Good morning!

Today is an interest rate decision day, with the Federal Reserve expected to keep rates unchanged at 3.75%.

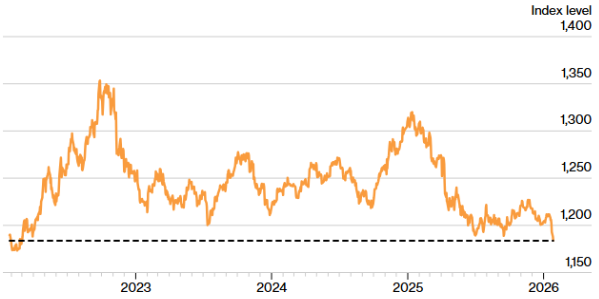

The path downwards for US interest rates has been a gradual one, but that hasn’t stopped the dollar from hitting its lowest level since March 2022. Here’s the Bloomberg Dollar Spot Index:

The weak dollar and the soaring gold price are easily rationalised in the context of President Trump’s approach to the Fed, and the criminal investigation against Fed Chair Jerome Powell.

After all, Jerome “Jay” Powell’s term ends in May. It’s tempting to think that his successor will lower rates at a much faster pace, with President Trump remaining in office (and presumably demanding lower rates) until 20th January 2029.

That’s not what the markets and professional forecasters are expecting, however: according to a CNBC survey, there will only be two more 0.25% cuts this year, and none are expected yet for 2027.

So the real reasons for the decline of the dollar are perhaps more mundane: runaway fiscal policy, protectionism, and international tensions.

Either way, today’s Fed announcements and press conference may be slightly more interesting than usual, with Powell and the Fed keeping rates unchanged despite the wishes of the US President. The decision will be out at 7pm, and the news conference at 7.30pm.

15.15: Today's report is now complete - thank you for reading, we'll be back in the morning.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Fresnillo (LON:FRES) (£30.5bn | SR81) | 2025: Gold production exceeded the upper end of full-year guidance and silver production delivered in line with guidance. 2026: production outlook reduced. Silver 45 to 51 moz reduced to 42 to 46.5 moz. Gold 515 to 565 koz reduced to 500 to 550 koz. | ||

Ashtead (LON:AHT) (£21bn | SR68) | Sunbelt Rentals has filed a registration statement with the SEC. A further step towards the establishment of a US primary listing for Sunbelt Rentals, to be listed on both the NYSE and the LSE from March 2026. | ||

British Land (LON:BLND) (£4.1bn | SR55) | For each Life Science Reit (LON:LABS) Share: 14.1 pence in cash and 0.07 New British Land Shares; valued at 42.8p per share on 27 Jan 26. | PINK (Roland) [no section below] | |

Atalaya Mining Copper SA (LON:ATYM) (£1.51bn | SR87) | 12.7 million new shares at £10 placing price, raising £127m. Retail Offer raises £2.7m. | ||

Oakley Capital Investments (LON:OCI) (£913m | SR68) | NAV return per share +6%, NAV 738p / £1,233 million. £50m buyback completed. | ||

Pets at Home (LON:PETS) (£904m | SR85) | Group consumer revenue +0.8%, total group revenue down 1%. FY26 underlying PBT to be in line with current consensus (£90 - 97m range, consensus £93m), all other guidance unchanged. | AMBER/GREEN ↑ (Roland) [no section below] I took a neutral view on PETS just before Christmas, when the company announced the appointment of a new CEO with extensive retail experience. Today’s update leaves FY expectations unchanged, but the company also highlights price cuts to 1,000 products and says only that Q3 results fell “within the range of our expectations”. It’s not hard to see that margins may remain under pressure. Q3 divisional numbers show a 1.1% fall in retail revenue, but this is an improvement on the 2.3% decline reported for H1. However, flat retail transactions in Q3 tells me that the average value of these transactions probably continued to fall, offsetting an increase in the average value of vet transactions. A new CEO and CFO are due to start in the spring, raising the risk of a kitchen sink event to reset expectations. Even so, I am going to tentatively upgrade our view on this business today. Pets has a >20% share of the UK pet care market and is currently trading below book value, with a covered 6% dividend yield. While the situation isn’t without risk, I share the StockRanks’ view of this as a Contrarian investment that could potentially reward further research. | |

PPHE Hotel (LON:PPH) (£779m | SR45) | 2025 total revenue and EBITDA are expected to be in line with market expectations (revenue range of £458.4 million to £469.0 million and a Reported EBITDA range of £133.2 million to £137.8 million). Strategic review ongoing. | ||

