Good morning, it's Paul here.

Italy again

Italy is being much more widely covered in the UK media now. Certainly it's the main topic that I'm reading up on, and thinking about. - in terms of how it may affect my portfolio. The political aspect of it all is only of passing interest. I'm more focused on how it could decimate my portfolio, and what action I can take to protect myself. So just to clarify, Twitter is the place to rant about the political stuff. Stockopedia is the place to have sensible debate about the markets & financial impact of various scenarios which might play out re Italy. It's all guesswork at this stage.

The more I think & read about Italy, the more I feel that the so-called populist parties are making promises they can't deliver on. They want to stimulate the Italian economy by dramatically increasing the budget deficit (more spending, and tax cuts), which would breach Eurozone rules.

Italy knew what it was signing up for, when it joined the Euro. Plus, if Germany allows Italy to breach spending rules, then other countries may well follow suit.

There's a fascinating account from Varoufakis in "Adults in the Room" of a (recorded) meeting of the Euro Group. He said that France, Portugal, Spain, Slovakia, etc, were so terrified of sanctions being imposed on them, that they made a great show of support and loyalty towards Wolfgang Schaeuble - who comes across as a monstrous bully in the book - but I suppose that is inevitable given that the author was the one being crushed.

What's even more interesting, is that both the Euro Group, and the IMF, knew full well, and openly admitted to Varoufakis, that they knew the Greek bail outs would not work. The agenda wasn't about helping Greece though, it was about saving the French & German banks which owned a lot of the Greek debt.

We already know from the Greek experience, that the main decisions are made in the Euro Group, and the ECB. Both are completely dominated by Germany. Their standard approach is to withdraw support for any recalcitrant member. The nuclear option, if the rebel state still won't fall into line, is to close their banks by switching off their liquidity. This is combined with aggressive briefing against individual opponents (and pushing for their removal/replacement) to undermine strong opponents, and buttering up politicians who are thought to be weak.

In this way, the rebellious Greek Syriza Government was beaten into submission.

Therefore, it seems to me that Germany is likely to adopt exactly the same approach with Italy. Ultimately, my hunch (nothing more than that - feel free to disagree) is that the Italians would probably also capitulate, after a struggle (no WWII jokes please!). After all, that's exactly what happened last time, in 2011, when the EU forced out Berlusconi.

The main risk seems to me that events might spiral out of control. The amount involved to backstop Italy's national debt (E2.3 trillion) - something like 130% of GDP - is way too big for Germany to underwrite - and why would they?

The EU may be able to find a fudge, which has happened in the past. I just wonder whether the big risk is of a meltdown in Italy's banks - capital flight out of the country - with the EU unable or unwilling to stop it. Would you want to own Italian Govt bonds? I certainly wouldn't.

The problem is so large, that it could then trigger a domino effect throughout the banking system, just like we saw in 2008.

Italians want to remain in the Euro, but the big question is whether that will be possible? Markets might force the issue and cause a disorderly break-up of the Euro. That might be a low probability, but I think we need to consider it, and have a personal portfolio plan of action which could cope in the worse-case scenario.

My portfolio

So, what have I done to protect myself against the worst case scenario?

I've now ditched all my large caps - because they are liquid, hence easy to sell. My aim was to reduce gearing fast. So Next (LON:NXT) , Marks and Spencer (LON:MKS) , and Superdry (LON:SDRY) have all gone. My intention is to buy back in, after the Italian crisis has been resolved, as I still think all 3 are good shares.

Secondly, as mentioned yesterday, last week I hedged my portfolio by shorting the main Italian index, and the 10-year bonds, through IG. I had to chuckle at a grumpy reader comment yesterday telling me that I don't know anything about Italy, and should stick to analysing Belvoir Lettings (LON:BLV) !

It did occur to me that I might post a screenshot showing the profit my Italian shorts had accumulated, in reply. But in the end I decided that would be vulgar.

Thirdly, I decided to go long of Gold, also through a spread bet. Historically that has been a good hedge in times of turmoil.

