Morning!

Updates I've noticed today (with your help in the comments!) are as follows:

- Castleton Technology (LON:CTP) - final results

- Taptica International (LON:TAP) - trading update

- Innovaderma (LON:IDP) - trading statement

- Footasylum (LON:FOOT) - full year results

- Bonmarche Holdings (LON:BON) - preliminary results

I will be writing through the afternoon, due to other demands on my time this morning - please check back soon.

Best,

Graham

Castleton Technology (LON:CTP)

- Share price: 82.75p (unch.)

- No. of shares: 79 million

- Market cap: £65 million

Acquisition of Financial Modelling Platform IP

This is a new one for me.

Checking the archives, Paul has covered it twice previously.

Most recently, in November 2017, he was not overly excited by it.

Having a listen to the management interview published at PIworld this morning, the CEO describes the company as "a complete one stop shop when it comes to providing basically all the key solutions that a housing association would require to deliver business functions to the tenants".

In the UK, its target market is the 700 housing associations with over one thousand properties. It also has a small Australian business.

Nearly all of the large UK housing associations are already customers. So for growth, it is looking to cross-sell to these HAs its entire range of software and services products. 40% of its customers used more than one product in the latest financial year, up from 35% last year.

The government is looking to reduce the net rents charged by HAs to their tenants every year. While that should motivate some HAs to increase efficiency using Castleton's products, doesn't it also negatively affect their budgets for spending on support services?

In general, you want your company's customers to be getting richer and having more money to spend, not the opposite! So I can't see why rent reductions are necessarily positive for the investment case.

The positive features of this stock on my initial view are:

- Strong cash conversion, enabling settlement of defcon (deferred consideration) and debt reduction

- Very well positioned among its customer base.

- Good forward visibility on sales with mostly recurring revenues and £8 million of deferred income (cash paid before revenue recognised)

Negative features are:

- B2B, selling to the public and non-profit sector. (Dependent to some extent on government spending & government policy. Customers quite price-conscious.)

- Few opportunities to find new housing association customers in the UK.

- Professional services / consulting work. Likely to be labour-intensive.

- No balance sheet cushion as the equity is dwarfed by intangibles

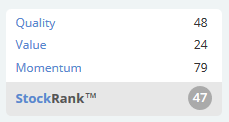

It has a very average StockRank and a forward P/E ratio of 14.6, according to Stocko data. Perhaps I've missed something, but I can't see any compelling reason to get involved at this point.

Taptica International (LON:TAP)

- Share price: 345p (+24%)

- No. of shares: 67.6 million

- Market cap: £233 million

A powerful relief rally today from this online marketing company.

A relief rally occurs when there is a positive surprise due to a lack of bad news. The market has been expecting Taptica to take a hit from the GDPR, but today's update doesn't even mention it.

To the contrary, we get a positive earnings beat instead:

...the Company expects to report adjusted EBITDA for FY 2018 moderately ahead of market expectations and revenue growth in line with market expectations demonstrating a moderately higher-than-expected EBITDA margin.

Operational and cost efficiencies improved the gross margin at its video brand advertising business (this one), so perhaps this is what fed through and boosted the EBITDA margin beyond expectations?

Either way, it's clearly a huge relief for shareholders to hear that everything continues to go smoothly. It has been nearly a month since GDPR implementation. If it was hurting the business model, today would have been a good day to announce that.

The valuation at Taptica has reflected foreign-stock risk (it is headquartered in Israel) and also regulatory risk (as acquiring customer data may prove more difficult in future). It has particular expertise in Facebook advertising, and of course Facebook has itself has been under pressure in recent months over how customer data is collected on its platform.

Taptica bears much in common with XLMedia (LON:XLM) and Plus500 (LON:PLUS), who share prices have exhibited similar discounts (for geographical and regulatory reasons).

It's not the absolute correct thing to do, but I am avoiding all of these stocks, virtually as a rule, when it comes to my own portfolio.

Note how the XLM share price collapsed by over 30% in a single day last week when it acknowledged uncertainty over the regulatory status of its European markets.

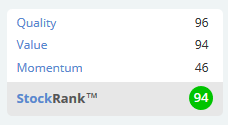

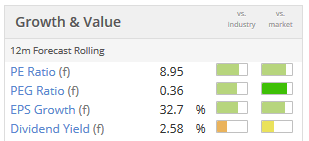

Taptica doesn't appear to be suffering from this problem, so perhaps it's the safest play among the three stocks I've mentioned. I would never feel comfortable enough to hold it in any size, and people with attitudes like mine probably explain why it is so cheap:

Price Monitoring Extension - a reader has asked what the price monitoring extension RNS is all about. I might not be the best person to ask, but I can try to answer this. Please do correct me if there are any mistakes in what follows.

