Good morning everyone!

There were a lot of RNS announcements to sort through this morning. Thanks for the suggestions, and keep them coming, as they help me figure out where to focus on.

My provisional list for today is as follows:

- Laura Ashley Holdings (LON:ALY)

- Robinson (LON:RBN)

- Headlam (LON:HEAD)

- Proactis Holdings (LON:PHD)

- Sportech (LON:SPO)

Cheers,

Graham

Laura Ashley Holdings (LON:ALY)

- Share price: 5.25p (+21.5%)

- No. of shares: 728 million

- Market cap: £38 million

Good news has been scarce for Laura Ashley shareholders. Today makes for a welcome change.

It's amazing how far a share can fall when it suffers is a loss of faith. Collapsing profits don't help either, of course.

For me, the most significant aspect of today's news is the disposal of the Singaporean property. This very strange asset has been an eyesore for existing and prospective investors such as myself (I owned ALY shares from 2014-2015).

When the property was purchased, back in June 2015, ALY's share price was 22p. Most of the value destruction since then has been related to weak trading, but some of it has been due to question marks over the company's move into property ownership.

It has been sold for SGD $54.5 million (£30.3 million), after being valued at SGD $56 million.

It was bought for SGD $66 million (£31.1 million based on exchange rates at the time), having been independently valued at $65 million.

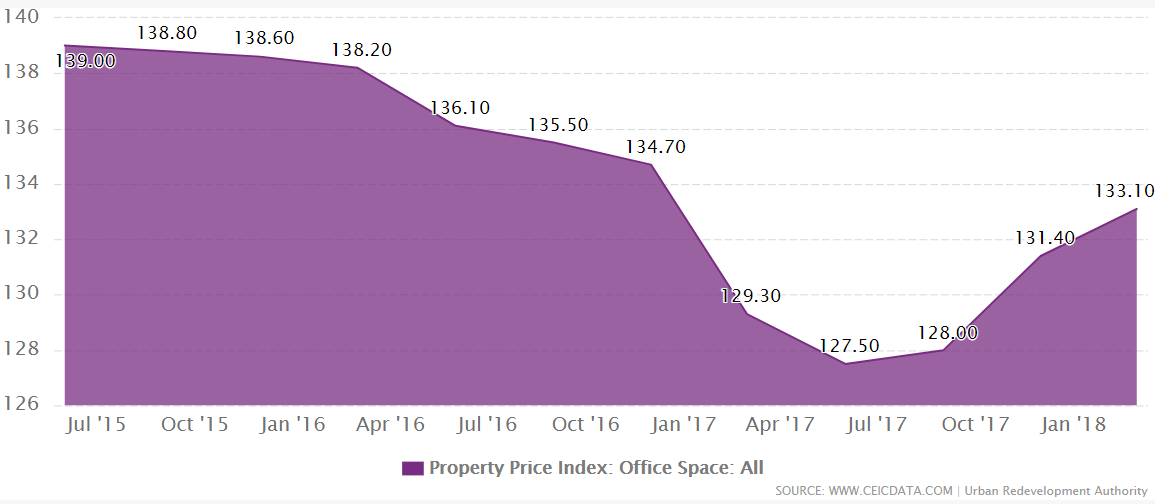

Singapore commercial property prices (for office space) are down by just 4% since June 2015:

Yet the value of Laura Ashley's property has allegedly fallen by 14%, and it is selling it for 17% less than it paid for it.

Bad luck? I guess we have to conclude that it's just bad luck.

The infusion of £30 million from the sale will make a big difference to the balance sheet, assuming that shareholders vote the deal through (I estimate that 444 million shares are held by the Malaysian chairman's companies).

At June 2018, ALY had bank borrowings of £20.1 million associated with the property and an overdraft balance of £11.4 million.

The disposal should wipe away almost all of this and leave us with a nice clean balance sheet.

Trading

Today's report draws a picture of trading which is weak, but not awful.

- Like-for-like retail sales down 0.4%

Within this, fashion is doing well (+9.7%). But fashion only accounts for 17% of UK sales.

Home accessories, furniture and decorating were all down.

- International sales (franchising and licensing) down 13% to £18 million.

It's a shame to see this going in the wrong direction. Franchise and licensing revenue is high-margin, making a big contribution to profitability, and the Asian expansion is supposed to be a source of growth.

There are signs of growth - new stores in Thailand and a greater presence on Chinese platforms. Hopefully this will turn around.

Outlook

Current trading is in line with expectations.

