Good morning!

Patisserie Holdings (LON:CAKE)

We had a reminder last night that frauds are usually worse than they first appear.

Patisserie Holdings (LON:CAKE) provided investors with the following update:

- "the misstatement of its accounts was extensive, involving very significant manipulation of the balance sheet and profit and loss accounts. Among other manipulations, this involved thousands of false entries into the Company's ledgers."

- "the cash flow and profitability of the business has been overstated in the past and is materially below that announced in the trading update on 12 October 2018"

Shocking stuff and a cautionary tale about frauds: after initial discovery, there is usually a lot more deception that is yet to be discovered.

Commiserations to shareholders, as the equity must be worth less than the 12 October 2018 update suggested.

That update said revenue and EBITDA for FY 2019 could be c. £120 million and £12 million, respectively.

If EBITDA is running materially below £12 million for the year, I suppose we have to wonder whether the company is profitable at all - perhaps it has not been profitable for years.

It is impossible to say, but what we can say with certainty is that the shares would be worth very little if they were admitted to trading today.

Those who took part in the £15 million October placing will have been warned that the profitability estimates released at that time were based on very limited information, so I can't imagine that they have any recourse after this latest update. But one or two of them are likely to be feeling disappointed and angry after those initial estimates turned out to be optimistic.

Plenty of updates this morning. My list is:

- GAME Digital (LON:GMD)

- DP Eurasia NV (LON:DPEU)

- Taptica International (LON:TAP)

- Judges Scientific (LON:JDG)

- XLMedia (LON:XLM)

- Portmeirion (LON:PMP)

- N Brown (LON:BWNG)

GAME Digital (LON:GMD)

- Share price: 25.5p (+10%)

- No. of shares: 173 million

- Market cap: £44 million

Positive share price action at GAME today despite full year performance trending only in line with expectations. Investors must have priced in a negative surprise.

Key points:

- Like-for-likes +2% during 7-week Christmas period, +1% since July.

- Spain stronger than UK over Christmas. Spain +4.8%, UK -0.3%.

- Total sales down marginally (this is less important than the like-for-likes in my view).

- Margin improvement

- Cash of £96 million by early January, an improvement compared to last year

The most interesting bit to me is about leases:

The Group remains in active property negotiations across its estate, with over 200 property lease events in the UK before the end of December 2019. The Group's flexibility in this area, with an average of less than one year to the earliest break in both the UK and Spain, will facilitate the reshaping of our estate, our fixed cost base and the rollout of BELONG arenas.

What a fantastic degree of flexibility it has.

The company is forecast to make a loss in the current financial year, returning to a small profit in 2020.

To me, this share is all about property portfolio management and whether they can size the business at the right level.

That right level is going to get smaller over time. We saw recently that Frontier Developments (LON:FDEV) makes most of its Jurassic World sales via downloads, rather than on physical discs. But long-term, perhaps there will always be a need for at least a few specialist video game retailers for those customers who need advice, coupled with BELONG arenas in which to try out the best games with the best equipment?

And there is an obvious value argument, given the company's large (but fluctuating) cash balance.

I must admit that it's tempting to have another flutter on these shares. But that's all it would be - I would not yet have the conviction to put money in this for the long-term.

Good luck to all holders. It will be fascinating to see how this plays out over the next 12 months as 200 lease events take place.

DP Eurasia NV (LON:DPEU)

- Share price: 113.9p (-1%)

- No. of shares: 145 million

- Market cap: £166 million

Trading Update - Strong top line growth

(Please note that I have a long position in DPEU.)

I thought the share price might have responded better to this RNS. It has been firm this month in advance of the update, so I can't complain.

This is my smallest individual position, due to the risk of investing in Turkey & Russia (two countries I have never visited).

But I know a little bit about Domino's pizza, and the franchise system. So I was willing to give it a chance.

Today's update for the year ending 2018 is in line with expectations.

- 81 new stores, 724 in total. Big pipeline for 2019.

- system sales (i.e. sales of food & drink on its network) up 30.9%.

- system sales +14% in Turkey (where it is already established and strong), +82% in Russia (its key growth opportunity)

- like-for-like sales +9% in Turkey, +16% in Russia.

- excellent online performance, e.g. Turkey online system sales +36%. Online is 61% of total deliveries. Russian website about to go live.

The company had net debt of TRY 149.5 million (£22 million) at the interim results for June, denominated mostly in Russian Roubles (RUB). Today it says:

We are also well on our way to eliminating our Turkish net debt and exposure to the associated high local interest rate as at the end of 2018.

Eliminating Turkish debt will leave it only with loans denominated in RUB, and nothing in Euros. That will be a positive development - the debt level is another reason for me to size this investment very small (c. 2% of my portfolio at entry, now worth only 1%).

I'm wondering whether I should increase position size - unlikely, since it's still very high-risk.

It has a poor StockRank of only 21, meaning that it's stastically unlikely to succeed. The value metrics help to sum up the situation:

Taptica International (LON:TAP)

- Share price: 180p (+3%)

- No. of shares: 68.5 million

- Market cap: £123 million

This bombed out Israeli company reports that 2018 was in line with expectations.

