Good morning, it's Paul here!

Thank you for the reader requests. I'll be able to cover most of them. Please see the header above for the list of stocks whose results or trading updates that I will be reporting on today.

Vianet (LON:VNET)

Share price: 122.5p (down 9.9% today)

No. shares: 28.0m

Market cap: £34.3m

(at the time of writing, I hold a long position in this share)

Vianet Group plc (AIM:VNET), the international provider of actionable data and business insight through devices connected to its Internet of Things platform ("IOT"), is pleased to announce its interim results for the six months ended 30 September 2017.

The core, cash generative business within Vianet is the Brulines business, which monitors & reports the flow of beer in tenanted pubs (to ensure the tenant doesn't cheat the system by selling cheaper beer, bought outside the brewery tie agreement). The second, up & coming division provides remote monitoring for vending machines. Its petrol station business has been disposed of.

Today's results look to have disappointed the market, with the share price down almost 10%. Although as with most small caps, there is little liquidity, hence it only takes a handful of small trades to move the price. So the initial price reaction is not necessarily anything to rely on.

Top marks to management for taking the time & trouble to produce a video & slides presentation for all investors, published this morning with the results. Why can't all companies do this? It levels the playing field, and gives retail investors similar additional information and understanding of the business that institutions & analysts get from meeting company management.

Talking of which, I'm meeting VNET management tomorrow, so if anyone has any specific questions, then by all means add a comment below, and I will endeavour to ask & report back. (please keep any questions brief, and to the point!)

Some key numbers for H1;

Revenues down 5.0% to £6.7m, although a very high proportion, 90% are recurring revenues - which are generally regarded as higher quality (as predictable & repeating) - hence deserving of a higher valuation of the shares.

Adjusted operating profit up 4% to £1.7m. It's always worth checking what items have been adjusted for, and in this case the adjustments look fine to me. Share based payments are only modest at £73k. Interest cost is negligible, and nets off against finance income.

Balance sheet - looks sound to me. It's top heavy with £17.9m intangibles, but even if you write that off, NTAV is still positive at £6.0m.

Working capital looks fine - current assets of £8.0m (including £3.86m cash), less current liabilities of £4.0m, gives us a very healthy current ratio of 2.0

Long-term liabilities are only £1.1m, so nothing to worry about there.

Overall then, this looks a well-financed business, which is financially stable, and should not need to dilute shareholders with any future fundraisings.

Note that a new £2m bank loan was taken out post period end, to finance the initial acquisition cost of Vendman.

Cash flow statement - this is fairly similar to last year, give or take the usual variations, which I would expect to see. In the company's results video, management note that last year's H1 cashflow was boosted by a customer paying up-front for a particular contract, which didn't repeat this year.

Note that the "purchase of intangible assets" line has gone up considerably, from £302k in H1 LY, to £788k in H1 TY. This relates to software development spending, which was a planned increase, to improve products. I'm all for product development, so this isn't a problem, as the amount capitalised is reasonable, compared with the £344k amortisation charge. Generally speaking, capitalised development spend only becomes a problem when companies chuck every imaginable cost into this line, thus greatly over-stating profits & EBITDA (think Telit Communications (LON:TCM) , Lombard Risk Management (LON:LRM) , and of course Globo).

Dividends - the company has an admirable track record of paying generous divis, of 5.7p per year, since 2012. So although the chart may not look amazing, when you add in dividends received, the total shareholder return has been pretty good - people who bought in 2013-14 would have roughly doubled their money overall.

I wonder if the boffins at Stockopedia HQ could conjur up charts which include dividends, to give total shareholder return, and make them comparable with other companies?

StockRank is noteworthy, being very high at 95. This share also has the positive "Super Stock" classification. Some people use the StockRanks to find shares which, in a basket, should statistically out-perform. Personally, I like to use the StockRank & styles classification as a sense check. So a high score confirms my thinking, if I like the share already. A low score gives me a wake-up call to revisit my research, and check I haven't missed anything negative.

Outlook - the company has not given any comment about how it is expected to perform against full year market expectations. I think companies should be obliged to include a comment on this. When it's omitted, I tend to feel that the company might be running a bit behind expectations, but are hoping to recoup it in H2. Hence perhaps why they prefer not to specifically mention full year expectations at the interim stage.

