Good morning,

I was up last night to catch the results from Tesla ($TSLA) - what great relief that I didn't have a position in it!

This morning, I think I'll say a few words about that before moving on to discuss:

- PCF (LON:PCF)

- Distil (LON:DIS)

- Solid State (LON:SOLI)

- Shoe Zone (LON:SHOE)

Tesla ($TSLA)

- Share price: $298 after hours (+17%)

- No. of shares:179 million

- Market cap: $53.3 billion

Q3 2019 Update (pdf - external link)

This was an incredible result from Tesla, and I'm very pleased that I had no position in the stock last night!

What appears to have happened (though many of the bears don't believe it yet) is that Tesla has achieved a new level of fiscal discipline. This would be the combination of both learning how to make its cars more efficiently, and also trimming a lot of the fat from its overhead expenses.

This was necessary, since revenues have been under pressure.

This goes back to a very important point about how car sales and revenues are interpreted. Tesla and Elon Musk are very proud that have they have been able to sell all the vehicles they produce, but I don't necessarily agree that this is something to be proud of - surely what matters is average selling prices (ASP)! There should be no problem moving metal if you are constantly cutting prices, and that is what Tesla has been doing.

Average selling prices declined again in Q3, due to the mix effect of selling more of the cheap Model 3's, and lower ASPs on all models.

Therefore, despite delivering more cars, the company's Q3 automotive revenues ended up declining by 12% to $5.3 billion, compared to Q3 last year. Automotive revenues were also lower compared to the most recent quarter this year.

Fortunately for Tesla, its operational improvements led to an improvement in automotive gross margin to nearly 23% - this is still lower than Q3 last year, but it is the best result so far this year.

Central overheads also declined by the best part of $200 million for the quarter.

The final result was operating income of $416 million. After the hefty interest bill, net income was $254 million.

Bears will point to things like $134 million of revenue from regulatory credits, possible under-provisioning of warranty reserve, and possible shenanigans in Chinese deliveries, as reasons for scepticism around these profit figures.

Balance sheet - thanks to modest capex, stretching payables, the use of stock-based compensation, and other effects, there was an increase in the company's cash pile to $5.8 billion (or $5.3 billion excluding restricted cash).

On the liability side, long-term debt and finance leases still add up to nearly $12 billion.

My view

Bulls and bears remain incredibly polarised on this stock.

Because I still expect competition to be extremely tough in this sector, I still believe that this will make for a terrific shorting opportunity some day, but I am relieved that I don't currently have a short position in it. And I am unlikely to open a new short position in the near future!

The best reason to be short a stock is that you know of a catalyst which is going to destroy the value of the equity.

And the best catalyst for a short is that the company is about to run out of money.

The primary reason for my shorting of Tesla was my suspicion that it was going to run out of funds, and that it might not be allowed to raise more (because of the antics of Elon Musk and the litigation which surrounds both him and Tesla).

It turns out that I was right about the company running out of funds, but my suspicions that it would have difficulty raising funds turned out to be wrong.

Tesla was allowed to raise a combination of convertible debt and equity in May, thereby putting my primary rationale for the short in doubt.

I will continue to watch it closely, as I do think that the company's long-term financial success is highly speculative, and that its corporate governance is questionable. Cutting its way to profitability has worked this quarter, but there is a limit to how far cutting expenses can take you.

Long-term success for Tesla will require strong margins to persist even in the face of direct competition from other auto manufacturers, and justifying the current valuation will require successful expansion in China and Europe.

This quarterly performance was boosted by Tesla filling its order backlog of expensive Model 3 variants in the UK and taking advantage of short-term tax incentives in the Netherlands. These are just two of the rabbits which Musk pulled out of the hat and I congratulate him.

But Tesla shares are still down 10% year-to-date, despite the rally which has taken place overnight. And justifying this market cap is going to be one hell of a mission.

PCF (LON:PCF)

- Share price: 32p (+7%)

- No. of shares: 250 million

- Market cap: £80 million

(Please note that I have a long position in PCF.)

I've been invested in this one for nearly two years, with my average entry point c. 27.5p.

Although I am currently in profit (having also collected a few dividends), it's surprising to me that the share price has not made further progress, given the growing strength of the company.

One of the reasons for the lack of progress is probably the fact that the company has raised fresh equity, and is very likely to raise more, over time, in order to fulfil its growth objectives.