My view

My view is pretty simple. Along similar lines to the position at French Connection (LON:FCCN), ALY needs to shrink its retail operations, and in particular its stores:

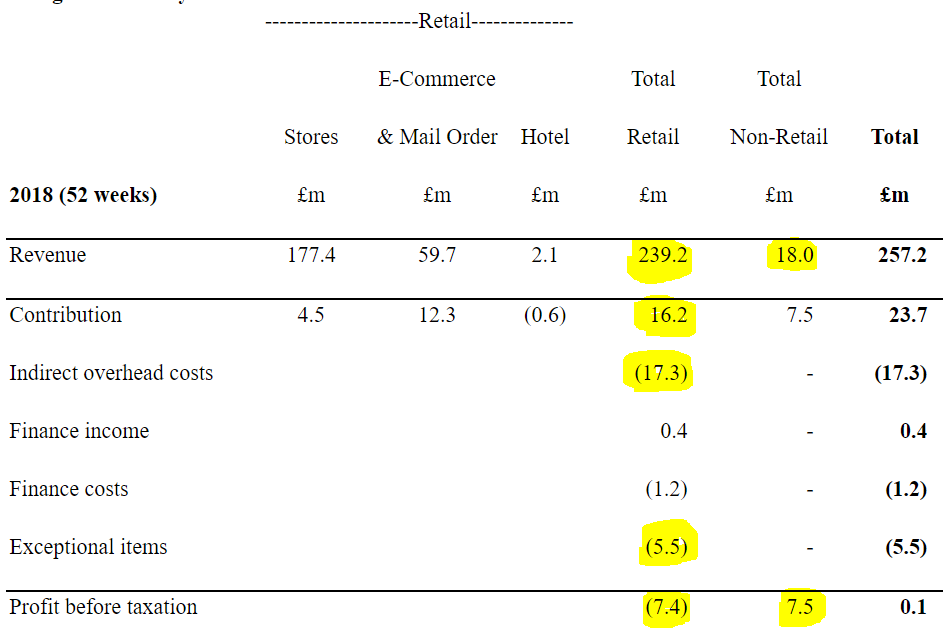

The pre-tax loss from retail is £7.4 million, and is still a loss even if we add back the impairment charge from the sale of the Singapore property (included within exceptional items).

Last year, it was a similar story: retail made a loss even if you added back the exceptional items.

Franchising and licensing, on the other hand ("non-retail"), are consistently and highly profitable.

The number of UK stores has reduced from 205 at January 2015 to 160 at June 2018.

That seems like good headway to me. But the company is promising to open two new stores and close only five stores over the coming year - wouldn't it be better for shareholders if the estate were to shrink much faster than this?

Like-for-like e-commerce sales grew by just 4%. I would have hoped for more, if the websites were really firing on all cylinders.

In summary, I think it is possible to make an argument for investing in this at current levels.

The cloud of the Asian property has been removed, albeit at a loss and with some nasty costs associated with its disposal. But that is a positive development.

The franchising and licensing operations are still profitable and the outlook for them should be good long-term. They require very little capital and are extremely high-margin.

The e-commerce business is growing at a slow pace but has ok margins.

The question for me is whether the retail stores are going to be the dead weight that eventually sink the whole thing.

If I had no UK retail exposure in my portfolio at all, I wouldn't hate the idea of owning a few shares in this, as a contrarian play. But I am carefully limiting my exposure to this sector. There are a lot of cheap retail shares at the moment, for the very good reason that their business models have been disrupted by online shopping and/or their brands are tired.

The StockRanks identify this as a Value Trap.

Robinson (LON:RBN)

- Share price: 75p (unch.)

- No. of shares: 17 million

- Market cap: £12 million

We've occasionally covered this plastic and paper packaging manufacturer. I've suggested that it could be a value play, though probably requiring a lot of patience for value to out.

The underlying business looks solid, but nothing extraordinary. It's hard to imagine that making plastic bottles or paper boxes is going to earn above-average returns on capital.

Reviewing its historical returns, I see that it briefly earned ROCE in excess of 10% during the 2010-2012 period. Apart from that, returns have been very modest.

Let's review the contents of today's update.

Trading:

- revenues up 15% and operating profit before amortisation increases to £530k. Not bad.

- PBT after amortisation and interest costs close to breakeven, a marginal improvement compared to last year.

Looks like solid trading, nothing to write home about but neither is it terrible.

Property:

No property realisations likely in the next 12 months.

The possibility of a big property sale has been the key value attraction with this share. But it sounds like there is going to be a lot more patience required for this to be delivered to shareholders.

Outlook:

Management are confident for 2019, with more capex due in H2 to facilitate new projects. Costs have risen but should be held steady from now:

The recent growth in operating costs (predominantly investment in people capability) has been concluded, so further revenue growth should improve profitability ratios moving forward.

My view

The rating is rather low, and the shares could easily bounce back if sales come through over the next year as anticipated and allow the company to continue paying large dividends.

It's a family business, another positive feature. This explains why it is run so conservatively and has barely diluted shareholders over its entire stock market tenure.

On the other hand, it's hard to imagine that a traditional packaging business is going to consistently earn a high ROCE. Robinson's track record shows how difficult this is.

Consequently, I intend to cease coverage of this stock until there is progress on the property disposals or some other major news.

Headlam (LON:HEAD)

- Share price: 441.8p (-2%)

- No. of shares: 85 million

- Market cap: £374 million

Headlam Group plc (LSE: HEAD), Europe's largest distributor of floorcoverings, is pleased to announce its interim results for the six months ended 30 June 2018

You can check the archives for our previous comments on this share. It's been a frequent topic of discussion!

