Good morning!

Today we have a bombshell offer for Premier Technical Services (LON:PTSG) at 210.1p. The stock closed last night at 87p.

Other stories:

- N Brown (LON:BWNG)

- Local Shopping REIT (LON:LSR)

- LPA (LON:LPA)

- Best Of The Best (LON:BOTB)

Premier Technical Services (LON:PTSG)

- Share price: 205p (+136%)

- No. of shares: 126 million

- Market cap: £259 million

PTSG has been covered very recently in this report.

According to the archives, most of the commentary around these parts has been thanks to Paul. I've not said too much about it, though like Paul I've been sceptical:

- March 2017 (107p) - saw a lot of complexity in the accounts, and negative net tangible assets. Thought that the company had a lot to prove to justify a high earnings multiple.

- 7 Aug 2017 (144p) - wary of valuation relative to the quality of the business.

- 21 Feb 2019 (119.5p) - explained that it was not the type of thing I would invest in personally, but also guessed that the recent, sharp deterioration in the share price was probably nothing more than short-term noise.

It turns out that I should have been more interested. The acquisition is priced at a:

- 145% premium to yesterday's closing price

- 72% premium to the volume-weighted price over the last twelve months.

There is a wall of text which I won't bore you with - basically, the CEO and MD plan to reinvest some of their sale proceeds back into the company, after the takeover. Rather than disposing of their shares and retiring, they will stick around to run the company under its new owners.

48% of shares eligible to vote the deal through have promised or declared an intention to vote in favour of the deal. It is therefore very likely to be voted through.

The Buyer

The buyer is Macquarie Principal Finance. They will use a combination of their own cash and debt financing (typical for private equity deals).

The Macquarie Senior MD has summarised it on LinkedIn today:

Deal announced! Pleased to announce a recommended public offer valued at over £300m enterprise value for PTSG Group plc that I was fortunate enough to lead. A testing and inspection business that focuses on the safety of buildings for those who work or live in them. Another private equity style investment in our theme of stable recurring businesses with strong organic and acquisitive growth. Looking forward to working with a fantastic management team.

The RNS goes into much more detail, talking up PTSG's market positions, "diversified and highly visible revenue streams", reputation, organic growth, etc.

Why Sell?

The independent directors at PTSG say that the deal will be good for the company:

PTSG continues to have a very strong pipeline of carefully selected acquisition opportunities. The need to execute and fund transactions in a timely and efficient manner has become increasingly more important and this is the key benefit offered by Bidco to PTSG through the Acquisition. The ability to accelerate PTSG's strategic acquisition plans will further cement its current first mover advantage position.

They don't provide the sums, but they say that it will be better for shareholders to get "compelling value in cash today", rather than having to fund more growth themselves and then wait around for the payback. The rationale shown above does make sense to me.

The buyer "does not intend to initiate any headcount reductions" - hopefully it can be trusted to follow through on this?

My view

For whatever it's worth, I'd like to congratulate holders on a delightful outcome for them which looks very likely to be confirmed by a shareholder vote.

I don't regret not studying it more closely, as it's not possible for me to be an expert in every sector. But for those who did study it and had the conviction to hold it despite warnings from others --- well done!

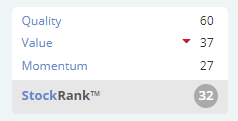

Let's take a quick look at the StockRank. The algorithms weren't impressed, despite a forecast P/E multiple of 6x as of last night:

Finally, as a consolation for the bears, it's worth mentioning that private equity buyers do make mistakes sometimes, and Macquarie might live to regret this deal!

N Brown (LON:BWNG)

- Share price: 135.4p (+3%)

- No. of shares: 285 million

- Market cap: £386 million

This is a Q1 update.

N Brown is the fashion retailer serving niche markets which closed all of its stores last year. A big round of applause for a retailer which did the right thing!

While sad news for store employees, it was a necessary step, given the nightmare in physical fashion retail.

Today's update says there is no change to full year guidance.

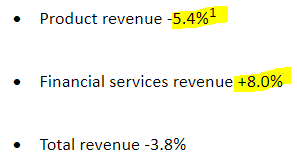

The funny thing about N Brown is that its revenue from selling things just keeps falling, while the interest it receives from its customers keeps going up! Where does this end?

Q1 is described as "solid". The main three brands are growing their online sales, but their overall revenue performance is weak. The only brand whose total revenue has increased is Simply Be (this sells clothing for women with sizes 12-32).

