Good morning, it's Paul here.

Please see the article header for the trading updates & results that I shall be covering today. It's very busy for updates today, so I'll be writing all afternoon (I've come down with a cold, so this morning was a wash-out).

Forex

I mention forex occasionally when there have been big changes, because these changes in exchange rates have a big effect on some companies' earnings, and growth. My worry is that the benefit of cheaper sterling might now drop out of results, or even go into reverse in some cases. Cheaper sterling has boosted earnings at groups with overseas subsidiaries, and for UK exporters. It's hurt UK importers, e.g. retailers. However, those are one-off impacts on growth. So we need to be careful about over-estimating future growth at companies that had previously seen profits grow a lot from overseas earnings translation into weak sterling.

Amazingly, sterling against the US dollar is now back to the same sort of level it was just before the Brexit vote;

(chart courtesy of IG Index)

However, this seems to be more about dollar weakness, than sterling strength. Against the Euro, sterling has not risen very much at all, nothing like the move against the dollar anyway.

Stronger sterling against the dollar should start to help retailers, once their forex hedges are used up, which could be 6 months to 2 years, depending on their hedging strategy (which can be checked, as it's often mentioned in the Annual Report - just open it online, then use CTRL+F to search for specific terms (e.g. "hedge" or "hedges").

Inflation in the UK should also gradually reduce, as the one-off impact of sterling devaluation unwinds. For that reason, I'm more relaxed about the likely direction of consumer spending, and hence am more bullish on (carefully selected) consumer shares than other commentators seem to be. There could be some bargains around now, if as I expect, the consumer is likely to be more confident & spending more later in 2018.

As an aside, I think a couple of readers got the wrong end of the stick last time I mentioned forex. I'm not interested in trying to predict what exchange rates will do. However, we do need to watch, and be aware of the impact on company earnings/growth from forex movements that have already happened. If you ignore this area, you might end up being hit with profit warnings that could have been anticipated.

Mello 2018

Hooray, it's Mello time! David Stredder has previously organised 2 marvellous investor events, which were both great successes. He's organising another one, 26-27 April 2018. The website has gone live, here, and tickets are already selling fast - because so many of us enjoyed the last one.

I'll be there of course, and I think David wants me to do a Small Cap Value Report live, as happened last time. David has a knack of arranging excellent speakers, and persuading good quality small cap companies to come along and talk to investors. It's very different to other investor shows, and I can almost gurantee that people who come along will enjoy it.

Mello events are also a wonderful way to meet people, and network amongst other investors. I can usually be found in the bar from lunchtime onwards, and enjoy chatting to anyone about shares!

Restaurant (LON:RTN)

Share price: 270p (up 2.0% today)

No. shares: 201.1m

Market cap: £543.0m

(at the time of writing, I hold a short position in this share)

Trading update- this group operates 497 casual dining restaurants, and pub/restaurants throughout the UK. Its brands include Frankie & Benny's, Chiquito, and others. Many of its sites are near cinemas, on retail parks.

As you know, I often mention consumer-orientated stocks (retailers, hospitality sector, etc), even if they're above my usual c.£400m market cap limit. This is because the sector interests me, I understand it well, and there is interesting read-across for the economy generally from observing how consumers are behaving.

The share price fell brutally in 2016, when it became apparent that RTN was no longer an exciting growth stock, but had turned into a struggling, rather dated restaurant operator. There's been a massive increase in capacity in the casual dining sector in the last 10 years, hence why I feel this sector is an almost total avoid. There's only one decent operator with its shares listed in the UK, and that's Fulham Shore (LON:FUL) (in which I have a small long position), and even that's struggling.

So I was expecting a poor update today, as were powerhouse broker, Peel Hunt, whose notes are usually bang on the money. They also took a gloomy view on RTN. Well, we've been wrong-footed by the company, which rather surprisingly has announced an in line update today;

We expect to deliver an adjusted PBT outcome for the 2017 full year in line with current market expectations.