So, having hedged my portfolio fully, I'm now relaxed about holding my remaining small & micro caps. Even in the worst case scenario with Italy, I would be fine.

I've heard from friends that some investors are increasing their cash weighting, by banking profits, and maybe throwing out some portfolio dogs. My broker tells me that there is no sign of panic yet, and that most clients are just trimming back on a few positions, nothing more than that.

One final point - in the past, I've found that troubled markets can provide some smashing buying opportunities. Many people go on a buyers strike, and stop looking for good things to buy. This means that brilliant results or trading updates can be ignored by most - thus providing a good entry point for investors who can be bold because they're holding cash, or have adequately hedged their risk.

Photo-Me International (LON:PHTM)

Share price: 115.8p (down 23.5% today)

No. shares: 377.5m

Market cap: £437.1m

Photo-Me (PHTM.L), the instant-service equipment group, announces the following trading update for the year ended 30 April 2018, ahead of its full year results which will be published on Tuesday 10 July 2018, and provides guidance for the year ending 30 April 2019.

This is a tricky one, as the last time I looked at PHTM was in Dec 2012!

Thankfully, to get me up to speed, there's a terrific article on Stockopedia from the excellent blogger (and thoroughly good egg) Damian Cannon, here.

Graham wrote about PHTM's in-line interim results, here on 11 Dec 2017. The share price has come down 36% since then.

Year-ended 30 April 2018 - broadly in line;

For the financial year ended 30 April 2018, the Board expects the Group will achieve turnover growth of approximately 6% versus the prior year on a constant currency basis, with the Group's profit before tax expected to be broadly in line with market expectations, including a one-off investment gain of £3.7 million relating to the Group's shareholding in Max Sight Group Holdings Limited.

It's not clear from this whether market expectations also include the one-off investment gain? Usually analysts strip out any one-offs like that, which implies that the underlying profit might have missed expectations? I've just found a broker update on Research Tree, which is very helpful, which seems to confirm that the underlying profit did miss forecast.

The announcement does not provide a footnote telling us what market expectations are, which is unhelpful.

Valuation - underlying earnings for 04/2018 are apparently c.9p. So at today's reduced share price of 115.8p, that gives a PER of 12.9 - probably about right for a business that has disappointed on growth.

Forecasts - for year ending 04/2019 have been reduced about 15% today, to 9.2p - essentially flat against 04/2018.

Net cash - is c.£26m as at 30 April 2018.

Other points - I won't go through all the narrative today, but the main issue seems to be the "very difficult" Japanese market for photo ID booths.

Dividends - the yield is now very high, but also only just covered by earnings;

Although no final decision has yet been made, the Board currently expects that it will maintain the Group's existing dividend policy at the full year results.

That's clearly worded so as to provide wiggle room to cut the divis in future, if necessary.

Therefore I think investors should assume that the divis might be cut in future. Maybe they won't, we don't know at this stage. The group is nicely cash generative, so it could be possible to hold the divis. There's not likely to be much growth though.

My opinion - I'm sure some readers know the company better than I do, so are better placed to judge it. My main concern with this company is how much longer photo booths are likely to survive? It seems to me virtually inevitable that selfies on smart phones, with a direct download to the relevant authority, would sooner or later make photo booths redundant.

PHTM is trying to expand into other areas (e.g. laundry machines). For me though, if the core photo booth business is probably in structural decline, then I wouldn't want to invest unless the share price was crazily cheap - so a PER of 5 or less.

It's not for me. This could be a value trap in the long term, I suspect.

Oxford Metrics (LON:OMG)

Share price: 72.7p (down 6.2% today)

No. shares: 124.9m

Market cap: £90.8m

Oxford Metrics plc (LSE: OMG), the international software company servicing government, life sciences, entertainment and engineering markets, announces interim results for the six months ended 31 March 2018.

I've just refreshed my memory by re-reading my notes here, on the year-end trading update, published on 19 Oct 2017. I came away with a positive impression, when the shares were 63p.

My initial reaction to today's results was to question whether the figures are good enough to justify a fairly punchy forward PER of 19.4 as at the start of play today?

