicating that the company still has a lot of heavily loss-making physical stores, which will take time to dispose of.

Working capital has deteriorated, but not disastrously - a year ago SDRY had net current assets of £77.5m, and a current ratio of 1.32 - reasonably healthy for a retailer/wholesaler. A year later, at end Oct 2021, net current assets had reduced to £51.3m, a ratio of 1.19

My opinion - having had a good rummage through these figures, for the first time, I can see in the numbers some evidence that a turnaround is starting.

Although to keep things in perspective, even if the company does meet current market expectations, that’s only for a tiny profit, and I reckon all of that profit is probably coming from releasing onerous lease provisions through IFRS 16. That’s something to carefully check for all retailers at the moment - as they slashed the Right of Use Asset during the pandemic (effectively a provision against future losses), they are now releasing some of those provisions as trading improves. It’s easy to bury that (non-cash) benefit in the reported numbers, and not many people will notice!

So as things stand, I reckon SDRY is operating around breakeven on a cashflow basis for FY 4/2022.

The question is, can it improve on that performance? There are big headwinds coming - 6.5% minimum wage increase from April 2022, and business rates relief disappearing. So SDRY will need to improve sales, and gross margins, to just mop up those additional costs.

So far, returning management seem to have stabilised things, and halted the decline. It remains to be seen if they can make Superdry decently profitable again? If you think they can, then at £198m market cap, it could be worth a punt.

Overall then, I’d say my stance has moved from negative, to neutral, as the fundamentals seem to be improving.

EDIT: The InvestorMeetCompany presentation by Julian Dunkerton today was hugely impressive! I can see how persuasive & convincing he is - well worth watching the recording, as there's lots of useful background about Superdry in his comments. Think I might have to dip my toe in here, with a small initial purchase. End of edit.

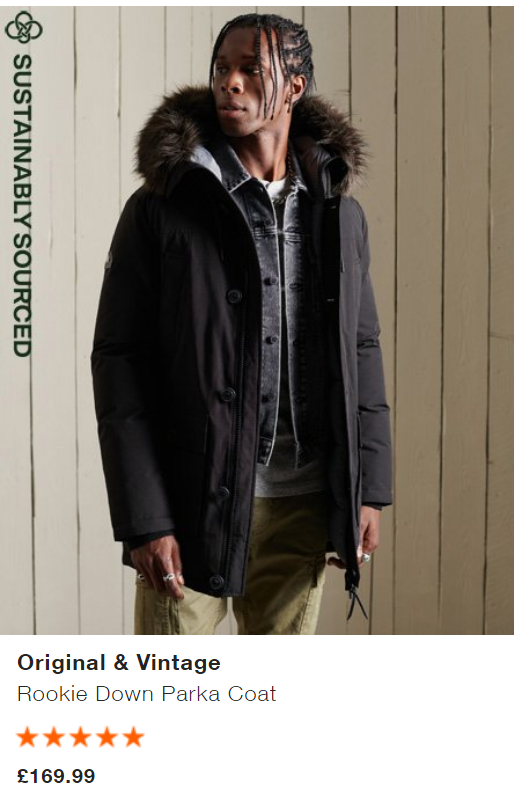

If you're prepared to pay £169.99 for a Parka coat (below), then would (say) a 5% price rise to £178.50 deter you from buying it? I'd say probably not. That's the advantage of a brand with high margins - they're already charging almost 4 times cost, so the customer wants the product a lot, is not value-focused, and is prepared to pay up. Hence I suspect SDRY might be able to push through price rises, if they get the product designs right.

There are 10 customer reviews, all 5 star.

.

Jack's section

Wincanton (LON:WIN)

Share price: 376.7p (+7.93%)

Shares in issue: 124,543,670

Market cap: £469.2m

Wincanton delivers strong trading performance; upgrade to full-year profit

Strong demand across all four business sectors, with high demand for its services and revenue growth of 15% in the quarter (14% excluding acquisitions and disposals). Given the result, and greater certainty around cost pressures, Wincanton now expects to exceed current market expectations.

Digital and eFulfilment revenue increased by 51%, thanks in part to the acquisition of Cygnia. Excluding Cygnia, sector revenue rose by 22%. Wincanton's Customer Fulfilment Centre for Waitrose.com executed the successful delivery of its first Christmas peak trading period. The two-person home delivery business contributed another quarter of strong performance, although volumes were down slightly.

The integration of the Cygnia business is progressing well, although online volumes for some customers were impacted by a higher-than-expected proportion of high street sales around Black Friday.