It claims to have net cash of $54 million (£42 million), i.e. one third of the market cap.

At the start of this month, it suspended its share buyback program to enter talks with a potential acquisition target. These talks are ongoing.

My view

If I held these shares, I would want the buyback to proceed at this share price. According to Stocko, it is trading at a P/E ratio of 4.4x and an EV/EBITDA ratio of 3x. If these numbers are real, it is a no-brainer to invest in its own shares rather than buy a new company at (presumably) a much higher valuation.

Taptica's previous CEO resigned in December over his role in a fraud case involving his previous company.

As we noted in relation to the Patisserie Holdings (LON:CAKE) fiasco, fraud tends to be an endemic or widespread condition at a company, rather than an isolated problem.

There is no suggestion that Taptica International (LON:TAP) is a fraudulent business, but the prominence of the previous CEO's role in its IPO and management heightens the risk that all may not be as it seems.

I view the suspension of the company's share buyback program as an amber flag and a bad decision for shareholders. The market is saying Taptica is a broken business and is refusing to pay a reasonable price for its shares, and Taptica itself is doing the same. The implication is clear enough.

Judges Scientific (LON:JDG)

- Share price: £24.50 (+1.6%)

- No. of shares: 6.2 million

- Market cap: £152 million

Trading Statement and Notice of Final Results

A short update:

- 6.2% growth in organic order intake

- total order book is 14.2 weeks of budgeted sales (down from 14.9 weeks, effectively the same)

- "healthy commercial activity" and "excellent exchange rates", EPS to be slightly ahead of expectations.

My view

Potentially a good entry point for this quality company. StockRank is 80, including a high QualityRank.

XLMedia (LON:XLM)

- Share price: 71.9p (-3%)

- No. of shares: 219 million

- Market cap: £157 million

Another Israeli tech company, this one is in the field of online, "performance" marketing.

EBITDA for 2018 will be in line with expectations, as the company achieves higher margins on lower than expected sales.

A similarity with Taptica:

The Company has a material cash balance and continues to generate strong cash flows from operations.

The difference is that XLM is buying back its own shares - up to $10 million of them, out of a cash balance of $42 million (June 2018). This is on top of a massive dividend yield (8.3%, according to Stockopedia).

If I had to add another Israeli company to my portfolio, it would probably be this one, simply because it is going ahead and executing a buyback, as it should at this low share price.

However, I prefer to focus on my existing Israeli holding, 888 (LON:888), which I understand better and believe should have greater longevity.

"Tread carefully when dealing in the shares of Israeli companies registered in offshore jurisdictions" - not a catchy motto, but a useful one.

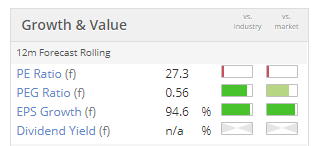

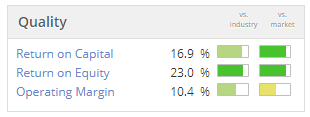

Portmeirion (LON:PMP)

- Share price: £10.50p (+5%)

- No. of shares: 11 million

- Market cap: £114 million

This British pottery company reports that 2018 revenue is ahead of expectations at £89.2 million. The forecast was £87.1 million. PBT is also ahead of expectations (forecast was £9.5 million).

There were clues that the company had a good year and might outperform - I thought that revenue forecasts were a a bit conservative back in August.

Onwards and upwards at Portmeirion, then. I remain a potential purchaser of these shares. It passes all 9 tests of the Neglected Firms Screen.

N Brown (LON:BWNG)

- Share price: 93p (-8%)

- No. of shares: 284.5 million

- Market cap: £265 million

Yet another bargain share, this online retailer is at a forecast P/E ratio of less than 5x, according to Stocko tables. It is being priced for extinction.

Q3 revenue update:

- product sales fall by 6%, as the non-core brands collapsed by 23%. The "power brands" were flat.

- financial services revenue +9.7%.

As Paul has noted before, this company seems to make more money from lending to its customers than from selling them things.

And that trend is exacerbated by the ongoing increase in financial revenue, and reduction in product revenue.

Full year expectations are unchanged.

Extract from CEO comment:

We continue to manage the anticipated decline of our legacy offline business and remain focused on improving our customer proposition to drive profitable online growth.

Adjustments to Guidance for FY 2019 (ending February)

- Better reduction in operating costs than planned

- Less depreciation and amortisation due to store closures

- Higher impairment charge due to VAT problem with HMRC.

My view

I think the bad news here is mostly in relation to the VAT issue. It is confirmed that marketing costs are set to increase by £6 million every year. That's a lot of hard-earned shareholder funds.

BWNG is an interesting contrarian play, as it has now closed all of its stores, giving it a clear route forward as an online retailer from now on.

On the other hand, the brands don't look particularly exciting, and there is no organic growth to speak of, at least not from selling products.

Worth investigating if you have the stomach to take on more retail exposure in your portfolio.

That's it for today, thanks everyone.

There are a lot of cheap shares out there at the moment - I'm feeling positive that there must be some bargains!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.