Handling cash imbalances

If you feel that your portfolio valuation is too low or incorrect it is most likely due to the fact that you are showing a cash imbalance in your portfolio. This occurs when you have entered a cash deposit into your portfolio but the sum of all your stock purchases exceeds it - which results in a negative cash balance.

There are 2 solutions to this situation depending on whether you wish to track your cash balance or not.

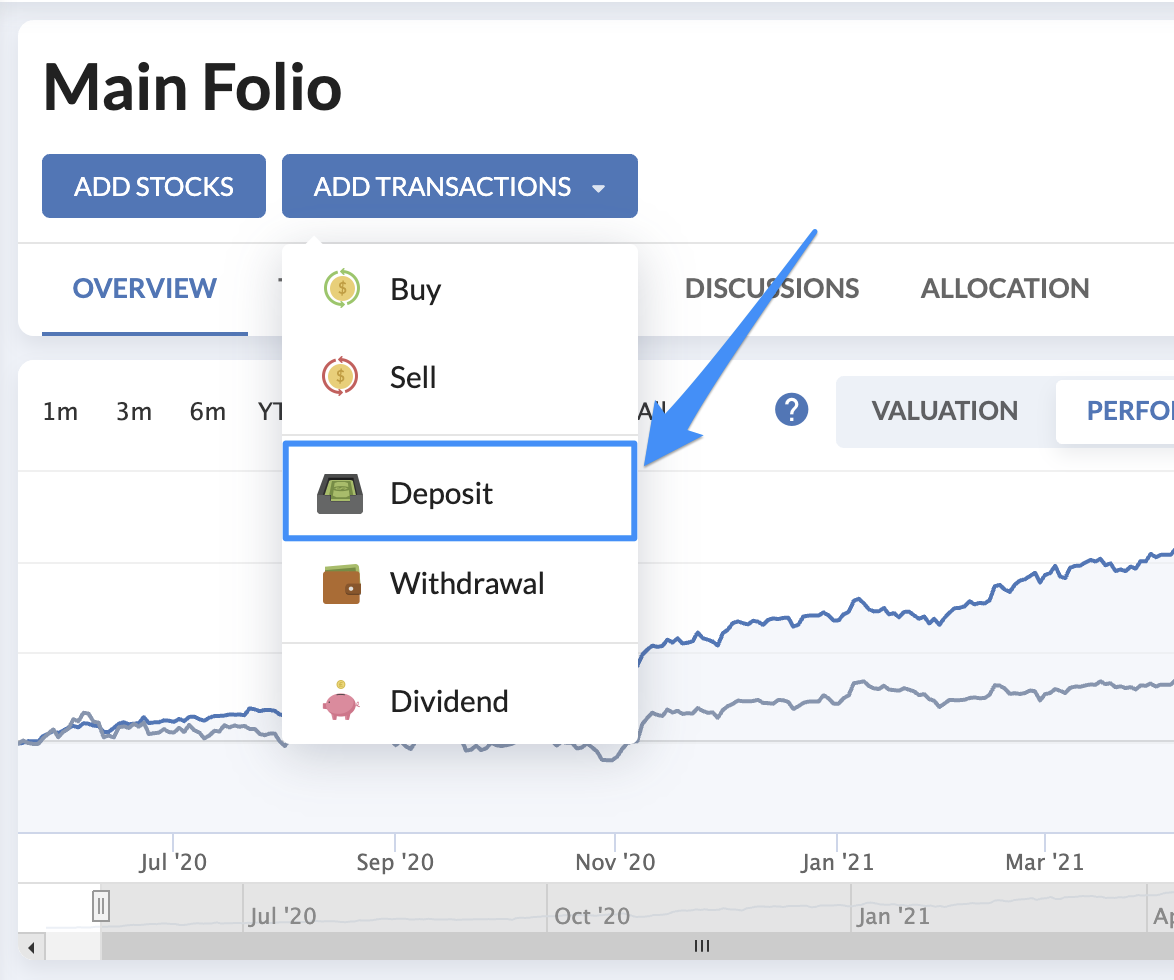

1. If you do want to track your portfolio and take advantage of both the valuation and performance charts - add a starting cash balance to the Folio. It's easy to add an initial cash balance - click "Add Transaction" and the "Deposit" and follow the steps. Your valuation will be correct as long as you add a cash balance amounting to the cost of purchases made plus the amount of cash in your trading account. The more detailed you are with recording cash inflows and outflows, the more accurate the valuation and performance chart will be.

