Good morning! It's looking like another busy day for earnings as results season gathers pace.

14:30: That's all we've got time for today, see you tomorrow!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Associated British Foods (LON:ABF) (£16bn) | SP -13% | AMBER (Roland) [no section below] I’ve been neutral on this unusual family-controlled food-to-clothes conglomerate this year, but today’s H2 trading update strikes a cautious note and has triggered a sell off. Primark (c.75% of H1 profit) saw LFL sales fall 2% in H2. Full-year margins at this value fashion retailer are expected to be “broadly in line” – i.e. probably slightly lower. Frustratingly, the company doesn’t provide clear overall guidance in today’s RNS. However, the market reaction suggests to me that investors are pricing in a slight miss on full-year earnings forecasts of 175p per share. Knocking 5% off earnings would leave ABF trading on just under 12x FY25 earnings after today's fall, with a c.3.4% dividend yield. That’s at the low end of the group’s historic valuation range, for a business that’s been a reliable performer for a long time. However, this is a relatively capital-intensive business with somewhat average profitability and considerable complexity. Right now ABF seems to be facing a number of headwinds. I think there could be some long-term value here, but given the patience that might be required I’m going to maintain my neutral view today. | |

DCC (LON:DCC) (£4.53bn) | £800m return: £100m underway through buyback, £600m tender offer & £100m when defcon received in two years' time. | ||

Old Mutual (LON:OMU) (£2.43bn) | Adj headline earnings +29% to 4,204Rm. NAV -6% to 1,804.1c per share. Outlook cautious. | ||

Vistry (LON:VTY) (£1.95bn) | Completions -12%, pre-tax profit -33% to £80.6m. 88% pre-sold for FY25. Full year guidance unch. | AMBER (Roland) Today’s results leave expectations unchanged but show just 30% of forecast 2025 earnings were generated in H1. While profits are typically weighted to H2, this suggests a heavier weighting than usual if Vistry is to meet forecasts. Medium-term prospects for a recovery in partner volumes seem positive, based on my understanding of the new £39bn government SAHP programme. However, today’s guidance suggests to me that the H2 outlook and perhaps the 2026 outlook still carry some uncertainty. Relatively high debt (compared to listed peers) and committed cash outflows also make me slightly nervous.The shares now trade below tangible net asset value, providing some margin of safety, but I’m staying neutral today. | |

Serica Energy (LON:SQZ) (£693m) | SP -11% In addition, planned repairs by operator Dana on Bittern subsea infrastructure will halt production from Evelyn and Gannet for three weeks, resulting in a temporary reduction of over 20kboepd net to Serica. SQZ 2025 prod guidance now 29-32kboepd (prev. 33-35k) Updated forecasts from Auctus Advisors: | BLACK (AMBER) (Roland) [no section below] Another month, another problem with the Triton FPSO. Serica doesn’t operate this platform but depends on it for around half of its production. This has proved to be a persistently uncomfortable situation as this ageing platform seems to remain unreliable however much maintenance it receives from its operator Dana Petroleum. In addition, today, we learn that Dana is also planning repairs to the Bittern field infrastructure (another of Serica’s non-operated fields). These had been postponed from this summer to 2026, but have now proved unavoidable. In my view, this does not reflect very well on Dana’s operatorship. Serica always looks cheap, with a high dividend yield and good cash generation. It’s also a major gas supplier to the UK. But as I’ve commented before, I’ve come to the view that this business deserves a discounted rating to reflect the lack of control it has over Triton and the unreliability of this asset. To reflect this further downgrade, I’ve cut our view to neutral today. | |

Wickes (LON:WIX) (£461m) | Rev +5.6%, LFL growth in Q2. Adj PBT +17% to £27.3m, net cash £158m. FY25 exps unchanged. | ||

Smarter Web (OFEX:SWC) (£365m) | Purchased 30 Bitcoin at £83,404.85 (£2.5m). Now holds 2,470 Bitcoin (worth c. £206m) | ||

Property Franchise (LON:TPFG) (£358m) | Rev +50% to £40.3m (proforma +8%). | AMBER/GREEN (Roland) [no section below] Today’s headline figures are inflated by the inclusion of Belvoir, with which Property Franchise combined last year. I prefer to focus on the pro forma numbers which show the combined group has continued to expand. Profit margins also seem to have improved, with an adjusted operating margin of 36.7% versus 34% in H1 24. The company’s breadth of services across franchising, lettings, sales, financial services and licensing help support 47% recurring revenue and should mean that it’s less exposed to cyclical fluctuations in the sales market. Right now, the pendulum seems to be swinging towards sales, with an agreed pipeline of £43.5m (H1 24: £33.4m). In contrast, the group’s portfolio of managed rental properties has shrunk slightly since last year, at c.150k (H1 24: c.153k). Looking ahead, management sounds confident , but warns that new instructions have softened slightly and suggest the Autumn Budget could bring unwelcome news on property taxation. Graham was GREEN on this estate agency group in August and I share his view that this is a quality business. However, forecasts have been left unchanged today and the valuation is starting to look a little high to me on a historic view, reflected in High Flyer styling. For these reasons I’m going to opt for AMBER/GREEN today. | |

Central Asia Metals (LON:CAML) (£314m) | Rev -2%, adj free cash flow 46% to $16.2m. $10m buyback. H2 outlook: production in line. | ||

