Good morning,

Today we have news from:

- Somero Enterprises Inc (LON:SOM) - interim results

- Alpha FX (LON:AFX) - interim report

- QUIZ (LON:QUIZ) - AGM trading update

- Cambria Automobiles (LON:CAMB) - trading update

- Frontier Developments (LON:FDEV)

Somero Enterprises Inc (LON:SOM)

- Share price: 232p (-17%)

- No. of shares: 56 million

- Market cap: £131 million

These are difficult times for investors, and it's unfortunate to see another private investor favourite which has started to struggle.

Somero makes concrete-levelling equipement and sells it worldwide. We already knew that it had a disappointing H1, after a major profit warning in June.

Unfortunately, the negative trends in trading appears to have spread internationally.

In June, Somero reduced its full-year revenue forecast to $87 million.

Today, it reduces this forecast further, to $83 million - $87 million. The broker Finncap is using $84 million as its central estimate. Revenues last year were $94 million.

What's gone wrong?

The profit warning in June was based on poor weather in the US, Somero's home market.

We now find that contracts have slipped in Europe and the Middle, and "wider macro pressures" internationally are mentioned:

Whilst towards the end of the period, trading in Europe and the Middle East fell below the prior year in part due to the timing of certain contracts, we remain confident to deliver improved H2 2019 results, broadly in line with guidance for the full year, notwithstanding the wider macro pressures in Europe, particularly Germany, the Middle East and Australia. Pleasingly, a number of our other markets delivered growth, alongside growth from new products.

In H1, European revenues are down by 26% to $5.5 million.

In China, "newly imposed tariffs and competition in the low-end productivity segment of the market are resulting in margin pressure."

I have repeatedly expressed scepticism that Chinese builders would be willing to pay a US company for technology of this sort. Somero's reference to competition - i.e. Chinese companies making very similar machines - helps to support this view.

In the Middle East, sales collapsed by $1 million to $0.2 million. The timing of projects is blamed - hopefully this six-month period is not representative of Somero's prospects in the region.

The overall gross margin has slipped, too, from 57.5% to 56%. Reduced volumes and increased material costs are blamed.

Products and site expansion: the company is happy with its latest product, the SkyScreed 25. Even though it requires "meaningful changes to structural high-rise jobsite workflows", customers are said to be willing to make the necessary adjustments.

Somero is also adding 35,000 new square feet to its Michigan facility, targeting completion in early 2020. This is "strategically important to support our longer-term plans".

Outlook

Management remain very confident for H2, based on their insights into customer activity levels. They say "we do not see a broad fundamental change in our markets". H1 problems in the US were purely weather-related, and the US construction market remains healthy.

The outlook in other markets is a lot more mixed. Europe is beset by economic uncertainty, demand in China for Somero's higher-quality products hasn't materialised yet, and the Middle East remains highly uncertain.

Analysis

This is a really tricky one. We have a weather-related profit warning in one region (US), and now we have an economic-related profit warning in another region (Europe). A coincidence?

I'm inclined to give Somero the benefit of the doubt, and say that on balance, I do think this is probably a coincidence - according to various sources, US weather has been extraordinarily wet. It makes sense to me that this would slow down activity at Somero's customers.

The cash balance remains strong at $15 million, though much reduced from $28 million at the start of the period. The business itself generated very little free cash flow (not helped by rising accounts receivable), and $14 million of dividends effectively came straight out of the pre-existing cash pile.

The broker has decided to "roll this lower momentum through into 2020", and cuts the 2020 EPS forecast by 7.7%.

StockRanks continue to love it, giving it an overall score of 90 and a perfect QualityRank. High quality, combined with a PE multiple of less than 10x, makes it attractive for QV-style investors. It passes no fewer than seven stock screens.

Like the StockRanks, I remain a fan of this company, and think that it could recover over time. I'm not firm enough in this view to deploy my own funds, but I wish the company and shareholders well. Fingers crossed for a recovery.

Alpha FX (LON:AFX)

- Share price: 770p (+5%)

- No. of shares: 37 million

- Market cap: £286 million

This is an impressive and relatively new corporate FX broker.

We had a preview of these results in July's trading update. I remarked at the time that the founder-CEO seems to be using unusual (and very successful) management techniques, to get the most out his team.

These interim results show client numbers increasing by 17% in the six-month period, with the staff count increasing by a similar percentage. Revenues increased by 60%, compared to H1 last year, with strong growth in revenue per client.

Outlook: "very comfortable" with market expectations - this sounds like an earnings beat is possible. There hasn't been an official upgrade, but the broker says their existing forecast is "conservatively unchanged".