My understanding is that price monitoring extensions allow additional time for the stock exchange to complete an auction.

Auctions take place at the market open, at mid-day and at the market close, and they sometimes take place at other times of the day, when trading is irregular. A very large share price movement with volume is the sort of thing that commonly triggers an auction. The closing auction is how we get the official price at the end of the day.

During an auction, the stock exchange takes in all of the bids and offers and analyses them, and meanwhile prevents trading so as to allow things to cool down. Then an uncrossing trade takes place at the price which best matches all of the bids and offers. If it needs more time to complete this process, we get a price monitoring extension RNS, to explain why normal trading has been suspended.

Innovaderma (LON:IDP)

- Share price: 111.5p (-7%)

- No. of shares: 14.4 million

- Market cap: £16 million

More share price weakness and disappointment at Innovaderma, owner of a range of consumer brands (mostly hair care and skincare).

This is a stock I really want to like, but was turned off it (as I explained at the previous trading update) by its expansion into so many sectors, many of them unrelated. If it had executed a small number of brands really well, then I would have been happy to see it add a few more brands via acquisition. But the pace of expansion was too much, too fast, by my estimation.

The company has been unable to predict its profitability this year. PBT was originally forecast at £2.3 million, according to my records. This was then halved at the profit warning in March. It is now significantly reduced again:

Revenue for the period increased strongly by 23.5% on a constant currency basis to approximately £11m (FY2017: £8.9m). However, partly owing to the significant one-off investments made across the business in launching new brands in the last quarter including the launch of Prolong, stock availability issues for Roots, and lower than expected revenue out of the US in June, profit before tax will be approximately £0.65m, lower than previously expected.

"Stock availability issues for Roots" - that's the sort of excuse that can sometimes make for a "good" profit warning.

Roots has been unable to meet consumer demand, and is about to be launched in Boots. Sounds promising.

The company is looking for a new CEO to manage hair care and skincare. This also sounds like a good move. Execution hasn't been terribly good so far, so a new CEO focused on these products would be welcome.

Meanwhile, the Exec Chairman will focus on the Life Science division.

The mere existence of a life science division is the main thing which has prevented me from buying the stock up to this point. It just seems too ambitious for a small company at such an early stage of its development.

A wide range of new distribution deals are announced in today's update. The incoming CEO will be busy.

Forecasts are as follows:

The Board expects 2019 to be a year of substantial revenue and profit growth as its key brands continue to flourish alongside new product launches, all underpinned by the strength of the DTC platform. The Company is still finalising budgets for 2019 and 2020, but expects FY19 revenues to be in excess of £14m with profit before tax in excess of £1.6m.

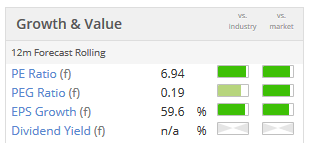

Hitting forecasts has not been its strong point recently, but the shares would certainly be on the cheap end of the spectrum if it did:

I think the key points of uncertainty are:

- New CEO - will they be any good?

- Are the recent sales blips really due to one-off issues? is Skinny Tan going to make it as a recognised brand?

- Is there any chance that the life sciences division could be sold off, to simplify matters? Or will it prove to be valuable component of the overall group?

- Is the company going to run out of working capital?

On the final point, the company is very clear on that matter today:

The Company's balance sheet remains strong with sufficient working capital to fund the anticipated growth of the business.

But do note that IDP raised money in November 2016, December 2016 and October 2017 (all the way up at 276p).

The most recent placing was for £4.4 million so you might think that the company does not need further capital, but it can't be ruled out.

Overall, I am tempted by this share at the current level. The uncertainties are plain to see, but maybe they are fully priced in now?

Footasylum (LON:FOOT)

- Share price: 80p (-52%)

- No. of shares: 104.5 million

- Market cap: £84 million

Wow - I did not expect to see a 50% reduction in share price with this one! Commiserations to any readers holding this stock.

It may turn out to be an over-reaction, after all. But for now, it's the classic tale of an IPO pumping up expectations rather high before flotation, and then disappointing shortly afterwards.

It has only been listed for about seven months, originally priced at 164p.

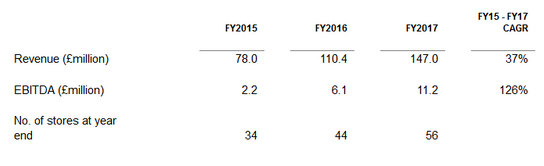

These were the financials presented to investors prior to IPO:

As you can see, both revenue and EBITDA were making dramatic progress higher, along with the number of stores. An expectation of this trend continuing is what helped to generate a P/E ratio of about 28x (as of yesterday).