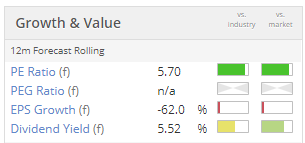

My view - the market is extremely cautious on this, and I wonder why. Without the physical stores around its neck, surely it's a much more attractive proposition now?

It has a few legacy offline businesses which need to be run off, and their gradual disappearance further hampers N Brown's growth statistics.

But I would have thought that the main online brands - JD Williams, SimplyBe and Ambrose Williams - would collectively deserve a decent rating? I've said before that they aren't first-tier brands, but even so, why punish them with such a low valuation?

There is a large net debt position which is forecast to end the year at £440 million - £460 million. Checking the broker note, I see that c. £390 million of this might be securitised on customer receivables (the loan book).

This means that the real debt position might end the year at £50 million - £70 million. Add that to the market cap for an enterprise value of £450 million and it still looks decent value to me.

Worth digging around here for value, I think.

Local Shopping REIT (LON:LSR)

- Share price: 30p (-0.3%)

- No. of shares: 82.5 million

- Market cap: £25 million

This became a very messy situation for LSR shareholders, brought about by the tactics of the company's major shareholder, Thalassa Holdings (LON:THAL) (or more precisely, by Thalassa's Chairman).

Thalassa built up a stake in LSR that was just large enough (more than 25%) to enable him to block LSR's voluntary liquidation and return of capital.

The 25% rules were designed to prevent minority investors from being exploited by a 50.1% shareholder. But it turns out that these rules introduce a new risk: deliberate obstruction by a minority investor.

Anyway, the story will have a happy ending thanks to an agreement by Thalassa that it won't block a tender offer proposal that allows the other LSR shareholders to exit at NAV.

There had been threats of a costly legal battle. This compromise agreement should hopefully sail through the Courts.

The interim results published today show LSR's NAV at 31p. So any LSR shareholders who want to get out at 31p (except for Thalassa) should be able to do so.

Control of LSR will then pass to Thalassa, as one of the conditions of the proposal is that it will own more than 50% of LSR after the tender offer.

So if you know anybody who owns shares in LSR, remind them that they will need to take action to get out, or they will be left with a minority position in a Thalassa-owned vehicle. I'd be surprised to find anyone who was desperate to own such a thing!

LPA (LON:LPA)

- Share price: 100p (-0.5%)

- No. of shares: 12.6 million

- Market cap: £13 million

It has been a year since I covered this. See my review of its interim results last year.

This is an LED lighting company which makes related components for a variety of end-users (aerospace, marine, rail, etc). All the products are laid out clearly on its website.

Last year, I talked about LPA's shrinking order book and there is indeed a 27% fall in its H1 revenues to just £10.1 million. Adjusted operating profit falls to around breakeven.

As noted last year, changes to public procurement processes have hit the group. I tend to steer clear of these tiddlers now, for this reason - I can't predict what public sector buyers are going to do next.

Bright spots:

- dividend unchanged (this can signal confidence of foolhardiness)

- order book rising again (from £16 million to £19 million)

- outlook in medium-term is "improving"

- R&D spend increasing

There is an exceptional item relating to pension equalisation. I think it's absolutely fine to treat this as exceptional.

Balance sheet - mostly PPE and receivables. There is net debt of £2.6 million, primarily in the form of a bank loan.

My view - I like this company's communications. They are always direct and clear, so that even I can understand them.

Stockopedia correctly identifies this as Contrarian. Due for a bounce, perhaps?

Best Of The Best (LON:BOTB)

- Share price: 315p (+1.3%)

- No. of shares: 10.1 million

- Market cap: £32 million

This is the online gambling company which had a bizarre (to me) tender offer at the start of the year.

It bought back its stock at a premium of 120% to the prior share price. The only explanation which made sense to me is that management didn't want to see their percentage stake reduced. Therefore, they choose a very generous price which would force any shareholder who wasn't asleep to tender their shares!

Anyway, these are good results with revenue up 14% to £15 million and adjusted operating profit up 32% to £2.1 million.

The proposed ordinary dividend is 2p, up from 1.5p last year.

The company strategy to leave airports has been executed. Only one site in Birmingham remains. From now on, efforts revolve around driving traffic to BOTB.com (I'm not on commission).

Outlook - positive:

We believe the streamlined, online-only business is well positioned for the new financial year which has started well and I look forward to updating shareholders on further progress in due course.

My view - a nice little business that has done well for shareholders, it could continue to shine.

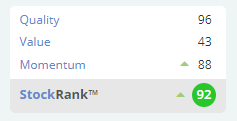

It's a favourite of the StockRanks:

I'm all done for today, have a great evening everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.