Whilst growth and profitability in the Smart Zones division continues to be influenced by the challenging backdrop to the UK pub sector, the Group has strong prospects and the Board is confident that the management team can deliver strong growth.

There are good reasons to expect profit growth in future, specifically;

Big vending contract recently announced with a large, international customer

- Acquisition of Vendman - a complementary & profitable small business

- iDraught - this is the more sophisticated, higher priced version of Brulines, which is gradually being rolled out, and offsetting the impact of pub closures

- USA iDraught project is proving painfully slow, but is still live, and now close to breakeven. Possible upside could come if several trials convert into full contracts

- Vending machine division seems to be gathering momentum, so there could be further progress here with contract wins - this technology is proven to be effective at making vending machines more profitable, so logically it should grow over time

My opinion - I've followed this company for quite a few years now, and my perception is that it's been a reliable cash cow, paying out nice divis. The growth potential never seemed to go anywhere, and progress seemed very slow.

However, the vending operation seems to be gaining traction now, with big contracts now appearing. So it's starting to get a bit more exciting.

I feel there is also blue sky potential here for possible expansion into different sectors. After all, Vianet is a genuine internet of things company, which has about 250k devices reporting to its servers. Its software & staff then provide data analytics for customers, to help them manage their businesses more profitably. Therefore Vianet already has the expertise to expand into other areas. I shall be asking management tomorrow where they see future opportunities, and am racking my brains to think of some helpful suggestions!

If the company does come up with some promising new growth areas above the existing ones, then there's a chance this share could be re-rated to a sexy technology stock rating, instead of a being considered a boring old value share. We are in a roaring bull market, after all. I wonder if the company could do something involving blockchain technology? That might be the quickest way to put a zero on the end of the share price!

The Board were pleased with the recent FTSE ICB subsector reclassification of Vianet from Support Services to the Technology subsector of Telecommunications Equipment, effective from 18 December 2017, and believes this classification more accurately reflects the Group's IOT and data analytics driven business model. We believe that this should also bring Vianet to the attention of a wider audience which would be a favourable development.

So overall, I like the fact that the current share price looks solidly underpinned by recurring revenues & hence reliable profits& cashflow. There could be additional upside from something more exciting happening in future, who knows. Meanwhile the big new vending contract should boost profits in 2019 & 2020. Plus we have a strong balance sheet, and healthy dividend yield of about 4.6% while we wait.

Vianet may not set the world on fire, but risk:reward looks quite good to me. I'd say the current valuation looks about right, but there are decent reasons to expect possible future upside. I've taken advantage of today's dip to top up my personal holding with a few more. I probably won't put any in BMUS, because no credit is given for divis there, so there's not much point in adding high yielding stocks to that fantasy portfolio.

FreeAgent Holdings (LON:FREE)

Share price: 78.5p (up 1.3% today)

No. shares: 40.7m

Market cap: 31.9m

FreeAgent Holdings plc, a provider of cloud-based Software-as-a-Service ("SaaS") accounting software solutions and mobile applications designed specifically for UK micro-businesses, today announces its unaudited interim results for the six months ended 30 September 2017.

This company issued an H1 trading update, which I reported about here on 10 Oct 2017. Comparing the figures today, they are in line with what was forecast on 10 Oct 2017. Adjusted EBITDA is slightly better, at an actual loss of £0.3m, vs. £0.4m loss indicated in Oct.

Key numbers for H1;

- Revenue up 28% to £4.6m, although it's only up 4.5% sequentially, on the previous half year (of H2 2016/17)

- Still loss-making, at £908k operating loss, vs. £1,126k in H1 last year

- Net cash of £3.4m - so OK for now, but unless losses reduce, it will probably need to do an additional fundraising in 2019

The problem seems to be that acquiring additional customers is expensive, so there doesn't (yet) seem to be much operational gearing from adding on new customers.

Balance sheet - looks alright for now.