Culture

The key point about AFX is that it's being run differently to the average company. The founder-CEO believes in "radical transparency" (i.e. brutal honesty) at his company, and it's working.

The importance of company culture is highlighted:

Culture remains the single most important differentiator for our business. The time and effort spent codifying our culture in order to instil the behaviours and principles that have driven our high levels of performance to date, is continuing to pay dividends. We are all proud of the foundations that we have built at Alpha and understand that we will only maximise the true potential that these afford us by continuing to protect and develop the culture that got us to this point.

Profitability

AFX calculates H1 "underlying" operating profit at £6.7 million. I would deduct the value of share-based payments from this to get £6.5 million.

The broker sees full-year revenues rising next year to £40 million, with EBIT of £15 million and EPS of 31p.

So the current share price is a punchy rating but it's hard to argue that the company doesn't deserve it, given the growth runway it's on.

It has rolled out new products such as currency options and "Alpha Pay" (an online platform) and these all seem to be going well. It is also increasing headcount in Toronto.

My view

I'm tempted by this one. There is key man risk, as the founder-CEO is clearly critical to the operation, but that often goes with the territory in small-caps.

QUIZ (LON:QUIZ)

- Share price: 16.225p (-12%)

- No. of shares: 124 million

- Market cap: £20 million

This is a dull and rather discouraging update. Revenues are "broadly in line with the same period last year", but trading conditions remain "difficult". There has been a reduction in store footfall (hardly a surprise).

Paul covered the preliminary results.

There is nothing in today's statement to disabuse us of the notion that Quiz will be loss-making in the short-term, as it seeks "to return to sustainable profitable growth in the medium term".

Online sales are about a third of the total. There is a lot of floor space to be used: 73 standalone stores and 174 concessions.

With short leases, this might not be a fatal issue, but getting rid of all the space which is about to become unprofitable could require a lot of management's focus.

Like Paul, I don't have a clear impression of where the Quiz brand is positioned: it's somewhere in the mid-market. Does it and can it stand out from the crowd?

My stance on retailers is unchanged: extreme selectivity. With so many of them headed for the knacker's yard, I only want to buy the safest and best among them.

Cambria Automobiles (LON:CAMB)

- Share price: 57p (+7.6%)

- No. of shares: 100 million

- Market cap: £57 million

This car dealership group, like all the others, has had a depressed valuation multiple. As of last night, its PER was less than 6x.

If it was possible to buy a "car dealership ETF", maybe that's something I'd be interested in. As a group, they look unduly depressed.

This is a busy RNS which includes lots of information about new locations which Cambria has opened. I'll spare you the details.

Update - the best part of this is aftersales, with revenues up 4.7% (or 1.8% on a like-for-like basis).

Used car sales were up 0.8% like-for-like, while new car sales were down nearly 8% like-for-like. This is a bit worse than the new car market as a whole, which has been impacted by UK consumer sentiment and supply problems as a result of WLTP.

Thankfully, Cambria has changed its business mix, and is focused on luxury cars which delivery a higher profir margin.

Therefore, despite the above challenges, "the total profit from the new car department of the business improved significantly year on year". Well done!

Outlook sounds good:

the Group has delivered positive franchising and property development activities over the past two years that have enhanced Cambria's excellent dealership portfolio mix and boosted its earnings capacity...

My view

Maybe this signals the bottom as far as sentiment towards this particular dealership is concerned?

Cambria has paid an attractive dividend stream over the years and the payout has been covered by earnings many times over.

This could be a nice stock for value-hunting contrarians.

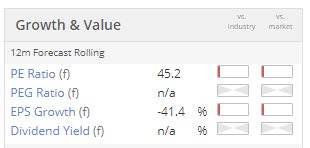

Frontier Developments (LON:FDEV)

- Share price: 1064p (-4.5%)

- No. of shares: 38.7 million

- Market cap: £412 million

This is "the UK's largest independent studio" in the videogames industry.

Operating profit comes in at £19.4 million for FY May 2019, on the back of the successful release of Jurassic World Evolution.

Next up is Planet Zoo, to be released in November.

Outlook

FDEV gives reasons why Planet Zoo won't match up to the success of JWE this year:

- JWE was multi-platform, Planet Zoo is PC-only.

- JWE was supported by the release of a new Jurrasic film and the Jurassic franchise.

- Planet Zoo will only contribute to revenues in H2.

Accordingly, "the Board is comfortable with the current range of analyst revenue projections of £65 million to £73 million for financial year 2020 (the 12 months to 31 May 2020)."

For context, revenue in FY May 2019 was £90 million.

While I like everything I know about this company, I continue to suspect that the valuation is overcooked when you take into account its reliance on just a handful of titles for the bulk of its revenues each year.

That's it for today, thanks everybody.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.