Good morning!

A couple of things today:

- GetBusy (LON:GETB) - response by CFO to my comments yesterday

- Portmeirion (LON:PMP) - interim results

- Walker Greenbank (LON:WGB) - half year trading update

- Countrywide (LON:CWD) - half year report and fundraising

- Non-Standard Finance (LON:NSF) - interim results

GetBusy (LON:GETB)

- Share price: 52.5p (+2%)

- No. of shares: 48.4 million

- Market cap: £25 million

In yesterday's report I looked at Getbusy, a document management business. I mentioned the company's use of adjusted earnings numbers and certain points raised by its auditors in the company's 2017 annual report.

Paul Haworth, Getbusy CFO, has kindly responded with additional detail and explanations, which I am glad to share.

Paul Haworth: Thank you for taking the time to comment on GetBusy’s results today; I know that this column is followed by a good portion of our UK retail investor base. I thought it would be helpful, if you’ll allow me, to provide some context to some of the points you’ve raised in your column.

Firstly, I wanted to provide some more information about why we quote “adjusted EBITDA” and what it means to us. As with any growing business that is cash absorptive, we need to closely watch our cashflow and ensure we’re making very deliberate, evidence-based investment decisions. It’s important to us to track a profitability metric that most closely matches what cash is doing. IFRS measures of profit rarely do that. So we take our IFRS operating profit and make the following key adjustments:

• We make sure all development costs are expensed. Why? Because development capitalisation is one of the most horribly used and abused tricks up a naughty CFO’s sleeve. There is so much judgement involved in capitalisation, and it is such a difficult area for auditors to really get a grip of, that it is often used to manipulate earnings in the short-term. That’s wrong, and it certainly doesn’t help with cash management. So all of the development capitalisation that the accounting standards require us to do is done “below” Adjusted EBITDA. We think that’s transparent.

• We remove the impact of any share-based payments. These are non-cash and the notional charges are calculated by statistical models that are very sensitive to inputs, which themselves are very judgemental. So we record them below Adjusted EBITDA.

• Depreciation and amortisation are removed as is fairly standard – as a software business our tangible assets are never going to be particularly significant in any case.

In response to questions we often get from investors, we also show Adjusted EBITDA before development and before corporate costs. This provides a different perspective on the “operational” business, and should be used with the other measures we provide, all of which we reconcile every time we put out numbers. Different investors will find different profitability metrics more or less useful – we prefer to offer the variety and allow our investors to select the metric that best suits their objective. Pick yours!

In your comments on the current assets / current liabilities split, you query the extent of cash outflows required to satisfy our deferred revenue. Your reasoning is spot on – those cash outflows are minimal. It’s worth bearing in mind that we early-adopted (last year) the new accounting standard for revenue, IFRS15. This had the impact of significantly increasing our deferred revenue because a lot of our non-recurring consulting and licence revenue – which previously was recognised as invoiced – now has to be recognised over a longer period. If you’re currently trying to navigate the complexity of the many companies explaining what the impact of the new standard is on their numbers, you have my complete sympathy.

Finally, you mention a couple of interesting points drawn out of the 2017 report from our auditors. Firstly, the auditing standards require auditors to presume that revenue recognition is a significant risk (with good reason!), so I would suggest this is something you’d find in common with almost all businesses, and particularly software. Secondly, their report refers to there being “insufficient evidence available to support the reliable measurement of development costs capitalised in previous periods.”, something that we also mention in the “critical judgements” part of our accounting policies. This refers to costs incurred before 2017. The accounting standard is very prescriptive that sufficient evidence needs to exist to demonstrate that, at the time of the development being carried out, the other criteria for capitalisation were met. I came in as CFO in November 2017 and it simply was not practical to obtain contemporaneous evidence that the very specific criteria were met at specific times, and in some cases 24 months ago. Our strong belief is that showing fully expensed development costs within our Adjusted EBITDA number is the most transparent way to present this. You can see exactly what we capitalise below Adjusted EBITDA and why in the notes to our accounts.

I hope that makes sense. We always value feedback, listening to a range of perspectives and are always happy to engage in discussion.

