Good morning, it's Paul here. Please see the header for companies I'll be covering today.

Estimated time of completion - the bulk of today's report should be finished by 1pm. However, I reserve the right to carry on doing more writing this afternoon, as I've got nothing else specific planned to do today.

Update at 13:59 - today's report is now finished.

A bit of macro stuff to start off with;

Barclaycard - consumer spending data

I've tracked down the Barclaycard consumer spending report for Dec 2019, which is here. It's well worth a look, as there's some useful intelligence in there for investors, relating to consumer spending on debit & credit cards.

In particular, this graphic (below) shows the winners & losers by sector - looks like pubs are a good place to be invested at the moment (hopefully augurs well for the update from Revolution Bars (LON:RBG) - one of my biggest holdings personally - this Wednesday Friday [thanks to Simoan for correction] ).

I hope Barclaycard don't mind me reproducing their very informative graphic here, seeing as it's already available free online;

NB. the reason why some of the Barclaycard data might look strange, is that it only covers debit & credit card spend, and hence excludes cash transactions. Given that contactless payments are replacing many cash transactions, then that skews the data.

For example, I sometimes (not in Dry January though) browse my online banking app, and see 5 or 6 consecutive debits labelled "The Lord Clyde", which reminds me that I stopped off at my local on the way home. They're usually £4.50 each, which isn't too bad, but it's when I see the later transactions doubling or tripling, that I groan and think, who was I buying drinks for?! Oh yes, so and so.

My point being, that in previous years, I paid using cash. These days, I rarely use cash at all, instead using contactless for almost everything. This effect is likely to be flattering the growth reported by Barclaycard of 11.7% growth in spending in pubs. Takeaways are up 12.5%, so somebody clearly did say Just Eat!

How long before Governments start abolishing cash altogether, in order to reduce tax avoidance, and exert more control over everybody? Once that happens, it probably won't be long until an electronic payments tax is applied - e.g. in Zimbabwe the Govt imposed a 2% tax on all card payments. It's much easier to collect in than VAT, so could such a tax eventually replace (or more likely supplement) VAT & sales taxes here maybe, potentially set at different rates depending on the type of transaction?

Deloitte CFO survey

This is another data source which I often find referred to in newspaper articles, etc. I've decided to track down the original data sources myself, and share them with you here, so that we can do our own analysis. After all, it's surprising how often mainstream journalists make basic errors, - e.g. muddling up retail sales volume, and retail sales value. And/or headlines which bear little relation to reality - this or that has "slumped", when it's moved about half a percent, is typical!

The latest report, using data gathered between 13 Dec 2019 to 6 Jan 2020 (i.e. immediately after the general election result), shows a remarkably good result;

The latest survey of UK Chief

Financial Officers shows an

unprecedented rise in business

sentiment. The fourth quarter

survey took place in the wake of

the UK general election, between

13th December and 6th January.

Confidence has seen the largest

increase in the 11-year history of

the survey taking it to its highest

ever level.

It will be interesting to see if confidence sticks at this level, or partially slips back again? There could be an element of relief that the extreme left Corbyn threat [Edit: to business profitability, through higher Corp Tax, and stealing 10% of the shares in listed companies from their rightful owners, etc] has disappeared for the time being?

Even so, this is very encouraging news. I had been thinking in terms of the recent large rally in UK small/mid caps being overdone, but maybe it's justified, given this positive outlook survey?

Anyway, well worth a look, so here's the link again.

I'll diarise to comment on this & the Barclaycard reports, as a regular feature here in future SCVRs, as it's useful stuff that can help guide & improve our investing decisions.

Quartix Holdings (LON:QTX)

Share price: 383p (up 5% today, at 08:49)

No. shares: 47.7m

Market cap: £182.7m

Quartix Holdings plc, one of Europe's leading suppliers of subscription-based vehicle tracking systems, software and services, is pleased to provide an update on trading for the year ended 31 December 2019 ...

Background - both Graham and I have written positively about Quartix before. Things we like about it are;

- Strongly cash generative

- High margins

- Recurring revenues & low customer churn - therefore great visibility

- International expansion going well, with more to come - should continue driving growth

- Good dividend yield

- Strong management & reliable outlook statements

- Clean accounts (e.g. fully expensing, not capitalising, product development)

My report on the last interim results, is here on 24 Jul 2019.

There was a nice opportunity to buy this share last year, because it looked expensive on a PER basis. However, as we pointed out here at the time, this was because Quartix was incurring short term marketing costs to expand in overseas territories. This suppressed short term profits, for the benefit of the long term.