Social Housing REIT (LON:SOHO) (£272m) | Net rental income +19%, adj EPS +22% to 3.34p. Dividend target +3% to 5.622p. Positive outlook. | ||

GYM (LON:GYM) (£245m) | Rev +8%, avg members +4%. Five new sites opened. FY adj EBITDA to be at top end of f’casts. | ||

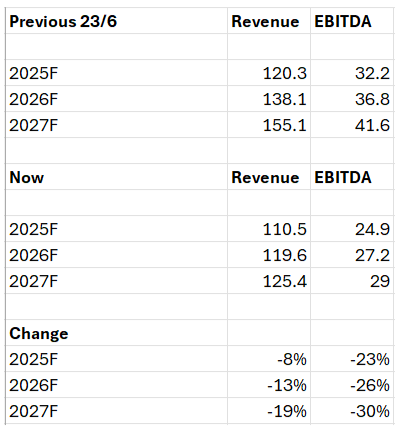

Warpaint London (LON:W7L) (£230m) | PW: Revenue +8% to £49.3m, PBT -41% to £6.4m, Adj. EPS -13% to 8.5p, Cash £17.0m (24H1:£5.5m). “...the board now expects the Company to achieve revenues of between £107 million and £112 million, and adjusted EBITDA of between £23.5 million and £25.5 million.” | BLACK/AMBER (Mark)

Shore Capital adj EBITDA forecast previously £32.2m, reduced to £24.9m today and reduce FY25/FY26/FY27 revenue by 8/13/19% and adj. EPS by 27/30/34%. | |

Public Policy Holding (LON:PPHC) (£219m) | H1 Revenue +23.6% to $87.9m (7.6% organic). EBITDA +14% to $21.4m, Adj. EPS +13% to 12c. Net debt $42.2m (24H1:$28.3m) “…on track to meet full year market expectations.” | ||

Kistos Holdings (LON:KIST) (£135m) | FY avg. production guidance of 8,000 - 9,000 boepd reaffirmed with daily production reaching 16,000 boepd on 8 September. Cash $104m incl $20m restricted (31 Dec: $143m). Net debt $86m. | ||

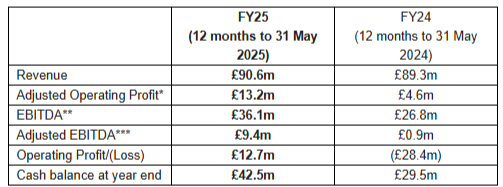

Frontier Developments (LON:FDEV) (£143m) | FY Revenue +1% to £90.6m, Adj Op Profit +187% to £13.2m, Cash £42.5m (FY24: 29.5m). “Confident in Frontier's ability to deliver further annual growth in FY26 through nurturing and expanding our genre-leading game franchises.” | AMBER/GREEN (Mark) | |

Anpario (LON:ANP) (£87m) | H1 Revenue +34% to £22.7m, PBT +62% to £3.4m, Adj. EPS +43% to 16.0p, Cash £11.1m (31 Dec: £10.5m). “The Group has made a strong start to the second half…” Shore Capital forecasts upgraded: FY25E EPS +7.4% to 32p | GREEN (Roland - I hold) A strong set of results is backed by upgraded forecasts from house broker Shore Capital. I’m encouraged by strong trading, improved profitability and early signs that last year’s Bio-Vet acquisition is making a positive contribution to margins. While the business is seeing headwinds in certain countries, overall momentum seems positive . Anpario's valuation looks reasonable to me on a FY26E P/E of 14 and I expect natural feed additives to remain a structural growth market. I’m happy to revert to a positive view today. | |

Nexteq (LON:NXQ) (£47m) | Revenue -16% to $40.7m, Adj. PBT -82% to $0.9m, Adj. EPS -81% to 1.17c, Net cash $28.1m (24H1: $29.1m). “Revenue and profit before tax for 2025 expected to be in line with expectations.” | ||

Kavango Resources (LON:KAV) (£31.3m) | 227.8m shares issued at 1p to raise £2.2m gross. | ||

Artisanal Spirits (LON:ART) (£30.8m) | H1 Revenue -4% to £9.7m, LBT £3.6m (24H1: £3.1m), Net debt £29.5m (24H1: £27.0m). “Trading in H2-25 to date has been in line with expectations.” | ||

Prospex Energy (LON:PXEN) (£20.2m) | LBT £180k, NAV +3.8% to £25.5m. | ||

450 (LON:450) (£14.1m) | Net loss £711,241. Cash of £3.1m at 30 June 2025. Continue to assess investment opportunities. | ||

Finseta (LON:FIN) (£13m) | H1 Revenue +16% to £5.9m, Adj. EBITDA -62% to £0.3m, Net cash £0.4m (31 Dec £0.6m). | ||

Arcontech (LON:ARC) (£12m) | Revenue +7% to £3.1m, PBT -10% to £987k, Net cash +3% to £7.4m. Final Dividend 4.0p. “Our growing sales and support teams are helping to drive growth with customers and is bringing good new prospects.” |

Roland's Section

Anpario (LON:ANP)

Up 15% to 485p (£98m) - Roland - Interim Results - GREEN

(At the time of publication, Roland has a long position in ANP.)

