Good morning! It's Paul here.

To get you started today, I added 3 more sections to yesterday's report in the evening, being updates from;

Ideagen (LON:IDEA)

N Brown (LON:BWNG) and

Carclo (LON:CAR)

Here is the link to yesterday's completed report.

Flybe (LON:FLYB)

Share price: 12.1p (up 3% today, at 10:48 - volatile)

No. shares: 216.7m

Market cap: £26.2m

Formal sale process - this regional airline has put itself up for sale. This is part of a strategic review with several options (i.e. Plan B, if nobody wants to buy it);

These options include further capacity and cost saving measures, initiatives to strengthen the balance sheet and preserve cash resources, as well as a potential sale of the Company through the commencement of a "formal sale process"

Discussions are already underway;

The Company confirms that, at the time of this announcement, it is in discussions with a number of strategic operators about a potential sale of the Company.

The question is whether any other airlines will see value in Flybe. The stock market certainly doesn't with the share price down to only 12p. There was a short-lived bounce this morning, that was snuffed out by sellers. Who knows what happens next.

On the one hand, I can see that buying Flybe for peanuts might be attractive, if another airline were able to strip out a lot of duplicated costs, and make Flybe profitable. On the other hand, maybe its legacy issues, such as onerous leases on uneconomic planes, might put off potential buyers?

The fundamental problem with Flybe seems to be simply that not enough people use its flights. Therefore, flying with too many empty seats just doesn't consistently make any money.

Let's have a look at its latest results, announced today.

Interim results - for the 6 months to 30 Sept 2018.

Usually when a company puts itself up for sale, after its share price collapsing, then you expect to see dire results. However, these interim figures actually look quite good - adjusted profit before tax is up from £9.4m last time, to £14.0m this time. That's a profit, not a loss.

The CEO's summary mentions the main points;

"In line with our strategy, we reduced seat capacity in the first half by 9.0% delivering a 7.2% increase in revenue per seat.

Continued improvements are being seen into quarter three which demonstrates the popularity of Flybe for our customers.

However there has been a recent softening in growth in the short-haul market, as well as continued headwinds from higher fuel and currency costs.

We are responding to this by reviewing every aspect of our business, especially further capacity reduction, cash management and cost savings. This is already starting to have a positive impact, as shown by the improved first half adjusted profit before tax; however, we must do more in the coming months. We remain confident in the vital role that Flybe plays in UK connectivity."

Seasonality has to be considered with airlines, too.

In fact, there are so many moving parts to consider, that I've come to the conclusion that it's not possible for a generalist like me to add much value in my commentary. It probably makes more sense to track down some broker research from specialist analysts of airlines.

Balance sheet - this is also tricky to analyse.

Net assets are positive, at £118.6m. If we deduct £12.8m intangibles, then NTAV is £105.8m - that's about 4 times the current market cap.

Fixed assets contain a huge amount of owned aircraft. Note 14 in the last annual report shows aircraft on the balance sheet with a NBV of £286.7m. This is positive, as bank debt can be secured against aircraft.

Large provisions have been made for maintenance costs.

Customers pay cash up-front, which helps cashflow (and is reflected in the cash balance and deferred income creditor).

Net debt of £82.1m looks relatively modest, in comparison with the aircraft assets on the balance sheet.

I could go on forever, but my overall impression is that this looks a solvent business, and does not appear to be in financial distress. Which is strange, considering how bombed out the share price is.

My opinion - it's tempting to file this in the "too difficult" tray. However, given the solid balance sheet, and fairly good interim figures, I am actually going to file it in the "fun money punt" tray - i.e. I wouldn't make a conviction purchase of this, as there are too many uncertainties.

I'm very tempted to take a small long position, with money I can afford to lose. The £26m market cap seems to be suggesting that the company is virtually finished. Yet the figures don't look anywhere near that bad.

The reason I'm only prepared to have a small punt on this, is that the company has a history of disappointing, operates in a very difficult sector, and things could be worse than they appear on the surface. Plus of course, I don't have any sector expertise re airlines. Hence why my position size on something like this would only ever be very small.

As you can see below, stock market confidence in the company has collapsed. Note the huge volume bars in the recent plunge in price - that looks like institutions dumping their position(s) at any price. Either they know something we don't, or it could be a buying opportunity, who knows? Time will tell.

Ab Dynamics (LON:ABDP)

Share price: 1448p (up 4.3% today, at 12:36)

No. shares: 19.54m

Market cap: £282.9m

AB Dynamics plc (AIM:ABDP), the designer, manufacturer and supplier of advanced testing systems and measurement products to the global automotive industry, is pleased to announce its final results for the year ended 31 August 2018.