(END)

My view (Graham): I think it's fantastic to get the company's perspective on these things, so I'm grateful to Paul for getting in touch and elaborating.

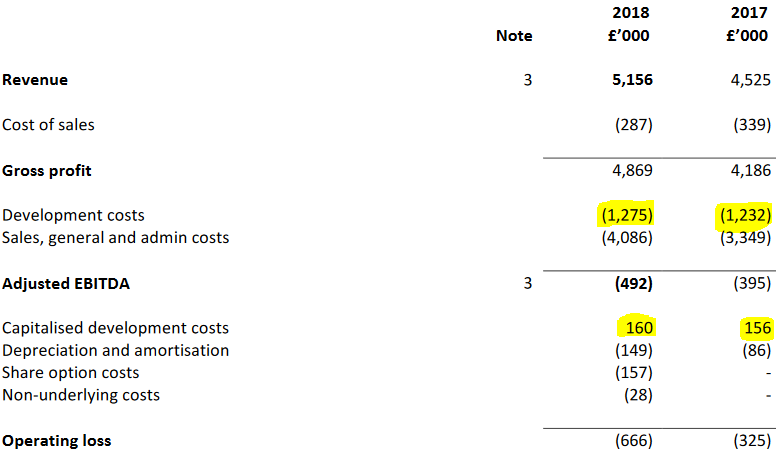

Let's quickly look at an excerpt from Getbusy's interim income statement:

In relation to development spending, I fully agree that what the company has done is transparent: instead of showing only the development costs which need to be expensed on the income statement, it has shown all of them (£1,275k).

Then, as Paul explained, it has added back the development costs which need to be capitalised, below the adjusted EBITDA line (£160k). A more standard treatment would have been to show only the £1,115k of non-capitalised development spending.

It is then up to us, as prospective investors, to decide for ourselves what measure of adjusted earnings we want to use.

For reasons discussed previously in this report, and because my investing style is conservative, I tend to focus on the reported operating profit or loss as my baseline number.

In the case of Getbusy, there was £1,115k of development spending that wasn't capitalised. Investors can have different views as to how much of this, if any, to add back in.

Portmeirion (LON:PMP)

- Share price: 1172.5p (+4.5%)

- No. of shares: 11 million

- Market cap: £128 million

We last covered this pottery company at its H1 trading update.

I thought that an eventual earnings beat for the year seemed likely after that update, given the positive tone.

Today the company says that it remains confident in its ability to meet full year market expectations. Still, the very positive tone leads one to hope that it might beat the full-year EPS forecast of 72p.

Interim dividend is increased 8%.

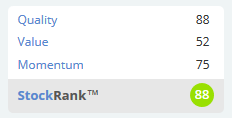

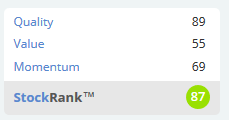

The yield is at a useful level, and the valuation is by no means extortionate:

Reading through the report, everything is very much in line with what we might have expected. As the company itself says, "our strategy remains unchanged".

It's still on the lookout for acquisitions, "where there is a strategic fit".

It's looking to rebuild dividend cover to 2x, which might constrain the growth in the final dividend this year, but that's no big deal.

Operating margin has increased from 5.2% to 5.7% for H1, a very good sign.

The revenue forecasts as shown to the market are for revenue to increase by just 3% for the full year. This looks too conservative to me.

So I think we have several reasons for positive sentiment towards this share.

The StockRanks love it, too:

Walker Greenbank (LON:WGB)

- Share price: 77.5p (-1%)

- No. of shares: 71 million

- Market cap: £55 million

This interior furnishings group is another stock that is fresh in the memory. We last mentioned it on 25 July, the day after it published a profit warning.

Expectations remain unchanged since the 24 July update, i.e. for adjusted PBT of £9.5 million - £10 million.

I don't think I need to revise my view following this update. I think it remains worthy of further research, for the same reasons as before.

The licensing business looks attractive with growth of almost 43% at constant currencies. This probably won't be matched in H2 after expectations had to be written down, but we should still get "a substantial upward step change" for the full-year (in the company's words).