Before people begin dusting off the bunting, I would point out that market expectations were lowered considerably this time last year - so the bar was set quite low;

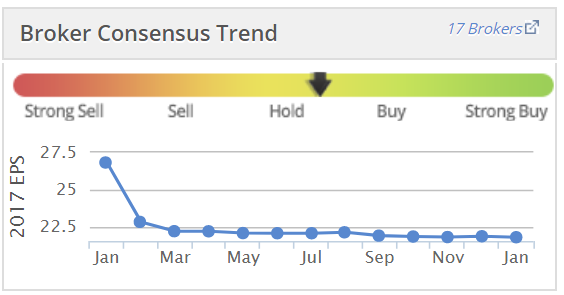

The forecast EPS of 21.8p for 2017 is well below 33.5p in 2015, and 30.0p in 2016. The trend in earnings is therefore firmly downwards, as you can see below (light blue blobs are the forecasts);

The trend in LFL sales is also downwards, consider these reported LFL sales growth figures for the year to date each time;

- 26 weeks ended 2 Jul 2017: down 2.2%

- 34 weeks ended 27 Aug 2017: down 2.5%

- 52 weeks ended 31 Dec 2017: down 3.0%

By extrapolation therefore, it looks as if the most recent trading period must have had LFL sales down c.4%, in order to pull down the year's average from 2.5% to 3.0%. This is not good. The issue is that the whole sector is having to offer customers discount deals, in order to get bums on seats. That reduces sales (unless volumes increase more than the price drops), and also reduces profit margins. This is all why I still feel negative about this share.

Turnaround strategy - I see from Twitter that some investors are buying into the new management turnaround strategy. I've seen articles about how menus have been tweaked, to bring back old favourites, etc. So the group does seem to be regaining its poise in some areas, and also cutting costs.

Cashflow - it remains decently cash generative, so there's no risk of insolvency here, in my view;

The Group's balance sheet remains strong and continues to benefit from good cash generation from our operations.

My opinion - I see this as a struggling business, that has negative momentum on sales & profits. Therefore, we need to be very careful before buying into a seemingly attractive divi yield (of nearly 6% - which I suspect is very likely to be reduced in future, as it may not even be covered by 2018 earnings), and lowish PER of about 12.

Broker forecasts are currently for a slight rise in 2018 earnings. Why would that happen, when the momentum is negative for the whole sector? I think this company could be heading for another profit warning in 2018, as estimates may need to come down again.

Could it be a bid target? Possibly, but why would anyone want to buy a group with fixed rents, which may now be too high in some places? The only way retailers & restaurants can survive & prosper long-term, is if rents come down significantly. That's really the only cost which can be changed enough to make a difference. However, rents can only come down at the end of a lease, or if there is a break clause. Otherwise, most shop leases are stuck on upward-only 5-yearly rent reviews. Shorter leases are becoming more normal now (5 years instead of 15 years), but of course the incumbent has to wait until the original lease expires, before being able to negotiate a more competitive lease structure. Leases aren't the only problem - add on to that, wage rises for not just Living Wage, but also staff above that level are pressing for the differential to be maintained. Apprenticehship Levy, and pensions costs too, all create more headwinds.

The other possible way forwards is more automation - note how self-service touch screens are appearing in more McDonald's sites, which lowers wages costs a fair bit - since nobody needs to be employed to operate a till any more. So I think we can expect to see more of this kind of thing, in future.

It will be interesting to see how this pans out, but personally, I cannot see any attraction in buying shares in the casual dining sector, which has serious structural over-supply. Look at how long it has taken for the pubs sector to reduce down to a sustainable number of sites? (10 years+). However, pubs groups are now generally reporting positive sales growth - because what we have left are the proverbial last men standing. Whereas casual dining companies have recently sprung up all over the place, often signing leases on inflated rents, and the sector is now carnage. Restaurant operators are mainly reporting negative sales, and hence a leveraged drop in profits. Therefore it seems obvious to me that the better sector to invest in right now is pubs, not restaurants.

As regards other listed restaurant group, I see the Fulham Shore (LON:FUL) has bounced strongly from a recent low of about 10p (it's now about 14p). I missed that rise unfortunately, as had intended to buy back a decent size (I only hold a tiny scrap, just to keep it on my radar), but dithered too long and missed it.

I see that Tasty (LON:TAST) is continuing to fall. That's a dud, in my view, so I'm not tempted to bottom fish there, even though the price is now only 19.5p.