Today’s results from this manufacturer of sustainable animal feed additives read well and have triggered earnings upgrades from house broker Shore Capital. Anpario is a SIF Folio stock, so it’s a company I’ve started to follow with more interest over the last year.

H1 results highlights

Anpario says it saw a “strong sales performance” in the Americas, Asia and Europe segments in H1. Chairman Matthew Robinson highlights “an encouraging turnaround in the United States” and a positive contribution from last year’s acquisition of Bio-Vet.

Although growth levelled off in the India, Middle East and Africa (IMEA) segment, overall sales and profits rose sharply during the six months to 30 June:

Revenue +34% to £22.7m

Gross profit +45% to £11.7m

Pre-tax profit +62% to £3.4m

Adj EPS +43% to 16.01p

Interim dividend +11% to 3.6p per share

Net cash £11.1m (Dec 24: £10.5m)

One thing I like to check when a company has made a recent acquisition is the mix of organic and inorganic growth. Bio-Vet was acquired for $7.3m and generated revenue of $8.2m in 2023, so might be viewed as a mid-sized deal for a company of Anpario’s size.

Today’s commentary reveals that Bio-Vet contributed £3m of revenue in H1, meaning that organic revenue growth for the half year was 16% – still a very respectable performance.

Reassuringly, all of the group’s core product groups delivered sales growth during the period:

Four of our key product groups (excluding Bio-Vet), which account for over 90% of sales, delivered sales growth. Acid-based eubiotics, mycotoxin binders, omega and phytogenic products grew sales by 6%, 9%, 49% and 41% respectively, helped by the launch of Orego-Stim®

Bio-Vet mainly supplies the US dairy market, so its contribution has been mainly felt in the Americas reporting segment, where total sales rose by 97% including Bio-Vet, or 21% on a like-for-like basis.

The company also reports a strong recovery in pHorce in the US, with sales up by 138% “as customers experience the dual benefits of feed mitigation and improved animal performance from better gut health”.

Anpario’s new Orego-Stim products (based on oregano oil) also continued to make progress in the US calf and poultry markets.

Elsewhere in the Americas, Brazil was a key area of weakness, with sales down 33%. My understanding is that this is due to the impact of tariffs.

Asia is another key market for the group, with higher margins than the Americas. Sales in the region rose by 25%, with LFL growth “in all sub-segments”.

In Europe, the group’s other large market, sales rose by 17%, with weighted average selling prices up 14%. Both measures included a mix of price rises, higher value products and a small contribution from Bio-Vet.

Profitability & Balance Sheet

The accounts reveal a significant improvement in profitability for the business, despite an increase in operating costs.

Gross margin for the half year rose by 3.9% to 51.4% as selling prices improved and the product mix improved, with a greater proportion of higher margin sales. Pleasingly, Bio-Vet appears to have improved margins – LFL gross margin was 49.8%, excluding Bio-Vet.

Moving down the P&L, administrative costs rose by 37% to £8.4m. This was partly due to the addition of Bio-Vet costs, but even excluding these like-for-like costs rose by 9% to £6.7m, primarily reflecting higher UK employment costs.

Even so, revenue growth was sufficient to improve operating margins from 11.4% to 14.5%. This supports a respectable trailing 12-month return on capital employed (ROCE) of 15%, by my calculations.

Underlying cash generation also remained healthy despite some working capital outflows on inventories. Anpario’s net cash balance edged up to £11.1m, from £10.5m at the end of 2024.

Outlook & Estimates

Today’s outlook statement actually seems quite conservative to me when it’s compared to updated forecasts from house broker Shore Capital.

Here’s what the CEO Richard Edwards had to say about the outlook:

The second half has started well continuing the momentum from the first and we are confident of building on this platform for the remainder of this year and into the next.

… and here’s how this is reflected in Shore Capital’s latest forecasts:

FY25E: revenue +1.8% to £45.5m, EPS +7.4% to 32.0p

FY26E: revenue +4.2% to £49.0m, EPS +8.8% to 34.3p

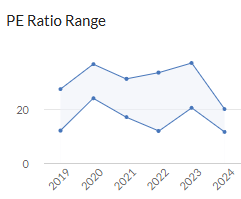

On these numbers, Anpario trades on a FY25E P/E of 15 after this morning’s gains, falling to a P/E of 14 in FY26. That’s well within the company’s historic valuation range and doesn’t seem too expensive to me:

Roland’s view

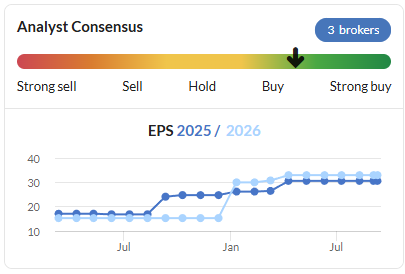

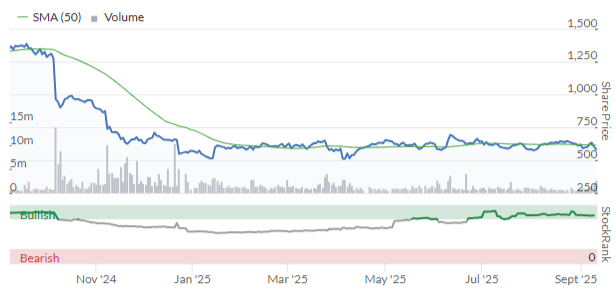

Shore notes that this is the broker’s third upgrade to forecasts since January. This is reflected in the StockReport’s trend chart and is a useful reminder of Ed’s research into “The Drift… “

My impression is that Anpario seems to be trading and executing well, despite some regional headwinds that are likely unavoidable in this type of business.