The most recent placing was at 30p in February. While this was at a significant premium to balance sheet book value per share, it was much lower than the prevailing share price in the market at 36p.

30p became a support level for the share price over the next few months, until recent pessimism towards banks and the UK financial sector as a whole saw the share price break lower to around 25p.

I was tempted to increase my own position size there, but PCF is already a large holding for me, at around 5% of my portfolio. So I sat still and waited.

Looking forward, I think the company will need to try harder to get placings away opportunistically and when the share price is at higher levels, if it wants to keep existing shareholders happy and avoid triggering future share price declines.

As an existing holder, I would prefer if the company refused to issue equity at a P/BV of less than 1.6x, for example. Raising equity is helpful, but the company shouldn't feel that it has to do it at whatever price it can - it should be willing to walk away and work with what it's already got, if the price being negotiated isn't good enough!

Trading Statement

Today's full-year trading update is in line with expectations and can't be faulted.

- lending portfolio is now £338 million, up 54% compared to a year ago. The £350 million target is being met a year early.

- 74% of new business originations are in prime credit grades, higher than last year and meeting management targets. Lending to the prime sector is "aligned to our cautious outlook for the UK economy".

- Reflecting the greater emphasis on lower-risk lending, net interest margin tightens to 7.9% (previously 8.2%).

- Loan impairment at 0.9% is unchanged compared to six months ago.

- The retail deposit base (which is cheap and therefore key to enabling profitable activity in the prime lending market) has increased by 39% to £265 million.

- The acquired company Azule has seen "excellent results" and the first defcon payment of £750k has therefore been earned by the sellers.

- New initiative in property bridging has had "a good first nine months".

CEO comment/outlook:

We have made excellent progress against ambitious targets and we continue to deliver strong growth despite the challenging economic and political backdrop. While there may well be some tightening of the economic cycle over the next 12 to 24 months, given the small market share we currently enjoy, we remain confident that we can continue to grow as planned whilst maintaining our prudent appetite for risk.

My view

I remain excited about what PCF might be able to achieve in the next few years.

The investment thesis here is about increased scale leading to operational leverage and therefore significant increases in EPS as the company reaches scale.

Estimates show EPS of 2.8p in the year which just completed, rising to 3.6p in the current financial year and then 4.6p in FY 2021.

One of the things which I like about this company, which suits my personal trading strategy, is that dividends are extremely modest (only 0.3p this year). Profits are reinvested in this business, boosting its ability to grow and, in the fullness of time, to hopefully deliver some serious capital gains.

Major uncertainties are:

- How the company would function in a recession (although its emphasis on prime lending should provide some insulation).

- The types of acquisitions it might undertake to accelerate growth.

- The timing and price of future fundraising efforts. Personally, I would prefer the company to not raise fresh equity, except when it can do so at a very significant premium to book value that reflects the excellent return on equity it has the potential to achieve.

Distil (LON:DIS)

- Share price: 0.725p (-15%)

- No. of shares: 502 million

- Market cap: £3.6 million

Apologies for covering something so small, but I find this one to be quite interesting.

I held it for about a year, exiting at a loss in June.

Selling it was a painful decision at the time, but it would be far more painful to have held on and seen the share price fall by another 60% in just 4 months!

While I'm always a reluctant seller, I do believe in ruthlessly selling when dealing in risky stocks where your bullish thesis turns out to be wrong.

Distil's financial progress over the past year simply didn't match my original expectations (or the company's official forecasts), and the difficult competitive landscape in spirits motivated me to get out, rather than risk sitting through continued failure.

If you go back to my detailed analysis of the company in June, you'll find that I still saw a lot of positives in what the company was doing. It's just that the negatives started to outweigh them, at the prevailing valuation.

With the market cap more than halving since then, and interim results out today, it's a good opportunity to take a fresh look at the share.

Interim results

These results see the company achieving breakeven, a step backwards compared to the £100k profit achieved in H1 last year.

The £100k reduction in operating profit is the result of the following key factors:

- H1 revenues were down by a scary-sounding 29% to £824k.

- Gross margin was approximately flat. Gross profits were down by £200k, to £500k.

- Administrative expenses were cut, particularly advertising costs, by over £100k.

By no means is this a financial disaster. We expect nano-cap companies to be loss-making, but Distil stands out as one of the very few profitable nano-caps (taking a full-year view).

Outlook

The concluding paragraph from the outlook statement:

Given the prevailing headwinds in our chosen markets, particularly the UK gin market, we anticipate full year revenue to be below current market forecasts. However, due to ongoing operational efficiencies and continued tight control of overheads, we expect operating profit to remain in line.