Metals Exploration (LON:MTL) (£515m | SR89) | FY2025 gold production (65,287 ounces) is low against revised guidance. AISC of US$1,368 /oz was above the upper forecast range of US$1,275 /oz due to the lower ounces sold. FY2026 gold production from Runruno forecast: 50,000 - 60,000 ounces. FY2026 AISC forecast for Runruno gold production: US$1,400 - US$1,650 /oz. | BLACK? | |

Cerillion (LON:CER) (£515m | SR48) | CFO has decided “to pursue new opportunities to build on his successful tenure at Cerillion and further develop his career.” His successor will take up the role by 1st May 2026. | ||

| Marstons (LON:MARS) (£437m | SR98) | Trading update for the 17 weeks to 24 January 2026 | Confident in delivering FY26 expectations, strong performance over festive period, with LFL sales +4%. | AMBER ↓ (Roland) Marston’s LFL sales performance appears to have been weaker than most rival listed pub chains over the festive period, while LFL growth for the whole 17-week period may have been flat. While full-year profit guidance is unchanged today, I can’t help feeling trading over the last 17 weeks may have been slightly weaker than expected. Although I think this remains an interesting turnaround situation, I’m cutting our view to neutral today out of caution and in recognition of the difficult trading conditions being faced in this sector. |

Auction Technology (LON:ATG) (£386m | SR25) | “FitzWalter has not been granted access to due diligence and confirms that, as a result, the financial terms of the Possible Offer will not be improved or increased and are final.” 400p possible offer. | PINK | |

| Next 15 (LON:NFG) (£361m | SR92) | Trading Statement | FY January 2026 to be in-line with market expectations (net revenue of £450m and adjusted operating profit of £66.6m). FY27: confident in like-for-like revenue growth and further improvement in operating profit and margin, before the impact of growth investment of £4m - 6m, partially offset by cost efficiencies. | |

Ecora Royalties (LON:ECOR) (£358m | SR60) | Total portfolio contribution of $57.0m (2024: $63.2m) reflected an increased contribution from critical minerals which comprised 63% of the total, offset by a weaker year-on-year steelmaking coal price environment.Closing net debt of $85.5m, “well positioned to continue to deleverage and also fund further growth…” | ||

Boohoo (LON:DEBS) (£333m | SR30) | FY Feb 2026 is above expectations, full year Adjusted EBITDA for total operations now expected to be £50m (previous guidance: £45m). | AMBER/RED ↑ (Graham) [no section below] I must upgrade our stance on this one, given the positive trading update. We can't stay RED permanently on businesses that are beating expectations, but I am still instinctively cautious (of course you can feel free to ignore my stance on this - I was RED on this at much lower levels). However, an additional £5m of adjusted EBITDA still doesn’t give me all that much confidence in the situation here. For context, H1 adjusted EBITDA of £20m produced adjusted EBIT of only £2m. Existing forecasts suggest that the business will still be in the red in the financial year that’s about to start (FY February 2027) and then hopefully make a profit in the year after that. Net debt to EBITDA will reduce thanks to today’s upgrade but there is still plenty of work to be done in terms of deleveraging. Financial net debt was £111m at the interims. | |

PayPoint (LON:PAY) (£313m | SR46) | Group Q3 net revenue -0.5%. On track to meet FY26 expectations. Net debt £131m. | AMBER/GREEN ↑ (Graham) Breaking our rule to stay cautious on stocks that recently issued profit warnings (this stock warned in November). I also acknowledge that the financial risk levels at PayPoint are a little higher than usual. But robust trading in recent months, and a cheap earnings multiple, keep me interested. | |

Newriver Reit (LON:NRR) (£300m | SR50) | Q3: 234,500 sq ft of new lettings and renewals, securing £2.1 million in annualised income. Long-term transactions completed in-line with ERV, +56.9% vs. prior rent. | ||

Mears (LON:MER) (£290m | SR91) | Birmingham City Council contract, estimated value £450m over initial period of 10 years. | ||

Franchise Brands (LON:FRAN) (£257m | SR61) | Adjusted EBITDA for the full year expected to be in line with market expectations (£33.8 - 35.3m). 2025 system sales +2%. Intends £10m share buyback. “We anticipate continued resilient demand for our essential reactive and planned services, but retain a more cautious view on the timing of the recovery in project and other discretionary work.” | AMBER ↑ (Graham) [no section below] I said in November that I’d be willing to revert to a neutral stance if customer demand, along with FRAN’s earnings forecasts, showed signs of strengthening again. While system sales are still not growing very strongly (2% growth in 2025), joint broker Dowgate Capital have at least left 2026 forecasts unchanged today (they “trimmed” forecasts back in November). EPS is seen rising from 8.9p (2025) to 9.9p (2026), putting the shares on a moderate P/E multiple just below 14x. This is not a bad business in my view and so retaining our moderately negative stance would now perhaps be overly harsh. Their economic commentary remains cautious, but the demand for the services they provide doesn’t seem particularly volatile (hydraulic hose replacement, kitchen fryer management, plumbing, etc.). | |