I’m encouraged by improving profitability of the whole business and by early signs that Bio-Vet may be improving the quality of the overall business and enhancing growth rates.

Natural feed additives seem likely to remain a growth area given growing concerns over antibiotic resistance and other toxic feed chemicals (apparently pHorce is sold as a safe alternative to formaldehyde, which is “widely used”in the US!)

Graham was GREEN on Anpario in January, following which I took a slightly more cautious AMBER/GREEN view in June, when forecasts were held.

I expect Anpario's StockRank to improve when today's results and broker upgrade are digested. Given the more positive tone of today’s report, I’m going to switch my view back to GREEN.

Vistry (LON:VTY)

Down 4% to 581p (£1.88bn) - Roland - Half year Results - AMBER

I’ve been neutral on most housebuilders recently and particularly cautious about Vistry, which is still recovering from some financial issues in one of its larger trading divisions and reported somewhat lacklustre trading last year. When I reviewed the 2024 results in March I took the view that “there’s still some risk of a further downgrade in 2025”.

Today’s results have left expectations for the full year unchanged. However, the numbers suggest to me that a heavy H2 weighting will be required after a weak first half. Let’s take a look.

Half-year results summary

Vistry differentiates itself from the other big housebuilders with its partnership model, where it aims to build the majority of its housing for partners such as housing associations and build-to-rent operators. In theory this should be a capital-light, volume business.

In practice, one flaw in the model has been the exposure to government policy and funding decisions. Demand from new partner-funded schemes was lower in H1 due to “uncertainty ahead of the June Spending Review” and “transitional funding constraints”.

Today’s H1 results are described as “in line with expectations”, but show a sharp fall in completions and earnings:

Completions down 12% to 6,889 units

Revenue down 6% to £1,853.2m

Pre-tax profit -33% to £80.6m

Adjusted earnings -30% to 17.6p per share

Return on capital employed: 9.6% (H1 24: 12.8%)

Net debt: £293.1m (FY 24: £180.7m)

Average selling prices also fell by 4% to £283k, which the company says reflects a change of property mix (rather than price cutting).

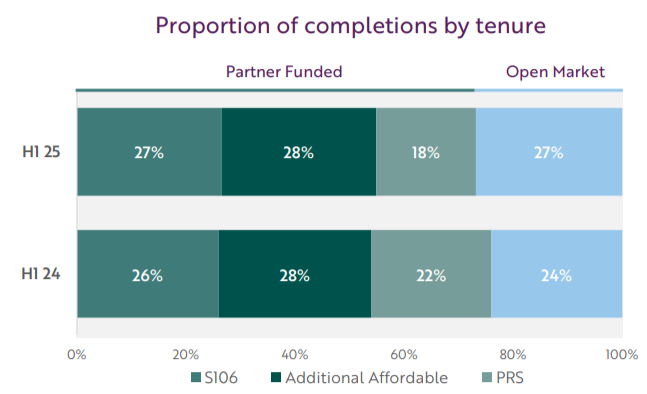

The fall in completions was driven by an “expected” reduction in partner volumes, which fell by 14% in H1. In contrast, open market sales outperformed with a reduction of 4%:

Although open market sales did help to support volumes, CEO Greg Fitzgerald says this sector of the market softened during the second quarter as interest rate cuts were pushed back and affordability remained challenging.

However, I think it’s worth contrasting the fall in open market sales here with growth reported by other mass-market housebuilders including Persimmon and Taylor Wimpey. In my view, Vistry still seems to be underperforming, perhaps as a legacy of last year’s problems in its southern division.

Financial review

Today’s balance sheet shows tangible net assets of £2,898.8m, or around 640p per share. With the stock trading at 582p as I type, there’s a near-10% discount here, but for an asset play, I think there are probably more attractive balance sheets elsewhere in this sector.

One concern for me is the company’s relatively high level of debt, compared to most peers. Net debt rose by £112.4m to £293.1m during the first half of the year. While £97m of this reflected working capital movements, it’s also worth noting that £33m of cash was used for buybacks in H1.

While I think the current level of debt is supportable, I don’t see any justification for buybacks in the current circumstances.

Net finance costs rose by 7% to £43.8m in H1 and Vistry is paying an average interest rate of 6.3% on its borrowings. I think it would be more prudent to deleverage, given that the company’s H1 (adjusted) return on capital employed was only slightly higher than the interest rate on its borrowings.

However, the most pressing issue for me is that today’s results imply a 30/70 H2 weighting to earnings. In fairness, Vistry’s results are generally H2 weighted, but Stockopedia’s data suggests to me the split is normally closer to 40/60.

Outlook

Today’s outlook commentary leaves full-year guidance unchanged and suggests that the company has reasonable visibility on sales for the remainder of the year, despite a reduced order book:

Forward order book £4.3bn (05/09/24: £5.1bn)

88% forward sold for FY25

Within this, Partner Funded sales are said to be 89% forward sold for 2025, with >100% of the remaining partner sales targeted this year being “in our deal pipeline”.