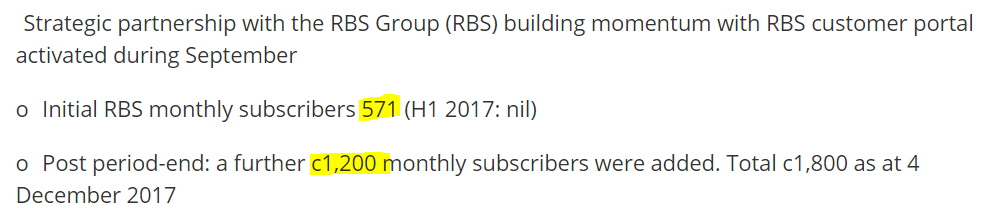

RBS deal - this has launched (offering free software to new business customers);

Outlook

Operating costs have grown in line with management expectations as the Group continues to consolidate and grow market share through a land, expand and retain strategy. Our balance sheet is strong with net cash balances at the period end of 3.4m and we anticipate monthly EBITDA break-even towards the end of calendar year 2018.

We expect to report further strategic progress and solid business growth during the second half, building on the achievements of the first six months of the year.

My opinion - this share leaves me flat. The growth rate isn't fast enough for operational gearing to really kick in, and give the explosive profit upside that growth company investors look out for.

I don't know what the terms of the RBS deal are, so I can't judge how material (or not) that might be.

I'll keep this share on the watchlist, and would buy back in, if the growth rate really stepped up a notch to say 40%+, that's the level where investors start to get really excited, and re-rate a share onto a big PER.

There's a lot to be said for accounting software companies - the revenues tend to be sticky, as once customers are set up, they are reluctant to move to a new system. This company is building a good stream of recurring revenues. Also, someone might want to buy it at some point, for its customer base - to cross-sell. Or to take out a competitor.

At the current valuation, with fairly modest growth, and still loss-making, this one doesn't interest me.

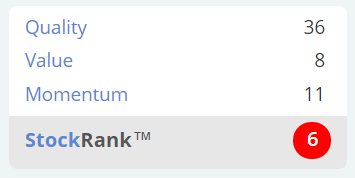

Stockopedia's computers agree - with a very low StockRank of 6, and a "Sucker Stock" classification. Personally I would need a very, very good reason (e.g. a spectacularly good trading update, which would not yet be factored into the figures going into the StockRank calculations) to buy any share with a StockRank this low.

Character (LON:CCT)

Share price: 422.5p (down 1.2% today)

No. shares: 20.9m

Market cap: 88.3m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Aug 2017. This is a toys company.

Graham reported on problems in the toys sector in yesterday's SCVR.

Looking back further through our archive here, to refresh my memory, I covered the profit warning here on 11 Oct 2017 which caused the share price to spike down to 357p. That was a nice little buying opportunity as it turned out. Although I have to admit to getting cold feet yesterday, after reading Graham's comments, and I've down-sized my long position today, to be on the safe side.

Looking at today's results, they seem to be in line with the last trading update. Underlying diluted EPS is 50.54p, which is roughly what was expected by analysts.

Dividends - a decent increase, to 19.0p total divis for the year (up 26.7%) gives an attractive yield of 4.5%. It's also signalling management confidence in the future, to raise the divi that much.

Balance sheet - looks sound. Although I am curious as to why the company holds £28.75m in cash, and simultaneously has short term borrowings of £17.2m? That seems inefficient in terms of interest cost. I wonder if the cash figure is high because of year end window-dressing? I've put that question to an adviser of the company, and will report back with any response.

Outlook - this is the problem area, which caused the sharp fall in share price in Oct 2017. Problems with the insolvency of Toys R Us, and apparently wider problems with demand for toys, seem to be affecting other companies in the sector too.

CCT says it has some great new products in the pipeline, e.g. Pokemon, but I am worried that the next set of interims might look grim. In this regard, it says today;

Whilst overall the Group's performance for the half year ending 28 February 2018 will reflect a temporary 'slowdown' when compared to 2017, the Directors anticipate that the business will return to its previous growth pattern during the second half of the current financial year ending 31 August 2018.

In addition, our exciting pipeline of new product releases planned for the 2018 calendar year is predicted to drive a return to a stronger trading performance in the financial year ending 31 August 2019.

That's all very well, but what if trading doesn't improve? I'm worried about this, and don't usually like holding shares where the next set of results is going to be poor.

The form of wording below has also worried me. I think the company used the same phrase in its last trading update;

Additionally, even in the current tough trading conditions, we expect our cash flow to remain positive, our reserves to grow and our Christmas stocks to remain firmly under control.