Gulf Marine Services (LON:GMS) (£256m | SR84) | Variation order from a major National Oil Company in the Middle East for extension to an existing contract for two of its vessels, to provide for up to an additional six years of contract duration across the two vessels, including optional periods. | ||

Card Factory (LON:CARD) (£241m | SR57) | On track to deliver profits in line with revised guidance announced on 12 December 2025. Adjusted PBT £55-60m. November and December trading: LfL store revenue down 1.2%, total group revenue +4.3%. | AMBER = (Graham) | |

Hargreaves Services (LON:HSP) (£222m | SR86) | Revenue +46% to £183m, driven by growth in Services on infrastructure projects. Pre-tax profit up 170% to £14.3m. CEO succession planning. Outlook: expect PBT and EBITDA to be 4% ahead of exps due to stronger Services revenue. | AMBER/GREEN = (Roland) I’m a long-term fan of this business and its departing CEO. Today’s results don’t change that view with evidence of continued growth in the Services business and further value realisations in the Land business. However, the stock is trading at c.1.2x book value and most of the group’s operations are inherently low margin and capital intensive. For me to be fully positive here I’d want to be buying below book value. As things stand, I am comfortable leaving my broadly positive view unchanged today. | |

Aew UK Reit (LON:AEWU) (£169m | SR63) | Total NAV return for quarter to 31 Dec 2.05%, NAVps 109.39p (Sept 25: 109.09p). Portfolio valuation -0.33%, quarterly dividend held at 2p. | ||

FDM (Holdings) (LON:FDM) (£159m | SR87) | 2025 was challenging. Results are expected to be “within the range of market expectations” (adj PBT £13.5m to £14.1m). Uptick in activity levels seen late last year “shows signs of continuing”. | ||

Pulsar Helium (LON:PLSR) (£156m | SR28) | Drilling of Jetstream 5 completed, encountering “multiple pressurized gas influxes”. However, difficulties were encountered removing drill string from well and 1,239ft of drill string remains, preventing a full appraisal. Mgt are considering options and hope to return to well in April this year. | ||

Mobico (LON:MCG) (£129m | SR9) | Confirms press reports that it is in the “advanced stages” of agreeing revised contract terms with five German rail authorities. | ||

Personal group (LON:PGH) (£108m | SR79) | FY25 revenue +11% to c.£48.4m, adj EBITDA +21% to c.£12.1m, ahead of expectations (prev. £11.6m). Continued growth in recurring revenues, net cash £29m. | AMBER/GREEN = (Roland - I hold) There’s no change to my broadly positive view of this workplace insurance/benefits provider after today’s solid year-end update. The shares are up by c.80% over the last year, removing some of the obvious value that was previously on offer. However, growth targets through to 2030 are loosely in line with recent double-digit growth rates – if Personal Group can hit these targets then I think the shares could remain quite reasonably priced. On balance I am happy to remain broadly positive. | |

Skillcast (LON:SKL) (£68m | SR72) | Revenue to be +16% at c.£15.4m, with ARR +19% to £11.6m. EBITDA to be in line with exps of c.£1.5m. Net cash £12.7m. | ||

Colefax (LON:CFX) (£53m | SR95) | Revenue up 11.7% to £59m, pre-tax profit up 21.3% to £5.3m. Net cash £22m (ex-leases). FY26 profits to be ahead of current market forecasts. | ||

Strategic Minerals (LON:SML) (£50m | SR39) | Latest drill results confirm strong WO3, Sn and Cu mineralisation; mineralised continuity within the Redmoor SVS high-grade zones; & validity of historical results. | ||

Kooth (LON:KOO) (£45m | SR56) | 2025 revenue to be £63.3m, broadly in line with expectations (Stocko consensus £64.8m), reflecting FX and contract delay (since signed). Adj EBITDA to be ahead of exps (prev. consensus: £9.5m), cash at £21.5m. | ||

Arrow Exploration (LON:AXL) (£44m | SR43) | Well was completed in C9 formation and is now producing c.230bopd (115bopd net), with 78% water cut. | ||

Poolbeg Pharma (LON:POLB) (£28m | SR21) | Peer-reviewed paper published in Frontiers in Immunology, highlighted reduced inflammation and safety. | ||

Pebble Beach Systems (LON:PEB) (£23m | SR68) | Revenue and adj EBITDA to be slightly ahead of expectations at c.£12.2m and £4.2m respectively (previously £11.5m and £4.0m). Confident outlook for 2026. | ||