The Group has been working closely with its affordable housing partners to identify development opportunities and has built a strong pipeline of transactions that are expected to complete in the second half, with positive momentum going into 2026

With just over three months of the year left, this suggests to me that there’s still some uncertainty over whether full-year sales will hit target levels. I don’t think it’s impossible at this stage, but I am going to stand by my previous comment that there’s still some risk of another downgrade in 2025.

However, I do think today’s results suggest that a significant improvement in trading could be possible in 2026.

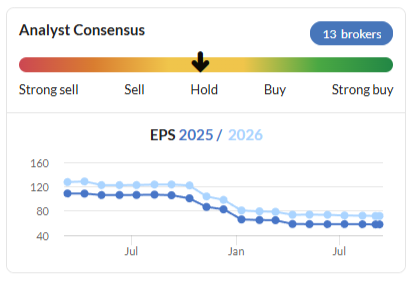

Broker estimates have drifted lower over the last year, but seem to have stabilised in recent months:

I don’t have access to broker notes today, but consensus forecasts on Stockpedia leave Vistry shares on a P/E of 10, falling to a P/E of 8 in 2026.

£39bn of new government money?

If Vistry can deliver the hoped-for recovery in partnership volumes, then I can see the shares could offer decent value at current levels.

A good amount of space in today’s results is spent talking up the potential of the government’s new Social and Affordable Homes Programme (SAHP). This is expected to allocate £39bn to new homes over the next decade.

Vistry is uniquely positioned to play a key role in the delivery of this new SAHP and is ready to do so.

There’s also some potential for a policy known as “rent convergence” to be reinstated. Broadly speaking, my understanding is that would accelerate the increase in social and affordable rents on existing lettings in order to bring them up to the so-called formula rent – the rent on a new letting.

A positive outcome (for housing providers) would potentially support greater investment of capital in the partnership sector.

I think it’s too soon to know what the impact of SAHP and possible rent convergence might be, but the company’s slide pack today includes some modelling of possible outcomes that might be of interest to shareholders.

Roland’s view

CEO Greg Fitzgerald is highly experienced and my guess is that he will complete a successful turnaround here. However, my impression is that external market conditions still remain mixed, if not outright challenging.

I’m also a little discouraged by Vistry’s decision to focus on buybacks rather than deleveraging. A strong balance sheet is never wasted and while I don’t think the company is in distress, there are still a number of calls on its cash flow that could lead to further pressure if volumes disappoint next year.

Vistry still has a £313.8m provision for Building Safety Remediation work and recorded a net cash outflow of £18.3m on this work in H1.

The company’s land creditor payment profile (payments due on contracted land purchases) is also heavily skewed to the next two years, with £357m of payments due in the next 12 months alone.

With the shares now trading below tangible net asset value, I think a margin of safety is emerging here. However, I continue to have concerns about the near-term outlook so am going to maintain my previous neutral view today. AMBER

Mark's Section

Warpaint London (LON:W7L)

Down 19% to 220p - Interim Results - Mark - AMBER

I previewed these results in The Week Ahead expecting them to be amongst the most followed amongst subscribers. This was my summary:

So, there seems to be a lot riding on the upcoming results. The H1 revenue figure is already known; the unknown is whether they will reiterate FY guidance for both revenue and profits based on the continued expectation of an unusually strong H2. If they guide in line again and provide strong H2 trading figures so far to back that up, then we can expect a relief rally. However, if there is a profits warning, or the recent sales figures are unconvincing, then we can expect a significant sell-off. Warpaint remains an investor favourite, and any disappointment will not be taken lightly. My own guess is that they will miss revenue but make the EPS target based on higher margins. I'm not sure I'm brave enough to take a position ahead of these results, though.

My cowardice looks to be rewarded today, as these results are worse than expected. Firstly there appears to be a miss against their AGM trading statement in June which said revenue was to “to be in the range of £50 million to £52 million” and today came in at £49.3m. Although a revenue miss for a company that is used to exceeding expectations should be a worry, it isn’t the only issue here. Doing £70m+ revenue in H2 always looked a stretch in the current consumer environment, and so it has proved:

…the board now expects the Company to achieve revenues of between £107 million and £112 million, and adjusted EBITDA of between £23.5 million and £25.5 million.

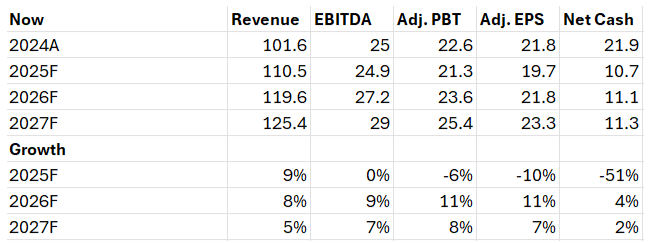

The company doesn’t mention any previous expectations, but their broker, Shore, help quantity the effect of this:

So it seems I was wrong to expect them to make up the short fall in revenue with reduced margins. The operational gearing that meant that EPS grows faster than sales, now works in reverse on the reduction in sales forecasts.

Three reasons are given for the profits warning:

An increasingly weak UK consumer environment.

The administration of a long-term customer, Bodycare.

Uncertain US market due to tariffs.