Cash flow remaining positive is not exactly a high hurdle! It depends what cash flow they mean - operating cashflow, or at the other end of the spectrum, free cash flow? This could be a good thing, or it could be very bad - are they suggesting that the company might be loss-making in H1 2018, but still generating cash (from de-stocking & running down debtors)? I'm confused, and worried about this choice of wording. My fear is that H1 2018 could be much worse than perhaps people are currently assuming? Or maybe I'm being too jittery?

Forecasts - the latest (revised slightly down) figures to hit my inbox today, show;

FY 08/2018: EPS 37.3p - PER 11.3

FY 08/2019: EPS 45.0p - PER 9.4

My opinion - as already mentioned above, I'm nervous about this share at the moment. Whilst the results published today are strong, and in line with expectations, the outlook sounds problematic. So I think that increases the risk of another lurch down in share price if the next interim figures come out worse than people are expecting. As we've seen before, the price can be very volatile, due to illiquidity, so I feel it's possibly safer to wait and see what happens.

We've had such a wonderful couple of years, I feel that capital preservation is a higher priority now than it was. Quite a lot of companies seem to be warning on profits, hence why I'd rather scale back any position (like this) which looks potentially problematic.

There again, the market might just shrug off soft interims, and focus on the future upside, who knows?

So in conclusion, I remain a small shareholder here, but am not confident to hold CCT in any significant size, until the picture becomes clearer. I'll review it when the interim figures come out in Apr 2018.

Fulcrum Utility Services (LON:FCRM)

Share price: 67p (up 3.1% today)

No. shares: 174.7m

Market cap: £117.0m

Fulcrum, the UK's market leading independent multi-utility infrastructure and services provider, today announces its interim results for the six months ended 30 September 2017

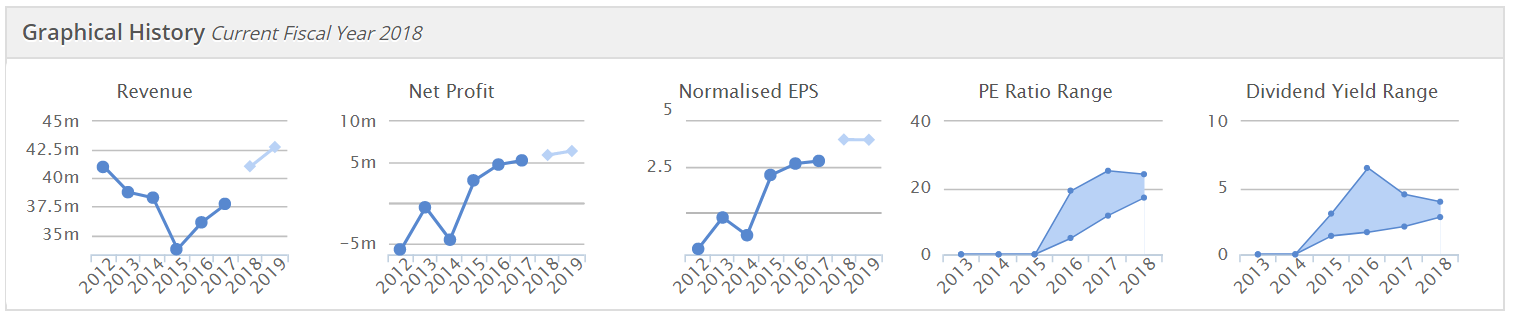

Checking the archive, I last looked at this one in spring 2013, and was not impressed because the company was loss-making at the time. There seems to have been a remarkable turnaround since then, as you can see from the Stockopedia graphical history, below;

It's very unusual to see a situation like that - where a strongly, consistently profitable business suddenly appears out of thin air in 2015 onwards. I wonder what caused that? Maybe a change of management? Do any readers know the history of the company, and could you fill me in?

Judging from the graphs above, I like the look of this company already - note that the profit margin in the last 3 years has been excellent - c.£5m profit each year, from c.£34-38m revenues. Note from graph 4 how the PE has gradually risen in the last 3 years. We can see from graph 5 that divis were introduced in 2015, and how the yield has improved on average since then.

Interim results today look good, e.g.

