Good morning!

Today we have news from:

- PCF (LON:PCF)

- Flybe (LON:FLYB)

- McBride (LON:MCB)

- Gooch & Housego (LON:GHH)

- Laura Ashley Holdings (LON:ALY)

- J Sainsbury (LON:SBRY)

PCF (LON:PCF)

- Share price: 31p (-14%)

- No. of shares: 214 million

- Market cap: £66 million (pre-Placing)

Proposed Placing to Raise Minimum of £10 million

(Please note that at the time of publication, I have a long position in PCF.)

This online bank and lender announces that it is raising funds at 30p. I have mixed views.

Current Trading & Outlook

The announcement includes a trading update which confirms that progress is in line with expectations.

By December 2018, PCF had grown its lending portfolio to £250 million, with the help of an acquisition.

It is targeting new business originations of £250 million in the current financial year, and is ahead of target to reach a total lending portfolio of £350 million and return on equity (ROE) of 12.5%.

It continues to target a portfolio of £750 million and ROE of 15% by September 2022.

Placing

This size of the Placing is fine: £10 million. Depending on costs, this could increases the book equity of the business by c. 22% (NAV was £42.6 million at September 2018).

While I'm less excited by the company's acquisition strategy than I am by its organic growth prospects, I don't mind if it raises fresh funds to accelerate growth. That was always likely, to enable it to get to the £750 million portfolio target.

It's just slightly disappointing that Somers (the 65% shareholder) didn't want to put money in at a higher level.

NAV per share was c. 20p as of September 2018, so Somers is paying a 50% premium to that.

The share price, on the other hand, was at an 80% premium to NAV p.s. as of last night.

The practical consequence in terms of dilution is that 33.3 million new shares will be issued for a £10 million placing, instead of 27.8 million. The total share count will be 247.5 million, instead of 242 million.

When you look at it this way, the difference in NAV p.s. caused by doing the Placing at 30p instead of 36p is just over 2%. In that light, perhaps it's not worth getting too upset about.

There is also a small Open Offer for £750k to those who don't participate in the Placing, so that small shareholders who feel strongly about it will still be able to buy some shares at the Issue Price.

My view

I don't mind the company raising funds, but naturally I would prefer if the price at which it did so was as high as possible.

However, even as someone with high hopes for the company's future, I wouldn't value it at more than 2x book value, at its current stage of development. So I can understand why Somers might feel that the level at which it it is funding the company is fair. They could have paid a little more.

At the end of the day, the reduction in NAV per share caused by the pricing of this deal is probably not worth losing any sleep over.

If the company continues to execute strongly, shareholders should still do well.

Flybe (LON:FLYB)

- Share price: 2.73p (+110%)

- No. of shares: 217 million

- Market cap: £6 million

Statement regarding media speculation

Despite a sub-£10 million market cap, this one is attracting lots of chatter on the bulletin boards.

Andrew Tinkler (who owns more than 10% of the company) and other investors are continuing to battle against the Board's plans to sell off the company's assets and then the company (for 1p per share).

The Board agreed the sale of the company's assets without asking for shareholder approval, which was made possible by switching to a Standard Listing on LSE.

It reiterates today that selling off the assets is a done deal ("Flybe is bound by the terms of the Sale Purchase Agreement").

The long stop date for the divestment is 22 February, i.e. on Friday. This is also the date on which Flybe must repay the loans it has drawn from the buyers of its assets. The Board also says that arrangements with its banks and credit card processors depend on the agreed deal going ahead.

In conclusion, the Board says that the deal it has agreed is "the only viable option".

My view - while the Board appear to have acted against the wishes of a substantial portion (if not an outright majority) of the company's shareholders, it looks to me as if they have succeeded in pushing this deal through.

If for any reason the deal doesn't go through on Friday, then I would see a risk of the company being immediately forced into administration - unless it can repay the amounts owed to Connect and satisfy the credit card companies, banks, etc., that business will proceed as normal.

If the Board wanted the Connect deal to fail, then maybe it would fail and an alternative solution could be found. But the Board is determined to carry on with its plans and there is almost no time left. So I think the shares are worth 1p!

McBride (LON:MCB)

- Share price: 89.4p (-31%)

- No. of shares: 183 million

- Market cap: £163 million

McBride is: "the leading European manufacturer and supplier of Contract Manufactured and Private Label products for the domestic Household and professional cleaning and hygiene markets".