These may well all be factors in the reduction of full-year expectations. However, I think only really Point 1. explains the weak H1. The administration of Bodycare only happened this month. And US sales were flat at £2.4m, meaning that changes here cannot have a big impact on these results. The UK pattern is muddied by the acquisition of Brand Architekts during the period, but they break out the LFL sales, -19%:

In the first half, sales in the UK were up 15.9% to £18.0 million (H1 2024: £15.5 million) and accounted for 36.5% of Group sales (H1 2024: 33.9%), assisted by the contribution from Brand Architekts. On a like-for-like basis sales were £12.5 million, a decrease of £3 million or 19%. The reduction in white label cosmetics in the first half of 2025 accounted for £0.8 million of the decrease, with the balance partially due to a change in buying patterns from some UK customers to reduce stock holding levels, because of falling consumer confidence.

Gross margin has improved from 42.5% to 45%, as expected. However, the key point for me is that their broker Shore, have made even more severe cuts to both sales and EBITDA the further we go out through the forecast window. Far from being one-off factors, this is instead a reset to expectations that are significantly lower for the foreseeable future. Whereas the market may have shrugged off a single weak year, a large multi-year warning such as this tends to be bad news all round.

The lipstick effect

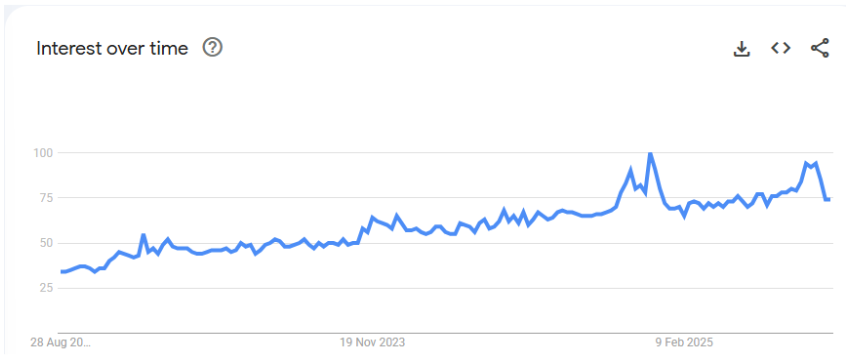

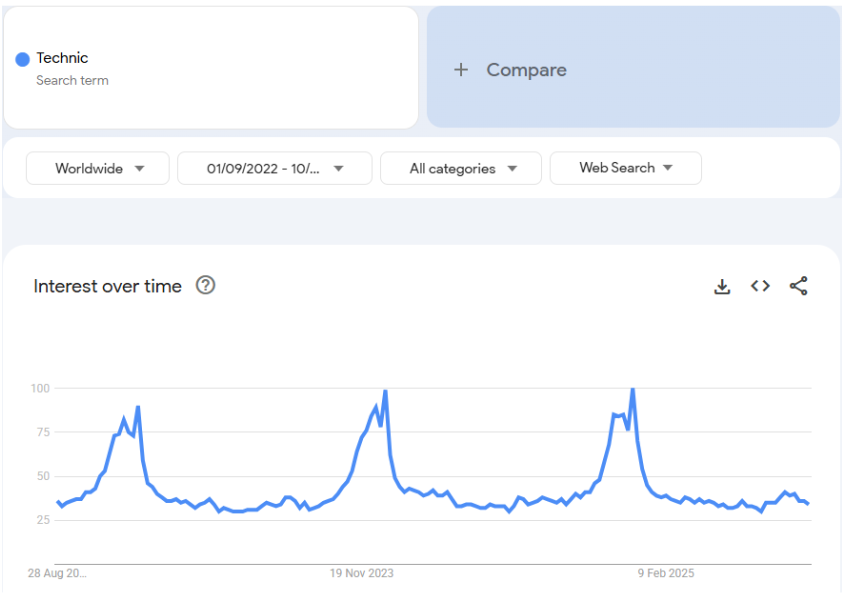

While this is undoubtedly a tough UK retail environment, there is a risk that these weak results represent something more severe - increased competition. Warpaint has been highly successful with its fast-to-market copies of successful make-up products. While they are careful not to infringe trademarks or design rights, their production of so-called “dupes” has been a major part of their success in the last few years, capitalising on a worldwide trend for more of these products. This can be seen by the continued increase of the word “dupe” as a worldwide google search term:

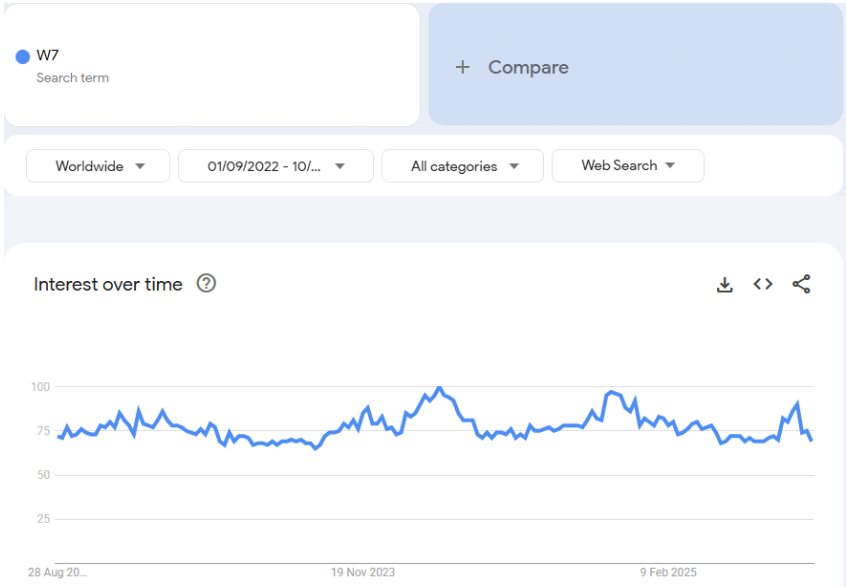

However, we haven’t seen a similar rise in searches for Warpaint’s key brands of W7 and Technic:

It’s possible that W7 is mixed in with searches not related to makeup, as it doesn’t show the same clear seasonality at Technic.