Medpal AI (LON:MPAL) (£22m | SR6) | Approved as authorised purchaser of Eli Lilly products in UK, so will now be able to purchase and dispense products including Mounjaro (weight loss). | ||

CT Automotive (LON:CTA) (£21m | SR58) | CFO Salman Mohammed has resigned with immediate effect. He is not thanked. Board provisionally expects FY25 revenue to be in line with expectations ($126m), with net debt at $7.7m. | ||

Tortilla Mexican Grill (LON:MEX) (£20m | SR77) | FY25 revenue +8.5% to £73.8m, with LFL growth +6.2%. FY25 adj EBITDA to be in line with exps. Seven new franchise stores opened. FY26 outlook mixed but expect “good improvement over FY25”. | ||

Cordel (LON:CRDL) (£14m | SR32) | H1 revenue -24% to £1.7m, pre-tax loss increased to £(1.0)m. H1 cash burn £520k, net cash c.£1m. Cites “extended negotiation cycles” for new contracts, confident of meeting revenue plan for y/e June 26. | ||

Inspiration Healthcare (LON:IHC) (£12m | SR35) | US subsidiary Airon has entered into 3yr purchasing agreement with “a large US healthcare provider”. Airon will receive an initial order for 150 units of Model A and Neo ventilators, no value given. |

Graham's Section

PayPoint (LON:PAY)

Up 14% to 571p (£353m) - Trading update for the three months ended 31 December 2025 - Graham - AMBER/GREEN ↑

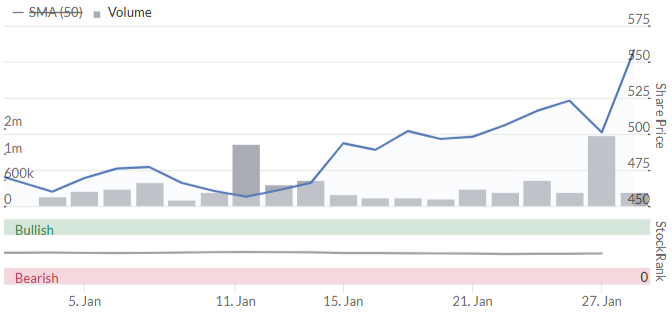

Keeping this on my annual watchlist was slightly controversial, but it is now up 24% year-to-date, helped by strong gains today:

This is after a very difficult 2025, in which it fell 40%.

That left it on weak earnings multiples as of last night:

The fact that today’s update is merely “in line”, and yet the share price is up by over 10%, to me says something about the low expectations that investors have had for the company.

Here are the Q3 (to December) numbers:

Group net revenue down 0.5% (£52.7m)

“Shopping” unchanged (£16.1m)

E-Commerce +2% (£4.2m)

Payments & Banking +2% (£14.3m)

Love2shop down 3% (£18.1m)

CEO comment:

PayPoint continues to be an entrepreneurial, agile business and the progress delivered in our Q3 FY26 results further demonstrates these attributes alongside the resilience of our core businesses, with a strong performance from our peak seasonal trading businesses… We remain on track to meet FY26 expectations and deliver progress in the current year.

The problems at Inpost in the Autumn (which weren’t PayPoint’s fault) have been solved:

We have successfully navigated the operational disruption experienced earlier in the year to deliver a record peak performance in our parcels business with positive transaction growth of 6.7%, Yodel/InPost volumes recovering and our Royal Mail partnership continuing to gather pace as we expand the Royal Mail Shop Branding and provision of postage services in our Collect+ network.

Even the banking division, which disappointed last year, appears to be doing fine:

….continued success in new business wins in our payment platform businesses, including MultiPay and obconnect, the accelerating pace in the rollout of BankLocal services for Lloyds Banking Group and FMCG brand campaigns into our retailer network.

Looking ahead, “the foundations and plans are in place to build on this performance in FY27”. The new financial year starts in only two months, after all, so FY26 will soon be old news.

Net debt is still considerable at £131m but I do think it’s affordable against forecast net income of £50m+.

Company policy is to pay out between half and two-thirds of earnings in the form of dividends (i.e. dividend cover 1.5x - 2x).

Buyback: £17m has been spent out of a £30m buyback programme.

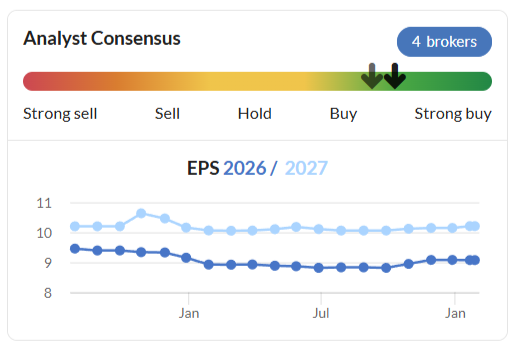

Estimates: Panmure Liberum have left estimates unchanged, including EPS of 73p (FY26), 80p (FY27) and 89p (FY28).

