Good morning!

I'm back from holidays in the Canaries, tanned and sunburnt and with great memories of beaches, water slides, camels, volcanoes, etc.

Paul has been productive in my absence and covered a big collection of shares in yesterday's report. He added quite a few in the evening - here's the link.

We have a busy RNS feed today. I'm looking at these shares:

- Water Intelligence (LON:WATR)

- Fireangel Safety Technology (LON:FA.)

- Ten Entertainment (LON:TEG)

- Property Franchise (LON:TPFG)

- 1pm (LON:OPM)

- Goals Soccer Centres (LON:GOAL)

Water Intelligence (LON:WATR)

- Share price: 345p (+4%)

- No. of shares: 15 million

- Market cap: £52 million

Water Intelligence, a leading provider of non-invasive leak detection and remediation services, is pleased to present its interim results for the period ended 30 June 2018.

This California-based business continues to show excellent growth. It uses acoustic and infrared technologies to pinpoint the location of water leaks (without needing to break through surfaces to find them).

- revenues +39% ($11.8 million)

- PBT up 49% ($1.26 million)

It's nice to see that the company reports its actual PBT first in the statement (before adjusted PBT).

Also, the adjustments to the accounts aren't huge. Adjusted PBT is also growing strongly and is not that much higher when compared with actual PBT.

Profits are described as "comfortably in line with expectations", which typically means at the higher end of the forecast range.

At the H1 trading update in July, the company confirmed that it was working toward the goal of $20 million of sales in 2018 and reaching $25 million of annualised sales in the near-term.

Today it says:

Given our consistency, we are confident that we should proceed full steam ahead towards our stated goal of passing $20 million in sales during 2018 and stretching towards $25 million in the near-term for a trailing twelve-month period.

While the growth in the core business is excellent in its own right, we also have a maiden profit from its UK-based services business.

The level of ambition remains encouraging - the company is seeking "to transform the global market for water solutions which is still a sleepy sector".

Indeed the entire strategic statement is a fine example of a company that has a clear plan and clear thinking about what it wants to achieve, and can articulate this to shareholders. Whether or not it will achieve these things is a separate matter, but a clearly articulated plan is a good place to start.

Our consistent growth results over several years, with 1H being the latest indicator, have provided us a launch point to create a great company.

My view

I'm struggling to find any negatives. We have a capital-light franchise business model and the company also has the ability and willingness to buy back franchises where it is advantageous to do so.

It is securely financed having raised fresh funds earlier this year. $6.1 million of cash is sitting on the balance sheet, or net cash (after deducting bank debt and deferred consideration) of $1.44 million.

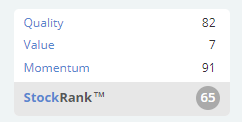

It's worth reiterating that this is a High Flyer:

High Flyers (speaking generally) are high-performing and growing companies whose main drawback is their valuation. They are considered to be a "winning style".

My own value investing instincts have prevented me from investing in this one so far. After falling back sharply from its high of 450p, and at a forward P/E ratio of c. 35x (according to Stocko) I reckon it's worth another look.

Fireangel Safety Technology (LON:FA.)

- Share price: 73.5p (+26%)

- No. of shares: 46 million

- Market cap: £34 million

FireAngel (formerly Sprue Aegis) is an alarm company. We've written about it many times in this report.

It has had a long series of mishaps over the past few years, to include another profit warning as recently as last month.

I'm happy for shareholders to finally get some good news.

FireAngel is becoming the preferred safety product provider for Mears (LON:MER) (responsible for the maintenance, repair and upgrade of 700,000 UK properties). It will supply home management systems to Mears' clients: smoke, heat and carbon monoxide alarms, with remote monitoring and notifications when an alarm is triggered.

My view

What this statement lacks is numbers. We are left to guess at the financial implications.