This suggests that consumers tend to search, at least initially, for dupes, rather than Warpaint’s brands directly. Other companies must have noticed the success of this strategy creating “dupes”, and I don’t think we can rule out the impact of competition, at least at the margin.

There is a theory called “The Lipstick Effect” first proposed by Estee Lauder chairman Leonard Lauder, that suggests that unlike other consumer products, cosmetic sales don’t tend to drop in a recession. This is backed up by data from the Great Depression and the GFC. The reason often proposed for this effect is that consumers still want to treat themselves to an affordable luxury, even if money is too tight for larger aspirational purchases. More recently, there has been a suggestion that consumer behaviour does change for cosmetics. While overall sales hold-up there is a shift towards more value ranges. The problem is that both of these trends should favour Warpaint sales. That they haven’t this year, represents a potential risk.

The signs were there

While I can’t claim any great foresight, having thought that they would moderate sales but not EBITDA forecasts today. I do think there were a few signs that would have warned shareholders of pain to come. The first warning was in December last year when they acquired Brand Architekts, and issued equity to do so. This is what I said on the DSMR at the time:

It does raise questions as to why they needed a placing at all. They are paying £13.9m for Brand Architekts, but will be getting £7m of cash which is on their balance sheet, minus any losses since 30th June. Some Brand Architekts shareholders will probably opt for Warpaint equity, and the company had £5.5m in cash at the last balance sheet date and no bank debt. This may reflect a high level of caution by management and the fact that this takeover comes at the point of peak working capital for the business. However, surely no bank would worry about lending a £400m market cap company £5-10m for an acquisition. The alternative view is that management view their equity as fully priced at current levels.

The second warning was that Shore reduced their revenue forecasts in June, in response to the AGM statement. While they kept their EBITDA forecasts the same at the time, this highlighted that meeting market profitability expectations was going to be a stretch.

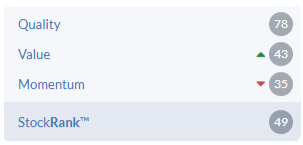

Finally, at Stockopedia we have often commented how investors in High Flyers, as Warpaint was earlier in the year, would be better off exiting as soon as the Momentum Rank started heading South. In this case, none of the current ranks look particularly supportive of the price, and I expect all three of these to drop further when the algorithms have processed today’s interims and reduction in forecasts.

Valuation

How to react to news like this can be tricky. Some investors will always sell on a profits warning such as this. The research at Stockopedia and elsewhere suggests that this is usually the best strategy and the share price of the typical warner will be lower in a year’s time. However, in this case the price was weak in the run up to these results so bad news was presumably expected. Perhaps not the c.30% cut to EPS for all forward years, and a halving of net cash, though. Still, it is possible that selling may crystalise an unnecessary loss.

For some investors, a big drop is an opportunity to average down, especially if the long-term prospects haven’t declined by as much as the price. However, this is fraught with danger as well. Investors often anchor on the high price they previously bought at and forget that the prospects may have declined significantly as well as the share price. To solve this conundrum we need to look at the current valuation, independent of any past results. Here are the updated forecasts from Shore, together with the growth rates I’ve calculated:

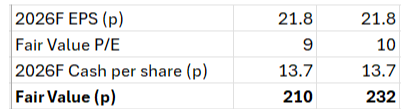

So it seems that going forward we are likely to see mid to high single digit growth rates in revenue and profits over the medium term. Typically, this sort of performance justifies a P/E of around 9-10x. If we look forward and use 2026 forecasts this gives a fair value between 210-232p adjusting for net cash (technically this slightly double counts cash as the net interest will be in the EPS as well, but the effect is minor for these cash levels.)

Coincidentally, this range is slightly above the current market price, but not by so much we could argue it is significantly under- or over-valued. On other metrics, we are now getting a forecast yield of around 5% that may attract some investors. Balancing this it remains at a significant premium to book value.

Some investors will see these forecasts as a management team with a strong track record of kitchen sinking things, and look for the company to return to beating expectations. However, profits warnings often tend to cluster together, and there is a very real risk that this weakness is not just consumer conditions but a shift in the competitive landscape.

Mark’s view

These results are a bit of a shocker. I had expected some moderation in expectations, but the scale of the reductions in EPS and net cash throughout the forecast window shows this to be a major profits warning. As such it is tempting to make a major downgrade to our view, which was previously AMBER/GREEN. Stock Rank investors will certainly want to avoid this company as the already weak ranks look to set to take a further lurch downwards once the algorithms have digested all the data.