Intriguingly, however, they hedge their bets by pointing out that management are targeting 5-8% revenue growth, and that their own forecasts are based on the low end of that range. They show that with a few tweaks to assumptions, the FY28 EPS result could be anything from 104p to 114p.

Graham’s view

Firstly, I acknowledge that the degree of financial risk has picked up here. They are carrying considerable debts while also paying out most of their earnings in the form of dividends and buying back their shares.

So it’s a higher-risk, higher-reward type of situation, compared to before.

But (famous last words) I think the profitability of the business is strong enough to justify buying back their own shares here.

If they had to cut back on something, I’d much prefer to see them paying a smaller dividend, instead of refraining from buying back their shares at a P/E multiple of about 7x.

As for my stance today, normally I would be AMBER on a company that issued a profit warning as recently as November. Profit warnings tend to increase the risk of more profit warnings, so it's important to be cautious around them.

I will make an exception today, because:

The share price reaction alone says that the market was expecting a much more negative Q3 update than what the company has produced.

The broker note reads to me like a partial upgrade: officially the forecast hasn’t changed, but they lay out “bear”, “baseline” and “bull” cases where the actual result is 17% to 28% higher than the official forecast.

So I’m AMBER/GREEN on this today, while at the same time acknowledging that there was a recent profit warning and that financial risk levels are a little higher than usual for PayPoint. The rules are there to be broken, I guess!

Card Factory (LON:CARD)

Down 2% to 67.98p (£235m) - Trading Statement - Graham - AMBER =

Card Factory plc, the UK's leading specialist retailer of greeting cards, gifts and celebration essentials, announces a trading update for the eleven months ended 31 December 2025.

This issued a major profit warning in December, falling 23% that day.

Today’s update steadies the outlook, with no change over the past six weeks:

We are on track to deliver profits in line with our revised guidance announced on 12 December 2025.

New guidance, as disclosed in December, is for adj. PBT of £55 - 60m (it was previously expected to grow from the previous year’s £66m result).

Christmas trading: in line with revised expectations.

Total revenue growth +4.3%

Total store sales down 0.8%

LfL store revenue down 1.2%

For the year-to-date, this leaves LfL store sales flat (which I guess means failing to keep up with inflation).

Outlook

We expect to deliver our revised guidance of adjusted Profit Before Tax (excluding one-off and non-trading items) for FY26 of between £55 million and £60 million. The Board anticipates declaring a progressive full-year dividend in line with the Group's capital allocation policy. The previously announced programme to purchase shares to satisfy future employee share schemes, has successfully concluded for FY26, at a total cost of £5 million. The Board remains confident in the long-term prospects of the business.

Graham’s view

I repeat everything I said in December, and don’t see any reason to change my stance here today. The profit warning was only six weeks ago, after all. It would be a surprise if the outlook had already changed since then.

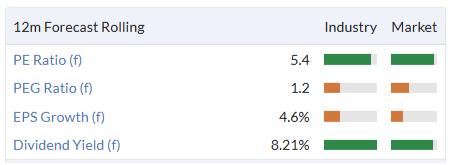

For those who may be tempted, this is trading cheaply:

Personally, I’m not tempted, as I think this sector should trade very cheaply.

Like PayPoint, this is trading on a cheap multiple, is carrying significant debts (£79m of financial net debt at the interim results), and is buying back its own shares. But unlike PayPoint, Card Factory’s buyback is small (£5m) and is designed merely to fund employee share-based bonuses.

It is better to buy back shares to pay for these bonuses, rather than increasing the share count and diluting shareholders. But given what shareholders have experienced here in recent months, I’d argue that the optics around these bonuses are unfortunate. I’m staying neutral

Roland's Section

Personal group (LON:PGH)

Up 3% at 355p (£112m) - Trading Update & Notice of Full Year Results - Roland - AMBER/GREEN =

(At the time of publication, Roland has a long position in PGH.)

This workplace benefits and insurance provider is a member of my SIF portfolio and my personal holdings, so I’m pleased to see today’s 2025 update is (slightly) ahead of expectations.

Key numbers:

Revenue up 11% to approx £48.4m

Adj EBITDA up 21% to approx £12.1m, ahead of expectations (previous consensus was £11.6m)

Management reports good growth on both sides of the business:

Insurance annualised premium income (API) up c.12% to £40.5m

Record new insurance sales of £15.4m API (up 11% vs FY24)

Benefits Annual Recurring Revenue (ARR) up c.6% to £7.1m

The balance sheet also remains strong, with year-end net cash of around £29m and no debt.