Let's dive straight into today's numbers:

- like-for-like UK sales down 5.2%, like-for-like continental Europe sales up 1.7%.

- small improvement in margins

- underlying PBT up 0.9% to £17.7 million

Another example for us today of solid trading in tough conditions.

M&A

The company continues to engage in lots of acquisition activity.

Last year, it made three acquisitions, including a £35 million deal. This year, it has made another three acquisitions so far. They aren't terribly big. But the company has a pipeline of further deals it is considering.

Outlook

Headlam has hinted a couple of times already that it could miss 2018 forecasts, if market conditions get any worse.

It is now confirmed that we should expect numbers to come in at the lower end of forecasts:

...given the ongoing softness in the UK floorcovering market and the associated trading impact on the Company's UK businesses coupled with the current indications that these conditions are likely to continue during the second half of the year, the Board now expects that the full year outcome, whilst ahead of the full year 2017 will be towards the lower end of current market expectations.

My view

It's yet another cheap retail-type stock (a distributor to retailers).

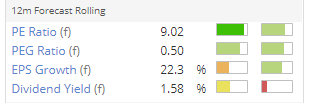

Public forecasts are for EPS of 42.6p in the current year. So the multiple is good and cheap.

I like this stock a bit more than others in the general retail space. It has a market-leading position and serves a crucial logistics role for its customers.

When you are buying into Headlam, you are buying into its ability to manage warehouse capacity, commercial vehicles and customer relationships. Its track record suggests that it is good at what it does.

It's another stock I might have considered, but again, I don't want my portfolio to be overly tilted to this sector. Economic conditions could get a lot worse before they get better, and I don't want my portfolio to blow up because I couldn't resist a bunch of cheap retail-oriented stocks just before we had the mother of all consumer recessions.

I'm happy to own a few of them (like Next (LON:NXT) ), but not too many.

I suppose what I'm doing is similar in spirit to what Ed does with the NAPS portfolio. His rules allow for at least 1 company from each sector, but no more than 3. The idea is the same: don't allow your portfolio to get battered if one sector happens to do a lot worse than you expected.

My other slight niggle with regard to Headlam (LON:HEAD) is that acquisitions tend to make me nervous, and Headlam has been doing an awful lot of them, with more to come.

So I maintain a watching brief only.

Proactis Holdings (LON:PHD)

- Share price: 103.5p (+2%)

- No. of shares: 94.5 million

- Market cap: £98 million

Proactis Holdings PLC, the global spend management and B2B eCommerce solution provider, reports a detailed update on trading for the financial year ended 31 July 2018 further to its initial update on 7 August 2018.

This is a tricky one. It provides business software used in sourcing, negotiating and purchasing from suppliers. I've been trying to catch up on the story by watching the video at PIworld.

It had a massive reverse takeover last year, at a racy valuation.

When the deal was announced, its share price shot up from 175p to 196p on initial excitement.

But it then lost two of its three largest customers, and the share price has suffered ever since. Revenue forecasts have been trending lower this year.

Key points from today's announcement:

- Guidance for FY 2018 (ending July) unchanged since the most recent update.

- Customer retention has "improved" and is now at "more normal" levels (probably still worse than average, I'm guessing).

- FY 2019 to show "normal, stronger" revenue growth

My view

I can't deny that this is cheap relative to prospective earnings.

The CEO made the case in June (in the video linked to above) that the company could make more acquisitions, despite losing those two large customers.

I'm not interested to buy an acquisitive B2B software business, so I'm not going to look into this any further. Lots of research is needed to understand what is going on with this one, I feel.

Sportech (LON:SPO)

- Share price: 66.9p (-3%)

- No. of shares: 187 million

- Market cap: £125 million

There have been all sorts of developments at this international betting software group over the past year or two. It deploys thousands of betting terminals for hundreds of clients around the world.

Let's focus on the present and future:

- New CEO & CFO

- Cash of £12.5 million, no debt, also received £2.5 million post-period end for a disposal.

- Small increase in revenue from continuing operations, using constant FX (£31.6 million).

- Small loss from continuing operations

There is a major US opportunity in sports betting after the law was relaxed at federal level. A direct-to-consumer offering is being built in Connecticut with the help of a data/risk management/technology partner.

The new management team are based in Toronto, helping to reduce corporate costs by 39%. Maybe this could ultimately get bought out by North American investors and/or get listed on that side of the pond?

Tax affairs continue to rumble on:

Following the successful Spot the Ball VAT reclaim, the Group is aware that HMRC are closely examining all the Group's tax affairs. The Board, after taking professional advice, believe the liabilities recorded in the financial statements are correct, and whilst they are open to challenge, the Group's position will be defended robustly.

My view

The numbers aren't pretty yet but with a big US opportunity and an established global business, I think there could be a lot of value that's not immediately apparent. Worth looking into.

Time's up for today, thank you for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.