However, following the c.20% fall in share price today and a weak year, the shares are probably now close to fair value on current earnings forecasts. As a value investor, I’ll go for AMBER as the shares look to be trading around fair value today, with the caveat that I have been consistently too optimistic on the outcomes here, and may yet still be wearing rose-tinted glasses.

Frontier Developments (LON:FDEV)

Up 4% to 389p - FY25 Financial Results - Mark - AMBER/GREEN

The results summary shows a big recovery in profitability:

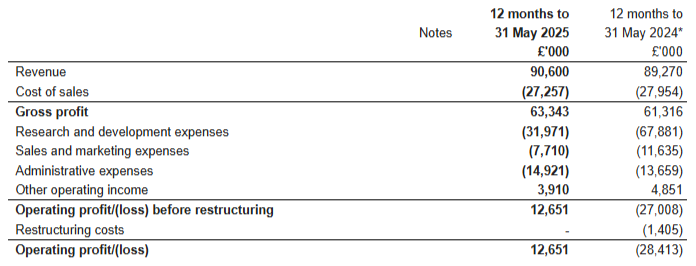

However, this has occurred on essentially flat revenue. Gross margin is fairly consistent, benefiting slightly from lower royalty costs:

Gross profit increased to £63.3 million in FY25, up from £61.3 million in FY24. This growth was driven by both higher revenue and an improved gross margin of 70%, compared to 69% in the prior year. The margin improvement reflects a greater share of revenue from own-IP games, which do not incur IP royalty costs.

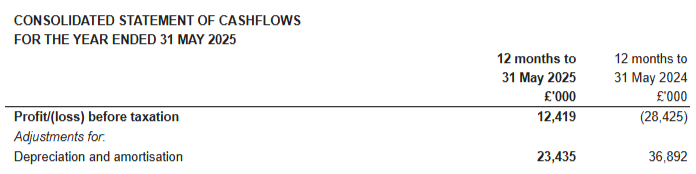

Which means all of the improvement comes from reduced costs. Here is their explanation:

Total operating expenditure under IFRS, which includes research and development, sales and marketing and administrative expenses and restructuring costs, declined by 42% to £54.6 million from £94.6 million in FY24. Approximately three-quarters of this reduction related to non-cash development cost accounting under IAS 38. The most significant factor was a £28.2 million reduction in amortisation and impairment charges for intangible assets related to game developments and technology. These charges fell to £19.7 million in FY25, compared to £47.9 million in the prior period, with costs in FY24 including a £16.9 million impairment charge for an underperforming title.

This is a big reduction in these costs. It seems that they are both capitalising more expenses:

Capitalised development costs under IAS 38 increased to £28.3 million in FY25, representing 72% of cash expenditure, compared to £26.5 million, or 58% of cash expenditure, in FY24. The increase in the percentage of cash expenditure capitalised reflects the strategic refocus on CMS games and the corresponding reallocation of employees to capitalisable projects.

And, looking at the cash flow statement, amortising less:

Overall, expensed R&D (representing the expensed software development and amortisation) has been slashed:

Plus, marketing costs have been cut. However, none of these quite significant changes seem to have warranted commentary from the management, bar the briefest of mentions about headcount reduction due to the closure of one of their labels:

Adjusted operating expenditure in FY25, as recorded under the new Adjusted Operating Profit performance measure, declined 13% year on year to £54.0 million (FY24: £62.0 million), following cost-saving measures implemented in FY24, including headcount reductions and the closure of the Frontier Foundry publishing label.

Their broker, Panmure Liberum, say that Adjusted Operating Profit is some 20% ahead of their expectations, but adjusted PAT is 6% below due to tax effects. They also adjust their future year forecasts for tax changes.

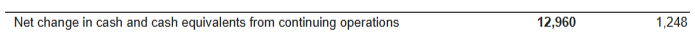

With all this going on, it seems almost impossible to judge if the FY25 reported figures are representative of underlying or future performance. Turning to the cash flow statement to try to solve this, things do look like they have genuinely improved:

Although, some of this positive cash flow is presumably a one(or two given they sold rights last year, too)-off:

With £42m cash the EV here is around £100m and this is an EV/FCF of 11, which seems good value. However, Panmure Liberum see cash outflow in FY26, before turning positive again in future years. FY26 EPS (FWIW) is also due to drop.

This means that many of the positive aspects that are reflected in the Stock Rank may well not look so good once FY26 figures are released:

With this sort of company, much of the value is in the pipeline of games they develop and future sales performance. Such a detailed analysis of the pipeline would require a sector specialist. On top of this, and while a portfolio of titles helps balance things out, such companies often end up at the mercy of the reviews and sales performance of a few blockbusters. This adds to the uncertainty of outcomes here. Panmure Liberum calculate that there is still some upside in valuation:

With FY25 results, we roll our DCF and lift our target price to 470p, representing c13x FY27E EV/EBIT.

However, with FY26 looking weak, a lot is relying on the pipeline and future year performance. This also makes this type of valuation very sensitive to the discount rate chosen. The company clearly believes that they are still on a medium-term up-cycle as they are buying back shares with that excess cash.

Mark’s view

This remains a Super Stock and with good figures for FY25 just reported I think it makes sense to be broadly positive. Especially as the cash balance means that they are protected against the cyclicality of their industry. However, with FY26 forecasts looking weak and so much of the value in the highly uncertain future years, I think now may be the time to express a bit of caution as well. It’s an AMBER/GREEN for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.