Operations ran smoothly in the group’s Grocery and Consumer sector, delivering 25 million cases of food and drink in the week before Christmas. Revenue was up 19%. General Merchandise sector revenue grew by 9%.

Wincanton's Public and Industrial sector revenue rose 5%, primarily driven by the growth of Public Sector business.

Driver and labour shortages are a challenge but have been managed well with no disruption to operations. The group has secured some ‘significant contract wins and extensions’ as well, including a new contract with the Department for Environment, Food and Rural Affairs (DEFRA).

Wincanton is also extending its partnership with DFS to manage deliveries that go directly from suppliers to customer. New services for The Range, MGA Entertainment, Lakeland and Department of Health and Social Care (DHSC) were implemented in the period, as the group saw strong take-up for its collaborative warehousing services.

It is also on track to deliver its previously announced five-year contract with Primark for the provision of transport services to all its UK stores, commencing in February.

Conclusion

Focusing solely on trading, the shares seem to be the wrong price. Wincanton is ahead of expectations, is successfully managing challenges, and is winning new contracts with big customers including the government. The latter two points suggest to me a competent management team.

All this for a forecast rolling PER of 9.7x (after this morning's rise).

Debt ex-leases has fallen somewhat (the financial summary figure adds in £94.3m of capital leases in FY20 and £113m in FY21). Here’s long term debt ex-leases.

Net tangible asset value is still negative though, with £469m of tangible assets set against £563m of total liabilities resulting in -£94m. And there’s also a pension scheme to consider, so overall the financial health leaves a little to be desired.

On that last point though, an improved actuarial valuation would reduce cash contributions in future. In general, deficits are improving at the moment so that is a potential boost (although for now it’s a drain on cash)

The financial health remains an important issue to consider, but I can’t fault the operational performance here. Good control over costs, a raft of new contract wins and extensions, growth across all business segments, and profit ahead of expectations, with a single digit PE ratio.

Wickes (LON:WIX)

Share price: 215.8p (-1.46%)

Shares in issue: 259,637,998

Market cap: £560.3m

(I hold)

Wickes is a spinoff from Travis Perkins. Anyone that’s read One Up on Wall Street by Peter Lynch will know will know that these can be attractive opportunities, with newly incentivised management and greater freedom now decisions are not tied to the agenda of a larger corporation.

The shares look cheap on a forecast PER of 8.9x, and the management team sounds competent, so I’ve taken a smaller holding here to see how it plays out. It’s a newer listing though and I’m keeping the position flexible.

Note the high levels of net debt on the StockReport - likely responsible for one of the two ‘Z-Score’ fails. This is mostly capital leases, so ex-leases the group was actually around £127m net cash as of June 26th 2021, although this is set to come down in the second half due to a combination of capex, IT separation costs, and dividend payments.

Q4 Trading Update for the 13 weeks to 25 December

As expected, Core sales moderated against the toughest comparatives from 2020, but were strongly ahead on a two-year basis. We continue to expect to report adjusted PBT* of no less than £83m.

- Core Q4 sales -6.8% year-on-year, +35.7% over two years,

- Do It For Me (DIFM) sales +1.6%, -13.5% over two years,

- Total sales -5%, +14% over two years.

FY figures show Core sales up 14.2% (one year) and up 35.7% (two years). DIFM is +9.7% and -20.9%, meaning Total sales are +13.3% and +18.9%.

Core sales in Q4 were supported by continued strong performance in local trade, where home renovations continue to drive robust order books for trade customers. TradePro membership and associated revenue continue to grow strongly, driven by Wickes’ digital capability.

DIFM delivered sales were strong in October and November, as we progressed through the elevated order book, but weakened in December from a higher incidence of Covid disruption and self-isolation ahead of the holiday period. As a result, the DIFM year-end order book has more than doubled on a two year basis. This, plus an encouraging lead and order profile from the winter sale, will support DIFM sales in the current year.

The group launched its DIY app successfully in November, with strong conversion rates. The Google Play Store rating is 3.9 from 15 reviews, with downloads in excess of 10,000. A respectable start, although I note the Wickes TradePro app has had its fair share of criticism and has a lower rating of 3.5 compared to others such as B&Q (4.4) and Toolstation (4.7). So perhaps more work needs to be done here.

Inventory levels have increased as a result of cost price inflation and the recovery of stock levels from the prior year. Wickes has also invested to protect the business against the risk of any future supply chain disruption.