The most recent full-year forecasts (FY March 2020) were for revenue of £2.5 million and EBIT of £210k.

My view

The company reports today that it has cash reserves of £836k. So according to my sums, the EV/EBIT multiple at the current share price is a reasonable 13x.

What I really care about is the outlook for RedLeg Spiced Rum, Distil's most promising brand.

The truth is that today's weak results are a consequence of gin, not rum. The statement tells us that RedLeg consumption is growing in line with the overall rum market:

RedLeg Spiced Rum shipments to distributors were flat year-on-year. However, depletions (sales from our customers to consumers) continue to show double digit growth in line with overall spiced rum market volumes, despite lapping strong sales in 2018 and a growing number of new entrants to the spiced rum category.

Obviously it would be better if RedLeg was growing faster than the overall rum market, but at least it's keeping pace.

And if gin sales are collapsing, then I don't think investors should care too much. It has been likely for some time that Distil's gin brands are worthless.

I'll continue to monitor this share, because I think there's a price and a growth rate where it would be an attractive purchase. Indeed, at the current market cap, it seems difficult to argue that it is overvalued.

On the other hand, at this low market cap, bears can argue that it faces a delisting risk, since it's not at a size which justifies a stock market listing.

And bears can also argue that if RedLeg is to succeed then it should be growing faster than the overall rum market.

I'm keeping this on the watchlist.

Solid State (LON:SOLI)

- Share price: 485p (-1%)

- No. of shares: 8.5 million

- Market cap: £41 million

Solid State plc (AIM: SOLI), the AIM listed manufacturer of computing, power and communications products, and value added distributor of electronic components, is pleased to announce a trading update for the six months ended 30 September 2019

My first time covering this one.

Paul covered it in September, when it issued a "significantly ahead of expectations" update.

This RNS confirms the recent update:

The Group is on track to deliver the recently upgraded full year earnings in line with the Board's expectations.

Sales are up 7.5% organically and gross margins are benefiting from positive FX effects. Underlying margins have seen "a slight improvement", despite the negative impact of acquisition.

H1 adjusted PBT is expected to come in at £2.5 million, 47% higher than H1 last year, thanks to the increase in gross profits combined with operational gearing.

Net cash is £0.25 million.

Order book is up 1% compared to last year, including the order book of the acquired company for both periods.

My view: this seems like a decent industrial company, but I'm not particularly familiar with it.

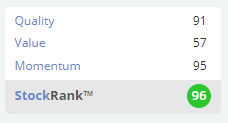

The StockRanks love it:

Return on Capital is calculated by Stockopedia as 11.7% - that's acceptable, and maybe it is set to improve a lot with the improved trading?

If so, then it's performing better than I'd expect from a company in this sector and could easily be worth looking into.

Shoe Zone (LON:SHOE)

- Share price: 128.5p (+8%)

- No. of shares: 50 million

- Market cap: £64 million

Shoe Zone PLC ("Shoe Zone"), the UK's largest value footwear retailer, operating in town centres, retail parks and online, reports on trading for the 53-week period to 5 October 2019, prior to entering its close period.

This is a good example of a share which has always looked "cheap".

Trading took a turn for the worse this year. There was a nasty profit warning on August 30th, the same day as the incumbent CEO left without warning.

This update says that full-year revenues are up slightly (<1%) and adjusted PBT will be in line with the revised expectations.

These expectations, according to the research note published by Finncap on August 30th, are for adjusted PBT of £9.5 million.

Net cash finished the year at £11.3 million.

Big box stores have rolled out: 40 of the planned 45 stores are now open.

CEO comment:

It is early days in the new financial year but we have been encouraged by the performance so far. There are a further twenty Big Box openings planned for the coming year which, alongside our strong Digital momentum, will continue to drive growth in the future.

My view

It's very cheap, e.g. with a (trailing) EV/EBITDA multiple of less than 4x (probably before IFRS 16 implementation) and P/E multiple of less than 7x.

It's probably undervalued. The market is heavily biased against physical retailers right now, and with good reason - many of them are going bust!

I'm being very selective on quality these days, and shy away from nearly all companies in the sector, so Shoe Zone is not something that will show up in my personal portfolio. But for those who love good old-fashioned value, and are optimistic for high street footfall trends, this could be of interest.

That's all for today, thanks everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.