In relation to brand sales, the company has previously referenced the "weaker UK consumer environment" in relation to its poor performance in its home market. They are down by a further 7% in H1. This would be my main worry: that the weakness is not just related to macro conditions, but might also have something to do with the brands becoming less fashionable.

Still, I think this makes for an interesting contrarian bet.

Countrywide (LON:CWD)

- Share price: 18p (-64%)

- No. of shares: 238 million

- Market cap: £43 million

Firm Placing, Placing and Open Offer 2018

Massive shareholder value destruction at Countrywide, but at least it will avoid going into administration.

Congratulations must go to MrC for shorting this.

And if you'll forgive me for tooting our own horn for a moment, Paul thoroughly analysed the situation at Countrywide in March and concluded that it was uninvestible.

I agreed, and made the following point in June:

That's the big problem with equity refinancing. As a shareholder, you might look at the share price and think "I will still be left with x% of the company after the placing, it's not so bad". But if the placing ends up being at a much lower level (and it's impossible to predict where a placing will take place, without inside information), then the percentage you are left with could be just a fraction of that.

Today, the company proposes to issue 1.4 billion new shares at the bargain price of just 10p. Existing shares will represent ownership of merely 14.5% of the company. Commiserations to anyone who has been holding this.

Countrywide has run out of money before and this is not a sector in which I have any desire to invest, so I'll leave my comments there for now.

Apologies for the slowness this afternoon. My laptop is showing signs of old age, and has nearly died.

The signs have been showing for a while, so I visited Currys (Dixons Carphone (LON:DC.) ) yesterday afternoon, to figure out what to do.

I have no complaints about the staff there but as someone who knows a little bit about computers (not much, but slightly more than an average person), I suspected there would be far more value available online.

I've now finished my research and placed an order for a very powerful refurbished machine, customised exactly the way I want it, along with a bunch of discounted monitors and cheap accessories. The trip to Dixons Carphone (LON:DC.) turned out to be useful for the showroom experience, that's all.

This purchase will hopefully sort me out for the next three years. The depreciation charges are going to hurt, though.

Non-Standard Finance (LON:NSF)

- Share price: 59.4p (+8%)

- No. of shares: 312 million

- Market cap: £185 million

Unaudited half year results to 30 June 2018

This share has a handy clue in the name. It provides an alternative source of credit to people who otherwise might not be able to access any.

It was formed in 2015 with the principal backing of Woodford/Invesco. I attended its presentation at Mello this year.

It's the UK's largest branch-based provider of unsecured credit, the second largest provider of guarantor loans and the third largest provider of home credit.

It is in roughly the same sector as H & T (LON:HAT) (in which I own shares) and Ramsdens Holdings (LON:RFX), although the pawn loans those companies provide are secured, while NSF does not do secured lending.

Results

Numbers reported today:

- impairments down as a percentage of normalised revenue (25.9%)

- net loan book up 37% (following acquisitions)

- normalised EPS up 7%

The accounts are complicated since it has been entirely formed by acquisitions. The last acquisition took place in August 2017, so we can't directly compare these results versus H1 2017.

Let me try to explain the company's "normalised" results as simply as possible.

When NSF bought various loan books, it estimated what they were worth.

Now it is finding out the true value of these loan books.

The difference between the original estimate and true value is added to or subtracted from revenue each period, depending on whether it is in the company's favour or not.

NSF also likes to remove the amortisation of acquired intangibles from the results.

Those two adjustments are how it calculates its "normalised" EPS.

Some might say those adjustments are reasonable.

If you allow them, then the PBT for the period is profit of £5.6 million.

If you don't allow them, the the PBT is a loss of £2.6 million.

Last year, and the year before, the company made a profit if you allow those adjustments and a loss if you don't.

I'm not seeing much cause to get excited about this yet. Something like £270 million was invested in the business, to enable it to make its three acquisitions, and it now has equity of just £213 million, after generating losses and making dividend payments.

Reported earnings should hopefully improve as the fair value adjustments wither away. Even still, I haven't yet seen any particular evidence to suggest that long-term performance will be better-than-average.

Until then, pricing the shares at a modest discount to book value looks appropriate.

All done for today. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.