Revenue up 8.3% to £19.6m

Profit before tax up 19.6% to £3.7m (note the very good 18.9% profit margin)

EPS - there's quite a big gap between adjusted basic EPS of 2.2p, and diluted adjusted basic EPS of 1.9p, which indicates that there must be a lot of share options outstanding. In note 4 this is disclosed as: 171.6m average number of shares in issue during the period, and 187.1m after full dilution from options. So I think investors would need to adjust the valuation to take into account this dilution.

Order book - up 11% in the last 6 months, to £33.7m

CEO comments - note the "potential funding options" comment, which might involve dilution from a placing. Although it sounds as if more debt is being sought;

"The successful execution of the Company's strategy continues to place Fulcrum in a strong financial and operational position. We remain committed to safety and excellent customer service, enhancing our in-house multi-utility capabilities and growing infrastructure services and the asset base.

The granting of the iDNO licence will further enhance our growth in utility assets and associated future income streams. We are reviewing potential funding options to enhance these purchases and deliver increased shareholder returns. Fulcrum's strategy provides a solid foundation to build upon the performance achieved in the first half of the year and the outlook remains positive for the full year 2018."

Balance sheet - here are the usual figures I focus on;

NAV: £14.0m

NTAV: £11.1m

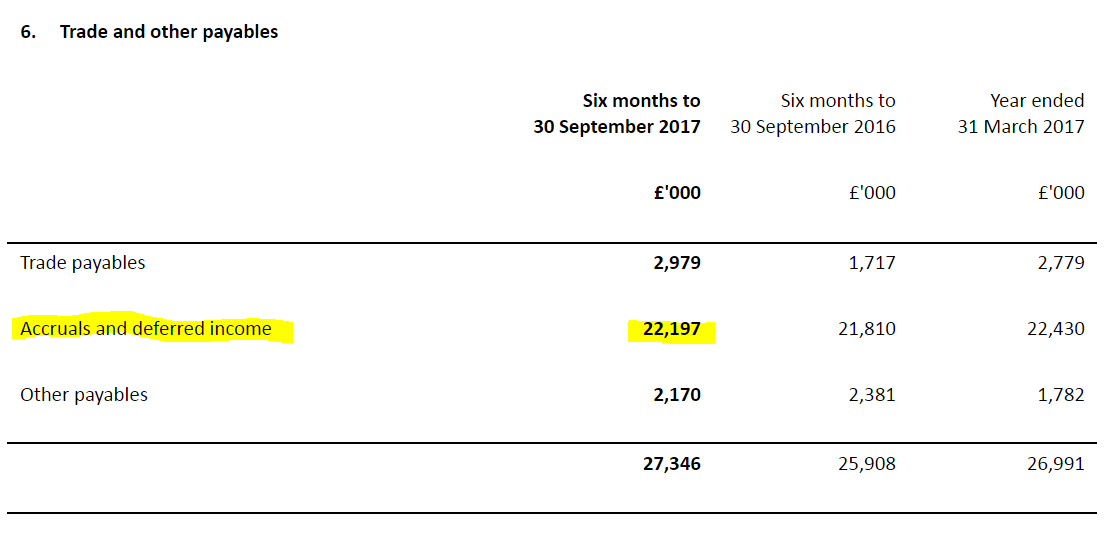

Working capital - this looks a bit odd. The company has £14.5m in cash, but trade & other payables of £27.3m looks extremely high, so I'll need to have a look what is in there - note 6 explains more;

It'as a I suspected, there is a large amount of deferred income - this is a creditor which reflects that customers have paid the company in advance, as explained;

Of the £22.2m accruals and deferred income, £15.6m (2016: £13.9m) relates to deferred income. Deferred income represents contracted sales for which services to customers will be provided in future periods.

Therefore, the company's entire cash balance of £14.5m is actually customer's money, paid in advance to Fulcrum. That's an important point to understand, especially when calculating enterprise value.

It's great to receive cash up-front from customers, before having to provide the service that is being paid for. However, this does distort the balance sheet. Also, companies in this position often select a year end date when cash is unusually high. So an important question to ask management is what the average cash balance throughout the year is. You may find that it's a lot lower than on the year end date.