Another similar factor, was that Quartix has been deliberately winding down its low margin insurance telematics business. This made total growth look anaemic, when in fact the main "fleet" business was growing nicely.

Trading update today - it's moderately good news;

The Board is pleased to report that it expects revenue, profit and free cash flow to be slightly ahead of current market forecasts.

[1] The Board believes that consensus market expectations for 2019, prior to this announcement, were as follows: revenue: £25.3m; adjusted EBITDA £6.8m; free cash flow: £5.7m.

Following best practice, as you can see, the company provides a footnote to tell us what the consensus forecasts are - this is so helpful, as it saves everyone time & hassle.

Memo to all companies, brokers, and PRs: please make sure trading updates for all your companies include consensus forecast details. Why wouldn't you include details that help readers digest the statement more quickly, easily, and accurately? Readers don't want to rummage around elsewhere, trying to find out what the forecasts are. Just tell us in the RNS! Time is really at a premium between 7-8am each weekday, so anything that speeds up the process of analysing a trading update is very much appreciated.

My only slight quibble above is that I would have liked to see the adjusted profit before tax, and adjusted EPS figures, which are the key profit measures for me. Follow up memo: EBITDA is not a figure I particularly want to see, because companies have different policies on capitalising development spend, therefore it's not a reliable comparative.

Adjusted EPS is probably the most useful number from my point of view (as that enables me to quickly value the share using PER), and this hasn't been given in this update either.

Fleet business - this is the core business, and it's doing well;

The Company made excellent progress in its core fleet business in the UK, France and the USA, and entered a range of new territories with encouraging results. Revenues in the fleet business are expected to have grown by around 10%, accounting for approximately 80% of Company revenues.

A table is given with details of growth by region (fleet business only, not insurance telematics), which shows good progress;

- New installations of 43.8k units in 2019 (up 39% on 2018)

- Subscriber base up from 123.2k units to 150.6k units (up 22%)

However, this has only translated into revenue growth of 10%, which seems low. I appreciate that revenue from new customers won would be spread over the year, so that a new client signed up in say November, would only contribute a small amount of additional revenue in 2019. However, that effect would be the same every year, e.g. a new client signed up in late 2018 would have contributed very little to 2018 revenues, but a full year in 2019.

I've emailed the company to query why revenue growth of 10% is lagging behind subscriber growth of 22%, and will edit the article if/when I get a reply. It looks like unit pricing might be under pressure, but nothing is said about pricing in today's update. Broker notes might elaborate on this point, perhaps?

EDIT at 12:23: Quartix has responded to my query re pricing;

- Yes there is pricing pressure in the industry, and always has been.

- Self-install units are sold at a lower price than installed units, hence revenues (but also costs) are lower - so not a problem for profits. [some overseas growth is coming from self-install]

- New installations produce avg 6 months revenues in year 1

End of edit.

International growth - a self-install product means that Quartix can expand overseas without the need for boots on the ground - a key point, and clearly very positive. This has driven expansion in Spain, Germany, Poland, and Italy.

My opinion - as mentioned before, there's a lot I like about Quartix.

The share has re-rated from a PER of about 20, to a forward PER of about 30. The dividend yield is still fairly good at about 3%.

In my view, the price now looks up with, or maybe slightly ahead of events. So it might be a good time to think about possibly banking some profits with a top-slice? Obviously that's for each investor to decide for yourself, I'm only giving my opinion.

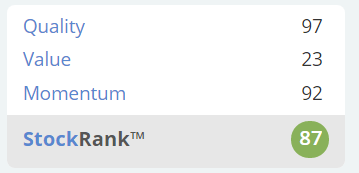

Note that the Stockopedia computers laugh in the face of my caution, giving Quartix a "High Flyer" classification, and a high StockRank. Or more seriously, the StockRank is saying that concerns over valuation are outweighed by very high quality & momentum;

Highly rated shares are often long-term winners. The trouble is that along the way, the market often imposes brutal price corrections. It can be very difficult to keep your nerve during such big pullbacks. Hence why I think there's a lot to be said for top-slicing some of the profits, after a big rise in price, if the valuation is looking stretched. We can always buy back at a later date, and we can't buy the dips if we don't have any cash on the sidelines.

Augean (LON:AUG)

Share price: 211p (up 0.5% today, at 10:32)

No. shares: 104.1m

Market cap: £219.7m

Augean, one of the UK's leading specialist waste management businesses...