Some numbers, together with my comments;

Revenue up 10.9% to £14.3m for H1. Note that the company achieves quite high profit margins, hence why the market cap is several times annualised sales.

Adjusted profit before tax in H1 fell, from £1.6m last time to £1.5m this time. I'm a little confused as to why this was "in line with our expectations"? I would have thought the 5-year plan to double profits (we're now in year 2) would require profit to rise in each reporting period.

Forecasts - hoorah, there's a broker update on Research Tree for this company too. This indicates no change to forecasts, of adjusted PBT of £5.2m this year (ending 30 Sept 2018). That implies a much larger H2 weighting to this year's profits - £3.7m PBT in H2 would be needed - possibly increasing the risk that there might be a shortfall?

Outlook - management sounds upbeat;

Looking forward to the second half, the Board is encouraged by the strong pipeline of sales opportunities in both Vicon and Yotta. We will continue to pursue our organic "amplify the core" growth strategy and we remain on track to achieve the objectives set out in our five-year plan.

Complementing this, the Group will continue to explore value-enhancing acquisition opportunities.

Notwithstanding macro-economic uncertainty, the Board remains enthused with the broad array of opportunities for the Group and is confident that, with the expected performance across the business, the Group is on track to meet current market expectations for the year as a whole.

It's worth noting that the company slightly beat expectations last year. That gives me some confidence in relying on their current outlook statement.

Balance sheet - looks strong. No issues there. The company has enough surplus cash to make acquisitions, which could help drive future profits, if spent wisely.

Cashflow statement - the group seems genuinely cash generative. Note that it capitalised £809k into intangibles in H1. There's nothing particularly wrong with that, but it renders EBITDA meaningless.

Dividends - the company has a history of being generous to shareholders, including a series of special dividends a while back. The regular divis aren't anything special though, no pun intended! The normal yield is forecast at just over 2%.

My opinion - this has long struck me as a good company, so it's pleasing to see the shares generally doing well (even though I no longer own any!)

It's a straightforward bet on whether you think management can continue to deliver profitable growth. If they do, then you'll probably make money on this share over the long term. If something goes wrong, then you might not.

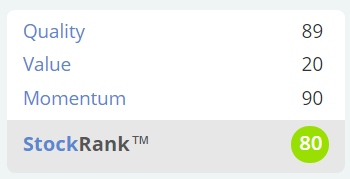

The Stockopedia algorithms like it too;

Pressure Technologies (LON:PRES)

Share price: 144p (down 22.6% today, at 14:49)

No. shares: 18.6m

Market cap: £26.8m

Pressure Technologies plc, the specialist engineering Group today issues an update ahead of its interim results for the 26 weeks to 31 March 2018...

There's quite a long explanation for how the various divisions are performing, and problems encountered. This is a highly abbreviated version;

... the Group's results for the full year are expected to be substantially below market expectations.

Some of this seems to be timing issues - work slipping into the next financial year.

Other problems at the alternative energy division, include contract delays, legislation delays. A review has concluded that the division will be loss-making this year, but strategic options are being explored - a disposal, possibly?

My opinion - for me, this share is too complicated - too many division, for such a tiny market cap of only £26.8m.

I feel that the level of debt is too high for comfort, and a balance sheet that is top-heavy with intangibles from acquisitions.

There's a bigger structural problem too - this type of engineering business, relying on large contracts, is not likely to have very predictable performance. So profit warnings seem to happen quite often.

An optimist would point out that its core oil & gas markets are improving. So there could be good upside if future profits recovered to anything like its glory days a few years ago. Also, the issues mentioned today are said to be "largely ones of timing" - so this share could recover over time, possibly?

On balance, I'm looking for groups with strong balance sheets first & foremost, so this one doesn't cut my mustard.

As you can see from the 5-year chart, PRES did roaring trade when the oil price was high in 2014. If you're bullish on the oil price, then this could be an interesting way to play that. So far though, share price recoveries have generally been dashed by disappointing results, hence were false dawns:

That will have to be it for today.

Sorry, I didn't get round to looking at Nexus Infrastructure (LON:NEXS) in the end.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.