Good morning!

Webinar at 1pm today (4 May)

Last call for Ed's webinar today at 1pm. It should be very interesting, as Ed will be unveiling some new features on Stockopedia. As mentioned yesterday, I've had a preview, and very much like the new classifications system. It will be fun to see how the site rates my shareholdings. I think this feature will be much talked-about, and is set to ruffle some feathers too!

So do sign up - here is the link.

Focusrite (LON:TUNE)

I covered this share in yesterday's report. I see it has risen by a further 7% today, on top of yesterday's rise. This reminded me of a term in the excellent Mark Minervini book, which he called something like "post announcement drift".

This is where a company puts out a highly significant piece of news (e.g. strong out-performance, or a big profit warning). What often happens is that the initial first day move is just the beginning of a much bigger move.

This is particularly the case with small caps - because lack of liquidity means that buyers & sellers cannot be immediately satisfied. Therefore buyers/sellers tend to continue buying or selling, often over a long period of time, as they have no other choice. Whereas large caps are so liquid, that most buyers & sellers can get filled quite quickly.

Also, I think a lot of traders use momentum-based strategies (which have worked very well since 2009 - buying the dips, riding the up-trend, then selling once the up-trend breaks). This reinforces the tendency of shares to continue drifting up or down after major positive or negative news.

The obvious conclusion from this tendency of prices to continue drifting after major news, is to buy or sell aggressively on the day of the big news. That's what I've been tending to do lately, and it's working a Treatt (LON:TET) ! (which is a great example of post announcement drift)!

I flagged up the great news from Treatt here on 23 Feb 2017, when the share was up about 21% on the day. Here we are just over 2 months later, and it's risen a further 29%.

A similar thing may be happening at Focusrite (LON:TUNE) although it's early days.

Therefore I am flagging to readers that spotting game-changing announcements, and acting quickly, is proving a very lucrative strategy at the moment. We're in a roaring bull market, and people are prepared to pay more punchy valuations. That means re-ratings can be bigger & faster than in more normal markets. Plenty of money to be made - for now. Obviously bulish conditions like this won't last forever though. While we are in a very bullish market, I think it's key to make the most of it.

Although one does have to be careful not to buy into an irrational spike. I did that with Richoux (LON:RIC), where I bought right at the top of the big spike on news that Jonathan Kaye was coming in as CEO. Then I sold at the recent low. A good example of over-reacting to significant news, and messing up both sides of the trade! This reinforces my conviction that the smallest, most illiquid shares are really best avoided - unless they are truly exceptional (which very few are).

Trinity Mirror (LON:TNI)

Share price: 112.8p

No. shares: 277.9m

Market cap: £313.5m

Trading update - covering the 4 months to 30 Apr 2017.

No surprises here - challenging market conditions, but it's still managing to trade in line with market expectations.

Like-for-like ("LFL") revenue remains in a nasty downward trend, of -9%. There's only so long they can keep stripping out costs, so at some point profitability is likely to collapse - we just don't know when.

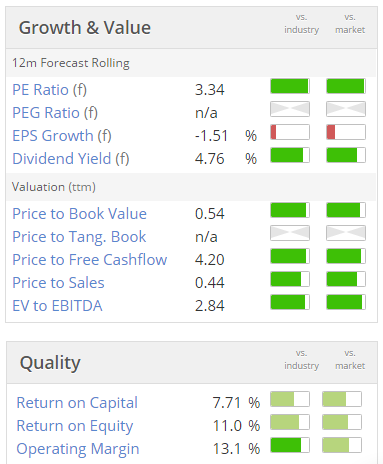

This is why the share looks staggering cheap - because everybody knows the current level of profitability is not sustainable. Therefore this share is probably a value trap. Plus the enormous pension fund remains a major issue.

That said, profits have remained strong for longer than many people imagined.

Mind you, the share has been cheaper before - I remember buying it on a PER of one! Plus it had considerable debt back then, which has since been mostly repaid.

The pension deficit is shown at a gigantic £466m in the most recent balance sheet. That's on the usually more lenient accounting basis of calculating it. I dread to think what the actuarial deficit is, as that's usually larger.

It's difficult to see where things go from here. Terminal decline seems the most likely end game. Although one thing intrigues me about both Trinity Mirror (LON:TNI) and Johnston Press (LON:JPR) - they're both amazingly profitable still. I'm struggling to think of other sectors which have been dying out, yet remained hugely profitable. Can any readers think of any similar situations?

This makes me wonder whether there might yet be some hope for newspapers surviving? The free papers in London - Metro, and Evening Standard, are still very popular indeed. It's much easier to browse and absorb content in a newspaper, rather than on a smartphone. So perhaps ultimately some papers might survive, if they move to a free model?

Blancco Technology (LON:BLTG)

Share price: 194.2p

No. shares: 58.2m (before Placing) + 5.8m new shares = 64.0m after Placing

Market cap: £124.3m after Placing

Placing - good news for shareholders here, with a successful placing being announced.

It looks like the institutions have rallied round the company, and have injected the necessary extra funding at 169p per share - which is no discount to yesterday's price. That's an encouraging display of support.

When cashflow problems emerged, which I reported on here on 25 April 2017, I flagged the possibility that this might have been a buying opportunity at 158p. The upside case has played out, at least in the short term anyway.

Overall though, I've never liked this company. It's too accident-prone, and this latest debacle raises serious issues about quality of the management. Therefore I wasn't prepared to take the risk of having a punt on them sorting out the problems. Pity, as it would have been a nice trade - so well done to anyone who did have a punt on a rebound.

The balance sheet will still be weak, even after this fundraising. Although at least the highly embarrassing short term problems have been fixed. A company which is providing security software to major companies just can't get into a mess like this. It undermines the credibility of the company to clients & potential new clients. So this avoidable debacle will have damaged the company and its reputation, in my view.

There again, that's probably reflected in the share price. Peel Hunt points out today that the valuation is at a 50% discount to its sector peers. So arguably the problems are priced in.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.