These numbers are a pleasure to behold, and I'm not even a shareholder! It looks to be a slight beat against expectations.

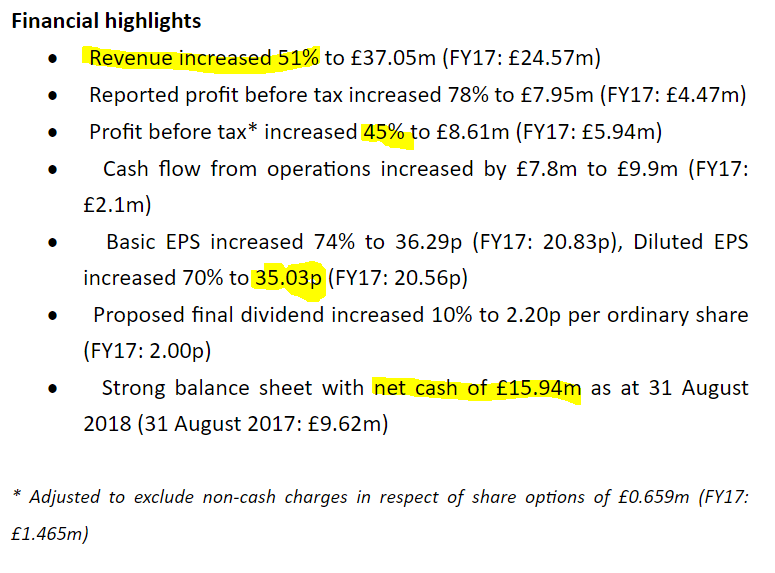

The financial highlights section speaks for itself;

Achieving that level of organic growth (revs up 51%), at high margins, demonstrates that ABDP clearly must have products that are highly desirable to customers. It also suggests that the company's products have competitive advantages of some kind.

On the downside, very high margins tend to attract increased competition, so may not last forever. The narrative today talks about innovating, and investing more in product development, which is reassuring. It sounds like the type of business that has to constantly innovate, to stay ahead.

Balance sheet - looks excellent. Very strong, no concerns here at all.

Net cash of £15.9m looks healthy. Surely the company could be a bit more generous with the divis, which are currently very small?

Cashflow statement - looks great, with profits turning nicely into cash.

Last year saw unfavourable working capital movements, which is always something to keep an eye on. That didn't repeat this year, so it looks a one-off, that came out in the wash. All good.

Capex has dropped from £8.0m last year, to £3.7m this year. This relates to a new factory, I believe. This is an interesting point to note for the future - ABDP said some time ago that it was facing demand that it could not fulfil, due to capacity constraints. It's built a new factory, and now sales & profits are soaring. We must remember to buy any shares in future when a similar situation arises. I didn't fully appreciate how significant that point was, a few years ago.

Outlook - sounds positive. Although note that the company is managing down investor expectations on the net profit margin. The share price suggests investors are happy with this. I agree - if a company is seeing outstanding customer demand & growth, then it makes sense to re-invest some of the profits in useful ways, and hence capitalise on the opportunities.

Despite our very strong growth, order intake has continued to run ahead of sales and this has provided the Group with a healthy order book into our new financial year and, as usual, visibility into our third quarter.

Against this pleasing backdrop, our progress continues to require ever greater investment in systems and our operational capability to ensure that we are fully capable of supporting current and future growth.

In the coming year, we expect to make further investment in new product development, marketing, service and support, our growing overseas footprint and, of course, our people, whose skills and energy remain so important to our future success. Inevitably this investment will provide some constraint to our operating margin, but the Board remains confident that, under the leadership of our new CEO, we are well positioned to deliver a year of solid progress."

Although I would add that, sometimes investors are not quite so sanguine about reduced margins when the figures are actually published, in future. As long as analysts make appropriate adjustments to their forecasts, then it shouldn't be a problem.

My opinion - a smashing company, that seems to be firing on all cylinders.

There's one broker note on Research Tree, pencilling in 45p EPS this year, and 55p next year. At 1448p per share, that equates to a forward PER of 32.2, and 26.3 - quite pricey, but not unreasonable, if present excellent performance & growth can be maintained.

The chart below shows us some interesting lessons. Namely that small caps are becoming particularly volatile in price. As we've seen in the indiscriminate market wobble in Oct-Nov this year, it only takes a few smallish sells, to generate a large spike down in price. It's a pity if people get shaken out of great stocks, through this volatility.