The P&L finance charge is a credit - i.e. net finance income is positive, at £33k. That suggests that the company was probably holding positive net cash balances throughout the year. I would be interested to find out how its customer contracts are structured, to get a better handle on how the company's cash flows work, the seasonality, etc. Anyway, getting paid up-front by your customers is a very nice position to be in.

Cash flow statement - all looks fine to me. The company seems to capitalise gas pipelines that it builds, and then presumably earns an income from them.

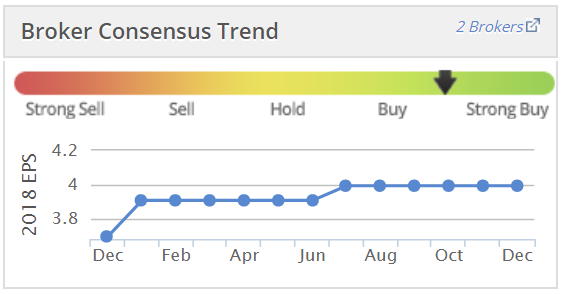

Forecasts - one broker comments today that the positive interim results puts upward pressure on their full year forecasts. I very much favour companies where broker forecasts are rising. This can often mean that you're buying the share more cheaply than it initially appears (because actual future earnings are likely to be higher than forecasts which are too cautious);

At 67p per share, the current year forecast PER is 16.75 - which looks reasonable, considering the high profit margin, decent profit growth, and ungeared balance sheet.

My opinion - I do stress this is just a quick review of the figures. I don't pretend to understand this business, having only a vague gist of what it actually does! However, based on that flimsy foundation, I like the look of these numbers, and conclude that this share is worth a closer look. So I'll add it to my list of things that need a closer look.

What do readers think? Are any of you familiar with this company?

PCI- PAL (LON:PCIP)

Share price: 54.5p (up 5.8% today)

No. shares: 31.6m

Market cap: £17.2m

Trading update & contract awards

PCI Pal, the customer engagement specialist focused on secure payment solutions, announces that it has won a further major reseller contract and two new UK local Government contracts in November 2017, through its partnership with global cloud contact centre telephony provider, 8x8 Inc.

These wins conclude a strong month for the business, with a total of 7 customer contracts (4 of which originated through channel partners) being signed.

The major reseller contract is with a FTSE-250 company with operations across the payments, telephony, contact centre, and outsourcing markets, and was won through competitive tender. The reseller will be utilising PCI Pal's Amazon Web Services (AWS) platform to deliver a cost effective, operationally efficient, secure payment solution to its customer base across the UK and Europe.

That sounds like good news. More detail is given;

The current financial year has started well with recurring revenues showing a 50% growth year-on-year, with 100% client retention.

Overall revenues are also ahead for the year-to-date, including less non-recurring, one-off revenue, as the revenue model transitions to a complete software as a service (SaaS) license fee focus. Set up fees and professional service charges will increasingly diminish in materiality as the business grows. There is also a significant pipeline of contracted projects still to go-live, which will generate further recurring revenue in due course; and new enquiries are continuing to increase as the business scales up its marketing activities.

There are a couple of caveats though;

...As with any channel sales route to market, revenue momentum may take time to build

...the Company is evaluating the resourcing levels that may be required to take full advantage of the commercial opportunities in a nascent but fast-growing international market."

My opinion - this all sounds great, but the context needs to be taken into account. This is a tiny company - revenues for y/e 30 Jun 2017 were only £1.9m, and a £1.7m loss before tax was generated (excluding profit on a disposal).

Today's update is non-specific about total revenue growth, and doesn't give any indications about profitability. Revenues are rising, but it sounds as if costs will also need to rise.

Overall, I think it's too soon for me to reach any sensible conclusion on this share, the company is too small. That said, I very much like tiny companies which are achieving strong sales growth, and high demand for their products. These can be the big winners of the future, if sales momentum really takes off.

To a certain extent, the early figures don't actually matter that much. If the product has strong customer appeal, then the company could end up being multiples of its current size in a few years' time. So rather than crunching the numbers, which is a rather pointless exercise, I think time would be better spent digging into what its product does, and how it compares with competitors.

A friend of mine who has a good track record of spotting winners in growing tech/telecoms/software businesses tells me that this company looks potentially interesting. So I'll put it on my watch list, to see how things progress.

As always, reader views are particularly welcome.

All done for today! See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.