Comptoir (LON:COM) is also a dud, in my view. See previous articles here for explanations as to why I wouldn't touch either of these last two.

Lamprell (LON:LAM)

Share price: 74.3p

No. shares: 341.7m

Market cap: £253.9m

Why on earth was this issued at 4:15pm, yesterday? It's such bad form to issue trading updates during market hours. Surely things can be managed better than this (e.g. only hold Board meetings to discuss a profit warning after the UK market has shut)? Then issue the update at 7am, like nearly everyone else does.

Anyway, this announcement has clearly unsettled investors, as it triggered a share price fall yesterday.

Lamprell last warned on profits in Nov 2017, which I reported on here. The company said that it had problems with a wind farm project off East Anglia's coast, but wasn't sure of the costs, other than saying the project would make a "significant loss".

Today's update quantifies the losses on this project at $80m - strewth! It also says;

This forecast loss on the project does not include any potential liquidated damages. We remain in constructive discussions with our client and are confident of meeting their expectations around the delivery schedule requirements.

I had to google the specific meaning of that term, which is;

More detail is given, but I can't see any point in going through it all. The situation just sounds too problematic for me to want to revisit it. A couple of points;

- Net cash at year end still very strong at $255m.

- Cash expected to trend downwards in 2018.

- Likely breach of bank covenant, but doesn't sound worrying as the facilities are currently undrawn.

- Order book needs to be re-built, as it's low for 2018.

As a result, we maintain our previous guidance for 2018 revenues and expect trading to be significantly impacted by the lower activity levels and the fact that the 2018 revenues on the EA1 Project (which comprise approximately 25% of our 2018 projected revenues) will be at zero margin.

My opinion - this is a lot more problematic than I realised. A friend talked me out of the shares over lunch in Dec 2017. He rightly believed that the company's outlook was very poor.

Its saving grace is a very strong balance sheet. Longer term there could be recovery potential here (with the stronger oil price of late), but for now it looks a complete dog's breakfast, so I'm steering clear.

MySale (LON:MYSL)

Share price: 113.5p (up 4.1% today)

No. shares: 154.3m

Market cap: £175.1m

MySale Group plc (AIM: MYSL) (the "group") the leading international online retailer, is pleased to provide a trading update for the six months to 31 December 2017.

The company has a 30 June 2018 year end.

Today's update sounds good, e.g.;

- Underlying EBITDA grew 80% to a record A$5.5 million (H1 FY17: A$3.0 million)

- Gross Profit increased 19% to c. A$45.7 million (H1 FY17: A$38.4 million)

- Gross Margin increased 200 bps to 30.1% (H1 FY17: 28.1%)

- Revenue increased 11% to c. A$152.0 million (H1 FY17: A$136.7 million)

- Guidance for full year of underlying EBITDA at least at the top end of market expectations

I'm not keen on "underlying EBITDA" being used as the key reported profit measure. Obviously this is done because it's fashionable at the moment, and because it makes profits look higher than using conventional measures like profit before tax.

Looking back at last year's interim results, it reported A$3.0m underlying EBITDA, and A$0.6m underlying profit before tax. So a difference of A$2.4m, which is obviously depreciation & amortisation.

There were quite a few items last year in the reconciliation from reported, to underlying EBITDA, e.g. A$510k share-based payments, acquisition & other one-off expenses, etc. So the underlying numbers look quite heavily massaged, to present the best possible picture.

Note that the company capitalised A$7.3m last full year for "payment for intangibles", shown within the cashflow statement. That's a lot, relative to EBITDA. This relates to purchases of software. It's not clear whether that is bought-in software, or whether the company is capitalising internal development costs? Anyway, it uses up most of EBITDA, so in cashflow terms the company is barely profitable.

Balance sheet - is strong, so no issues there.

Ourpay - this is interesting. It's a buy now, pay later scheme operated by this company. This now makes up 18% of orders, so seems a useful addition.

My opinion - I'm tempted to buy back into this share, as have previously held it, and know the company reasonably well. I met management last year too - they clearly know what they're doing, and are ambitious.