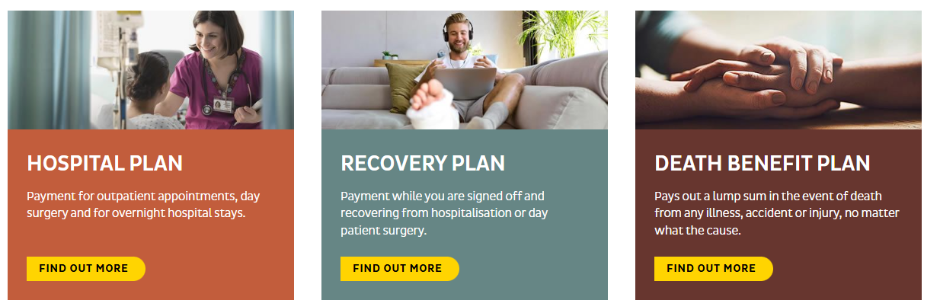

Trading commentary: I covered this business in some detail in my post-Mello write up in November. In short, the company’s core business is selling insurance to blue collar workers whose employee sick benefits may be limited. Personal Group offers three main insurance products:

Alongside this, the company offers a workplace benefits platform employers can provide for their staff. This is sold independently under the Hapi brand and also through a partnership with Sage (disc: I hold SGE).

Insurance: Personal Group’s model is to win a new client and then send its teams into the workplace to sell directly to employees. New client wins in 2025 are expected to give the company access to c.50,000 new employees in 2026.

Strong new sales were supported by retention levels of over 80%, in line with previous years.

A digital product is also being trialled with 17 customers, “receiving positive feedback”. This is aimed at clients for whom Personal Group’s in-person sales model isn’t a good fit.

Benefits & Reward: uptake of the Hapi platform and Sage partnership (which targets SMEs) improved in 2025. The company also launched a new partnership with provider EB Now, also targeting SMEs.

The final part of the business is a small but high margin Pay & Reward consultancy. This generated £1.2m of revenue in H1 last year and has a growing digital business, which, with ARR of £0.8m (+14%) in 2025.

Outlook & Updated Estimates

No specific guidance is provided for 2026 today but we do have access to a new broker note from Canaccord Genuity – many thanks.

CG’s analysts have chosen to leave both 2025 and 2026 forecasts unchanged today, despite today’s “ahead” statement. Forecasts for 2026 will be revisited when the 2025 results are published on 24 March.

2025: CG is forecasting adj EBITDA of £11.6m, but has not updated its forecast to reflect today’s guidance of £12.1m.

2026: CG notes that strong momentum in insurance means “we see slight upside risk” to FY26 forecasts. To me, that doesn’t sound like the broker expects to make a big upgrade to its 2026 estimates in March.

As far as I can see, Canaccord is the only broker covering Personal Group – its EPS forecasts are identical to those on the StockReport:

FY25E adj EPS: 20.1p

FY26E adj EPS: 24.9p (+24% vs 2025)

These estimates put Personal Group shares on a FY25E P/E of 18, falling to c.14 in FY26.

Roland’s view

Personal Group has been a strong performer over the last year, gaining over 80%:

The value on offer from the stock is less compelling than it was 12 months ago, but the shares still don’t look too expensive to me if the company can maintain recent growth rates.

Maintaining double-digit growth rates is certainly CEO Paula Constant’s ambition. 2026 will be the first full year of the five-year growth strategy she announced last year. This will target revenue of £100m, EBITDA of £30m and SaaS ARR of £20m by 2030.

Based on today’s update, these targets imply revenue growth of 15.6% annualised between now and 2030, with EBITDA growth of 20% annualised. These growth rates aren’t far from the 12% and 21% reported for 2025, so they don’t seem unrealistic to me, based on what we know today.

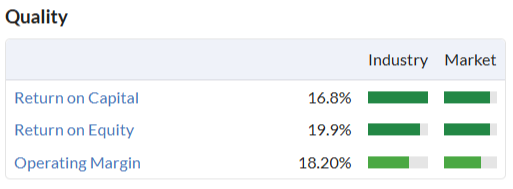

Personal Group’s quality metrics are also good, which should aid profit growth. The underlying driver of this profitability is the insurance business, which enjoys relatively low claims ratios.

The balance sheet is also very strong. After subtracting the regulatory/management buffer of c.£10m, I estimate that today’s net cash figure of £29m translates into around £19m of genuine surplus net cash. This should be enough to fund bolt-on acquisitions or additional shareholder returns on top of the ordinary dividend, which currently yields c.6%.

I am always a little bit wary when companies set seemingly arbitrary targets for revenue or profit growth. But Personal Group’s targets seem reasonable enough, based on recent performance.