This is the closest thing to financial guidance in the statement:

FireAngel will charge Mears a monthly subscription fee per connection, giving the Company a recurring revenue steam and increased visibility on its future revenues. Mears has committed to deliver a minimum number of connections during the term of the minimum three year Agreement.

Without any numbers, we have to be a little bit sceptical of the news.

The company's broker has issued a short note this morning (available on Research Tree) saying merely that it expects to reinstate its forecasts when FireAngel produces interim results later this month (25 Sep).

In a nutshell, the existing forecasts for 2019 are not reliable. The broker doesn't know or can't say yet what the new forecasts should be, and the information given by the company itself is insufficient. The company itself may not even have a clear idea!

On the positive side, there is tangible net asset value on the balance sheet and the current H2 period has already been forecast to generate a modest operating profit. Combined with today's partnership news, there are vague grounds for optimism.

Ten Entertainment (LON:TEG)

- Share price: 255p (-0.4%)

- No. of shares: 65 million

- Market cap: £166 million

We don't usually cover this one, maybe we should? It has been listed since April 2017.

It describes itself as "the second largest tenpin bowling operator in the UK", with 44 sites.

If you like this concept, there is also Hollywood Bowl (LON:BOWL), which operates 58 sites. It listed in September 2016.

Neither of these shares are particularly expensive relative to earnings. They both offer decent dividend yields, good quality metrics (return on capital), and have performed well since their respective IPOs.

Today's numbers from TEG are ok: sales up 7.7%, and like-for-like sales up 3.1% (for the period up to 1st July). Increased footfall and higher spend per person both contributed to the gains.

Many bricks-and-mortar companies have been blaming the weather this year. TEG says that it has demonstrated "robustness" in the weird weather, and performance would have grown more significantly without it.

But things went downhill in the weeks following the end of H1.

Thanks to a very soft July (people don't want to go bowling in a heatwave), year to date like-for-like sales growth is a meagre 0.8%.

Adjusted EBITDA is set to be broadly in line with expectations, i.e. a slight miss is possible. It sounds like we would have had a full-blown profit warning if staffing hours hadn't been trimmed back over the summer.

Growth in adjusted profits ends up being rather pedestrian for the period. Adjusted PBT is essentially flat, while adjusted EBITDA makes a gain of 4.8%.

My view

I'd much rather invest in this than in a restaurant chain: you typically get one bowling venue and one cinema in a particular location, surrounded by multiple competing restaurants. So it strikes me that the bowling venue (and the cinema - see Cineworld (LON:CINE) ) is a safer bet than the restaurants.

Having said that, I wouldn't be in any particular rush to buy these shares. I suspect they will offer a steady return and can be picked up at reasonable prices for the foreseeable future.

Not quite as exciting as an actual game of bowling, then.

Property Franchise (LON:TPFG)

- Share price: 138.5p (+2%)

- No. of shares: 26 million

- Market cap: £36 million

This is my favourite estate agent share. I've been thinking about buying into it today, but haven't quite managed to convince myself to pull the trigger.

A nice overview and discussion of today's results has been published by piworld at this link.

It operates multiple brands, and they occasionally compete with each other in the same geographic area. It is ok with that.

One of its brands is the online agent. EweMove (ewemove.com). This is a full-service estate agent: the only difference between it and TPFG's other brands is that it has no physical premises.

I like the business model. Franchisees have to employee lots of capital and lots of labour. TPFG, on the other hand, collects license fees and completions and only needs to employee 50 full-time staff, earning 25% return on capital.

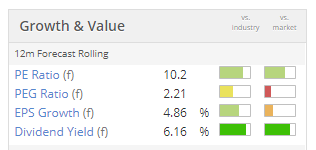

It's a great strategy and I find it hard to resist the combination of that plus a really cheap valuation. These figures are based on last night's closing price:

In my view, this share ought to be a winner even in the context of a weakening housing market. 70% of revenues are from lettings, i.e. they should be more dependable than sale transactions.