The snag here is rather pedestrian top line growth. To achieve multibagger share price performance, there needs to be very rapid top line growth. We saw that first at Asos, then more recently shares in Boohoo.Com (LON:BOO) and Gear4Music (I hold long positions in both companies) both did very well, on the back of extremely rapid organic growth. The market isn't that interested in profitability with these companies (yet), because they're in the growth phase. So fixating on PER is completely the wrong way to look at eCommerce companies, and people who did so missed out on some spectacular gains (that was the big lesson we should have all learned from Asos).

Whilst MySale looks interesting, its top line growth of only 11% just isn't enough to command a big valuation. Therefore, it doesn't really float my boat. Something else needs to happen to turbocharge growth. Then & only then would it reignite my interest.

Van Elle Holdings (LON:VANL)

Share price: 90p (up 1.7% today)

No. shares: 80.0m

Market cap: £72.0m

Interim results - for the 6 months to 31 Oct 2017.

Van Elle Holdings plc ("Van Elle", the "Company" or the "Group"), the AIM quoted geotechnical engineering contractor offering a wide range of ground engineering techniques and services to customers in a variety of UK construction end markets...

I reported on this company 9 days ago, here, when it revealed a potential £1.6m loss related to Carillion's insolvency. I checked Van Elle's balance sheet, and concluded that the likely £1.6m bad debt was not a problem, and could be absorbed by the company without undue stress.

Note that there have also been some disagreements between shareholders and Directors at this company, which I mentioned here. The founder seemed unhappy with the way the company was being run.

There was a trading update, which I reported on here, on 22 Nov 2017. So I shall compare today's reported results with that trading update. It should be in line, but I'll double-check anyway.

Revenues £52.6m (expected £53m - near enough). That's good growth of 22% vs H1 LY.

Underlying PBT is £5.4m (in line), up 15.4%. I'm happy with the basis for the "underlying" adjustments - this is mainly to strip out the £1.5m IPO cost in last year's interims. There are no adjustments to this year's H1 figures, so it looks absolutely fine - they're not fiddling the figures.

The PBT profit margin is therefore £5.4m divided by £52.6m = 10.3% - that seems a very good profit margin for a contracting business, suggesting that it has some special niche pricing power.

Another point on margins, is that the company mentions its gross profit margin of 31.7% (PY H1: 36.2%) was impacted by contract-specific problems, which have now been resolved. So I wonder if that is pointing towards higher margins in future? If so, that's potentially good news.

H2 weighting & outlook - the company said on 22 Nov 2017 that it has an H2 seasonal weighting normally. However, it's back-tracking somewhat from this today, in what appears to be a profit warning;

We have also had constructive dialogue with both the Official Receiver and Network Rail in respect of the 2.5m of anticipated revenue and whilst it is possible that some of the anticipated contracts may be delivered in the current year, the status and timing of specific programmes remains uncertain.

Van Elle would typically expect to achieve good margins on rail-related work and therefore these anticipated contracts are material in the context of the Group's financial results.

The Board believes it is prudent at this stage to recognise that the disruption to the expected order book due to the situation at Carillion will impact the Group's ability to achieve its previous expectations for the year as a whole.

"Meanwhile, enquiry levels across the Group in general remain encouraging and beyond the specific risks associated with the Carillion situation, the current order book as at January 2018 remains substantial.

However, the Group's second half expectation included a small number of important contracts which we had originally expected to commence in the fourth quarter but now believe will slip into the first quarter of next financial year.

Not good then - it sounds like forecasts for 04/2018 will need to come down - this is a profits warning. I'm very surprised that the share price actually went up slightly today, on this profit warning - not something you see very often. Maybe investors have just ascribed this to a one-off factor (Carillion) and hence haven't been spooked? There is a strong case for looking through the Carillion-related mishaps, and

Forecast updates - I can't find any broker updates today, unfortunately.

Existing consensus seems to be 11.1p EPS for 04/2018, and 12.4p for 04/2019. If we're just ignoring the Carillion-related losses, then the PER is low, at 8.1 and 7.3 respectively.

Balance sheet - dominated by £37.4m in PPE (property, plant & equipment), in fixed assets, as you would expect for this type of business. As this is a material figure, I'd like to see the breakdown, which is available in the last Annual Report, note 14. This shows the net book value at 30 Apr 2017 as follows;

- Land & buildings (freehold) £5.8m - excellent, I very much enjoy finding freehold property assets on balance sheets. This helps de-risk an investment. It also is pledged as security for the bank borrowings - meaning the borrowing facilities are less likely to be withdrawn in bad times.