More broadly, my view is that the company’s strong position in its niche insurance market is likely to continue supporting above-average profitability unless anything happens to disrupt progress. I’m leaving my previous AMBER/GREEN view unchanged today.

Marstons (LON:MARS)

Down 12% at 61p (£384m) - Trading update for the 17 weeks to 24 January 2026 - Roland - AMBER ↓

Marston’s share price has risen by 50% over the last year, as investors have rewarded trading progress and the debt reduction driven by the sale of the company’s brewing assets to Carlsberg. However, today’s update appears to have disappointed the market, with the stock down 12% at the time of writing:

2025 trading: key points

Most of the listed pub chains have already provided Christmas trading updates, providing ready comparisons for these figures. Unfortunately, Marston’s like-for-like figures appear to be at the bottom end of industry results for the key festive period – perhaps one reason for today’s share price drop.

Note that while these figures are all broadly equivalent, they don’t cover exactly the same date ranges. Some companies report a three-week festive period, some cover five weeks and Marston’s has chosen two weeks:

Company | LFL sales, Xmas period |

Young’s | +11.2% |

JD Wetherspoon | +8.8% |

Fuller, Smith & Turner | +8.2% |

Shepherd Neame | +8.1% |

Mitchells & Butlers | +7.7% |

Marston’s (two-week period to 3 Jan) | +4.0% |

Disappointingly for investors, Marston’s management has declined to report LFL sales for the whole 17-week period covered by today’s update. Instead, we get this vague statement:

Like-for-like sales for the 17 weeks have remained resilient, with performance tracking in line with the prior year and continuing to outpace the total market.

As Graham pointed out earlier this week, when management deliberately obscures key information in an RNS update, it’s rarely good news.

Checking back to last year’s January update, Marston’s reported LFL growth of 2.0% (i.e. below inflation). In the absence of any other guidance, I’m going to assume a figure under 2% for the 17-week period to 24 Jan 26.

Checking today’s broker note from Panmure Liberum confirms this interpretation; the broker describes 17-week LFL sales as “flat”.

The company’s claim that revenue growth is outpacing the total market seems positive, but the bar seems very low. I wonder if this comparison includes many underperforming small/independent operators.

Fortunately, money being spent on capex appears to be delivering results.

Management says 23 new pub format roll-outs were completed during the quarter, with a total of 50 planned by the end of the current financial year (Sept 26). New format pubs such as Grandstands (sports pubs), Woodies (family-friendly) and Two-Door (drinkers and diners) are said to be outperforming the wider estate.

Outlook: full-year guidance is unchanged today:

The Board remains confident in delivering full-year consensus expectations and that the Group is firmly on track to deliver against the targets set out at the October 2024 Capital Markets Day, including shareholder returns.

Consensus expectations for adjusted pre-tax profit are given as £78.7m.

Broker Panmure Liberum has left its FY26E adj PBT forecast unchanged at £77.4m.

Forecasts have now been stable for nearly 12 months:

Roland’s view

Today’s update suggests to me that Marston’s has underperformed rival listed pub chains over Christmas and the most recent quarter.

Despite this, I can see some positives. Profitability is improving despite very modest revenue growth. Ultimately, generating higher returns from the existing estate is key and Marston’s appears to be making progress.

The pending increase in business rates for pubs may also be partially reversed if a rumoured government u-turn goes ahead. In today’s note, Panmure estimates this could add c.£4m to current profit forecasts.

Marston’s shares also continue to trade at a discount of more than 40% to net asset value. Based on current forecasts, I think this discount could narrow a little further over the next two years, especially if Marston’s brings leverage below 4.0x EBITDA as targeted. This now seems likely to happen in FY27, at which point dividends are expected to resume – potentially a cue for institutional buying.

My main concern is that Marston’s revenue growth appears to be below inflation and lagging listed peers. If this situation persists, it’s likely to become harder for the company to maintain margin growth.

I was broadly optimistic following November’s full-year results and moved our view up by one notch to AMBER/GREEN. However, I’m going to move our view back to neutral today. This might be too cautious, but I’m a little discouraged by the content and presentation of today’s update. My feeling is that recent trading may have been slightly weaker than hoped for.

Hargreaves Services (LON:HSP)

Up 9% at 730p (£239m) - Interim Results - Roland - AMBER/GREEN =

Today’s interim results bring good news for shareholders, with news of services growth, land sales, a £15m tender offer and an upgrade to full-year forecasts.

There’s also perhaps some sad news, as long-time CEO (& 8.5% shareholder) Gordon Banham announces plans to retire on 31 July, after 20 years in charge. Banham has led the business through some complex periods of change. In my view, his strategic judgement and clarity of guidance have served shareholders well.