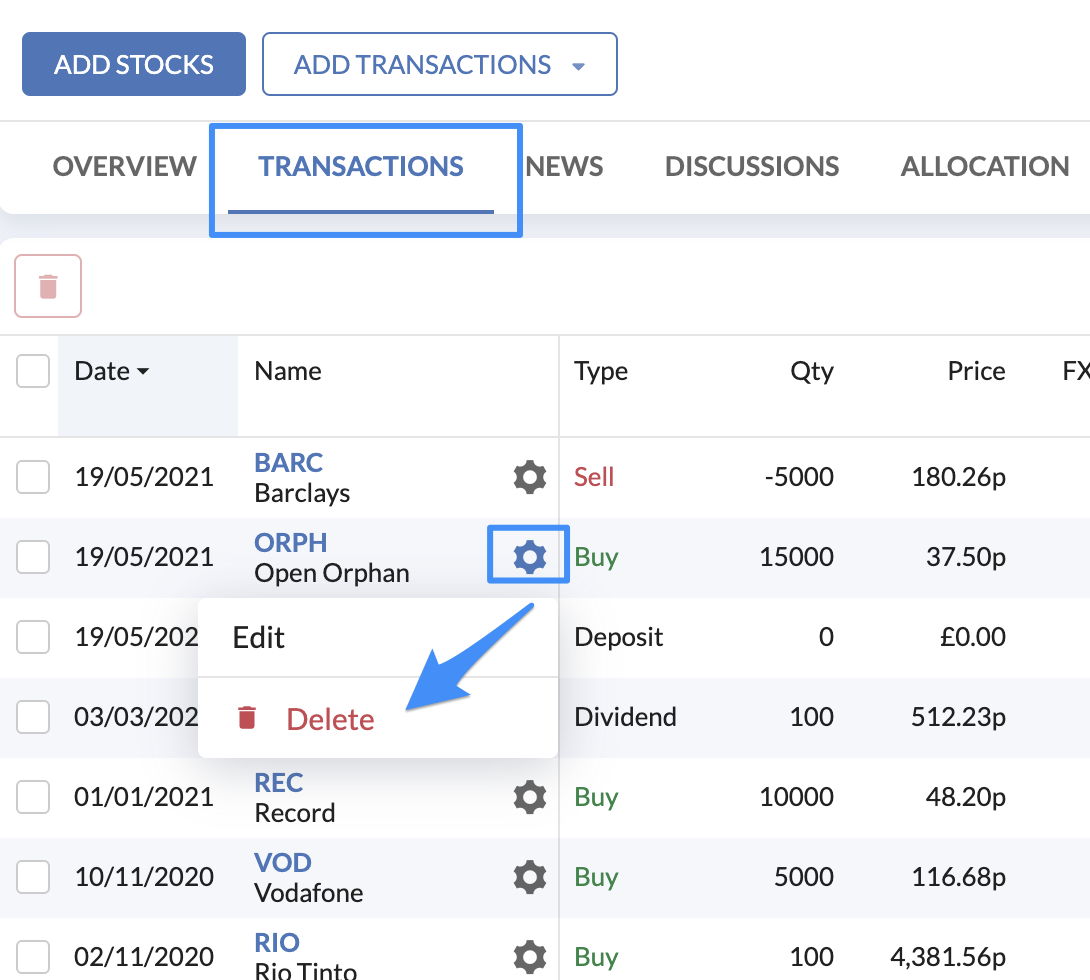

2. If you do not want to track your cash balance - remove all deposits & withdrawals from the Folio! Solution 1 is preferable if you with to track your total account valuation and see your performance, but if you are happy to just track the equity portfolio valuation you could just delete all cash deposits and withdrawals.

Any confusion over this please do get in touch using the Green Support Messenger on the side of the website.