In other words, it makes laundry powder, bleach, disinfectant, dishwasher tablets, etc.

It has been rather accident prone historically: see this review by Paul in September 2018, and this review by me in July 2018.

More bad news today with news that there is more "pressure on its cost base" - raw materials and distribution costs are higher than the company had estimated. If you read our archives, you will see that the estimates have regularly been too rosy at McBride.

Rising costs are attributed both to external and internal factors ("logistics capacity shortfalls and internal service gaps" - unlikely to win any Plain English awards).

Full year adjusted PBT is now forecast 10% to 15% lower than the prior financial year. It's helpful that this has been quantified - something that the company didn't do in the previous profit warning which I reviewed).

Adjusted PBT last year was £33.2 million, so the result this year is now forecast to be c. £28 million - £30 million. After tax and adding back the adjustments, the final net income figure will of course be substantially lower. And we have to hope that there won't be yet another failure to meet estimates in H2.

The company was carrying net debt of over £110 million as of June 2018. Since then, it has made a debt-reducing disposal, and the forecast for June 2019 net debt (as of last night) was £98 million.

Adding forecast net debt to the market cap to get an enterprise value of £260 million, it seems to me that the shares could now be trading around fair value. I wouldn't say that they are cheap yet, but they are beginning to look interesting from a value perspective.

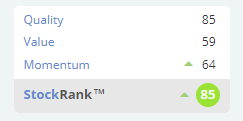

The StockRanks might agree: this is the StockRank for last night, before a greater than 30% share price fall in response to today's profit warning. The long-term outlook for the company remains as bumpy as ever.

Gooch & Housego (LON:GHH)

- Share price: 1325p (-11%)

- No. of shares: 25 million

- Market cap: £331 million

AGM statement for "the specialist manufacturer of photonic components & systems". I've only written about it at the SCVR before on one occasion.

Update - this is a profit warning. Frustratingly, however, the company makes no reference to prior expectations. It only says that the expected trading performance is now set to show "low single digit growth compared to last year".

Brokers (who will have been briefed by the company) have reduced their adjusted EPS forecast for the current year from 65.9p to 58.2p. FY 2020 forecasts are also adjusted downwards. It would be nice if companies said what their previous and updated EPS forecasts were in the RNS!

Demand downturn - this is an Apple-like profit warning. Chinese demand for industrial lasers using in microelectronic manufacturing has reduced. G&H acknowledges that this is a cyclical market and US/China tariffs are having an impact.

H2 pick-up - the company is expecting the industrial laser market to pick up in H2, but what if it doesn't? I suppose we will have another profit warning in that case.

G&H has a great long-term track record, so long-term holders may feel justified in continuing to hold. If I was going to open a new position in it, I would be inclined to wait for another profit warning or two before having a nibble.

Laura Ashley Holdings (LON:ALY)

- Share price: 3.15p (unch.)

- No. of shares: 728 million

- Market cap: £23 million

The forecast P/E ratio in the metrics for Laura Ashley is 3.5x, indicating that there is something wrong with the forecasts!

Today's interim report shows tha the company achieved breakeven before exceptational items in H1, or a £1.5 million pre-tax loss after exceptionals.

(The exceptional item is the write-off of value in an "Associate Company", which is now deemed worthless - I think this relates to restructured East Asian operations.)

The share price has barely budged, despite the Chairman saying today that "the performance for the entire year will fall short of market expectations". The market must have already concluded that this year was going to be dire!

There is a glimmer of hope with fashion like-for-like sales up 11.8%. Other categories must be very poor, though, as the total like-for-like sales drop is 4.2%. Add some store closures into the mix and total sales are down almost 9%.

The weird Singapore property purchase of several years ago is now history following its disposal, and the company was debt-free as of December 2018, although without any cash reserves worth mentioning.

Outlook - expects conditions to remain challenging.

My view - not worth dabbling in this until there is a sale/liquidation planned, as the brand seems to be dying a slow death under current management.

J Sainsbury (LON:SBRY) is facing serious objections from the Competition and Markets Authority in relation to its merger with ASDA.

Worryingly, "the CMA's current view is that it is likely to be difficult for the companies to address the concerns it has identified". Sounds unlikely to go ahead, then! Just thought I would mention it in passing.

All done for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.