Refitted stores continue to perform very well, with a strong returns profile as we work through the estate and we therefore plan to accelerate the pace of major store refits from 2022 onwards. We will provide further detail on our investment and broader capital structure as part of full year reporting.

The group announces a new CFO today as well: Mark George, to replace Julie Wirth who plans to retire. He’s the CFO of The Gym Group, also reporting today.

Conclusion

This is a recent demerger on a modest rating with a fairly low risk growth opportunity in the form of ongoing store refittings. That won’t continue indefinitely, but it could be a nice tailwind over the next couple of years.

Q4 sales are down against tough comps, but the group reaffirms its FY profit before tax guidance of not less than £83m. Stockopedia shows fluctuations in the tax rate, from 45% in FY19 to 9% in FY20. Assuming a notional 20% charge this year would give a minimum profit after tax of £66.4m and earnings per share of 25.6p, which is in line with the consensus forecast.

This is set to fall slightly the following year, but there has been a general rising trend in consensus estimates.

Wickes remains a bit of an unknown entity as a listed company, so the jury’s out for now, and for all its talk of a strong market position this is a competitive sector with some very good operators. Management has referred to the ‘dynamic’ market environment over the Covid period, so it’s a particularly hard time to understand how various players are performing on an underlying basis.

Has there been a temporary, unsustainable revenue boost over the Covid period? I think that’s possible, as is a more sustainable opportunity should people end up working from home for longer than expected. Rising costs such as wage inflation could potentially become an issue though.

Ultimately I come back to the valuation, which is undemanding. If the group shows it can defend and grow market share or revenue then it might not take too much for the market to rerate the stock.

Time Finance (LON:TIME)

Share price: 25p (-0.99%)

Shares in issue: 92,512,704

Market cap: £23.1m

This was pitched by twitter user JimTech at last night’s StockSlam as a value play. That video should be out later today. I’ll link to it later so do check it out if you want a three-minute ‘slam’ of the company from an existing shareholder.

It’s very small, a micro cap, so won’t appeal to all, but the value is pretty clear.

Time Finance's core strategy is to focus on providing or arranging funding finance for UK SMEs, primarily from its own book. There are four divisions: Asset Finance, Invoice Finance, Vehicle Finance, and Loan Finance.

Half year results for the six months ended 30 November 2021

- Origination +3% to £58.1m,

- Revenue +1% to £11.8m,

- Gross profit +3% to £7.6m,

- Profit before tax +1% to £7.6m,

- Net assets up from £57.1m to £58.2m (against a market cap of around £24m),

- Net tangible assets up from £28.4m to £29.6m,

- Net deals in arrears down 26% to 9% of the gross lending book, with no deals in forbearance.

Covid is still having an impact on trading activity and normal business has yet to be fully resumed. This is hitting the non-core brokerage arms more.

Investments have been made in sales resource across Asset, Invoice Finance and Commercial Loans. The lending portfolio performance was better than pre-pandemic levels and continues to improve. UK SMEs have remained resilient during the pandemic, with borrowers missing payments reducing.

The group had £9.6m of cash, cash equivalents and convertible 'paper' at period end, leaving it well placed to capitalise on future opportunities.

Conclusion

Again, a stock that doesn’t have to shoot the lights out in order to justify a rerating. Covid is still having an impact but trading figures are modestly positive. Time Finance is listed as a ‘Super Stock’, but it’s probably more ‘Contrarian’ in spirit.

It’s all about the value here, and whether or not the new CEO (appointed back in June 2021, and with previous experience working at the company) can arrest what has been a long, slow share price decline.

Looking back, I actually wrote up some notes of a meeting with the CEO (Ed Rimmer) back in September 2021, which are worth going over.

Companies change all the time, and investment cases improve and deteriorate. Time Finance could well be getting its house in order and so it is worth looking at more closely in my view. Drawing a line under the ‘buy and build’ strategy to focus more on organic growth strikes me as a positive step.

I think shares could potentially double if we see sustained signs of improvement. Things do seem to be slowly moving in the right direction, and the valuation is supported by £28.4m of net tangible assets. Meanwhile, debt in arrears has declined and there are no deals in forbearance.

Equity Development follows the company and calculates a fundamental valuation of 45p per share for the group. Here are the notes. We’re going through a busy patch at the SCVR with lots of updates, so heading over to ED to see what a dedicated Time Finance equity analyst makes of the stock is a good move I think, if the valuation piques your interest.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.