The macro environment is still going to be a headwind and it's just enough to put me off buying these shares today. This line in the outlook statement is what particularly caught my eye:

We are also expecting to see an impact on our Group revenues from the Government's proposed tenant fee ban, the timing of which is expected to be 1 April 2019 and which will impact Group revenues and profit by circa £0.75m gross in 2019, reducing to £0.5m net after mitigation factors are taken into account.

PBT this year is forecast at £4.6 million, and forecast to be unchanged at £4.6 million in 2019.

So the outlook is flat for now. But if you're willing to look past the next year or two and look out at a longer time horizon, I think it has a great chance of doing well for investors.

1pm (LON:OPM)

- Share price: 60p (+10%)

- No. of shares: 86 million

- Market cap: £52 million

1pm plc, the AIM listed independent specialist provider of finance facilities, is pleased to announce its final results for the year ended 31 May 2018.

I'm happy for shareholders that the market is recognising value in this lender. It provides car loans. asset finance, invoice factoring, etc.

It's a share I reviewed in June, explaining that I liked it but had a preference for PCF (LON:PCF) (where I have a long position).

Today's results show more progress at 1pm, including organic revenue growth of 31% and total growth of 78%.

Return on capital (a key metric to look at when measuring performance for companies in general, but especially for financials) ticks up to 13.3%, an improvement of 180 basis points. This reflects well on the acquisition strategy. Many support functions (IT, HR, etc) have become group-wide functions, making it a more efficient PLC.

As far as lending goes: impairments net of unexpected recoveries, are flat at 1.2% of the total book. Provisions for future losses are 1.5% of the portfolio. This suggests a lot of safety but of course impairments are prone to fluctuate depending on economic conditions (and the company's own risk tolerance and competence).

EPS improves by "just" 24%, despite the fact that profits almost doubled. This is due to the large number of new shares that had to be issued, mostly to pay for the acquisitions.

Outlook - the Board is "encouraged" by the level of demand and feels it is well placed with new, larger wholesale funding facilities.

My view - it's definitely at the "cheap" end of the spectrum. In terms of book value, it is now trading at a small premium to book (which is £48 million). A premium looks appropriate, given the strong return on capital.

I'm not tempted to put my own money in because it just has too many different moving parts for me to keep track of (after half a dozen acquisitions, each with their own niche).

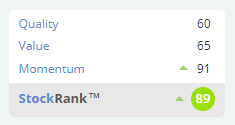

The StockRanks like it:

Goals Soccer Centres (LON:GOAL)

- Share price: 73.5p (+3.5%)

- No. of shares: 75 million

- Market cap: £55 million

Lots of things have been going wrong at this operator of 5-a-side football pitches.

Snow, the World Cup and people playing 11-a-side on a Wednesday have all contributed to an H1 operating loss. However, there is an operating profit

As I reported a few months ago, its lenders have agreed to temporarily relax its debt covenants.

Today we learn that net debt at the end of June was still around that £30 million mark and net debt/EBITDA at 3.2x. The covenant was relaxed only to 3.25x, and reduces to 3.0x after this month.

Positive trading in recent months gave the Goals share price a boost today:

H2 trading has started well and despite the challenging H1, Like-for-Like Sales (note 1) for the year to date are now positive. Trading has normalised and has returned to its positive trend following the anticipated slowdown during the World Cup, demonstrating clearly that where major investments have been made positive sales trends follow. We are therefore optimistic with respect to the trading outlook for the remainder of the year.

My view

It's a pleasant relief for shareholders that trading has improved. But I don't think this business is particularly exciting as an investment opportunity. It feels like a property play where the returns are weak, and its debt load has threatened to get out of control. So I'm steering well clear!

I'm afraid I've run out of time, so I won't be able to cover Medica (LON:MGP) or Trakm8 Holdings (LON:TRAK). It was a tough day - it takes quite a while to read an interim (or full year) results statement, even if you're skimming through the paragraphs. Reporting season is in full swing!

Let's try again tomorrow.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.