I hope some readers managed to take advantage of the very positive update from this company, which I reported positively about here on 16 Oct 2019, with one of my "worth a closer look" conclusions (which means that I really like the look of this, but haven't had time to dig any deeper yet, so am not 100% certain). The share price has risen 57% since that report.

Today it says -

trading has continued to be strong through the final quarter and it expects, subject to audit, to report adjusted PBT for the year ended 31 December 2019 at least in line with recently upgraded consensus market expectations of £18.4m.

Great stuff!

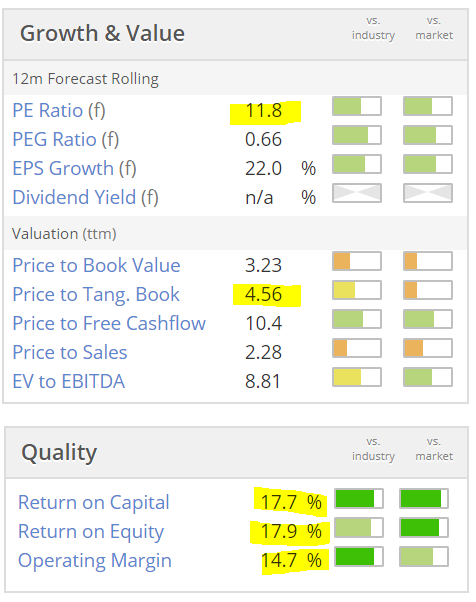

Valuation - the share price is up a lot, so have we missed the boat? Possibly not, as these valuation stats still look good value - as I've highlighted below, we have:

low forward PER of 11.8, NTAV (i.e. Price to Tang. Book) is fine at 4.56, and great quality scores. No divis though. Also note (not highlighted) that the PEG is attractively low, at 0.66, i.e. earnings growing much faster than the PER, implying the share is cheap if that earnings growth can continue.

My opinion - I haven't done any in-depth research on this one, so don't understand the business model. However, clearly something really positive is going on - the share price has tripled in the last year, yet the forward PER still looks modest. This is because earnings forecasts have been rising strongly;

Obviously I'm kicking myself for not buying any personally, despite writing up a strongly positive article 4 months ago. The trouble with writing these reports, is that I'm constantly pulled from pillar to post, writing about lots of companies, so often can't see the wood for the trees!

Also, I didn't have any spare cash last autumn anyway. Looking back though, maybe I should have chucked out some laggards in my portfolio and re-deployed the funds into this? Oh well, just something to ponder.

As always with this type of share, the key thing is to find out what is driving the earnings upgrades, and ascertain whether earnings, and earnings growth, are sustainable? If they are, then this share could still be worth a closer look.

It's almost 10-bagged in the last 2 years - wow!

Indigovision (LON:IND)

Share price: 187p (up 5% today, at 11:43)

No. shares: 7.3m

Market cap: £13.7m

IndigoVision is a leader in the design and supply of high performance, highly-intelligent video security systems for security installations of differing sizes and complexity.

An old favourite, puts out a reassuring update today;

The Board of IndigoVision is pleased to report that sales for the financial year ended 31 December 2019 were $50.1m, representing a 9% increase over 2018.

Gross margins were maintained in line with prior year and with strong cost control, the Company expects to report operating profit and EBITDA in line with market expectations.

That reads fairly well. Note that IND reports in US dollars.

The announcement today does not indicate what market expectations are, which is unhelpful particularly for a very small company with hardly any broker coverage.

The last forecast I can find on Research Tree is from Oct 2019. This suggests adj EPS of 29.3 US cents. Divide that by 1.30 arrives at 22.5p EPS, and a PER of 8.3 - quite an attractive valuation. Although very small, illiquid shares like this should be cheap.

EDIT: an updated note came through, from the house broker, via my watchlist on Research Tree. It confirms the forecast figures I have used above, so all good. End of edit.

Net cash - is reported at $2.0m at 31 Dec 2019. It drew down $2.7m on a loan facility to make a small acquisition. Therefore gross cash must be c.$4.7m, to arrive at net cash of £2.0m - which looks a satisfactory position.

My opinion - it looks good value, and has quite a large installed base of digital CCTV systems, having been doing this for many years. Set against that, it's had a lot of false dawns in the past, where growth tailed off, after a spurt.

City Pub (LON:CPC)

Share price: 197.5p (down 9% today, at 12:31)

No. shares: 59.7m

Market cap: £117.9m

Trading Update (mild profit warning)

The City Pub Group, the owner and operator of 47 premium pubs across Southern England and Wales, announces its year end update for the 52 week period to 29 December 2019.