- Plant & machinery £21.3m (of which £16.4m are held under finance leases)

- Motor vehicles £4.8m (of which £2.2m held under finance leases)

I see that the book value of PPE has risen from £32.1m to £37.4m in the last 6 months, so the group has spent heavily on capex. The narrative confirms this;

Capital investment continues to be a key driver of growth with a further 8.0m spent in the first half of the year (H1 2017: 2.1m), bringing the total investment over the last three and a half years to over 40.0m.

Nine rigs were purchased in the period and our fleet now stands at 118 rigs and we continue to believe that Van Elle has the broadest and most modern range of specialist piling rigs in the UK market.

Whilst the profit growth in recent years has been impressive, it's important to remember that this has been achieved through heavy capex investment. Personally I prefer companies that are capex-light, and can grow profits without tying up large amounts of capital. This company has some similarities with an equipment hire business (lots of assets, lots of debt), except that customers are hiring the operators of the equipment too. So depreciation policy, and utilisation rates of the equipment will be very important.

Strangely, the cashflow statement only shows £3.0m purchases of PPE, which is £5.0m short of what the narrative says. There's probably a reasonable explanation for this discrepancy, I just can't think what it could be yet.

What else? Working capital looks OK, in particular receivables is £21.0m versus annual turnover which is at a run rate of about £105-110m p.a. I make that about 71 days debtors, or 59 days if I assume that debtors are inclusive of VAT (which they probably would be, for a UK services business). That looks fine - 60 days is normal.

The current ratio is 1.5, which I see as healthy.

Borrowings mostly relates to finance leases, so is secured on the assets concerned, so that's all fine.

NAV is £39.2m, deducting a small intangibles figure of £2.3m (goodwill, relating to a historic acquisition) gives NTAV of £36.9m. That's a very healthy position, for a £72m market cap company.

Overall then, Van Elle looks financially strong, and I don't have any concerns at all about its balance sheet. It's has decent asset backing, as well as being decently profitable.

My opinion - personally I'm not really interested in buying shares in contracting companies. Something always seems to go wrong. That said, this company does appeal to me a bit. It's very cheap on a PER basis, has a strong balance sheet, and has an attractive dividend yield.

Set against that, it needs to spend a lot on capex to drive growth. This type of business is bound to be very cyclical. Ultra-low interest rates have triggered something of a building boom in the UK, and Van Elle seems to be doing particularly well on lucrative infrastructure projects. We don't really know whether those profitable contracts are likely to continue, or not. Or whether competition might also sniff out the decent profit margins, and start eating VANL's lunch.

Overall though, this looks a pretty decent investment, at a modest valuation, if current levels of profitability can be sustained, or growth further. Plus of course if nothing else goes wrong, which is always the danger with contracting companies, that something might go wrong.

Mission Marketing (LON:TMMG)

Share price: 47.5p (up 5.6% today, at market close)

No. shares: 84.1m

Market cap: £39.9m

(at the time of writing, I hold a long position in this share)

... the technology-embraced marketing communications and advertising group, today issues a trading update for the year ended 31 December 2017.

Trading in 2017 is in line with market expectations.

Revenues up 6% (4% organic) - sounds pretty good, in a year where there's been a lot of macro uncertainty (often marketing budgets are the first thing that companies cut).

- Headline PBT up 10% to £7.7m

- Net debt £7.5m, materially better than forecast.

- Lower net debt has triggered a reduction of 0.5% in the bank's interest rate.

- Trying to improve margins further - target is 14% by March 2020 (headline operating profit margin).

That all sounds rather encouraging to me.