At the trading update in January, the company presented sales growth of 35% for the first 44 weeks of FY 2018 (ending in February). It made no mention of EBITDA, but said that trading was in line with expectations.

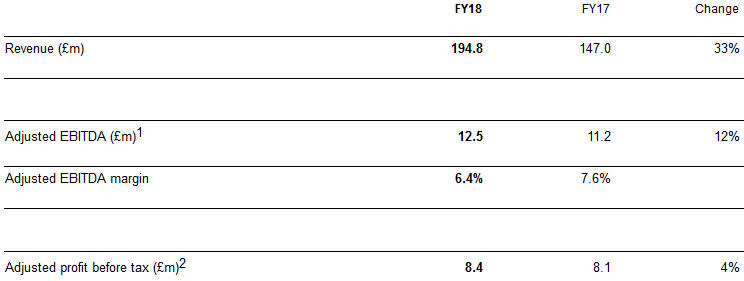

These are the actual results today:

As you can hopefully see, EBITDA growth has slowed to just 12%, far below the exponential growing trend in the pre-IPO financials.

Revenue growth is also a bit softer, and there is only modest growth in adjusted PBT.

Worse, we are told to expect that FY 2019 will see lower growth, compared to FY 2018.

The weak High Street is culpable:

While our core target market of the 16 to 24-year-old consumer has proved to be comparatively resilient in a downturn, our trading since the beginning of the new financial year has undoubtedly been impacted by the widely documented weak consumer sentiment on the high street.

The company says that FY 2019 revenue will be in line with expectations, but the costs of "investment in our consumer offering" and store capex will result in "more modest growth" in FY 2019 adjusted EBITDA.

Does that, in itself, warrant a 50% share price reduction? Probably not, but I imagine that some shareholders were left feeling mugged by the IPO when they saw today's announcement.

The big question now is whether the shares have fallen to a level where even the miserly value investors among us would want to get involved.

Personally, I do think it is getting into interesting territory, at about 10x adjusted PBT.

From the £8.4 million adjusted PBT figure, I would deduct the £0.4 million share-based payment charge. The exceptional items - £4.1 million of IPO costs and £1.9 million of VAT provision - look like reasonable adjustments to make, so I wouldn't deduct them.

Therefore, I would use an adjusted PBT figure of £8 million. We can assume this converts to adjusted net income in the region of £6.5 million (after tax).

How to value it? My understanding of Footasylum is that it's primarily a warehouse for the big footwear brands, and its own brands have limited pricing power. This inevitably limits the valuation I would consider to be fair value for it. Maybe around a £60 million market cap?

The stock market has an awful lot of cheap retailers at the moment. Today, Footasylum joined their ranks after discovering that it hasn't bucked the trend on the High Street. Unfortunate that this was only discovered after IPO.

Bonmarche Holdings (LON:BON)

- Share price: 110p (+7%)

- No. of shares: 50 million

- Market cap: £55 million

Talking about cheap retailers, we have the likes of Bonmarche Holdings (LON:BON) and also N Brown (LON:BWNG) (covered here last week), each trading below 8x earnings.

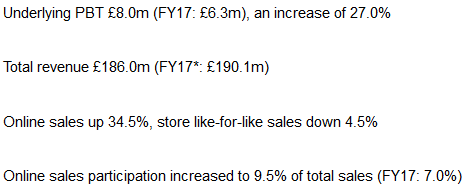

These results confirm the online sales growth mentioned in the April trading update.

It's just a shame that online sales aren't already a bigger slice of the pie. Despite rapid growth, online sales aren't yet big enough to take up the slack from declining store growth.

The all-important outlook statement is as follows. Trading is in line with expectations:

The financial position of the business continues to be sound, with no net debt, and the robust balance sheet provides a stable platform for the future.

We will continue to improve our proposition, through the implementation of a series of self-help initiatives. Whilst we anticipate that the market will remain difficult, we expect these ongoing improvements to make a real difference to customers, and we look forward, with confidence, to delivering further progress in the coming financial year.

As Paul has noted previously, it's not a particularly high-margin business. The gross margin is 58.4%, and the operating margin is a lowly 4.4% (using today's figures).

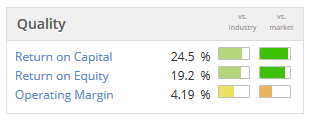

Despite this, it has generated very nice return on capital stats, thanks to the very efficient conversion of its asset base into sales:

Conditions are tough out there (see Footasylum) and this might never deserve a premium rating on the merit of its own brands. But I think there are signs at this company of competent and shareholder-oriented management who haven't taken an undue amount of risk. One of the more interesting retail stocks at the moment, I think.

All done for today! Sorry again for the slow start. Hopefully I managed to write up a decent report in the end.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.