LFL sales were soft over the festive season, "marginally ahead" of a strong 2018 (when LFL was up 7% - so tough to beat).

YTD LFL sales are up +1.7% for the year. It's always useful to look back at the previous update, to see how LFL sales have changed. At the interims, LFL was +2.6%. Since the full year LFL was +1.7%, then this implies that H2 LFL was probably just under 1% - a deteriorating trend, although not a disaster.

My understanding is that bar operators (and retailers) need about 2-3% increases in LFL sales to recoup cost increases (especially labour costs). Although cost savings can trim that figure a bit lower perhaps. The danger of cutting costs too much (esp. staffing rotas) is that it can dent the customer experience, and risk them going elsewhere. Nobody wants to spend 10 minutes waiting at a bar, for a drink they could buy at a quarter of the price from Tesco's.

Reasons given - for subdued H2 trading strike me as stretching credibility in some cases;

- Rugby World Cup did not have expected benefit

- Political uncertainty held back sales - really?! People I know were getting drunk a lot more, due to the agony of the whole political saga. Also, how come other pub groups have been generally reporting more positive updates then?

- Weather - described as "unhelpful" in Nov & Dec - again, I don't buy that explanation at all. it's just an excuse

- Disruptions on S.West trains - really??! On the margins there might have been a few more people working from home, but I cannot see that would make a material difference. And if your train is cancelled or delayed, what do you do - nip for a pint!

- 2 refurbs were delayed, so missed out on Xmas bookings

Actually, having typed it up, that just looks more like a list of excuses, not reasons.

Revised forecasts - FY 12/2019 forecast EPS goes down from 8.1p to 7.2p.

FY 12/2020 drops from 9.5p to 9.0p.

At 197.5p this gives PERs of 27.4 and 21.9 for 2019 & 2020 - which strikes me as expensive, but it depends on what the balance sheet looks like.

Balance sheet - this is vital to how we value pubs. In this case, it looks good - at the last interims, freehold property had a NBV of £92.4m.

Net debt is £30m, part of a £50m facility with Barclays. Assuming that the freeholds are worth around NBV, the the overall loan to value looks reasonable, at about a third. The last results said that its estate of pubs is "predominantly freehold", which I like.

NTAV when last reported at 30 Jun 2019 was £73.5m. The market cap is 1.6 times tangible book value.

My opinion - it looks a reasonably good business. I'm not convinced the shares offer value for money though.

Instem (LON:INS)

Share price: 490p (down 1% today, at 10:22)

No. shares: 16.6m

Market cap: £81.3m

Instem (AIM: INS.L), a leading provider of IT solutions to the global life sciences market, is pleased to announce a trading update for the year ended 31 December 2019 (the "Period").

I flagged up a positive trading update here on 1 Apr 2019.

Graham quite liked the look of it here on 15 July 2019.

Trading update today - this all sounds pretty good;

Organic growth was strong, with revenues c.12% higher than 2018

EBITDA during the Period in line with management's expectations.

Recurring revenue increased as the transition towards Software as a Service (SaaS) continued, resulting in further improved earnings visibility.

Technology-enabled outsourced services grew strongly during the Period.

Net cash at 31 December 2019 was £5.9m.

SaaS - I do like SaaS businesses. There are lots of them at the moment, transitioning from one-off licence fees, to SaaS (i.e. subscription fees). This usually involves depressing short term profitability, but benefiting both long-term profits and revenue visibility. Therefore investors need to allow for this factor when valuing shares (i.e. it might be worth paying more now, to secure a better & more dependable long term profit stream).

Outlook - interesting that operational gearing & highly scaleable are mentioned. Both very promising phrases;

The Company has established a highly scalable platform with improved operational gearing as growth is delivered.

Key opportunities moving forward are centred on continued organic revenue growth, further margin improvement and accretive M&A.

Strong performance across our operations, combined with healthy new business pipelines, underpin management's confidence that the momentum achieved during 2019 will continue into the current year.

My opinion - this looks a really good business. As mentioned last time though, I have no idea how to value it, or assess its future prospects.

So this section is really just to flag up that it looks an interesting company, which readers might want to have a look at, if you understand life sciences (which I don't).

The shares recently shot up from 386p to 490p - I wonder if it was tipped somewhere as a NAP for 2020? I wouldn't want to buy immediately after such a jump on no news, in case it's a speculative spike that might wear off, as often happens with tips.

EDIT: Subscriber veritas has kindly informed us in the comments below that Instem was indeed tipped, a 2020 NAP from Techinvest, apparently. Thanks for the info. End of edit.

I'm tired now, so will leave it there for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.