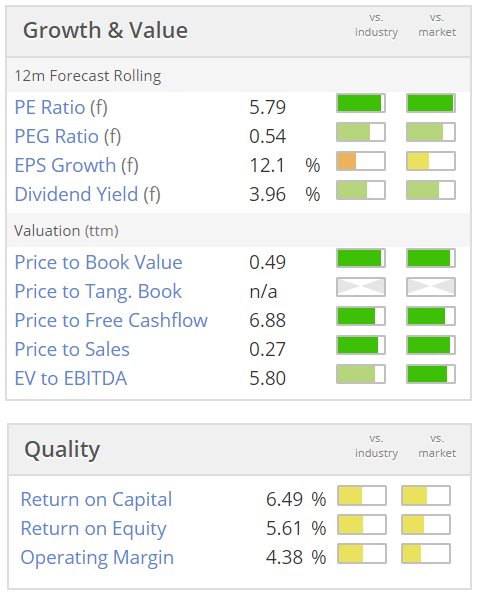

Valuation - this looks cheap, even after allowing for the net debt, and some deferred consideration creditors.

Note that the "Price to Tang.(ible) Book (value) above says "n/a". That means that P/TBV is negative. So that's a quick check to flag up that you need to check out the balance sheet. I don't like it - the group has a weak balance sheet, stuffed full of intangibles. There again, that's reflected in a very low PER.

Stockopedia likes it! This is a very high StockRank;

My opinion - obviously I like it, as I hold some. However, the only reason I still hold it is because my broker tried to sell them a while back (I wanted the money for something else), but there were no buyers. So beware that this share is extremely illiquid, and once you've bought, it can be almost impossible to sell. Or you would have to take a haircut anyway.

Mind you, that lack of liquidity works nicely on the upside when good news comes out. I see that earlier today the market spread was 46p bid, 48p offer, and someone had to pay 1p premium price, at 49p, to get hold of just 6,000 shares!

That said, I've just noticed that there were loads of trades today, totalling 650k shares. That's very, very unusual, as normally hardly anything trades in this share. So maybe I could have sold today, as there was plenty of demand. Of course, now the company has put out a decent trading update, I don't want to sell any more.

Conclusion - it's cheap, but very illiquid normally, so tricky to get in & out of. Therefore, it's more a share for longer-term investors than traders.

Vertu Motors (LON:VTU)

Share price: 44.1p (down 6.0% today, at market close)

No. shares: 387.6m

Market cap: £170.9m

Vertu Motors, the automotive retailer with a network of 121 sales and aftersales outlets across the UK, announces the following update ahead of its preliminary results for the year ended 28 February 2018.

First off, kudos to the company and its advisers for giving an honest summary line at the top of this announcement, which says;

Toughening market conditions: extension of share buy-backs

It's a mild profit warning, so today's 6% share price fall is a gentle response by the market, which probably wasn't expecting things to be good. Industry data is published online here - so trends are known before vehicle dealerships report their results. Share prices often react to newly released SMMT data.

The Board expects trading performance for the year ending 28 February 2018 to be moderately below current market expectations, following further declines in the new car market resulting from the depreciation of sterling and a softer general consumer environment.

It's interesting that Vertu doesn't mention confusion over diesel car pollution, which has triggered a large drop in diesel sales, without a corresponding increase in petrol sales. So I'm wondering if there could be pent-up demand building? Vertu know the sector better than me, so if they don't mention it, then it's probably not much of an issue.

The detail in today's announcement is a familiar trend - after-sales (servicing, etc) is doing well, whilst new car sales are heavily down. After-sales produces 38.1% of total gross profit, so is highly significant.

- Used car sales & margins are down, which is a deterioration from the trend in recent years.

- New fleet cars is a stand-out good number, being up 12.4% on LFL basis, in a market down 11.8%, gaining market share.

- Share buybacks will continue.

Balance sheet - I've reviewed the last (28 Feb 2017) balance sheet, and I think it's excellent. Working capital nets off - i.e. current assets and current liabilities are roughly the same.

What that leaves us with is basically a property company. Vertu owns the freeholds to over half its sites, which are in the books at cost, of £182m (source: page 3 of 2017 Annual Report). That's more than the market cap. There's only £9.8m of interest-bearing debt, in long-term creditors.

I can't find any information on what the market value of group freeholds is now. There could be upside, if properties are now worth more than historic cost, perhaps?

Valuation - you have the freehold property underpinning the market cap very nicely. Then we have earnings to consider. The company seems to be flat-lining around 6p EPS. So the PER is just 7.4 - mind you, all car dealers are cheap at the moment.