That's why I think stop losses are particularly poorly suited to volatile, illiquid stocks, and I never use them on shares like this. All too often, a stop loss is triggered on a random spike down from some muppet panic selling, or being stopped out on their spread bet. So why would I want my position to be closed in those circumstances? I'd rather be buying their shares at a discount, than having my own shares sold off in sympathy!

Marshall Motor Holdings (LON:MMH)

Share price: 156.5p (up 6.5% today, at 13:58)

No. shares: 77.9m

Market cap: £121.9m

Marshall Motor Holdings Plc, one of the UK's leading automotive retail groups...

This is a turn-up for the books! Car dealer shares have been in the doldrums of late, but things seem to be rebounding;

... better than anticipated trading during October 2018 and a more positive outlook for the remainder of the current financial year.

The following comments echo what another car dealership recently said, and I reported on here. I think it might have been Lookers? Here is what MMH says, which is similar;

As previously announced on 11 October 2018, the introduction of the new Worldwide Harmonised Light Vehicle Test Procedure ("WLTP") had a significant impact on the UK new vehicle market during September 2018 which was expected to continue for the remainder of the year.

Whilst the resultant new car supply imbalance is continuing, growth in our used car volumes and margins given supply constraints in the new car market, combined with further revenue growth achieved in aftersales, has given us more confidence over the expected outcome for the year.

The conclusion below isn't terribly helpful. They should have mentioned market expectations, not last year's figures;

As a result, the Board now expects continuing underlying profit before tax for the year ending 31 December 2018 to be ahead of the Group's record results reported last year.

Still, I suppose it's a given that better than expected trading is likely to flow through into better than market expectations profit. Why couldn't they have just said that? Extra work has been created now, as I have to look back at last year's results.

Adjusted continuing EPS was 26.9p last year. Stockopedia shows 23.7p consensus forecast for this year. So it looks as if we could be looking at say 28p-ish for this year? That's quite a big beat against forecast, if my numbers are correct.

At 156p per share, I make that an estimated PER of 5.6.

I can't find any updated broker forecasts today, so please treat my guesswork above with caution.

My opinion - this looks a potentially excellent opportunity to pick up some bombed out shares in car retailers. We now know that the supply difficulties haven't really had any impact, as margins have increased - makes sense really doesn't it? If supply is constrained, then you don't need to offer discounts to customers.

My sector pick remains Vertu Motors (LON:VTU) (in which I hold a long position). But Marshalls looks an excellent choice too. I don't think there's a lot to choose between the listed car retailers actually.

Consumers seem happy to shell out on big ticket items like cars & houses. So again, I'm scratching my head as to why the media keep telling us that everything is doom & gloom, when it isn't? The answer could be that the pressure on the High Street from internet migration of sales, is dominating the headlines. The negatives get reported, but the positives (of booming sales at internet companies) doesn't get reported.

As regards cars, the market has totally changed in recent years. Most sales are not sales, they're leases - which are available at very attractive prices - e.g. brand new Mercs for £259 per month (plus a deposit). It makes more sense to run a brand new, leased car, than some old jalopy that's costing a fortune in repair bills. For this reason, I'm positive about the prospects for car dealer shares - and they're so cheap right now.

Downside risk? As always, it's supply chaos if Brexit goes wrong. That would only be temporary though. Overall then, this looks a good buying opportunity to me - things are improving (a lot, by the sounds of it), but the stock market hasn't reacted much yet.

Renold (LON:RNO)

Share price: 36.6p (up 5.8% today, at 14:35)

No. shares: 225.4m

Market cap: £82.5m

There seems to be a solid turnaround underway at this industrial chains & gearboxes group.

Interim figures today look good - underlying adjusted operating profit is up from £6.0m to £8.2m - remember this is just for 6 months.

Outlook comments - positive;

The Group is well diversified and order intake has remained stable in the face of an uncertain macro-economic backdrop and order books remain robust.

As a result of continued momentum from the first half of the year, the Group is currently on track to deliver a result for the full year slightly ahead of the Board's previous expectations.

Balance sheet - as previously reported here, this is a major issue. Specifically the huge pension deficit. So you cannot correctly value this share without adjusting for this. Hence the apparently bargain low PER, isn't quite so attractive once adjustments are made.

The pension deficit is swallowing up cash that could otherwise pay divis.

It's quite capex-intensive too.

My opinion - I would love this share if there wasn't such a large pension deficit.

There are no divis at the moment, but the management seem to be signalling that divis should start at some point in the future.

Providing you properly get your head around the pension deficit, then this share is still worth considering, in my view. It looks a fundamentally good business, generating decent profit margins.

I have to leave it there for today, as I have a company meeting in London later this afternoon.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.