Fortunately, Banham is being replaced with an in-house appointment, current COO Simon Hicks. He has plenty of infrastructure experience and was appointed last year – perhaps with this situation in mind.

H1 key numbers:

Revenue up 46.1% to £183.1m

Pre-tax profit up 169.8% to £14.3m

Earnings per Share up 173.8% to 33.4p

Interim dividend +5.4% to 19.5p

Net cash (ex-leases) of £37.3m (FY25: £23.3m)

Net asset value per share up 4.8% to 608p

Trading commentary: remarkable 46% revenue growth was driven by the expansion of Hargreaves' Services business. This provides earthmoving services for infrastructure projects and is active in other areas, such as waste management.

The company says it saw growth across its Services portfolio in H1, but that most of the improvement was driven by “major infrastructure projects” in the Clean Energy sector.

Services revenue rose by 41.4% to £172.4m in H1, supporting a 33% increase in pre-tax profit to £11.7m. Although net margin fell from 7.3% to 6.8%, this reflects a change of mix. My impression is that these are respectable margins for this sector, which tends to be quite low margin.

Hargreaves Land: the company’s former coal mining operations left the group with some large and valuable parcels of land. These are being gradually sold for housing or renewables projects.

Two important sales were highlighted during the period:

Sale of 16-acre plot at Blindwells (Edinburgh) to Bellway for £11.5m

Completed the sale of the first tranche of renewable energy land assets. This had a book value of £4m but has been sold for £8.8m, with a contingent payment of up to £5m due by 2029 depending on future wind yields.

The renewable sale – at >2x book value – shows how Hargreaves is generating value from its land assets for shareholders. Today’s £15m tender offer is effectively returning the proceeds from these land sales to shareholders. To reflect the fact that these are one-off gains that cannot be repeated, I think it makes sense to reduce the sharecount through a tender offer rather than paying a special dividend.

Management reports a strong pipeline of future land sales in both renewables and housing. A sale planned for FY28 has now been delayed as a higher value opportunity “in the digital space” may become available. Having a strong balance sheet means Hargreaves can take long-term decisions to maximise shareholder value rather than rushing to raise cash.

HRMS (Hargreaves Raw Materials): this German business is involved in commodity trading and recycling. An exciting new €18m project is now underway “to extract zinc oxide from steel waste dusts”.

I don’t have any understanding of what this means, but Gordon Banham (who will remain in charge of HRMS) believes it “has the potential to be disruptive in the market” and “deliver significant shareholder value”.

Tender offer: £15m of cash will be returned through a tender offer priced at “an anticipated premium of 12% and 15%” to the prevailing share price.

Based on the share price of 660p prior to today’s open, that would have been c.750p. Further details will be confirmed in due course.

Exact pricing is still uncertain, but this tender seems likely to reduce the sharecount by perhaps 6%, which would add c.6.5% to earnings per share.

Outlook & Updated Estimates

With thanks to Cavendish and Research Tree, we have an updated broker note for Hargreaves Services.

Cavendish’s updated forecasts now factor in the tender offer. They also reflect “the recategorisation of an estimated £3m of capital gain” into profit. The combined effect of these two factors is that increases to profit estimates are larger than they might have been otherwise.

Here are the latest numbers from Cavendish:

FY26E revenue: £290.5m (+6% vs £273.5m previously)

FY26E adj PBT: £24.9m (+19% vs £20.9m previously)

FY26E adj EPS: 61.9p (+17.5% vs 52.7p previously)

Forecasts for FY27 have also edged higher, while estimates for FY28 have been trimmed slightly to reflect the delayed land sale I mentioned above.

At current levels these forecasts price Hargreaves on a FY26E P/E of 11.6 – not excessive, in my view, especially as the expected 37p full-year dividend implies a 5.1% yield.

Roland’s view

I am a long-term fan of this business and of Gordon Banham, who I believe has done an excellent job of identifying and releasing value from the group’s assets, while also developing its operating businesses and protecting the balance sheet.

My only slight reservation is on valuation. To be fully green here I’d want to buy the shares below book value. This may seem excessively cautious (it may be excessively cautious!), but as far as I can see the company’s continuing operations are relatively capital intensive and carry somewhat average margins. I would guess that return on equity is likely to be in the 8%-10% range going forward, so the current valuation at c.1.2x book value looks reasonable but not especially cheap to me.

A change of leadership after 20 years could also be significant — Gordon Banham has proved to have an owner’s eye and his large shareholding has aligned his interests closely with those of shareholders. While the new CEO appears to be experienced in this sector and well briefed for the role, there’s always the possibility that strategy and execution will evolve.

For these reasons, I’m leaving my AMBER/GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.