My opinion - I like it a lot. It's got a low PER, a reasonable 3.3% dividend yield, and the whole market cap is supported by freehold property almost owned outright (with little bank debt).

The trouble is, that the stock market doesn't like it, or other car dealers. The main concerns seem to be;

- Soft consumer demand for new cars (and now used demand seems to be slowing too) - so maybe earnings could start falling?

- Electric cars - will probably soon become ubiquitous, and they require less servicing than ICE vehicles. Bad for dealers.

- Self-driving cars - in the pipeline, so will people buy cars at all in the future?

- Sterling weak vs the Euro still, which pushed up car prices & hence reduced demand.

Personally, I think that the risks are already in the price, and in any case the market cap is supported by freehold property. So it should be pretty underpinned. The trouble is, what's going to trigger an actual big rise in share price? It might be copper-bottomed, but that's not much use if the share price just carries on going sideways. Somebody might bid for it, I suppose - to do some financial engineering (e.g. a sale & leaseback on the freeholds), or disposals for alternative use. This share is more for value investors, who might get a nice payday one day, if someone bids for it. Even if things go badly, there probably isn't much downside from the current price, due to the property backing.

Haynes Publishing (LON:HYNS)

Share price: 224p (up 9.8% today)

No. shares: 15.1m

Market cap: £33.8m

Haynes Publishing Group P.L.C. ("Haynes" or "the Group"), creator and supplier of practical information and data solutions to drivers, enthusiasts and professional mechanics in print and digital formats, today announces its results for the 6 months ended 30 November 2017.

- Headline numbers look good - assisted by an acquisition.

- Organic growth was good too - LFL revenue up 8%

- EBITDA is meaningless with this company, as it spend so much creating new content.

- H1 adjusted profit before tax up 120% to £1.1m

- Interim divi held at 3.5p

- Net debt iof only £0.3m

- Elephant in the room is the massive pension scheme, deeply in deficit - you can't value the shares properly without adjusting for this in some way.

- Post period end a US property was sold for $5.4m (£4.0m)

My opinion - I nearly bought some of these last year, but shied away because there's hardly any liquidity in the share, and the bid:offer spread can be prohibitive.

The company seems to be enjoying a turnaround, with some sensible new ideas from management, and apparently sensible acquisitions. I think continued expansion is vital, to help dilute the scale of the pension scheme problem. The word "pension" appears 110 times in the last annual report.

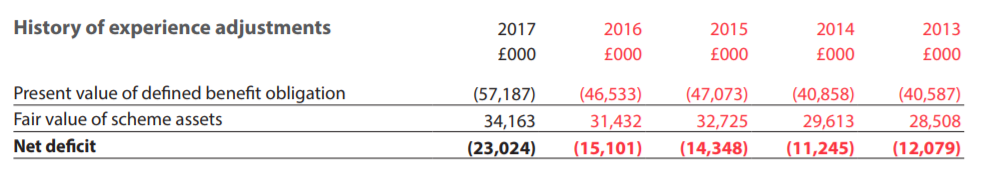

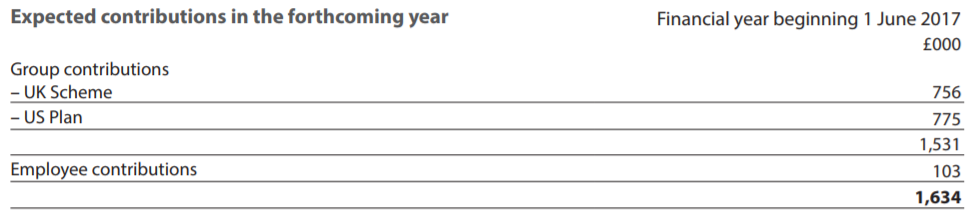

As you can see, the pension scheme liabilities seem to be escalating much faster than the assets, creating a yawning gap, that ultimately the company has to fund, over the long term;

As you can see, the company is having to pour serious money into supporting the pension schemes, which is money that otherwise could be paid out in divis;

It has a great StockRank of 96, although I'm not sure whether the StockRank factors in the pension deficit? It's also classified as a "Super Stock". So it's worth a closer look I think - both Graham and I wrote positive articles here last year about the emerging turnaround at Haynes. Just don't forget to price-in the pension deficit!

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.